Get the free Monthly State Revenue Report

Get, Create, Make and Sign monthly state revenue report

Editing monthly state revenue report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly state revenue report

How to fill out monthly state revenue report

Who needs monthly state revenue report?

Monthly State Revenue Report Form: A Comprehensive Guide

Overview of monthly state revenue reporting

A monthly state revenue report serves as a vital tool for tracking and analyzing state revenue generation activities. These reports encompass various revenue streams such as taxes, fees, and other income sources that feed into the state budget. The primary purpose is to provide a clear and structured overview of the financial health of the state's coffers, aiding in effective budgeting and forecasting.

The importance of these reports extends beyond mere numbers; they are essential for fostering transparency and accountability within state financial management. By regularly monitoring and disseminating this information, states can better prepare for economic changes and allocate resources more effectively. Various stakeholders, including state agencies, policymakers, and the public, rely on this data for informed decision-making.

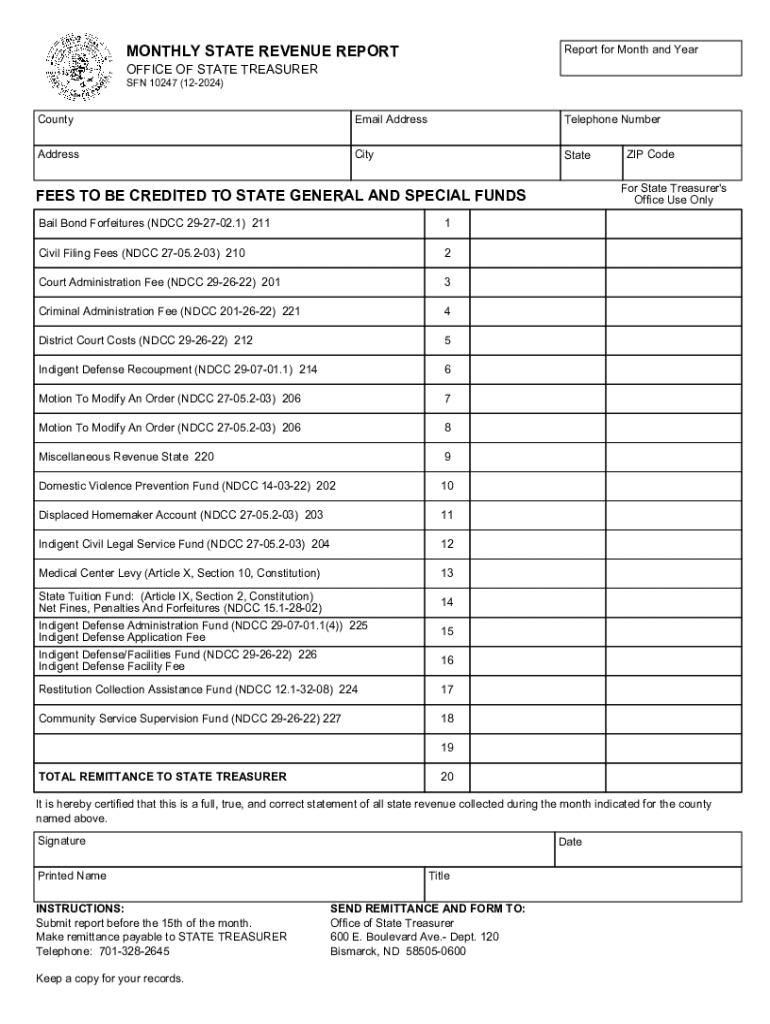

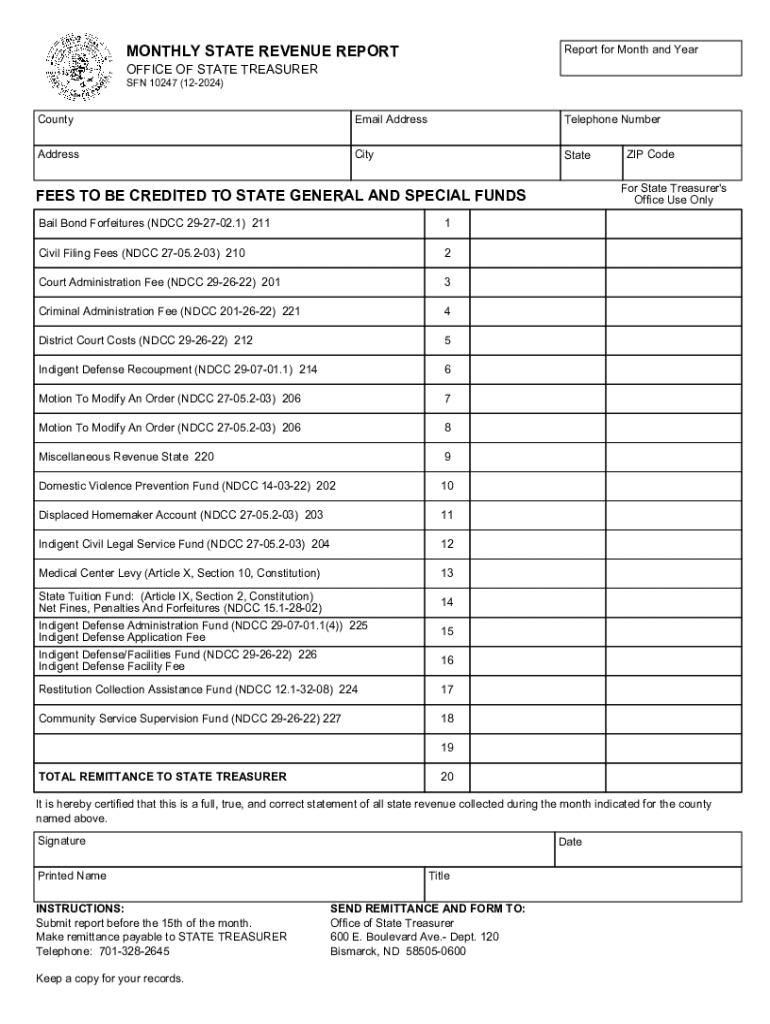

Understanding the monthly state revenue report form

The layout of a monthly state revenue report form typically consists of several designated areas, each catering to specific financial data. At the top of the form, you'll find the header information, which generally includes the state name, report period, and pertinent contact details for the reporting agency. This section ensures that all stakeholders can quickly identify the report's source and timeframe.

