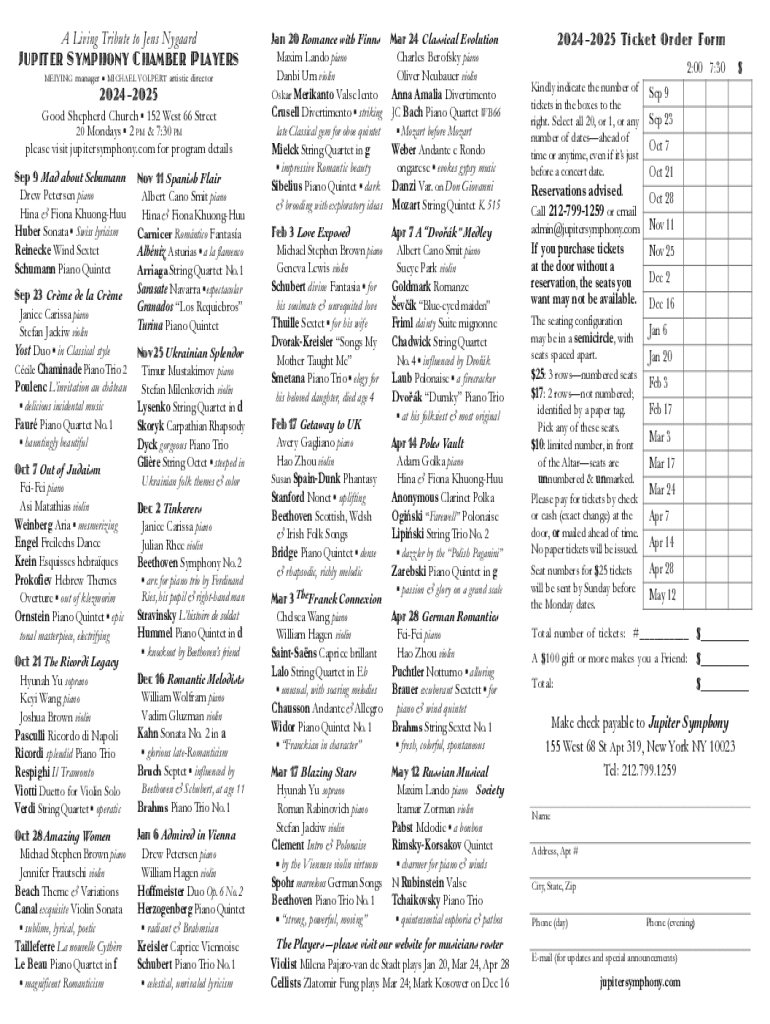

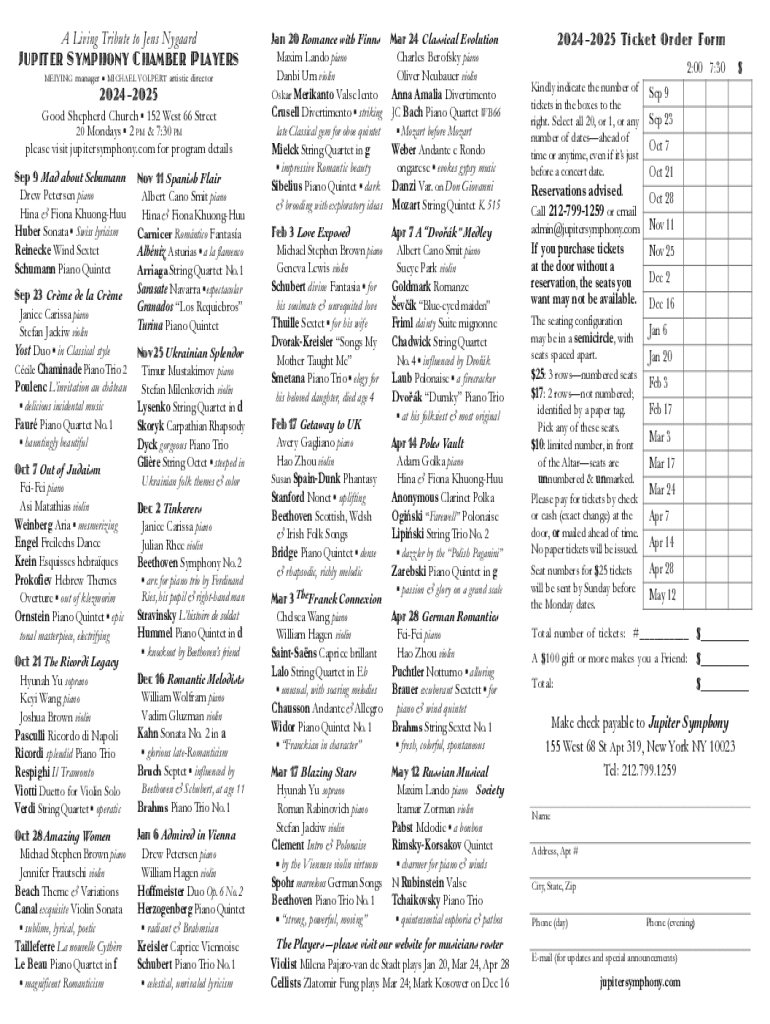

Get the free Make check payable to Jupiter Symphony 155 West 68 St Apt 319 ...

