Get the free Schedule J (541)

Get, Create, Make and Sign schedule j 541

How to edit schedule j 541 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule j 541

How to fill out schedule j 541

Who needs schedule j 541?

Schedule J 541 Form How-to Guide

Overview of Schedule J 541 Form

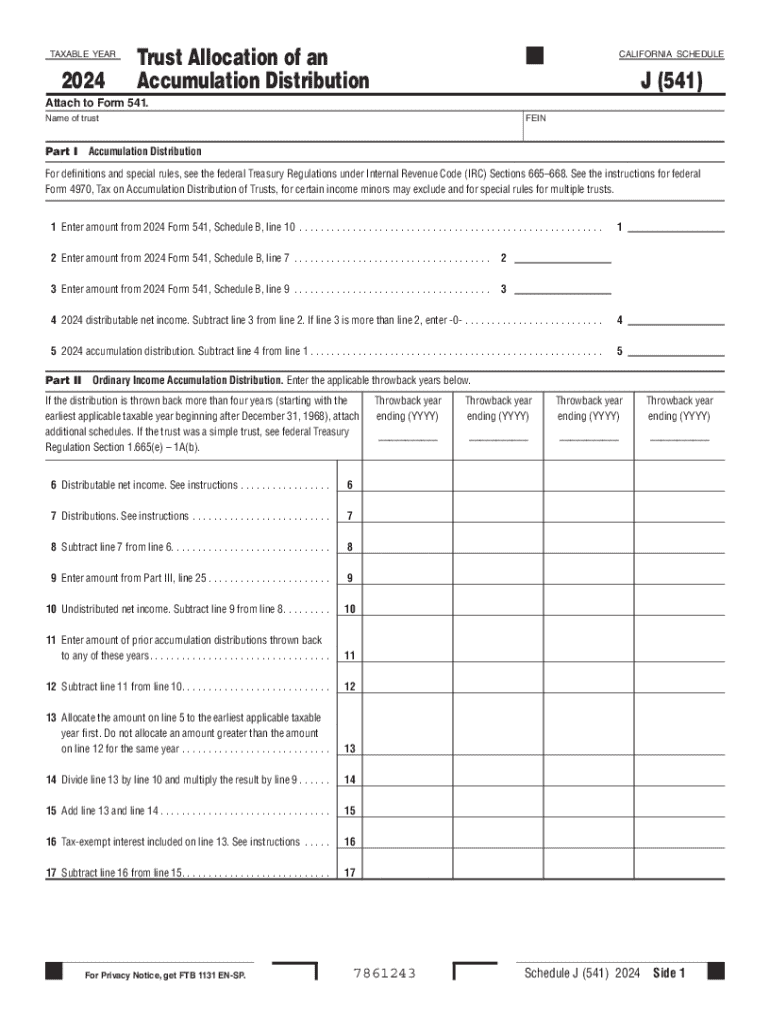

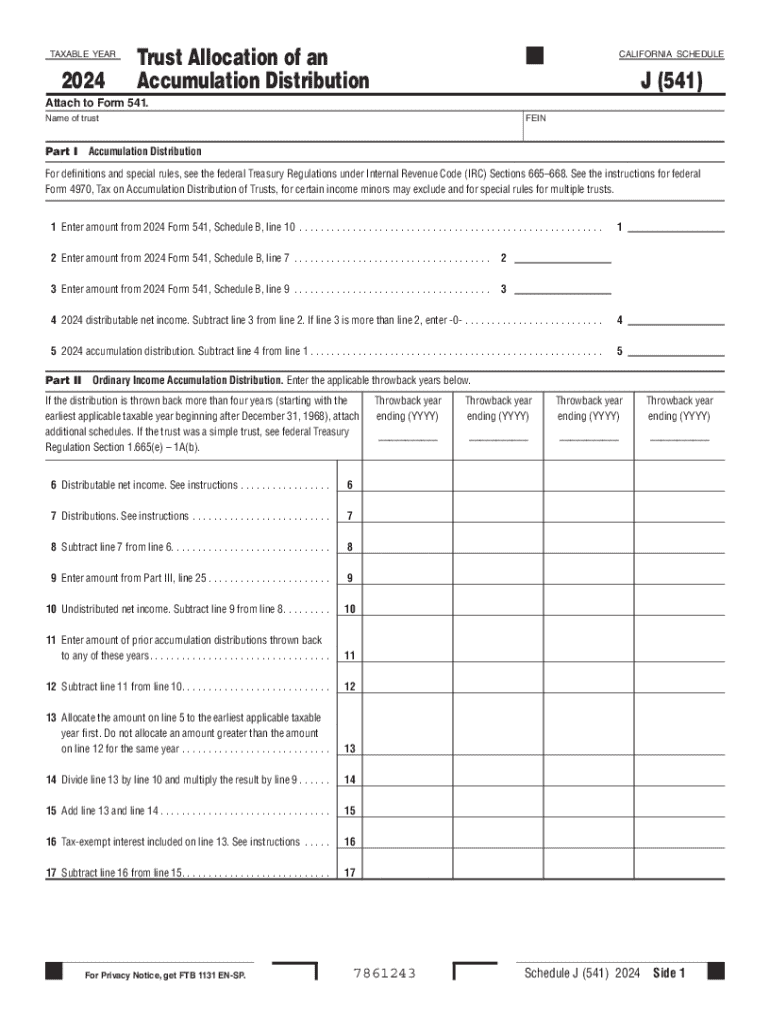

Schedule J 541 is a crucial form used in the administration of certain trusts, particularly for reporting income distributions to beneficiaries. This form allows trusts to detail their accumulation distributions, ensuring that the tax liabilities associated with undistributed income are correctly allocated to the right beneficiaries. Understanding this form is vital for trustees and tax preparers, as it directly impacts the tax obligations of the trust and its beneficiaries.