Below the header, the revenue categories overview presents a breakdown of different revenue sources, allowing for a quick assessment of how funds are generated. This can include categories like income tax, sales tax, property tax, and various fees. Finally, the notes and additional comments section provides space for any explanations or anomalies related to the report data, offering context that highlights specific revenue trends or irregularities.

Step-by-step instructions for filling out the form

Filling out the monthly state revenue report form can seem daunting, but by segmenting the process into manageable steps, anyone can ensure accuracy and efficiency. The first step involves gathering all required financial data from various sources of revenue, such as taxes, fees, and grants. Using reliable data ensures that the final figures presented are accurate and reflective of the state’s true financial position.

Once you have your data, start filling out each section of the form, paying close attention to detail. Ensure you include all relevant revenue streams, and be clear on what should be included or excluded to maintain accuracy. For instance, distinguishing between recurring revenue versus one-time income sources can be crucial for a realistic budget forecast. After completing the initial entries, take time to review and format the report according to the specific standards laid out by your state.

Interactive tools to aid revenue reporting

Embracing technology can significantly enhance the efficiency of revenue reporting processes. Online calculation tools can simplify the estimation of potential revenue by allowing users to input various parameters and receive instant calculations based on the latest tax rates and projections. These digital calculators offer the added advantage of reducing human error often encountered in manual calculations, ensuring accuracy in the final report.

