Get the free Ct-945 Athen

Get, Create, Make and Sign ct-945 aformn

Editing ct-945 aformn online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-945 aformn

How to fill out ct-945 aformn

Who needs ct-945 aformn?

CT-945 Aformn Form: A Complete Guide to Completion and Management

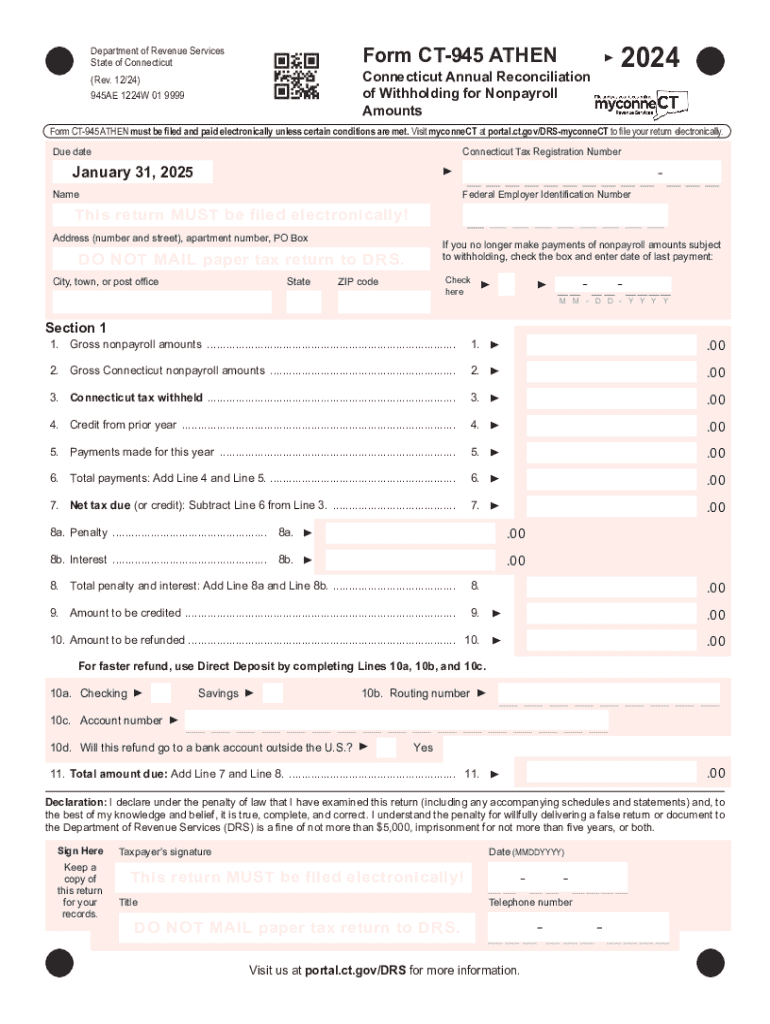

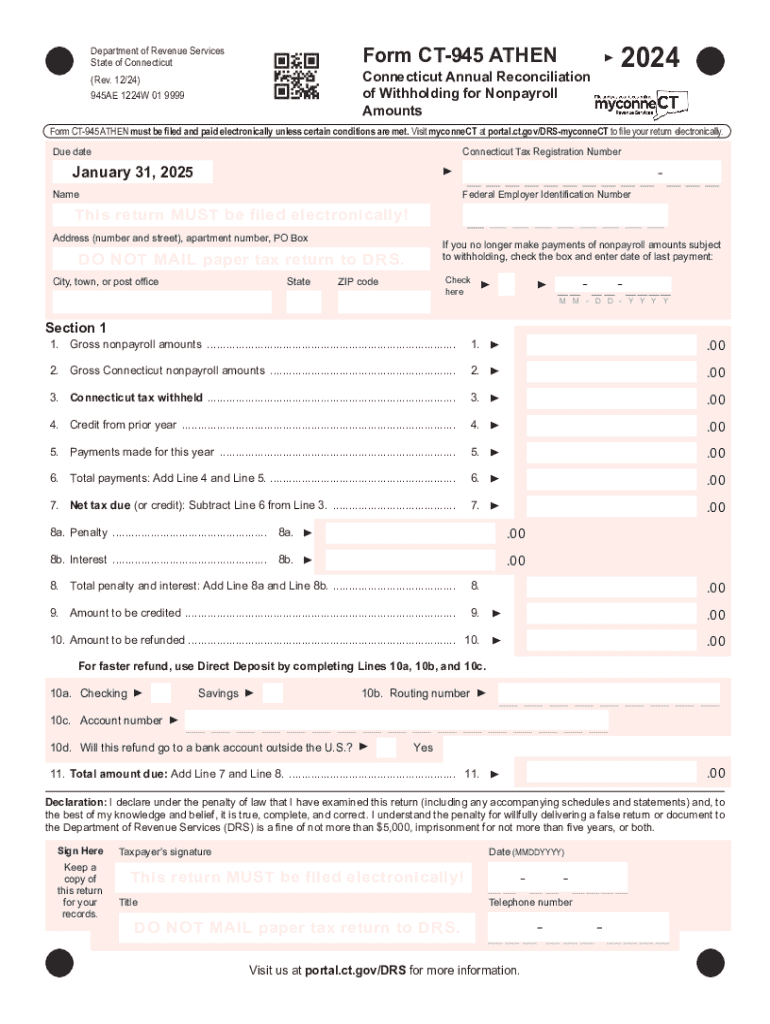

Overview of the CT-945 Aformn Form

The CT-945 Aformn Form is a crucial document utilized for payroll tax reporting in Connecticut. This form is essential for employers who have withheld income taxes from their employees' paychecks. By accurately submitting the CT-945 Aformn, employers ensure compliance with state tax regulations and avoid unnecessary penalties.

In terms of requirements, any employer that withholds state income tax must fill out this form, regardless of the size or duration of employment. Hence, understanding the details of the CT-945 Aformn Form is vital for maintaining accurate payroll records.

Key features of the CT-945 Aformn Form

The CT-945 Aformn Form serves multiple functions within payroll tax management. Primarily, it consolidates the information regarding the income tax withheld from employee paychecks into one streamlined document for the Connecticut Department of Revenue Services.

One significant advantage of using pdfFiller for the CT-945 Aformn Form lies in its cloud-based access. Users can edit, fill, and manage the form from anywhere, making it especially convenient for businesses with remote teams. The interactive features of pdfFiller allow for easy document sharing and collaboration, ensuring that multiple stakeholders can work on the form simultaneously.

Step-by-step instructions for filling out the CT-945 Aformn Form

Filling out the CT-945 Aformn Form can seem daunting, but with the right preparation, it can be straightforward. To begin, gather essential data such as your business's FEIN (Federal Employer Identification Number), the total wages paid, and the total amount of taxes withheld for each period. This information forms the backbone of the submission.

Preparing your information

Before diving into the form, ensure all needed documentation is in hand. This includes previous payroll records, employee tax identification numbers, and any other pertinent financial details. Having these ready will help streamline the form-filling process.

Detailed field-by-field breakdown

