Get the free Business Transfer Agreement

Get, Create, Make and Sign business transfer agreement

Editing business transfer agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business transfer agreement

How to fill out business transfer agreement

Who needs business transfer agreement?

Understanding and Utilizing the Business Transfer Agreement Form

Understanding business transfers

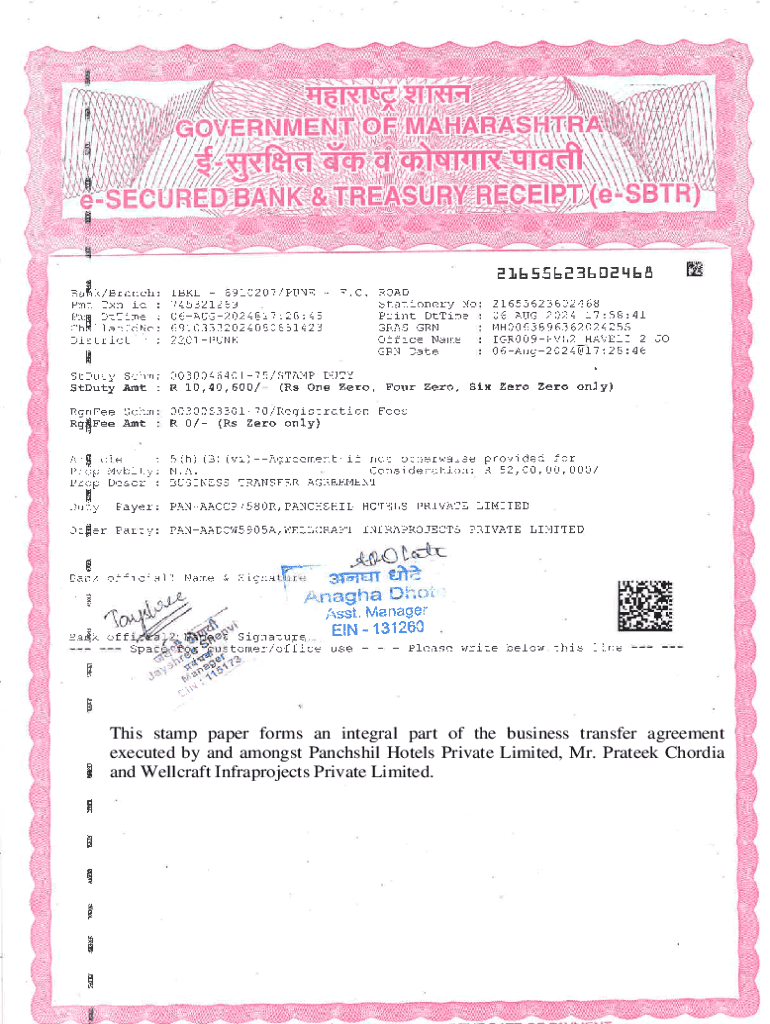

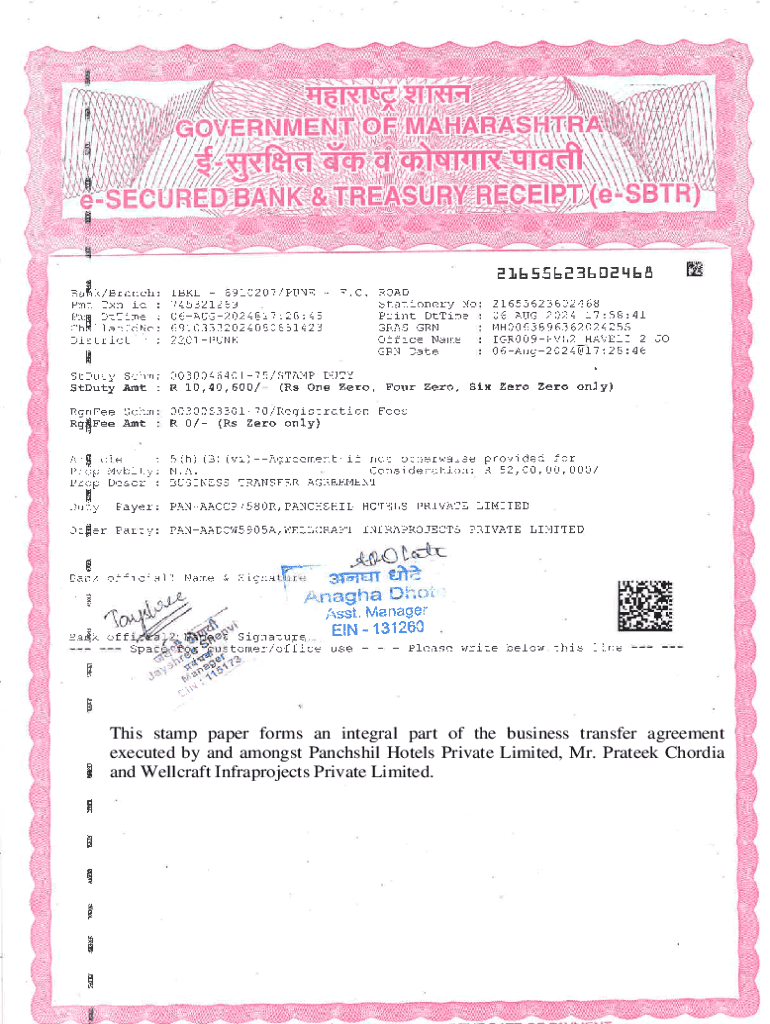

A business transfer refers to the process of transferring ownership or control of a business entity from one party to another. This can encompass the sale of a company, transfer of its assets, or changes in partnership agreements. A business transfer agreement is crucial in this context, as it legally formalizes the terms under which the transfer occurs.

The importance of a business transfer agreement cannot be overstated. It protects both the transferor (the seller) and the transferee (the buyer) by clearly outlining each party's rights and obligations, ensuring a smooth transition that minimizes disputes.

Overview of a business transfer agreement

A business transfer agreement serves as a comprehensive document that delineates the terms and conditions of the transfer. Key components include the identification of the involved parties, detailed descriptions of the assets and liabilities being transferred, and the payment terms. Each party plays a distinct role; the transferor accepts the payment while relinquishing ownership, and the transferee receives the assets and takes on an associated set of obligations.

Each section of the agreement is designed to mitigate risks and ensure clarity. By defining the parameters of the transfer, both parties are safeguarded against potential legal disputes and misunderstandings.