In addition to calculative tools, utilizing templates can save time and streamline the reporting process. pdfFiller provides a wealth of customizable templates to cater to specific reporting needs, enabling teams to create consistent and professional documents effortlessly. Accessing these templates allows you to focus on the actual data and analysis rather than getting bogged down in formatting issues.

Editing and managing your monthly state revenue report form

Once the report is prepared, the need for editing and managing the document arises. pdfFiller aids in this process with its robust editing tools, allowing users to annotate, comment, and markup documents easily. This functionality ensures that any necessary changes, such as updated revenue figures or clarifications, can be seamlessly integrated without starting from scratch. The ability to collaborate with designated team members can streamline the revision process further.

In addition to editing features, effectively saving and organizing reports is critical for future reference. Create a folder structure that categorizes different reporting periods, ensuring easy access to past reports when necessary. Employ best practices like consistent naming conventions for files to avoid confusion and keep your document management system user-friendly.

Electronic signing and submission

As digital processes become the norm, understanding electronic signing capabilities is crucial for compliance when submitting monthly state revenue reports. eSignatures are recognized legally in many states, streamlining the signing process for all stakeholders involved. When preparing for submission, decide whether to submit electronically or via traditional paper methods, as some state regulations may dictate specific requirements for different forms.

Additionally, be mindful of submission timelines. Knowing when reports are due can prevent missed deadlines, which can have implications for the state's financial management and planning. Prioritize setting reminders or tracking to ensure that reports are submitted punctually, whether utilizing electronic filing systems or mail.

Collaboration features for teams

When multiple individuals are involved in preparing the monthly state revenue report, collaborative features become invaluable. pdfFiller allows colleagues to invite others for real-time editing and commenting, facilitating a smooth workflow that keeps all team members on the same page. This collaborative approach eliminates misunderstandings and maximizes productivity.

Moreover, tracking changes and managing versions are essential for maintaining the integrity of the report. Version control features offered by pdfFiller ensure that all edits are logged, and users can revert to previous files as necessary. This not only mitigates the risk of lost data but also fosters accountability among team members by keeping track of who made specific changes.

Common challenges and solutions

Navigating the complexities of monthly state revenue reporting often presents various challenges. One common pitfall is inaccuracies in reporting, which can stem from data entry errors or misunderstandings of revenue categorization. To combat this, implement thorough data validation processes during the preparation phase to catch mistakes before they escalate into significant issues.

Another prevalent challenge involves meeting deadlines. Late submissions can affect financial planning and jeopardize compliance. Establishing a reporting calendar with milestone deadlines can help mitigate this risk, ensuring that everyone involved in the process is well aware of their responsibilities and required timelines.

Additional resources and best practices

To enhance your understanding and efficiency in completing the monthly state revenue report form, various resources can be invaluable. State-specific guidance can offer insights into local regulations and requirements, ensuring compliance with reporting standards. Additionally, reaching out to organizations or contacts specializing in state finance can provide assistance tailored to your unique situation.

Staying informed about regular economic updates can further support your revenue reporting efforts. Understanding local economic trends not only improves reporting accuracy but also aids in forecasting potential revenue fluctuations, enabling better budget planning.

Feedback and continuous improvement

Engagement with stakeholders and continuous improvement is critical for optimizing the monthly state revenue reporting process. Regularly seeking feedback from team members can highlight areas needing adjustments, whether related to the form’s structure or the data collection mechanisms employed. This iterative approach ensures that the reporting process evolves and improves over time.

Consider engaging with pdfFiller for suggestions on enhancing workflow efficiency. By sharing your insights into how the platform can better serve your reporting needs, you contribute to the continuous development of tools that can further streamline the revenue reporting process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my monthly state revenue report in Gmail?

How can I get monthly state revenue report?

How do I complete monthly state revenue report on an Android device?

What is monthly state revenue report?

Who is required to file monthly state revenue report?

How to fill out monthly state revenue report?

What is the purpose of monthly state revenue report?

What information must be reported on monthly state revenue report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.