Equitable LC-7774 2024-2026 free printable template

Get, Create, Make and Sign Equitable LC-7774

How to edit Equitable LC-7774 online

Uncompromising security for your PDF editing and eSignature needs

Equitable LC-7774 Form Versions

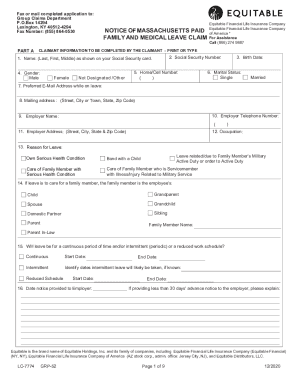

How to fill out Equitable LC-7774

How to fill out blank coverage cert

Who needs blank coverage cert?

Blank Coverage Cert Form: Your Comprehensive How-to Guide

Understanding the blank coverage certificate form

A blank coverage certificate, often referred to as a certificate of insurance, serves as proof that an entity holds various forms of insurance coverage. This document provides essential details about the types of insurance in effect, including general liability, property insurance, and any specialty coverages that may be applicable for specific businesses. Often required in many business transactions, the blank coverage certificate acts as a protective measure for all parties involved.

The significance of filling out a blank coverage certificate cannot be understated. Businesses and contractors must supply this form to demonstrate their financial responsibility and ability to cover potential claims. Without it, transactions may be delayed or halted, as clients, vendors, and partners seek assurance that financial repercussions stemming from unforeseen incidents will be managed adequately.

Key components of a coverage certificate typically include the policyholder's name, the effective dates of coverage, types of coverage provided, as well as any special endorsements or limitations. Understanding these elements ensures that everyone involved is on the same page regarding what financial protections are in place.

The role of coverage certificates in risk management

Effective risk management is essential for businesses, and blank coverage certificates play a vital role in this process. Risk management involves identifying, evaluating, and mitigating risks that could have financial implications for a business. By providing a coverage certificate, businesses can communicate their insurance status and affirm their commitment to maintaining coverage that protects against potential liabilities.

Coverage certificates provide peace of mind by reassuring all stakeholders that risks are addressed. These documents outline the specific types of coverage in effect, showcasing the business's preparedness to handle accidents, property damage, and liabilities. This level of coverage also signifies professionalism, as it shows potential clients and partners that the business takes its responsibilities seriously.

Common situations that necessitate a blank coverage certificate include construction contracts, leasing agreements, and professional services engagements. In these scenarios, the entities involved want reassurance that they are protected from financial losses that could arise from accidents or other unforeseen events. Therefore, presenting a blank coverage certificate not only enhances credibility but also minimizes risks associated with business operations.

