Get the free Property Tax Bill

Get, Create, Make and Sign property tax bill

How to edit property tax bill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax bill

How to fill out property tax bill

Who needs property tax bill?

Understanding the Property Tax Bill Form: A Comprehensive Guide

Understanding property taxes

Property taxes are essential for funding local government services such as education, infrastructure, and public safety. They are based on the assessed value of real estate, which includes residential and commercial properties. Property owners need to understand the implications of these taxes, as they influence both homeowner finances and community resources.

There are three primary types of property taxes: secured, unsecured, and supplemental. Secured taxes apply to real property and are typically based on its assessed value. Unsecured taxes, on the other hand, are levied on personal property such as business equipment or furniture. Supplemental taxes are additional taxes imposed when property changes ownership or is improved, reflecting the increase in value.

Local governments play a critical role in property tax assessment. They determine the property’s assessed value, which is crucial for calculating taxes owed. Understanding the process of assessment can empower property owners to ensure their taxes are accurate.

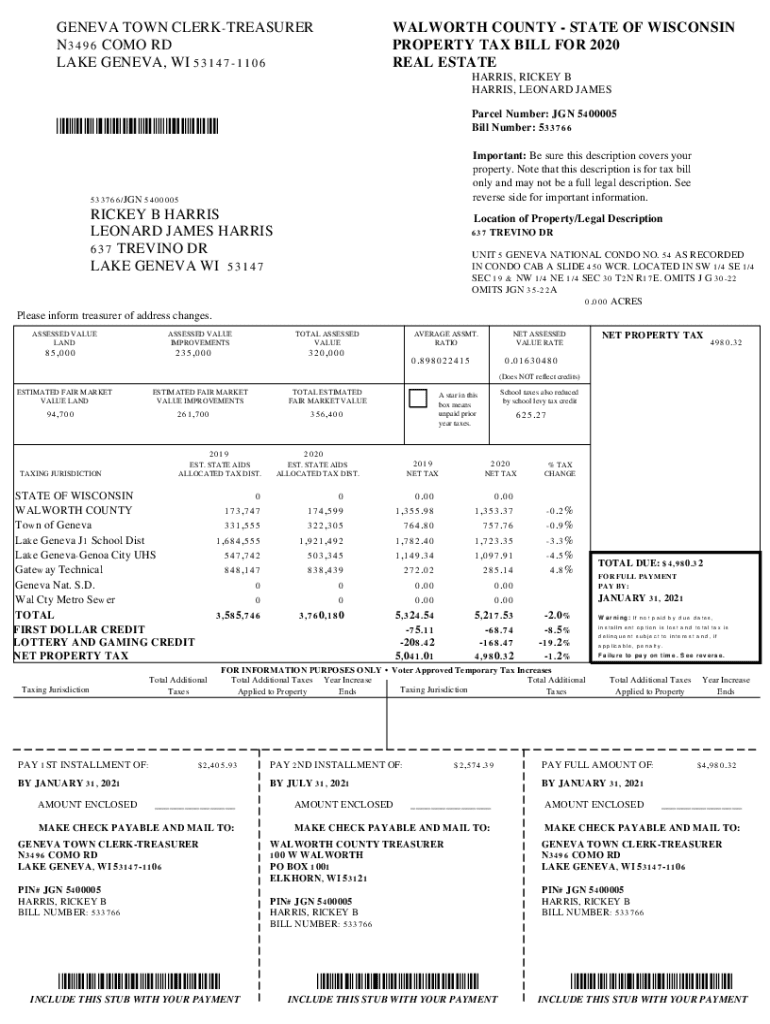

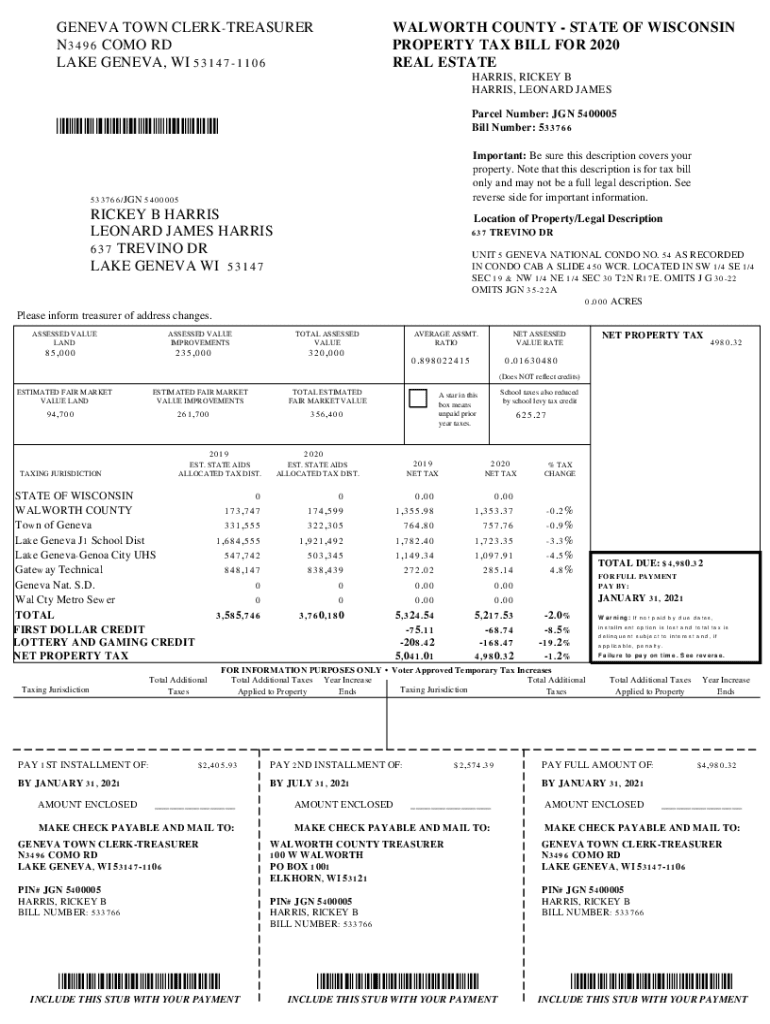

Overview of the property tax bill form

A property tax bill form is a formal document that outlines the taxes owed on a property for a specific period. It's typically sent to property owners annually or biannually, detailing property assessments and payment obligations. Understanding the components of this form is crucial for property owners to ensure proper management of their tax liabilities.