1. **Employer Information**: Fill in your business name, address, and FEIN. 2. **Reporting Period**: Indicate the timeframe for which you are reporting. This could be monthly, quarterly, or annually, depending on your filing frequency. 3. **Total Wages Paid**: Record the gross wages paid to employees. 4. **Total Tax Withheld**: Enter the total amount of state income tax withheld from those wages.

Common mistakes to avoid

Errors on the CT-945 Aformn can lead to penalties for late payments or incorrect filings. Common mistakes include missing signatures, incorrect calculations, and failing to check for updates in tax laws. Always double-check your entries against employee records for accuracy.

Managing your CT-945 Aformn Form in pdfFiller

Using pdfFiller enhances your experience in managing the CT-945 Aformn Form. This platform offers editing capabilities that make it easy to correct any mistakes before submission. If changes are necessary, simply access your document, make your changes, and save your updates instantly.

Editing your document

Editing your CT-945 Aformn Form in pdfFiller is user-friendly. You can click on form fields to enter or modify information. Plus, the platform saves your progress automatically, which minimizes the risk of data loss.

eSigning with confidence

The eSigning feature on pdfFiller allows for a straightforward signing process. After completing the CT-945 Aformn Form, simply add your electronic signature. This feature is compliant with a range of regulations, ensuring that your submission stands up to scrutiny.

Collaborating with your team

With pdfFiller, you can share the CT-945 Aformn Form with team members for review or input. This collaborative approach increases accuracy and ensures that all necessary parties are aware of the contents of the form.

Frequently asked questions (FAQs)

1. **What is the purpose of the CT-945 Aformn Form?** It consolidates payroll tax withholdings for reporting to the Connecticut Department of Revenue Services. 2. **Who is required to use the CT-945 Aformn Form?** Any employer withholding state income tax must complete this form. 3. **What deadlines should I be aware of?** The filing deadlines generally align with quarterly tax filings but be sure to confirm with the DOI. 4. **Is there a penalty for late submission?** Yes, there may be penalties assessed for late submissions, impacting compliance.

