Get the free Minority Business Enterprise Disclosure Affidavit

Get, Create, Make and Sign minority business enterprise disclosure

Editing minority business enterprise disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minority business enterprise disclosure

How to fill out minority business enterprise disclosure

Who needs minority business enterprise disclosure?

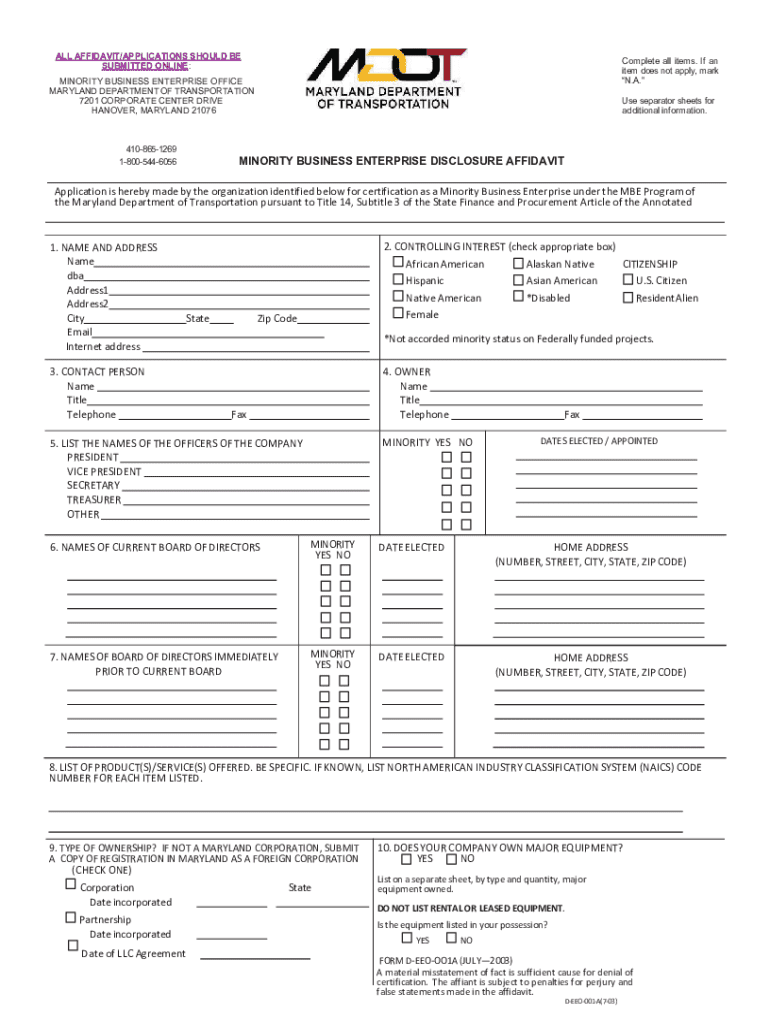

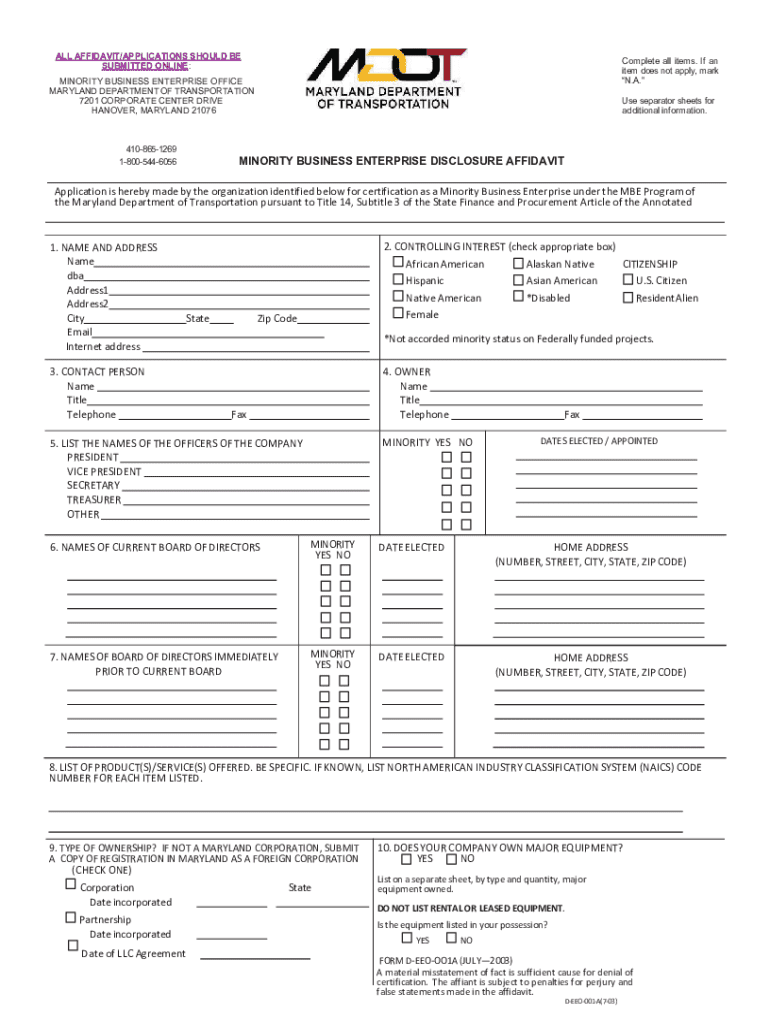

Comprehensive Guide to the Minority Business Enterprise Disclosure Form

Understanding the Minority Business Enterprise Disclosure Form

The minority business enterprise disclosure form serves as a vital tool for minority-owned businesses to demonstrate their eligibility and provide essential information. This form often plays a critical role in the certification process for businesses seeking to participate in government contracts or receive funding from private sectors that prioritize diversity.

This document not only aids in ensuring compliance with various regulations but also highlights the significance of minority-owned businesses in the overall economy. By filling out this form accurately, companies can unlock new opportunities while contributing to a more inclusive marketplace.

Who should complete the minority business enterprise disclosure form?

Understanding who needs to fill out the minority business enterprise disclosure form is essential for effective compliance. Typically, this form is required from businesses that identify themselves as minority-owned, which includes corporations, partnerships, and sole proprietorships owned by individuals from designated minority groups.

Criteria for eligibility often hinge on specific definitions established by federal, state, and local regulations. These criteria ensure that the form fulfills its role in promoting economic equity.

Key components of the disclosure form

The minority business enterprise disclosure form is composed of several key components that provide a comprehensive snapshot of a business's identity, financial standing, and diversity metrics. Each section is crucial for assessing eligibility and for ensuring that businesses are classified accurately.

Understanding these components is vital for accurate completion of the form, greatly reducing the likelihood of errors that could delay processing or lead to compliance issues.

Step-by-step guide to filling out the minority business enterprise disclosure form

Filling out the minority business enterprise disclosure form can seem daunting, but breaking it down into manageable steps can simplify the process significantly. Preliminary preparations involve gathering essential documents that validate your claims and understanding the language used in the form.

Each section of the form will require careful attention. It is crucial that the information presented is accurate and reflects the current state of the business. Common pitfalls include underreporting revenue or inaccuracies in demographic data.

Editing and modifying the MBE disclosure form

