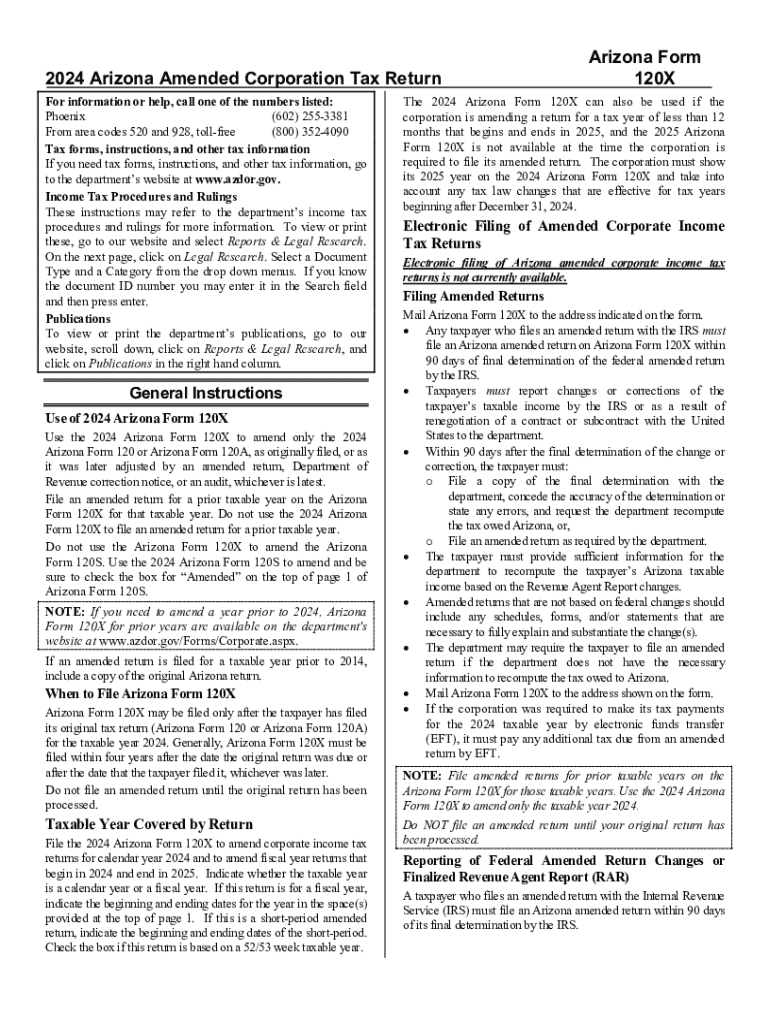

Get the free arizona form 120 instructions 2024

Get, Create, Make and Sign az form 120 instructions 2024

Editing arizona 120s instructions 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 120 instructions

How to fill out 2024 arizona amended corporation

Who needs 2024 arizona amended corporation?

2024 Arizona Amended Corporation Form: A Comprehensive Guide

Overview of the Arizona amended corporation form

The Arizona amended corporation form serves as a crucial document for businesses seeking to alter their corporate structure, purpose, or operational details. As guidelines and regulations evolve, keeping this form updated is benchmarked in maintaining good standing with the Arizona Secretary of State.

Filing the amended form not only clarifies any operational discrepancies but also helps prevent legal disputes and ensures compliance with state laws. In 2024, various requirements and procedures have been modified, reflecting the state’s commitment to streamline corporate governance.

Eligibility criteria for filing an amended corporation form

Understanding who is eligible to file the 2024 Arizona amended corporation form is essential for ensuring compliance. Generally, any corporation that wishes to change its operational structure, business purpose, or other significant information can file an amended form. This includes both for-profit and nonprofit organizations.

Common situations that necessitate filing an amended form include changes in corporate officers, address modifications, an expansion in business purpose, or updates to share structure. Failing to comply with these filing requirements can result in penalties, including loss of good standing with the state, which may hinder business operations.

Preparing to complete the amended corporation form

Before diving into the completion of the amended corporation form, ample preparation is key to ensuring accuracy and completeness. Start by gathering essential documents such as the current articles of incorporation, previous amendments, and any supporting documentation that may be required for the specific changes being made.

Being organized can significantly reduce filing errors. Engaging with internal stakeholders, such as your legal counsel or board members, can also help in ensuring accuracy in the presented data. Common mistakes include incorrect corporate identification numbers or failing to include necessary signatures, which can lead to a rejected filing.

Step-by-step guide to completing the 2024 form

Completing the 2024 Arizona amended corporation form involves several detailed steps. Following this structured approach ensures that you cover all necessary components.

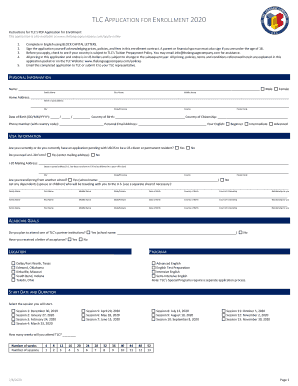

Step 1: Downloading the amended corporation form

To begin, you need to download the appropriate form. A convenient option for accessing the form is through pdfFiller, which offers an interactive platform to manage your documents.

