Get the free Nonprofit Organization Claim of Exemption - Form Np

Get, Create, Make and Sign nonprofit organization claim of

How to edit nonprofit organization claim of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonprofit organization claim of

How to fill out nonprofit organization claim of

Who needs nonprofit organization claim of?

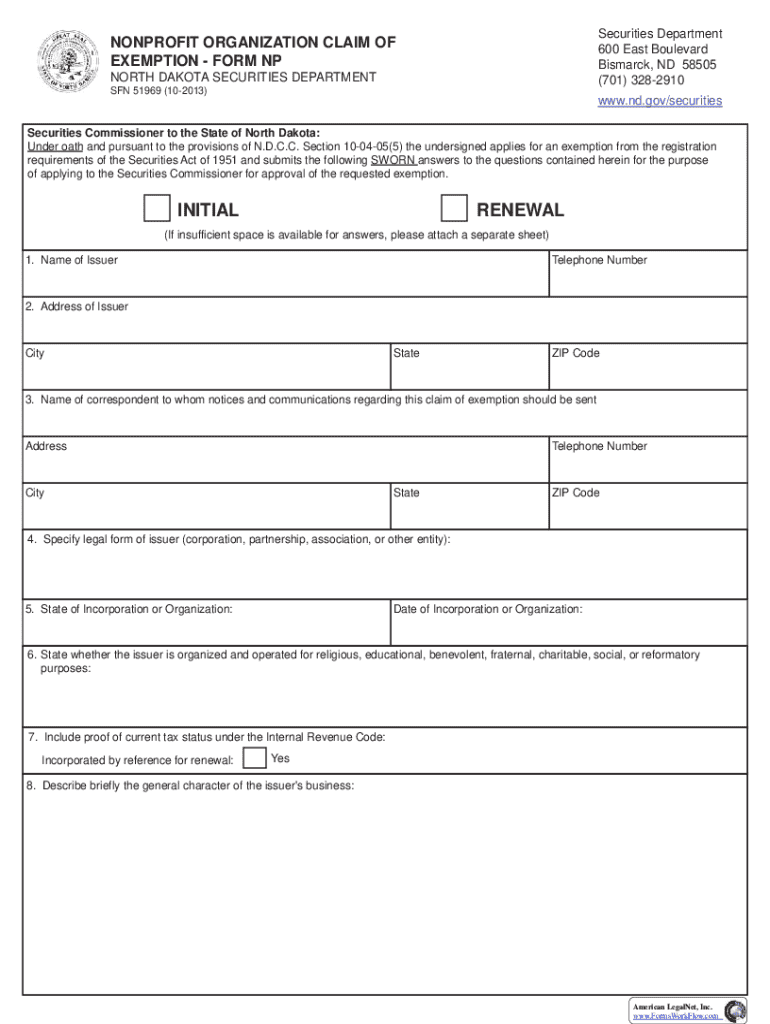

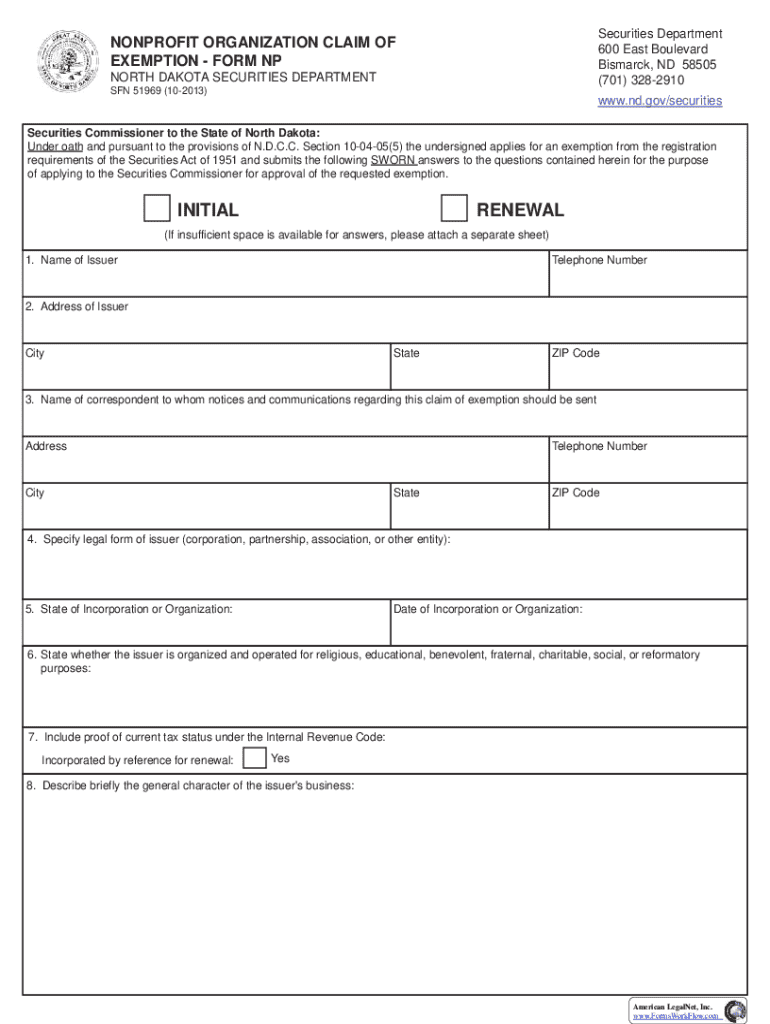

Understanding the Nonprofit Organization Claim of Form

Understanding nonprofit organization claims

A nonprofit organization is a legal entity that operates for a charitable purpose and does not distribute its income to shareholders. Instead, it reinvests any profits back into the organization’s mission, whether that be healthcare, education, or community service. Nonprofits play a crucial role in addressing societal needs, and managing their administrative tasks effectively, including claims, is vital to their success.