Using the business transfer agreement form

For those looking to transfer a business, the first step is accessing a business transfer agreement form. These forms can often be found online, such as on pdfFiller, where users can conveniently download templates tailored to their needs.

The forms are typically available in various formats, such as PDF and Word, ensuring compatibility with different systems and preferences. This flexibility allows for ease of use, whether you are editing the document on a computer or signing it physically.

Step-by-step guide to filling out the business transfer agreement form

Filling out a business transfer agreement form requires careful attention to detail. Here's a breakdown of the sections you will encounter.

Section 1: Parties involved

The agreement should start with the identification of the parties involved in the transaction. This includes the transferor, i.e., the individual or entity selling the business, and the transferee, the buyer. Including full contact information and any relevant legal titles helps prevent confusion and miscommunication.

Section 2: Recitals

The recitals section outlines the purpose of the agreement and provides background information about the transfer, ensuring both parties have a shared understanding.

Section 3: Assets being transferred

This section details all assets included in the transfer, which may encompass tangible assets like inventory and equipment, as well as intangible assets like trademarks or business licenses. Clearly listing each asset ensures there are no misunderstandings about what is included in the transfer.

Section 4: Liabilities

The liabilities section addresses any outstanding debts or obligations associated with the business. It's crucial to specify how these liabilities will be handled after the transfer to avoid future disputes.