When filling out the Schedule J 541 form, expect to convey complex financial details about the trust, including income, distributions, and retained earnings. It's essential to be meticulous, as inaccuracies can lead to penalties or misunderstandings with the IRS. This form serves various purposes, primarily for trusts seeking to clarify how net income is allocated to beneficiaries, making it a key document in trust taxation. Individuals or entities managing estates or trusts, tax professionals, and fiduciaries will find this form particularly relevant.

Preparing to fill out Schedule J 541

Before tackling the Schedule J 541 form, it’s crucial to gather all necessary documentation and information that will support accurate completion. Key pieces of information include the names and identification details of each beneficiary, as well as comprehensive financial statements of the trust. This ensures that all figures accurately reflect the trust's income and expenditures.

Additionally, it's wise to understand trust allocations—specifically how income is distributed among beneficiaries and which amounts remain accumulated. Familiarize yourself with key terminologies related to trust accounting and tax obligations, such as "accumulation distribution" and "ordinary income." These concepts are integral to completing the form correctly and ensuring compliance with tax laws.

Step-by-step instructions for completing Schedule J 541

Filling out the Schedule J 541 form can seem daunting, but following a structured approach simplifies the process. The form is divided into four major parts, each addressing different aspects of the trust's income and distributions.

Part : Accumulation Distribution

This section requires a detailed breakdown of the income that has been accumulated but not distributed to beneficiaries. You'll need to include key figures such as the total accumulated income and any amounts distributed during the tax year. Make sure to indicate the specifics of what constitutes accumulation, such as reinvested earnings and other forms of income that aren't directly paid out.

Part : Ordinary Income Accumulation Distribution

In this part, trustees must calculate the ordinary income that exceeds the distributions made during the year. Carefully follow the instructions to ensure that all income earning categories are considered and correctly reported.

Part : Taxes Imposed on Undistributed Net Income

It's essential to report any taxes that are applicable to the undistributed net income correctly. The IRS provides specific guidelines regarding the federal tax rates that apply here, and you may find calculators useful to estimate the anticipated tax liability.

Part : Allocation to Beneficiary

This final section outlines how the accumulated income is to be allocated among the beneficiaries. If there are multiple beneficiaries, it’s important to detail the criteria and the specific amounts allocated to each. Proper documentation of allocations can prevent disputes and enhance transparency.

Interactive tools for Schedule J 541

Utilizing online tools can greatly expedite the process of filling out the Schedule J 541 form. Platforms like pdfFiller offer innovative features, such as online calculators and templates specifically designed for this form, that simplify the calculation of taxes and income distributions.

Interactive checklists are also available to ensure all necessary steps are followed when completing your form. This helps streamline the process and reduces the chances of errors.

Tips for editing and finalizing your Schedule J 541

Once your Schedule J 541 form is filled out, a thorough review is essential. Check all figures for accuracy and ensure that all required sections are completed. A common best practice is to read each section in context, verifying that the reported amounts align with the overall financial statements.

Should you need to make any corrections, leveraging platforms like pdfFiller can be beneficial. The platform allows users to edit documents seamlessly, correcting any inaccuracies without the need for a complete overhaul. Finally, utilize the eSignature feature available to securely sign your document, ensuring compliance with submission requirements.

Common mistakes to avoid with Schedule J 541

When completing the Schedule J 541 form, several common mistakes can lead to processing delays or penalties. Failing to accurately report the income accumulated can result in significant tax implications. Additionally, neglecting to allocate undistributed income properly among beneficiaries can lead to misunderstandings and potential disputes.

To mitigate these risks, ensure all income is clearly categorized according to IRS guidelines, and that the allocations are derived from documented decisions made by the trust. Utilizing interactive tools to guide the completion of the form can also reduce human errors, facilitating the submission process.

Frequently asked questions (FAQs)

Navigating the complexities of the Schedule J 541 form often leads to confusion regarding specific procedures and requirements. For instance, many users wonder how to handle cases where a trust has both accumulation and distribution periods within the same year. A simple solution is to separate these instances clearly on the form, documenting each distribution as it occurs.

Another common issue arises with beneficiaries who are changing year to year. In such cases, keep precise records about who was a beneficiary during each tax year to ensure clarity in allocations when filling out the form. This proactive approach helps to avoid potential discrepancies and regulatory scrutiny.

Related documentation and forms

It’s essential to recognize that the Schedule J 541 form works in conjunction with several other trust-related documents. Forms such as the IRS Form 1041, which reports income for estates and trusts and the Schedule K-1, which informs beneficiaries of their share of income, are closely related. Understanding how these forms interact ensures that the overall tax position of the trust is coherent and compliant.

The comparative overview of similar forms can also aid in understanding their specific uses. For instance, while Schedule J 541 focuses on accumulation distributions, the IRS Form 8862 relates to the Earned Income Tax Credit, which is entirely different but shares the context of income reporting for tax purposes.

Additional support and resources

Understanding and filling out the Schedule J 541 form can be complex, leading many to seek professional assistance. Engaging with tax advisors or legal consultants who specialize in trust management can provide clarity on intricate issues and ensure compliance with all current regulations. These experts can help navigate unique nuances pertinent to your specific situation.

Furthermore, governmental resources such as the IRS website offer comprehensive guides and updated information on trust taxation and related forms. Accessing these resources can significantly enhance your understanding and compliance when dealing with tax collections and distributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit schedule j 541 from Google Drive?

Can I sign the schedule j 541 electronically in Chrome?

Can I edit schedule j 541 on an Android device?

What is schedule j 541?

Who is required to file schedule j 541?

How to fill out schedule j 541?

What is the purpose of schedule j 541?

What information must be reported on schedule j 541?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.