Claims, particularly the nonprofit organization claim of form, are essential for managing finances, ensuring tax compliance, and securing funding. By understanding various claim types and processes, nonprofit managers can more effectively navigate the regulatory landscape and maintain their organization’s charitable status.

Nonprofit organization claim types

Nonprofit organizations encounter various claim types that are crucial for operation. Tax exemption claims are one of the most important for nonprofits, which often seek 501(c)(3) status. This designation allows them to be exempt from federal income tax and to provide tax-deductible donations for their supporters.

To apply for 501(c)(3) status, nonprofits must submit Form 1023 to the IRS, detailing their organizational structure, mission, and financial forecasts. Eligibility is generally limited to organizations operating for charitable, educational, or religious purposes, among others. Additionally, grant claims and funding applications are prevalent, which require detailed reporting on how funds are intended to be used and documentation of previous expenditures.

Filing requirements for nonprofits

Filing requirements are essential for keeping a nonprofit in good standing. At the federal level, organizations must adhere to strict obligations set forth by the IRS. Key forms include Form 990, which reports annual financial information. This form is crucial for maintaining transparency with stakeholders and ensuring compliance with tax laws.

Moreover, nonprofits must remember that various states have specific requirements, which may include additional annual filings or local permits. Compliance varies widely between states, making it critical for organizations to familiarize themselves with both federal and state regulations.

Steps to file nonprofit organization claims

Filing a nonprofit organization claim can seem daunting. However, by breaking it down into steps, you can simplify the process. Begin by thoroughly determining the specific form required for your claim. This step is critical as it guides the subsequent actions you'll need to take.

Once you’ve identified the necessary documentation, gather all required information. This includes financial statements, proof of donations, and organizational structure documentation. After that, fill out the claim form carefully. Pay attention to the details, as inaccuracies can lead to delays or denials. Review the completed claim for any mistakes before submitting it through the appropriate channels, whether online or by mail. Finally, utilize tools like pdfFiller to track the claim submission and monitor its status.

Best practices for managing nonprofit claims

Effective management of nonprofit claims requires a robust organizational system. A well-structured document management system allows nonprofits to keep track of important forms, filings, and correspondence. Cloud-based solutions streamline this management process, enabling team members to access documents from anywhere and collaborate in real-time.

Additionally, ensuring compliance with all regulations is vital. Regular audits and reviews of your filings can prevent costly mishaps. If claims are denied, organizations should be prepared to appeal the decision or revise the claim properly, addressing any issues that led to the denial.

Utilizing pdfFiller for nonprofit claims

pdfFiller offers a range of features that enhance document management for nonprofits. From seamless document creation and editing to easy e-signing, pdfFiller empowers nonprofit teams to manage their claims efficiently. Collaboration tools allow multiple users to work on a document simultaneously, providing the flexibility needed in today’s fast-paced environment.

Moreover, its interactive document tracking capabilities ensure nonprofits stay informed about claim statuses. Users can simplify the entire claims process using pdfFiller's features and case studies highlighting successful claims handled through the platform.

Troubleshooting common claim issues

Navigating the complexities of claim issues can be a challenge for nonprofit organizations. If a claim is rejected, it's essential to review the reasons provided and understand the necessary steps for repositioning the claim effectively. Addressing the concerns raised by reviewers can lead to a successful re-submission.

Nonprofits must also remain adaptable and informed about changes in filing requirements, as these can impact future claims. When facing difficulties, resources such as legal aid for nonprofits or community support forums can be invaluable in overcoming hurdles.

Frequently asked questions (FAQs)

Understanding common questions surrounding nonprofit organization claims helps demystify the process. One of the most frequently asked is about the necessary forms nonprofits typically require. Forms like 1023, 990, and contribution acknowledgment forms are among the most crucial for compliance and operations.

Organizations also often wonder how to ensure their claims are accepted. Thoroughly reviewing the forms, providing complete information, and adhering to legal guidelines significantly boosts acceptance rates. Missing deadlines poses another challenge that can lead to penalties, highlighting the importance of staying organized and proactive with documentation.

Explore related topics

As nonprofit organizations navigate the claim process, exploring related topics can provide additional insights. Tax considerations for nonprofits, effective grant writing strategies, and the importance of building strong donor relationships can all enhance an organization's operational success.

Furthermore, regularly conducting financial health check-ups ensures that your nonprofit remains within compliance while optimizing financial performance. These topics are not just supplementary; they are integral to fostering a robust foundation for all nonprofit activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nonprofit organization claim of without leaving Google Drive?

How can I send nonprofit organization claim of to be eSigned by others?

How can I get nonprofit organization claim of?

What is nonprofit organization claim of?

Who is required to file nonprofit organization claim of?

How to fill out nonprofit organization claim of?

What is the purpose of nonprofit organization claim of?

What information must be reported on nonprofit organization claim of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.