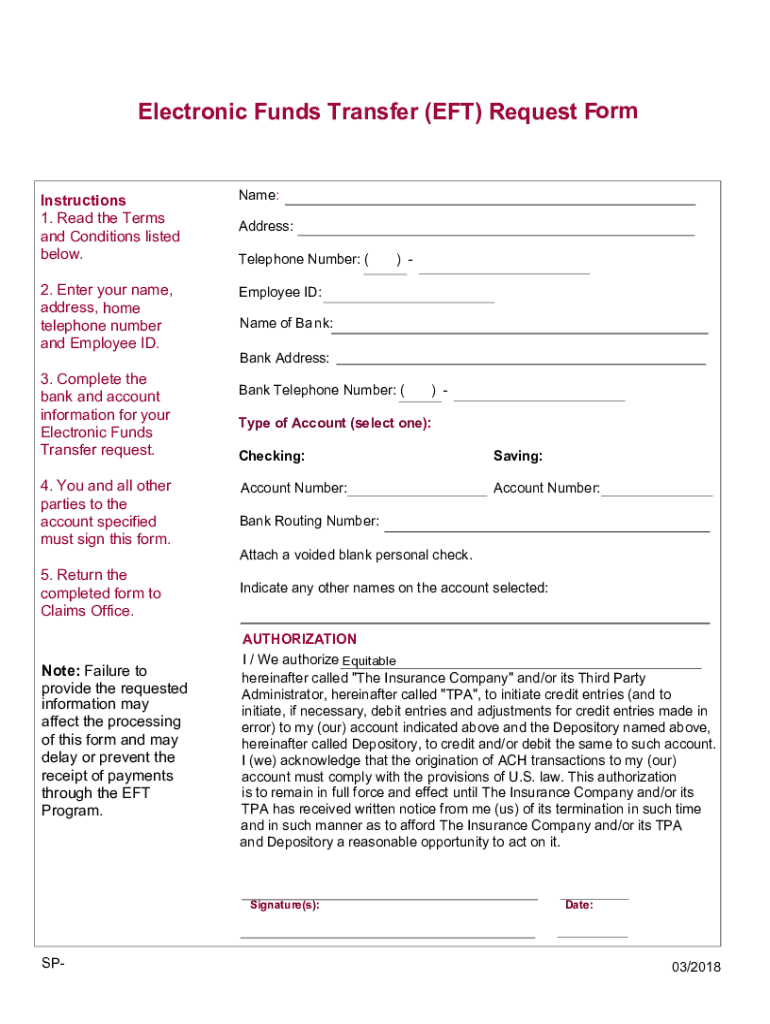

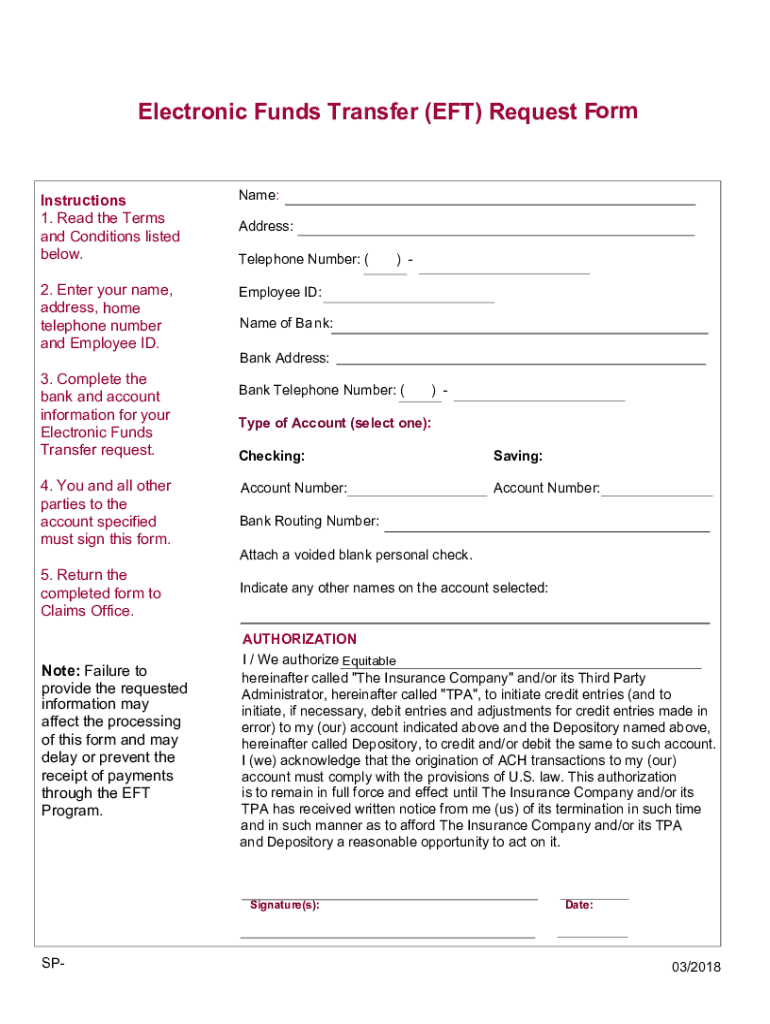

Step-by-step guide to filling out a blank coverage certificate form

When filling out a blank coverage certificate form, certain information is mandatory to ensure that it serves its intended purpose. Required information typically includes the contact information of the insured, the policyholder's details, the coverage limits of respective policies, and any additional essential information such as locations or descriptions of insured activities.

For completing each section accurately, focus on clarity and precision. Ensure that every piece of information matches official documents and is legible. Common pitfalls to watch out for include omitting necessary information, using vague language that could be misinterpreted, or failing to keep copies of the completed form for your records.

Editing and customizing your coverage certificate

Customization of your coverage certificate is often necessary to meet various business needs. Utilizing tools like pdfFiller simplifies editing this document by allowing users to add or modify fields effortlessly. The user-friendly interface makes it easy to keep everything tailored to specific projects while ensuring compliance with legal and industry standards.