Once the minority business enterprise disclosure form is initially filled out, ongoing management and occasional editing may be necessary as business details change. Utilizing tools like pdfFiller can streamline this process considerably.

Here’s how to efficiently manage the form and ensure it reflects true and current business information.

Digital signing and submission process

The submission of the minority business enterprise disclosure form typically involves a digital signing process that adds an extra layer of security. Digital signatures are becoming increasingly accepted due to their efficiency and ease of use.

Once signed, the next step is submission, which can usually be accomplished online. Knowing the submission requirements ahead of time ensures a smooth process.

Ensuring ongoing compliance

Compliance does not end with the submission of the minority business enterprise disclosure form. It’s essential to stay updated with changes in regulations and ensure that any necessary updates to your form are made promptly.

Conducting regular audits can help identify any gaps in compliance and reinforce the importance of maintaining accurate records.

Tools and resources for minority business enterprises

Numerous tools are available to assist minority business enterprises in managing their documentation needs efficiently. Platforms such as pdfFiller offer interactive tools that not only streamline form submissions but also enhance collaborative efforts.

Access to customer support and training resources can also provide additional assistance in navigating compliance and maximizing the benefits of being a certified minority-owned business.

Community and networking opportunities for minority business enterprises

Community engagement and networking are key factors in the success of minority business enterprises. Establishing connections with other MBEs can mitigate challenges and open up new avenues for collaboration.

Various workshops and events can provide valuable insights into best practices and strategies for business growth.

Contact information for further assistance

If you require further assistance with the minority business enterprise disclosure form or any related processes, several resources are available. pdfFiller provides robust customer support, ensuring that users can get help whenever needed.

In addition, local and national MBE support organizations can offer invaluable insights and guidance tailored to specific needs within your state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my minority business enterprise disclosure in Gmail?

How do I complete minority business enterprise disclosure online?

How do I complete minority business enterprise disclosure on an iOS device?

What is minority business enterprise disclosure?

Who is required to file minority business enterprise disclosure?

How to fill out minority business enterprise disclosure?

What is the purpose of minority business enterprise disclosure?

What information must be reported on minority business enterprise disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.