Get the free Custodial Account Salary Reduction Agreement

Get, Create, Make and Sign custodial account salary reduction

How to edit custodial account salary reduction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out custodial account salary reduction

How to fill out custodial account salary reduction

Who needs custodial account salary reduction?

Custodial account salary reduction form: A how-to guide

Understanding custodial accounts

Custodial accounts are specialized accounts established to hold and manage assets for minors until they reach the age of majority. Such accounts are typically set up under either the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA). These accounts are crucial for parents and guardians looking to save for educational expenses or other financial needs of the minor, providing a controlled and growth-oriented environment.

A salary reduction is a beneficial method to fund these custodial accounts, wherein an individual opts to allocate a portion of their earnings directly into the custodial account. This route is important because it encourages consistent savings, compounding interest, and disciplined financial planning for a child’s future.

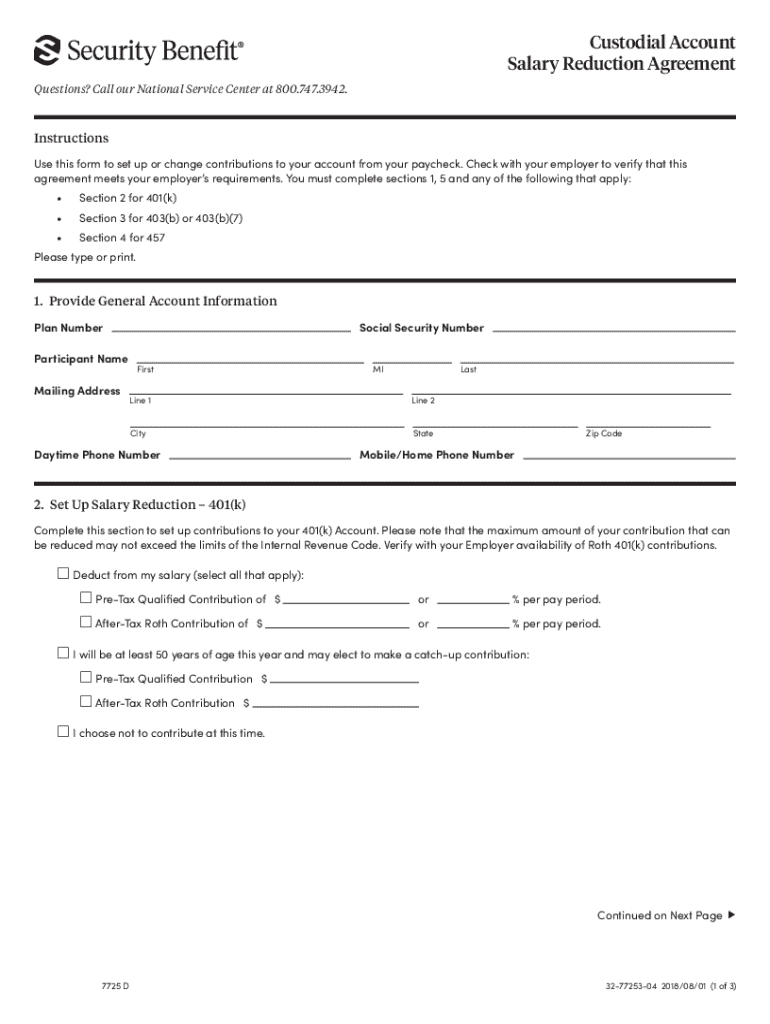

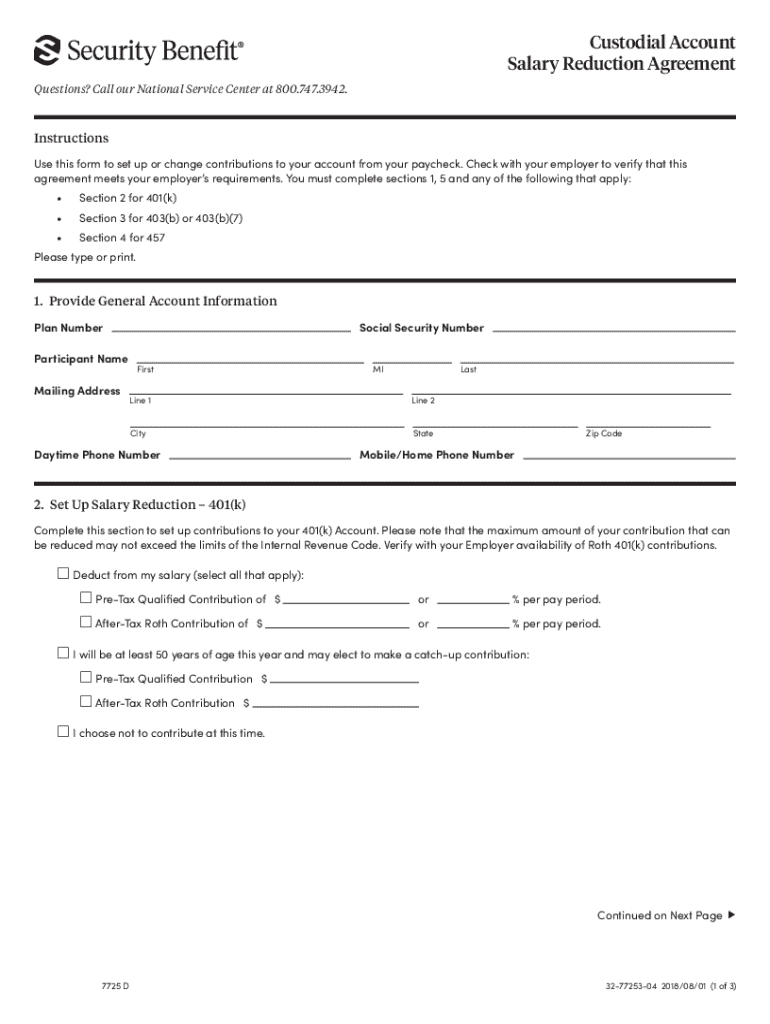

Overview of the salary reduction form

The custodial account salary reduction form is a crucial document that allows employees to designate a specific portion of their salaries to be contributed directly to a custodial account. This form serves as both a way to automate contributions and a tool for financial planning, ensuring that savings efforts for the custodian's minors are consistently met.