One of the standout features of pdfFiller is the ability to incorporate custom fields. Businesses can add specific information that may not be covered in standard certificates or adjust elements to reflect unique terms of engagement. Incorporating digital signatures further boosts the authenticity and legality of the document, ensuring that all parties affirm their agreement to the terms laid out within the certificate.

Collaborating with teams on coverage certificates

When multiple stakeholders are involved in the completion of a blank coverage certificate, collaboration is essential. pdfFiller provides collaboration tools that enable team members to review and comment on documents in real-time. This functionality ensures that feedback is immediate, which reduces errors and streamlines the overall process of completing the certificate.

Best practices for team review include designating a lead reviewer who oversees the collaboration process, establishing clear deadlines for comments, and ensuring that all feedback is documented for future reference. Version control is another critical aspect—pdfFiller allows users to track changes, designate who made edits, and revert to previous versions if necessary. This prevents confusion and ensures the most current information is always utilized.

Signing and managing your coverage certificate

eSigning your coverage certificate with pdfFiller takes mere moments compared to traditional signing methods. The platform offers an easy-to-use eSignature feature that complies with legal standards, making digital signing just as valid as handwritten signatures. After signing, users can track changes and the status of signatures, which helps keep the document management process orderly and transparent.

To further enhance document security, it is advisable to store and access your coverage certificate in the cloud. This offers not only protection against loss or damage but also ensures that all authorized personnel have easy access to vital documents whenever needed. Cloud storage simplifies sharing and enhances teamwork, contributing to effective document management.

Frequently asked questions about coverage certificates

Many individuals and businesses have concerns regarding blank coverage certificates. One common question is, "What are the legal implications of not having a coverage certificate?" Generally, the absence of this document can lead to disputes and decreased trust in business transactions, as it signifies a lack of financial planning and responsibility.

Another frequently asked question involves insurance claims: "How will a coverage certificate affect my insurance claims?" Having a valid and accurate coverage certificate can greatly facilitate insurance claims processing by providing necessary proof of coverage at the time of an incident. Lastly, individuals often ask, "Can I modify a coverage certificate once it’s issued?" Modifications may be possible depending on the nature of changes required and the procedures established by the insurance provider.

Real-life applications of coverage certificates

Coverage certificates have broad applications across various industries. For instance, in the construction sector, contractors routinely present these documents to owners before work begins, ensuring compliance with contractual requirements. Similarly, service providers in the healthcare industry utilize coverage certificates to demonstrate their insurance status while negotiating contracts with providers.

Testimonials from businesses reflect the advantages of utilizing coverage certificates effectively. Many report increased confidence from clients when they possess validated insurance credentials, which often leads to higher contract completion rates and customer satisfaction. In this way, having a well-managed coverage certificate is not just a formality; it directly contributes to improved business results.

Related topics for further understanding

Diving deeper into the world of coverage certificates, understanding types of insurance coverage is crucial. Each policy serves different purposes, whether it’s general liability, workers' compensation, or property insurance. Knowing these distinctions helps in crafting a comprehensive coverage certificate that meets all necessary legal and operational demands.

Furthermore, recognizing the differences between an additional insured and a certificate holder can clarify responsibilities and coverage levels between parties. Taking the time to learn about insurance documentation and resources will empower professionals to create more effective risk management strategies, ultimately benefiting their businesses and clients.

Conclusion and next steps

The blank coverage cert form is not just a piece of paper; it’s an essential tool that connects businesses with their commitments to liability coverage. By streamlining the process of form completion through platforms like pdfFiller, users can enhance their document management experiences significantly. This cloud-based platform empowers individuals and teams to edit PDFs, eSign, collaborate, and manage vital documentation efficiently.

To get started, consider exploring pdfFiller’s various tools designed specifically for coverage certificates. By adopting this comprehensive documentation strategy, you can secure your business's future while effortlessly managing your insurance requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Equitable LC-7774 for eSignature?

Can I create an electronic signature for signing my Equitable LC-7774 in Gmail?

How do I edit Equitable LC-7774 straight from my smartphone?

What is blank coverage cert?

Who is required to file blank coverage cert?

How to fill out blank coverage cert?

What is the purpose of blank coverage cert?

What information must be reported on blank coverage cert?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.