Get, Create, Make and Sign make check payable to

Editing make check payable to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out make check payable to

How to fill out make check payable to

Who needs make check payable to?

How to Create a 'Make Check Payable To' Form: A Comprehensive Guide

Overview of payable checks

To 'make a check payable to' someone means you're designating who should receive the funds written on the check. This simple yet crucial step ensures that the funds are directed to the intended recipient. Understanding this is not merely about following the format; it is about ensuring trust and clarity in financial transactions. The importance of correctly completing this part of a check cannot be understated, as errors here can lead to delays and confusion.

There are various types of checks including personal checks, business checks, and money orders. Each type serves a different purpose but fundamentally requires proper payee designation. Personal checks are often written for everyday expenses, while business checks are used for corporate transactions. Money orders, on the other hand, are a safer alternative for individuals who may not have a bank account.

Understanding the context: when to use make check payable

Knowing when to use a 'make check payable to' form is essential. Typically, checks are used in situations such as paying for services, settling bills, or making donations. Each of these scenarios requires clear and accurate payee details to avoid misdirection of funds. If the check is incorrectly payable, it could cause delays in receiving payment, and in worse scenarios, legal disputes may arise.

Legal and financial implications arise from mislabeling the payee's name. If a check is made out to the wrong person, the intended recipient may never get paid. Furthermore, if the payee uses the check without clarification, it could lead to claims of fraud or misrepresentation, which can have severe consequences. Therefore, understanding the importance of accurate details is paramount.

Essential information for filling out a check

When filling out a check, several key elements must be addressed to ensure the document serves its purpose effectively. You need to include:

Including all these elements correctly can help streamline the payment process and ensure that your check is cashed without unnecessary interruptions.

Step-by-step instructions for making a check payable

Now, let's outline the steps to correctly make a check payable. This guide is structured to provide clarity and prevent mistakes in this fundamental financial activity.

Following these steps will help you ensure that your check is correctly completed and ready for processing.

Common mistakes when making a check payable

Even seasoned check writers can make mistakes, which can lead to delays in processing or even financial loss. Here are some of the most common errors found when making a check payable:

Avoiding these mistakes can save time and headaches in handling payments.

Tips for ensuring your check is processed smoothly

To maximize the likelihood that your check will be processed without issues, keep these tips in mind:

Diligently applying these tips can enhance the security and efficiency of your financial transactions.

Alternatives to making a check payable

While checks are still widely used, digital alternatives are becoming increasingly popular. Here are some alternatives to consider when making payments:

Evaluating these alternatives might lead you to a more convenient and efficient payment method in certain scenarios.

Frequently asked questions about making checks payable

When dealing with checks, several common queries tend to arise. Here are answers to frequently asked questions:

These answers provide vital insights into effectively managing check payments.

Utilizing pdfFiller for effortless document management

pdfFiller offers a versatile solution for managing checks and other documents in an increasingly digital world. With pdfFiller's tools, users can simplify the process of filling out and sending checks.

The platform allows users to securely distribute and store checks online. With electronic signatures, you can expedite your payments without the need for physical travel or mailing delays.

Additionally, pdfFiller offers editing features, allowing you to customize your check template easily, ensuring compliance with various payee formats.

Conclusion of best practices

In summary, ensuring that checks are filled out correctly is not just about the information on the paper—it's about financial efficiency and security. Make checks payable correctly and be vigilant against common pitfalls.

Utilizing tools like pdfFiller can streamline the process, allowing you to focus on what matters—effectively managing your financial obligations.

User experiences and testimonials

Many individuals and teams have turned to pdfFiller for their check management needs. User experiences highlight how seamlessly the platform integrates document creation and eSigning, vastly improving workflow.

The interactive features provided by pdfFiller not only simplify filling out checks but also ensure secure storage, making checks easier to manage than traditional methods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify make check payable to without leaving Google Drive?

How can I send make check payable to to be eSigned by others?

How can I edit make check payable to on a smartphone?

What is make check payable to?

Who is required to file make check payable to?

How to fill out make check payable to?

What is the purpose of make check payable to?

What information must be reported on make check payable to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.