Step 2: Filling out the form

Now, it's time to fill out the form. Key sections include:

Step 3: Review and validation

Before finalizing the form, meticulously review it. Utilize a checklist to confirm you have included all necessary details. Correct information is vital, as inaccuracies can lead to processing delays.

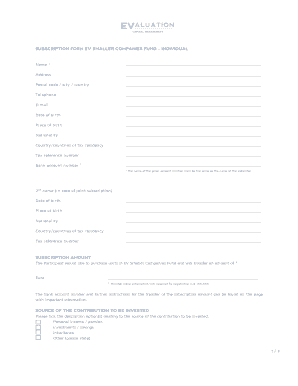

Step 4: Signing the form

Once reviewed, the form must be signed by an authorized signatory. pdfFiller provides convenient eSigning options, making this process straightforward and legally binding.

Step 5: Submitting the amended form

Finally, submit your amended form. Submission methods include online filing, mailing, or in-person delivery to the Arizona Secretary of State. Be mindful of the associated fees when submitting your form.

Post-submission: what to expect

After submission, you will receive confirmation that your form has been filed. Standard processing times may vary, so it’s recommended to frequently check the status through the Arizona Secretary of State's online portal. Stay proactive in following up until you receive acknowledgment of your amended corporation details.

Once approved, it’s crucial to update any operational references and inform internal and external stakeholders about the changes made. This ensures everyone related to your business operations is on the same page and minimizes potential discrepancies.

Common questions and issues related to the amended corporation form

Understanding common queries can significantly enhance your filing experience. Below are some frequently asked questions regarding the Arizona amended corporation form.

Additional resources for Arizona corporations

Navigating the complexities of corporate documentation can feel overwhelming, but various resources can aid in the process. The Arizona Secretary of State's website is a vital tool for accessing forms, filing requirements, and further details about corporation management. pdfFiller also offers extensive resources for document management, making it easier for you to track amendments and retain records efficiently.

Best practices for document management with pdfFiller

Utilizing the capabilities of pdfFiller can greatly enhance your document management strategies. To maintain a well-organized workflow, consider these best practices:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify arizona form 120 instructions without leaving Google Drive?

How can I get arizona form 120 instructions?

How do I complete arizona form 120 instructions on an iOS device?

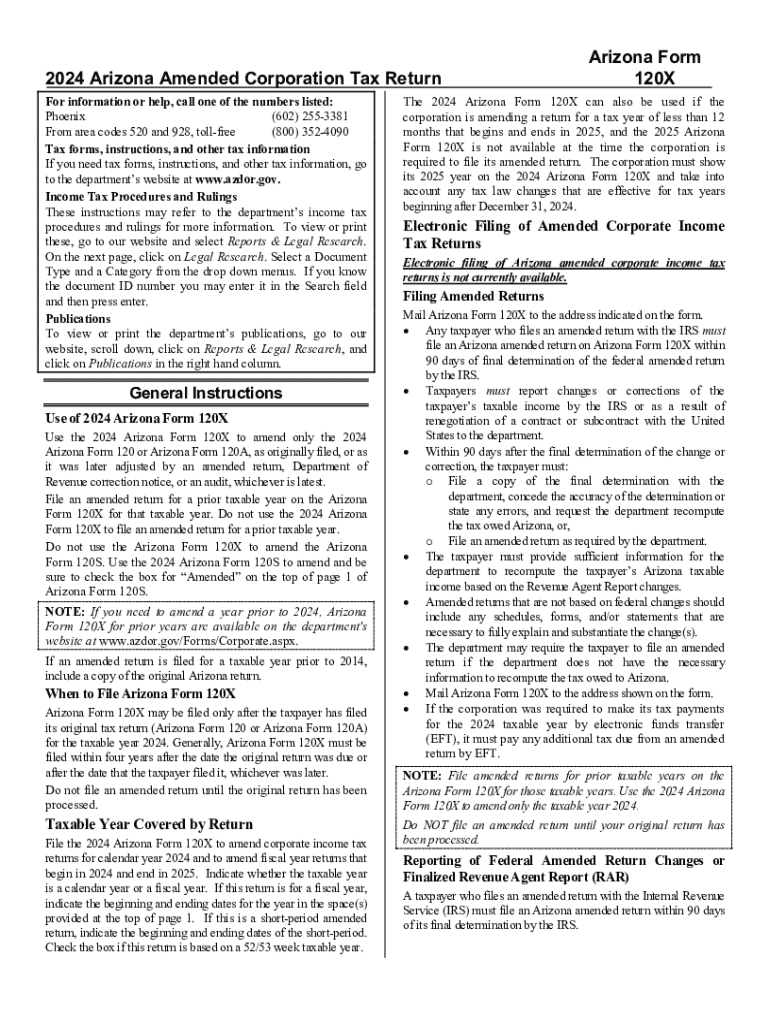

What is arizona amended corporation?

Who is required to file arizona amended corporation?

How to fill out arizona amended corporation?

What is the purpose of arizona amended corporation?

What information must be reported on arizona amended corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.