Get the free Business Internet Banking Enrollment Form

Get, Create, Make and Sign business internet banking enrollment

How to edit business internet banking enrollment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business internet banking enrollment

How to fill out business internet banking enrollment

Who needs business internet banking enrollment?

Business Internet Banking Enrollment Form: A Comprehensive Guide

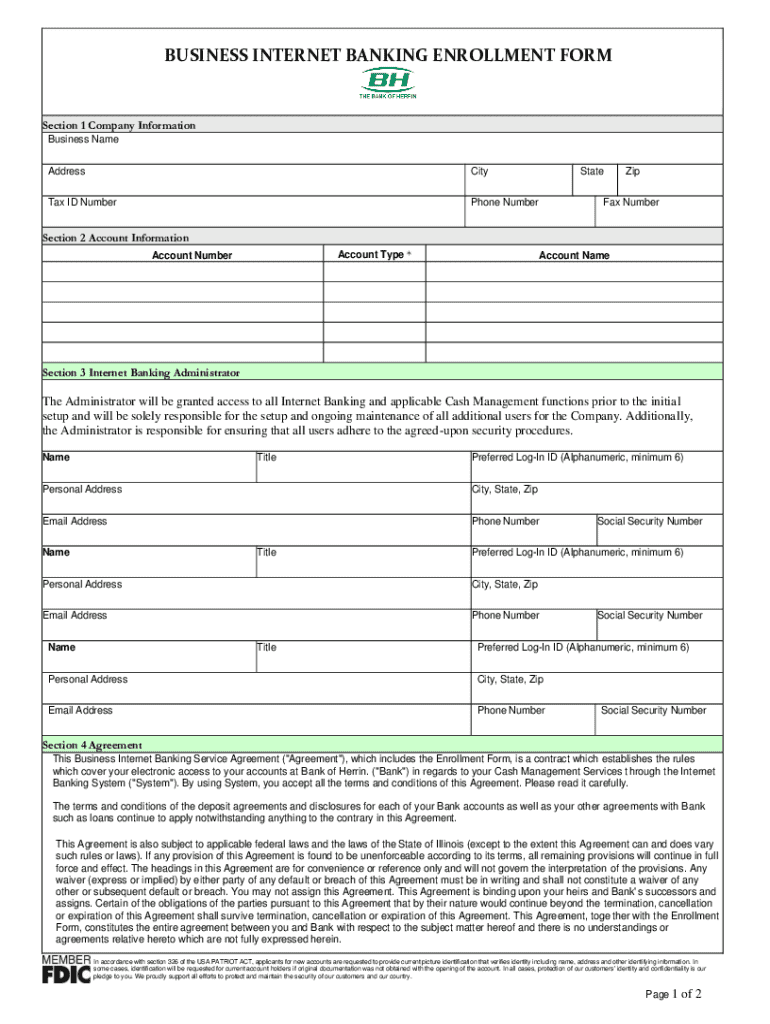

Understanding the business internet banking enrollment form

A business internet banking enrollment form serves as the initial step for organizations looking to manage their finances online. This document integrates various account functionalities and is essential for accessing bank services via the internet. By completing the enrollment form, businesses can facilitate operations such as fund transfers, account management, and payment processing without the constraints of physical bank visits.

The enrollment form is vital for businesses because it allows for secure, efficient financial management, enabling transactions and record-keeping at any time and from any location. Moreover, given the increasing reliance on digital solutions, ensuring that this form is completed correctly is crucial for protecting sensitive information and maintaining uninterrupted access to vital banking services.

pdfFiller enhances the enrollment process with features such as electronic signatures, document templates, and collaborative tools, leading to a seamless experience for businesses navigating this stage.

Preparing for enrollment

Before diving into the enrollment form, businesses must meticulously prepare to ensure a smooth process. This involves gathering critical documents that are often required by banks to verify and authenticate the business entity.

Furthermore, clearly defining business roles and responsibilities within the accounts is crucial. Assigning specific access rights, such as admin users, view-only access, or limited roles, aids in maintaining security and accountability.

Step-by-step instructions for filling out the form

Accessing the business internet banking enrollment form through pdfFiller is a straightforward process. Users can navigate to the appropriate section of the website and find the interactive form, which is designed to guide them efficiently through each required detail.

Once you have located the form, begin filling it out by breaking it down into sections. Here’s a closer look at what each field entails:

pdfFiller offers interactive tools that augment user experience, such as auto-fill features for commonly entered data and options to save progress and edit the form later, ensuring users can complete it at their convenience.

Editing and customizing your form

After submitting the enrollment form, you might find that changes are necessary. pdfFiller’s editing capabilities allow users to make amendments easily post-submission. This is particularly beneficial in instances where businesses expand or restructure, and updated information becomes essential.

In addition to editing, teamwork plays a large role in the overall enrollment process. pdfFiller provides collaboration tools that allow administrators to invite team members for review. With real-time feedback options available, everyone involved can contribute their input, making it a more comprehensive and informed submission.

Submitting your enrollment form

Before submitting your business internet banking enrollment form, it’s crucial to conduct a thorough review. Checklists can simplify the final review process, guiding you to confirm that all essential information is correctly filled out.

Once reviewed, submitting the form through pdfFiller is an intuitive process. Users can leverage e-signing functionality, enabling them to add a secure signature electronically. Following this, the form can be sent directly to the bank, streamlining the submission process substantially.

Managing your business internet banking account

Post-enrollment actions significantly influence how effectively resources are managed within the business internet banking account. Understanding available account features is essential. For instance, businesses can easily access transaction history, allowing for better reconciliation and budgeting.

Setting up alerts and notifications can also prove advantageous, as they keep users informed of transactions, due dates, and other important events. Further enhancing document management, pdfFiller can facilitate storing vital banking documents securely, ensuring compliance and easy access in the future.

Frequently asked questions (FAQs)

Many businesses have common queries related to the enrollment process. Whether it’s questions about document requirements, how long the approval process takes, or troubleshooting account access issues, having a clear understanding of these topics can ease concerns.

Having access to a comprehensive FAQ section can aid businesses in navigating the often complex landscape of enrolling in internet banking.

How to optimize your banking experience

Leveraging digital tools significantly enhances financial management. Integrating payroll services with your business internet banking account can lead to more streamlined operations, enhancing cash management, and making payroll processing easier than ever.

Regularly staying informed on banking innovations is also crucial. Continuous education about updates and new features can empower businesses to utilize their accounts to the fullest potential, optimizing their banking experience.

User testimonials and success stories

Many businesses have found great success by utilizing pdfFiller for their banking needs. Testimonials highlight increased efficiency through features like easy document editing and seamless collaboration.

These success stories emphasize how pdfFiller has fostered productivity within teams, allowing businesses to focus more on strategy rather than getting bogged down in paperwork.

Additional features of pdfFiller for business users

Beyond just banking forms, pdfFiller offers a range of document templates that businesses can utilize for other banking services. This all-in-one platform integrates seamlessly with various business tools, enhancing the overall efficiency of managing multiple aspects of business through one portal.

Moreover, pdfFiller is committed to customer support and guidance, ensuring that businesses have the resources they need to navigate the complexities of online banking and document management with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business internet banking enrollment from Google Drive?

How do I edit business internet banking enrollment in Chrome?

How can I edit business internet banking enrollment on a smartphone?

What is business internet banking enrollment?

Who is required to file business internet banking enrollment?

How to fill out business internet banking enrollment?

What is the purpose of business internet banking enrollment?

What information must be reported on business internet banking enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.