The primary parties involved in this process include the employee filling out the form, the employer who processes the salary deductions, and the financial institution managing the custodial account. Each of these stakeholders plays a critical role in ensuring that the form is executed correctly, and all parties stay informed of the contributions.

Preparing to complete the salary reduction form

Proper preparation is essential before completing the custodial account salary reduction form. Start by gathering all necessary personal information, including your name, address, and Social Security Number. It's also important to collect relevant details about the custodian and the beneficiary to ensure accurate processing.

In addition to personal data, familiarize yourself with your employer’s requirements and policies regarding salary reduction for custodial accounts. Understanding how your particular workplace handles such forms can greatly smooth the submission process and minimize issues.

Step-by-step guide to filling out the salary reduction form

Filling out the custodial account salary reduction form can be a straightforward process when approached in steps. Begin by accessing the specific form on pdfFiller. The platform offers a user-friendly interface that allows for easy navigation and editing.

Once you’ve downloaded the form, start by completing your personal information. Ensure accuracy, as any mistakes could delay the process. Next, specify the amount you wish to deduct from your salary and how often these deductions should occur. Various reduction options may be available depending on your financial goal and employer's policies.

Proceed to fill out the custodian and beneficiary details. This might involve entering your relationship to the minor, which can also impact how the account is managed. After providing all required information, take time to carefully review the entire form for any potential errors before submission.

Finally, determine the method of submission. On pdfFiller, you can submit the form electronically, which can expedite processing and add an essential layer of convenience.

Editing and making changes to the salary reduction form

Even after submitting a custodial account salary reduction form, there may be instances where you need to make adjustments to your contribution amounts or other details. Thankfully, pdfFiller provides robust editing tools that make this task straightforward. Access the form again on the platform and use the in-built features to revise your entries quickly.

It's essential to update your reduction amounts carefully, ensuring that your changes align with your current financial goals and any changes in your employment status. Additionally, pdfFiller allows you to save previous versions of your forms, making it easy to revert to earlier entries if necessary.

Signing the form: Options and process

Electronic signatures have gained popularity in recent years, allowing for swift and secure form submissions. eSignature is a digital method of signing documents that is legally binding and incredibly convenient. On pdfFiller, signing your custodial account salary reduction form is easy and efficient, thanks to the user-friendly interface.

To sign your form, navigate to the signature area within the document and follow the prompted steps. You will be guided through the process of adding your eSignature, providing immediate authenticity to your submission. After signing, it’s crucial to verify that your signature has been correctly applied to ensure a smooth approval process.

Managing your custodial account after submission

Once the custodial account salary reduction form has been submitted and contributions have begun, active management of the custodial account is essential. This includes tracking salary reductions and confirming that deposits are being made timely into the account. Regular checks will assist in monitoring growth and ensuring that funds are allocated as intended.

Additionally, it’s important to stay informed about updates or changes in custodial account regulations, as these can impact your contributions and the overall strategy for managing the account. Keep an eye on account statements and balances to make sure everything aligns with your financial plans.

Employer and financial professional insights

Employers play a significant role in facilitating custodial accounts for their employees. Understanding the nuances of the custodial account salary reduction form allows employers to help their employees navigate the process more effectively. Employers should ensure they have clear policies in place for managing these forms while also providing resources to help employees understand their options.

Financial professionals are also invaluable in assisting clients who wish to establish or manage custodial accounts. They can provide tailored advice on contributions and investments to maximize the benefits of the accounts. Additionally, they can help clients recognize and avoid common pitfalls, such as not aligning investment strategies with beneficiary needs.

FAQs about the custodial account salary reduction form

Many questions arise when dealing with the custodial account salary reduction form. One common query is regarding changes to the amount or frequency of contributions; typically, employees can modify these details by resubmitting a new version of the form. It’s essential to check with the employer for specific policies governing changes.

Another frequent concern involves stopping contributions entirely. Most employers allow individuals to halt deductions at any time, but written communication or a specific form may be required. Lastly, if an error occurs while filling out the form, it's advisable to address the mistake promptly with the employer. Often, corrections can be made swiftly to ensure the account remains in good standing.

Leveraging pdfFiller’s features for future document needs

Beyond handling custodial account salary reduction forms, pdfFiller offers a comprehensive suite of document management solutions that cater to a wide array of needs. Users can explore various document types for different situations, ensuring they have a tool readily available regardless of what they’re working on.

Key features include collaboration tools, making it easy to work alongside financial advisors or family members when planning savings strategies. Furthermore, pdfFiller maintains robust security measures to protect sensitive documents, reassuring users that their information is in safe hands. By leveraging these capabilities, individuals and teams can greatly enhance their document handling processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send custodial account salary reduction for eSignature?

How can I get custodial account salary reduction?

Can I create an electronic signature for the custodial account salary reduction in Chrome?

What is custodial account salary reduction?

Who is required to file custodial account salary reduction?

How to fill out custodial account salary reduction?

What is the purpose of custodial account salary reduction?

What information must be reported on custodial account salary reduction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.