Get the free Financial Assistance Application

Get, Create, Make and Sign financial assistance application

Editing financial assistance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assistance application

How to fill out financial assistance application

Who needs financial assistance application?

Financial Assistance Application Form: A How-to Guide

Understanding financial assistance applications

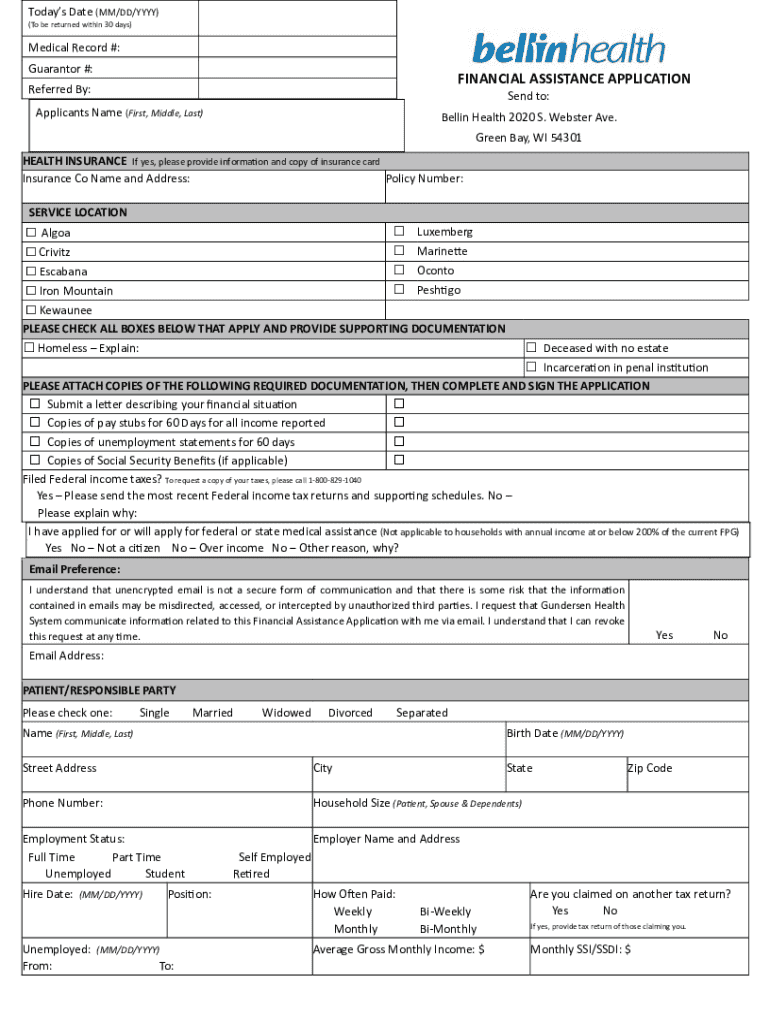

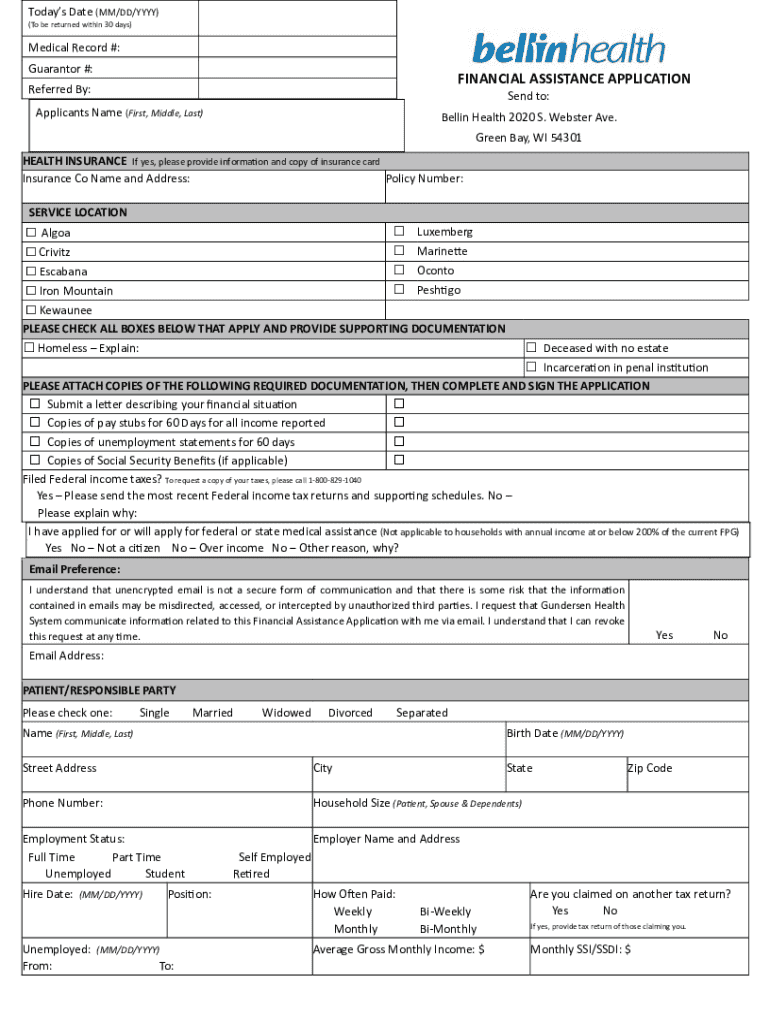

A financial assistance application form is a critical document designed to assist individuals and families in securing financial support to meet essential needs. This support can cover various services, from medical payments to utilities and educational expenses. By documenting information about your financial situation, you can demonstrate your need for assistance, helping organizations evaluate your eligibility.