Interactive tools and resources

pdfFiller provides a range of interactive tools to assist you in working with the CT-945 Aformn Form. One such resource is the fillable template, which allows for easy input of data without the hassle of manual entry. Additionally, users have access to built-in calculation tools that help verify the accuracy of figures before submission.

Fillable template download

To ensure all fields are correctly filled out, consider downloading the fillable template directly from pdfFiller. This template is designed to guide you through the filing process while maintaining the necessary formatting required by the state.

Version history and document management

The version history feature in pdfFiller enables you to track changes made to the CT-945 Aformn Form. This can be invaluable for keeping detailed records of edits and ensuring compliance with filing regulations.

Troubleshooting common issues

Despite the user-friendly interface, users may encounter issues while filling out the CT-945 Aformn Form. Common problems include difficulty in entering information, formatting issues, or errors when uploading the document. To address these challenges, pdfFiller offers comprehensive support through its help center.

Problems filling out the form

If you experience problems entering data, check to ensure that all fields are correctly labeled and within the limits set by the form. If the issue persists, consider reaching out to customer support for further assistance.

Issues with eSigning

Should any issues arise during the eSigning process, ensure your internet connection is stable and that you are logged into your pdfFiller account. If you encounter a technical error, the support team is available to help troubleshoot.

Document compatibility concerns

Compatibility issues may arise if the form isn't in a supported format. Always check that you are using PDF format when working with the CT-945 Aformn Form in pdfFiller to avoid complications.

Best practices for managing your forms

To ensure a smooth experience with the CT-945 Aformn Form, consider these best practices: - Regularly review and update your records. - Set reminders for key deadlines to avoid late submissions. - Utilize the organizational tools offered by pdfFiller to categorize and store your forms securely.

Organizing your documents in pdfFiller

pdfFiller’s organizational features allow you to categorize documents by type, date, or custom tags, simplifying future retrieval. Create folders for each reporting period or employee to enhance efficiency.

Setting reminders for important deadlines

Setting automated reminders for filing deadlines helps all team members remain accountable, ensuring submissions are on time and compliance is maintained.

Related topics and further reading

Understanding the broader landscape of payroll tax forms can further enhance your knowledge. Consider exploring topics such as other payroll tax forms and the importance of document security to ensure compliance and protect sensitive information.

Understanding other payroll tax forms

Familiarizing yourself with other forms such as the CT-941 Form for quarterly tax filings or annual forms can provide a complete view of your compliance requirements.

The importance of document security

As you handle sensitive information, understanding how to secure your documents is paramount. Ensure you're aware of the security features available in pdfFiller to protect your data.

How to use pdfFiller for other document types

pdfFiller is not limited to payroll tax forms. Explore its capabilities for creating, editing, and managing various document types, enhancing your overall productivity.

Real-world applications of the CT-945 Aformn Form

The practical applications of the CT-945 Aformn Form demonstrate its importance in various business environments. Employers report that using the form has streamlined their payroll processes and improved compliance with tax laws.

Case studies from users

For instance, a local manufacturing company integrated the CT-945 Aformn Form into their payroll operations, resulting in a 30% reduction in time spent on tax reporting each month. Testimonials reveal that efficient document handling frees up valuable time for HR departments to focus on employee engagement.

Impact on efficiency and compliance

By leveraging tools like pdfFiller, organizations enhance their workflow efficiency and ensure compliance with state regulations. The ability to easily manage these documents in a secure, digital environment allows companies to operate seamlessly.

Contact support for assistance

For any questions or challenges you face when working with the CT-945 Aformn Form, pdfFiller's support is ready to assist you. Their help center offers a wealth of resources covering everything from basic navigation to advanced features.

Help center overview

In the help center, users can find articles, tutorials, and troubleshooting guides designed to support your needs with the CT-945 Aformn Form and more.

Live support options

If your issue requires immediate attention, you can access live support options for real-time assistance tailored to your specific requirements.

Community forums for user interaction

Join the community forums to interact with other users of pdfFiller, share experiences, and find solutions together regarding the CT-945 Aformn Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ct-945 aformn without leaving Google Drive?

How do I make edits in ct-945 aformn without leaving Chrome?

How can I fill out ct-945 aformn on an iOS device?

What is ct-945 aformn?

Who is required to file ct-945 aformn?

How to fill out ct-945 aformn?

What is the purpose of ct-945 aformn?

What information must be reported on ct-945 aformn?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.