Key components of a property tax bill include a detailed description of the property, the applicable tax rates, and the calculation method used to derive the total amount owed. Moreover, the form provides vital information regarding due dates and payment options, ensuring taxpayers adhere to scheduled payments.

Step-by-step guide to filling out the property tax bill form

When it comes to completing the property tax bill form, careful preparation is key. Start by gathering the necessary information, including the property address, Assessor's Parcel Number (APN), and ownership details. Special attention should be paid to accuracy, as discrepancies can lead to payment issues.

Each section of the form will require specific details: personal information like the name of the property owner, assessment details including property type and assessed value, and the payment section that outlines how and when to submit payments. Be meticulous in providing correct information to avoid any delays in processing.

When filling out the form, it's crucial to avoid common errors. Ensure all information is spelled correctly, confirm numbers are accurate, and double-check the corresponding sections for any missing details to prevent delays or inaccuracies in tax assessment.

Editing and managing your property tax bill form

Once you've filled out your property tax bill form, you might need to make changes. Using pdfFiller for editing is straightforward and user-friendly. This platform allows you to modify text, add additional information, or correct errors seamlessly.

In addition to editing, pdfFiller offers collaboration tools, making it ideal for teams managing multiple properties. Users can share forms for review before finalizing submissions, ensuring that all stakeholders are in agreement. Once edits are complete, saving and sharing your form is as easy as a click.

eSigning your property tax bill form

eSigning is becoming a widely accepted option for signing documents digitally. It provides convenience and legality, with eSignatures recognized by most jurisdictions. For property tax forms, this means you can instantly sign your document online, streamlining the submission process.

Using pdfFiller, you can easily eSign your property tax bill form. The platform ensures your signature is securely captured, protecting both the signatory and the recipient. Moreover, eSignatures are legally binding, meaning your signed property tax form is valid for all official purposes.

Submitting your property tax bill form

Once your property tax bill form is complete and signed, the next step is submission. Various methods are available for submitting your property tax bill, allowing for flexibility based on your preference. Online submissions are typically quicker, while mail or in-person submissions provide a tangible record.

It's important to familiarize yourself with the submission process because compliance with deadlines is critical. Most local governments provide online portals for easy submission, so taking advantage of these can save time and ensure swift processing of your document.

Managing your property taxes after submission

After submitting your property tax bill form, it's essential to stay informed about your tax responsibilities and rights. You can view your payment history through your local government's records. This helps ensure you remain compliant with tax obligations and can help identify any discrepancies over time.

If you encounter issues, such as penalties or tax bill adjustments, being proactive is key. You can request a penalty cancellation if you believe it was applied unjustly, or you may need to understand the procedures for correcting any errors.

Frequently asked questions about property tax bill forms

It’s common for property owners to have unanswered questions regarding their property tax bill forms. One frequent issue is what to do if you don't receive your bill. Each local government's regulations may vary, but you usually need to contact your local assessor's office.

Handling disputes over tax assessments is another concern. If you believe your property has been overvalued, it’s essential to gather relevant documentation and appeal the assessment with your local office. Resources and guidance are often available to assist in this process.

Additional tools and resources

For individuals seeking assistance with property tax calculations, various interactive tools are available. These tools can help property owners estimate their tax liabilities based on their property's assessed value and local tax rates. Being informed helps in budgeting accordingly.

Other important resources include forms for changing property addresses, as keeping your records accurate helps prevent issues. Access to GIS maps can also provide valuable information about local properties, assessments, and zoning.

Contact information for further assistance

If you require additional help regarding your property tax bill form, reaching out to your local tax assessor’s office is a good first step. They can provide specific guidance related to your area and address any questions or concerns you may have.

Beyond local offices, pdfFiller’s customer support team is also an excellent resource when it comes to document management queries. They can assist in navigating the platform effectively, ensuring you get the most out of your document creation experience.

News and announcements related to property taxes

Property tax laws frequently change, impacting how assessments are conducted and bridging necessary updates for property owners. Monitoring local legislative changes can provide insights into potential impacts on your property taxes, and adjustments in assessment methods can shift how properties are valued.

Remaining engaged with community news sources and local government announcements can help property owners stay informed about any new programs or changes that could affect their taxes or payment obligations.

Navigation and quick links

For further assistance or information surrounding property taxes, several online resources are available. These include links to main areas of the local property tax website, relevant forms, and applications that cater to a range of requests from property owners.

Utilizing external tax resources can also be beneficial for additional learning. Some websites provide in-depth information about tax laws, tips for property owners, and articles discussing trends in property taxation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in property tax bill without leaving Chrome?

How do I edit property tax bill straight from my smartphone?

Can I edit property tax bill on an Android device?

What is property tax bill?

Who is required to file property tax bill?

How to fill out property tax bill?

What is the purpose of property tax bill?

What information must be reported on property tax bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.