The significance of these applications extends far beyond the immediate financial relief they offer. They empower those in need to gain access to necessary services, ensuring that economic hardships do not hinder an individual's or family's well-being. Without financial assistance, many people would struggle to maintain their health, education, and living conditions during challenging times.

Understanding who should apply is equally crucial. Individuals facing sudden job loss, unexpected medical expenses, or a significant change in family dynamics often find themselves in situations that warrant a financial assistance application. Particularly, those with low or fixed income, large families, or exorbitant medical debts should consider applying to seek aid from local charities, hospitals, or government programs.

Preparing to complete your financial assistance application form

Before diving into the application process, gather all relevant documents to ensure a smooth experience. Essential documents typically include proof of income, identification (such as a driver’s license or social security card), and any recent tax returns. Having these documents readily available will streamline the process, allowing you to fill in the application form with accuracy and confidence.

Organizing your paperwork efficiently is vital. Create a dedicated folder where you can keep all your documents together. This can minimize stress when the application deadline approaches, ensuring that you do not overlook any essential paperwork. By aligning well-organized documents with the application, you boost your chances of quick approval.

Understanding the eligibility criteria is another key step in preparing your application. Eligibility varies by program but often includes considerations such as income level, family size, and existing debts. Most financial assistance programs target low-income households, so it’s crucial to assess your financial standing against these benchmarks. Typically, support programs have set income limits that, if exceeded, disqualify applicants.

Detailed sections of the financial assistance application form

When completing the financial assistance application form, you will encounter several key sections. The first section—**Applicant Information**—requires basic personal details like name, address, and contact information. It's crucial to ensure that all entries are accurate and complete to avoid delays in processing.

Next, depending on the applicant's situation, you may need to furnish **Patient Information**, especially if the applicant differs from the patient needing assistance. Accurately providing the patient's medical background and residency can facilitate eligibility checks, so take your time to gather all relevant health-related documentation.

**Patient or Responsible Party Information** is another essential section that gathers details about caregivers or financially responsible parties. In cases where you are applying on behalf of someone else, ensure that you include consent forms and identification that confirms your role as a supporter.

The **Spouse or Partner Information** section is equally important. Documenting your spouse’s or partner's income gives a comprehensive view of household finances. Be thorough and include any income documents such as pay stubs or tax returns, as this assists evaluators in grasping the complete financial picture.

As you disclose income, include all relevant types such as wages, child support, and social security. Calculating total household income accurately is crucial—if you misreport or leave out income information, it may lead to processing delays or denial of assistance. An important aspect is detailing your existing **Medical Debt**; accurately indicating your debts helps lawmakers verify your claim and expedite your application.

Completing the application process

Filling out the financial assistance application form can seem daunting, but it becomes manageable with a step-by-step approach. Start by carefully reading every section to ensure you understand the information required. Focus on each segment, ensuring that you provide detailed and honest responses while adhering to word limits, where applicable.

After completing the application, it is essential to review it thoroughly before submission. Compile a checklist of key information, including verifying your name, waiting for errors like 'error enter employer name,' and ensuring all income and medical debts are accurately stated. Double-checking prevents issues that could lead to delays, as even minor inaccuracies can derail the entire application process.

Submitting your financial assistance application

Once your application is complete, it’s time to submit it. There are typically several methods for submission: online, by mail, or in person, with many programs favoring digital submissions for their speed and efficiency. If you opt to submit your application digitally, consider using platforms like pdfFiller, which offers user-friendly tools for uploading and sending forms securely.

Managing your submission confirmations and following up is crucial. Keep track of any confirmation numbers you receive and note down the dates of your submission. Following up with customer service teams can also ensure that your application is under review and assist in clearing up any issues that may arise.

Frequently asked questions (FAQs)

When applying for financial assistance, many people have common questions that arise during the process. A prevalent query includes the timeline for approval, which can vary significantly depending on the organization and the volume of applications they handle. In general, processing times range from a few days to several weeks. Therefore, it's wise to inquire about expected timeframes when you submit your application.

Another frequent issue is what to do if your application is denied. Most assistance programs offer a formal appeal process, so if your application isn’t successful, read the denial letter carefully. It typically outlines the reasons for denial and the steps you may take to appeal the decision or re-apply.

Utilizing pdfFiller for your financial assistance application

pdfFiller is an excellent resource for editing and customizing your financial assistance application form. With intuitive tools available at your fingertips, you can easily make necessary changes, ensuring the application reflects your current circumstances. This cloud-based platform provides a secure solution for managing your documents and includes features for real-time collaboration when working with advisors or family members.

Additionally, pdfFiller allows you to seamlessly eSign your application, a critical step in the submission process. By digitally signing your application, you can save time without compromising security. This feature grants a simple, efficient way to complete your application and submit it to relevant organizations, making your path to relief smoother.

For those collaborating on their applications with family members or financial advisors, pdfFiller’s sharing options allow real-time document updates, enhancing communication. This feature ensures everyone involved can contribute effectively, allowing for a comprehensive and accurate application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in financial assistance application without leaving Chrome?

Can I create an eSignature for the financial assistance application in Gmail?

How do I complete financial assistance application on an Android device?

What is financial assistance application?

Who is required to file financial assistance application?

How to fill out financial assistance application?

What is the purpose of financial assistance application?

What information must be reported on financial assistance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.