Get the free Chart of accounts: How it works and best practices

Get, Create, Make and Sign chart of accounts how

How to edit chart of accounts how online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chart of accounts how

How to fill out chart of accounts how

Who needs chart of accounts how?

Chart of Accounts How Form

Understanding the chart of accounts

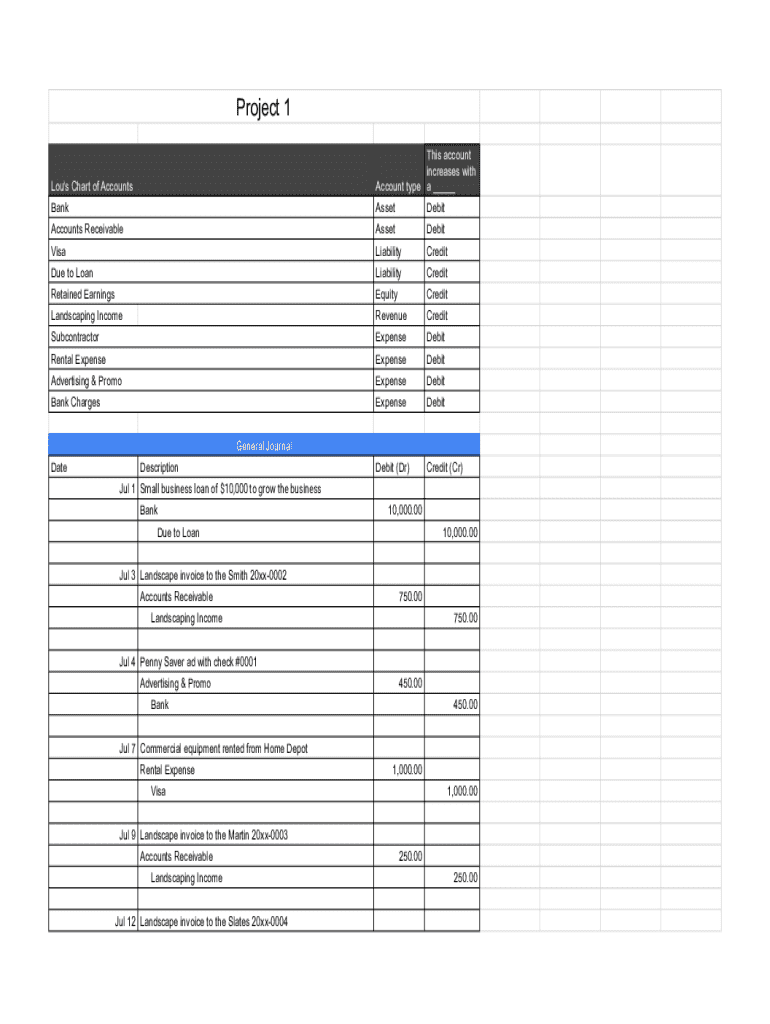

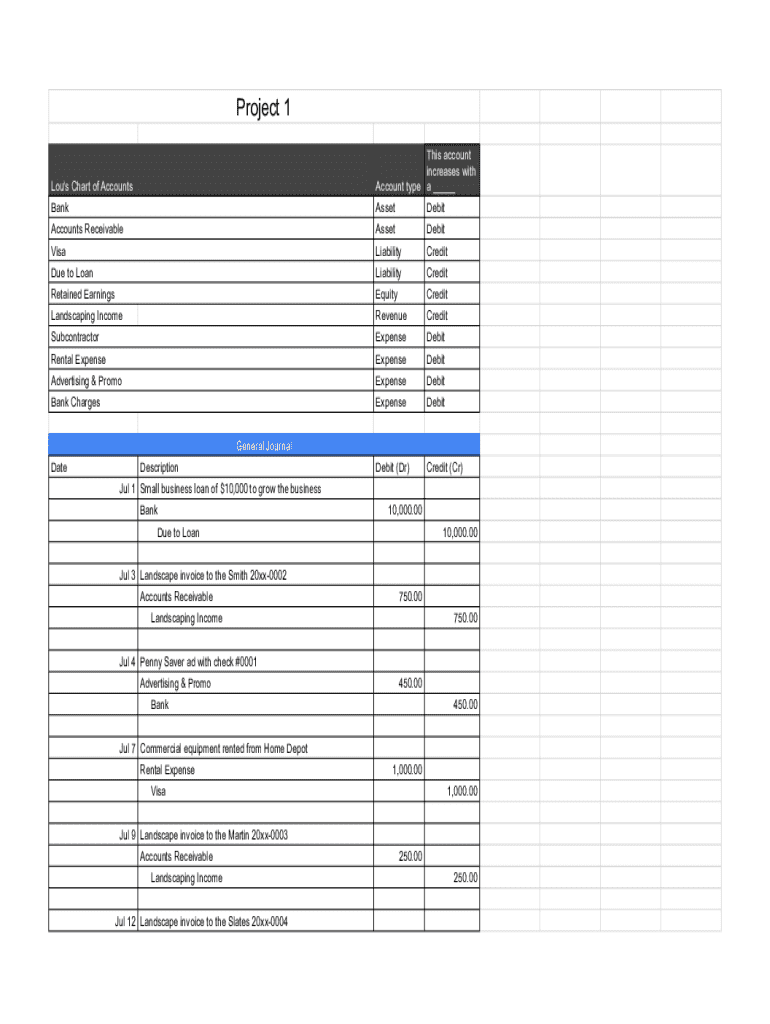

A chart of accounts (COA) is a systematic listing of all account titles and account numbers for an organization’s financial transactions. It serves as the backbone of a company’s accounting process, enabling the organization to track its financial performance effectively. Each account within the COA correlates with a specific type of asset, liability, revenue, expense, or equity, which helps categorize financial data for easy reporting.

The importance of the chart of accounts in financial management cannot be overstated. It provides a comprehensive structure that allows businesses to organize financial information in a coherent manner, enabling stakeholders to make informed decisions based on accurate financial reporting. A well-structured COA instills clarity, not only within an organization but also for external accountants and auditors.

Components of a chart of accounts

A chart of accounts is composed of several critical components that group financial information in meaningful ways. The primary categories of accounts include asset accounts, liability accounts, owner’s equity accounts, revenue accounts, and expense accounts. Each category serves a distinct purpose in financial reporting and helps identify a company's financial position.

The asset accounts include resources owned by the company, such as cash, inventory, and property, while liability accounts encompass obligations towards outside parties, like loans and accounts payable. Owner’s equity accounts reflect the residual interests of the owners in the business, revenue accounts capture income generated from normal business operations, and expense accounts document costs incurred during business operations.

Additionally, a structured account numbering system is fundamental. A clear coding structure facilitates efficient data entry and retrieval. For instance, a numbering system may categorize accounts using a four-digit scheme where '1000' represents assets, '2000' represents liabilities, with subsequent codes differentiating between different types of accounts.

Creating a chart of accounts

Developing a chart of accounts tailored to your organization starts with identifying specific business needs. Each business is unique, with different operational structures and financial reporting requirements. Thus, the COA should reflect these differences to enable effective tracking and reporting.

For creating and managing your COA efficiently, tools like pdfFiller can significantly enhance your document management capabilities. This platform allows you to create, edit, and adapt your COA structure as per evolving business needs, providing flexibility in a cloud-based environment.

Sample charts of accounts

A small business chart of accounts typically contains fewer accounts than that of a large corporation. For instance, a small business may include basic categories such as cash, inventory, accounts payable, and revenue from services provided. The simplicity of the COA allows the owners to focus on the primary aspects of financial management without overwhelming detail.

Conversely, a large corporation’s COA may be more complex and detailed, consisting of numerous account categories that span across different regions and departments. For instance, they may have sub-accounts to track international sales separately or account for diverse subsidiaries, reflecting a convoluted structure that enables comprehensive financial analysis.

