Get the free Single-family Individual Review (ir) Guidelines’ Key Points Checklist

Get, Create, Make and Sign single-family individual review ir

How to edit single-family individual review ir online

Uncompromising security for your PDF editing and eSignature needs

How to fill out single-family individual review ir

How to fill out single-family individual review ir

Who needs single-family individual review ir?

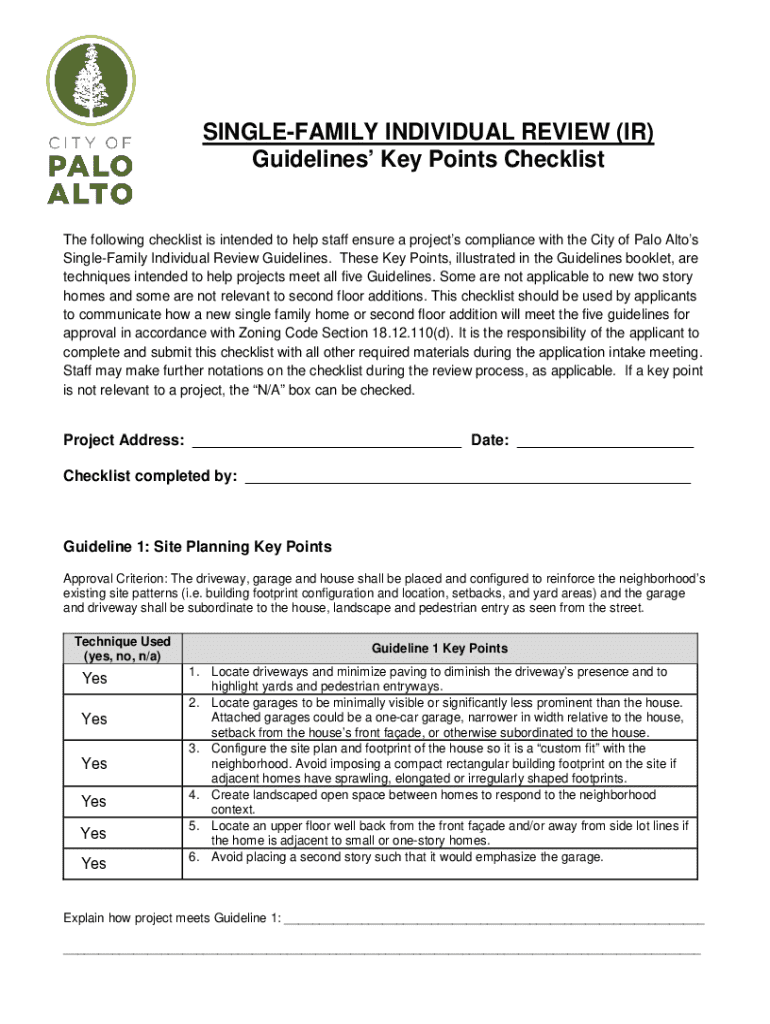

Understanding the Single-Family Individual Review IR Form

Overview of the Single-Family Individual Review IR Form

The Single-Family Individual Review IR Form is a critical document used primarily in property assessments, mortgage applications, and real estate transactions. Its primary purpose is to collect essential information that helps stakeholders, such as lenders and appraisers, assess a property's value and the borrower's financial capabilities.

Effective document management hinges on forms like this, which streamline processes and ensure compliance with regulatory requirements. By utilizing the Single-Family Individual Review IR Form, all parties involved can gauge property conditions, validate financial standing, and facilitate smoother transactions.

Key features of this form include sections for personal information, detailed property assessments, and financial data requirements. Each feature is designed to capture pertinent details crucial for making informed decisions during property transactions.

Understanding the context of the Single-Family Individual Review

The Single-Family Individual Review IR Form serves various stakeholders. Homeowners need this form to provide lenders with a clear picture of their financial capabilities and property conditions, which are essential for loan approvals. Real estate agents utilize the form when representing buyers and sellers, ensuring that all necessary information is communicated effectively during negotiations.

Additionally, financial institutions—such as banks and mortgage companies—require this form to assess risks and make informed lending decisions. Specific usage scenarios include:

Step-by-step guide to filling out the form

Completing the Single-Family Individual Review IR Form accurately is essential for ensuring effective communication of your financial and property details. Here’s a comprehensive guide to successfully fill out the form.

Required Information

Filling out this form involves three main categories of information:

Detailed instructions for each section

1. **Section 1: Personal Information** - Fill in your name, address, and contact details. Double-check for accuracy. 2. **Section 2: Property Details** - Enter the property address, year constructed, number of bedrooms and bathrooms, and any unique amenities. 3. **Section 3: Financial Overview** - Disclose income sources, monthly expenses, and outstanding debts. Accuracy helps avoid processing delays.

To avoid common mistakes, ensure clarity in handwriting or typing, double-check all figures, and follow the guidelines for each section closely.

Editing and customizing the form

When using pdfFiller to manage the Single-Family Individual Review IR Form, you can easily edit and customize the document as needed. Utilizing its editing tools allows you to tailor the form to meet your specific requirements.

Options for customization include:

eSigning the Single-Family Individual Review IR Form

The eSignature process for the Single-Family Individual Review IR Form is straightforward with pdfFiller. eSignatures provide a legally binding way to finalize your document without the hassle of printing or scanning.

To set up your signature in pdfFiller:

Ensuring compliance with legal standards is crucial, so check that your eSignature meets national and regional requirements.

Collaborating with team members

Collaboration is key in completing the Single-Family Individual Review IR Form accurately. pdfFiller allows users to share documents with team members or stakeholders efficiently.

Utilize tools offered by pdfFiller, including:

Managing and storing your completed forms

Effective document management of your completed Single-Family Individual Review IR Form is crucial for future reference and compliance. Best practices for management include:

Troubleshooting common issues

While filling out the Single-Family Individual Review IR Form, several common issues might arise. Being aware of these can help you troubleshoot effectively.

Common errors include:

If errors occur, pdfFiller offers tools to correct mistakes easily. If further help is needed, contacting support is just a click away.

Frequently asked questions about the Single-Family Individual Review IR Form

Understanding potential queries can further enhance the efficiency of using the Single-Family Individual Review IR Form. Common questions include:

Enhancing your document management workflow with pdfFiller

To maximize your efficiency when handling the Single-Family Individual Review IR Form, integrating pdfFiller with other software solutions can streamline your workflow.

These integrations facilitate:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send single-family individual review ir to be eSigned by others?

Where do I find single-family individual review ir?

How do I edit single-family individual review ir on an iOS device?

What is single-family individual review ir?

Who is required to file single-family individual review ir?

How to fill out single-family individual review ir?

What is the purpose of single-family individual review ir?

What information must be reported on single-family individual review ir?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.