Section 5: Terms of transfer

This part of the agreement outlines the payment structure, including how much will be paid, deadlines for payments, and whether any conditions must be met for the transfer to proceed.

Section 6: Confidentiality clauses

Confidentiality is paramount in business transfers to protect sensitive information. Including specific clauses regarding confidentiality can prevent the unauthorized dissemination of business secrets.

Section 7: Restraint of trade

This section explains any non-compete agreements and constraints placed on the transferor, ensuring they do not directly compete with the business after the sale.

Section 8: Miscellaneous provisions

Finally, the agreement should include miscellaneous provisions such as governing laws, dispute resolution methods, and any clauses regarding amendments or severability.

Tips for effective business transfer agreements

Creating a strong business transfer agreement is essential for avoiding future complications. Here are some best practices.

Avoid common pitfalls such as vague stipulations, overlooking liabilities, or neglecting the necessity for formal signatures. Proper negotiation during the drafting process can significantly impact the success of the transfer.

Legal guidelines for business transfers

Every business transfer must adhere to local laws and regulations. It’s crucial to familiarize yourself with legislation governing sales and transfers in your jurisdiction to ensure compliance and avoid legal repercussions. Ignoring these regulations can result in severe penalties or invalidates the transfer altogether.

Thus, the involvement of legal counsel is advisable. They can provide valuable insights on the legal ramifications of the agreement and help navigate any complexities that may arise during the process.

Case studies: Examples of business transfer agreements

Examining real-life case studies can provide valuable insights into the practical aspects of business transfer agreements.

Short case study #1: Successful transfer with a comprehensive agreement

In one notable case, a local retail chain successfully transferred ownership to a larger corporation through a meticulously drafted business transfer agreement. Every asset was outlined with clarity, and liabilities were resolved prior to the sale, resulting in a seamless transition with minimal disputes.

Short case study #2: Pitfalls encountered in a business transfer

Conversely, a tech startup faced challenges during its transfer due to vague provisions regarding intellectual property rights. This lack of clarity led to disputes between the parties, prolonging the transfer process and requiring legal intervention. This underscores the critical importance of precision in drafting agreements.

Frequently asked questions (FAQ)

What is the typical duration of a business transfer?

The duration of a business transfer can vary widely based on factors such as the complexity of the deal, the size of the business, and the efficiency of the negotiation process. Generally, the process can take anywhere from a few weeks to several months.

How do determine the value of my business for the transfer?

Valuing a business for transfer can be accomplished through various methods, including market comparisons, income approaches, and asset-based valuations. It may also be beneficial to engage a business appraiser for an objective assessment.

What are the tax implications of a business transfer?

Business transfers can have significant tax implications which vary by jurisdiction. Consulting a tax professional can provide insights into potential capital gains taxes, sales taxes, and any other tax obligations that may arise.

Can a business transfer occur without a formal agreement?

While a business transfer can technically occur without a formal agreement, it is strongly advised to have one in place. A documented agreement ensures legal protection and provides a clear understanding of the terms involved in the transfer.

Related templates and resources

When preparing for a business transfer, it is helpful to have access to a variety of related templates and forms. pdfFiller offers comprehensive resources for business owners, including customizable transfer agreement forms that align with legal standards.

Additionally, tools for document management, such as eSigning features on pdfFiller, can streamline the process of finalizing agreements and ensuring both parties retain copies of signed documents.

Interactive tools for managing business transfers

In navigating the complexities of a business transfer, having the right tools can make all the difference. pdfFiller provides interactive capabilities that allow users to edit, sign, and collaborate on documents easily.

Utilizing these features enhances the overall experience of managing a business transfer, making the process seamless and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business transfer agreement to be eSigned by others?

How do I edit business transfer agreement online?

Can I edit business transfer agreement on an iOS device?

What is business transfer agreement?

Who is required to file business transfer agreement?

How to fill out business transfer agreement?

What is the purpose of business transfer agreement?

What information must be reported on business transfer agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.