Best practices for maintaining a chart of accounts

Maintaining an effective chart of accounts requires ongoing attention. Regular reviews and updates to the COA prevent it from becoming outdated or irrelevant. Over time, businesses grow, operations change, and new accounts may be necessary to track additional dimensions of financial performance.

Taking these best practices to heart will ensure that the chart of accounts remains an accurate reflection of the business's financial standing and aids in effective decision-making.

Linking the chart of accounts to financial statements

Understanding how the chart of accounts links to financial statements is key for anyone looking to interpret the financial position of a business accurately. Accounts within the COA directly impact the balance sheet, which shows what the company owns and owes at a specific point in time. For example, assets and liabilities from the COA populate the balance sheet, allowing stakeholders to understand total ownership equity.

Similarly, revenue and expense accounts are integral to the income statement. This statement summarizes profitability over a certain period, directly using figures from the chart of accounts to calculate net income. Comprehensive summarization provided via the COA can significantly enhance the accuracy of reporting when preparing financial statements.

Common mistakes to avoid when setting up a chart of accounts

Setting up a chart of accounts requires careful thought, and several pitfalls can lead to long-term complications. Overcomplicating the structure of the COA can make it challenging to navigate, causing frustration for users attempting to input or retrieve data. Simplicity, when executed correctly, enhances understanding and usability.

By steering clear of these common mistakes, businesses can maintain a COA that remains relevant, accessible, and efficient.

Enhancing the chart of accounts with pdfFiller

pdfFiller offers a powerful platform for enhancing the chart of accounts through seamless document management. With features such as eSignature functionality, users can expedite the approval processes for financial documents, ensuring that financial reports can be signed digitally in real-time.

Additionally, collaborative editing features empower teams to work simultaneously on a chart of accounts documentation. This capability is particularly beneficial for businesses operating across different locations, as it allows for coherent updates regardless of where users are based. Furthermore, the cloud-based nature of pdfFiller ensures that you can access and manage your COA documents anytime, anywhere, streamlining your accounting processes significantly.

Understanding coding and account integration

Efficient account coding hinges on several factors, including business size, industry practices, and specific reporting needs. Companies must analyze their operational requirements and align coding practices to specific categories to ensure seamless data flow between accounts and financial systems.

Establishing a precise coding framework encourages accurate financial analysis and eliminates potential errors in reporting. Products like pdfFiller can facilitate coding integration by ensuring that all documents reflect the designated account numbers and categories accurately, thereby reducing manual errors.

Conclusion and future considerations

Preparing for shifts in accounting standards can be daunting, but maintaining a flexible chart of accounts can ease the transition process. Businesses should continuously assess the relevance and effectiveness of their COA and remain open to improvements in structure and functionality. Establishing protocols for regular updates can prevent discrepancies and ensure accurate financial reporting.

Ultimately, enhancing your chart of accounts setup necessitates a proactive approach. By leveraging advanced document management solutions like pdfFiller, organizations can maintain a COA that is both dynamic and aligned with their evolving business strategies.

Additional insights on document management solutions

Utilizing pdfFiller for ongoing document management goes beyond just creating a chart of accounts. Businesses can streamline various document-related processes, enhancing overall operational efficiency. By studying case studies of effective COA implementations utilizing pdfFiller, organizations can glean valuable insights into best practices and innovative methods for maintaining their financial documentation.

Engage with your community

Encouraging dialogue within your professional network can foster a better understanding of effective financial management. Sharing experiences and discussing challenges in setting up and maintaining a chart of accounts can significantly benefit individuals and teams looking to optimize their accounting practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my chart of accounts how directly from Gmail?

How can I edit chart of accounts how from Google Drive?

How can I send chart of accounts how to be eSigned by others?

What is chart of accounts how?

Who is required to file chart of accounts how?

How to fill out chart of accounts how?

What is the purpose of chart of accounts how?

What information must be reported on chart of accounts how?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.