Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

A comprehensive guide to understanding Form ADV

Understanding Form ADV

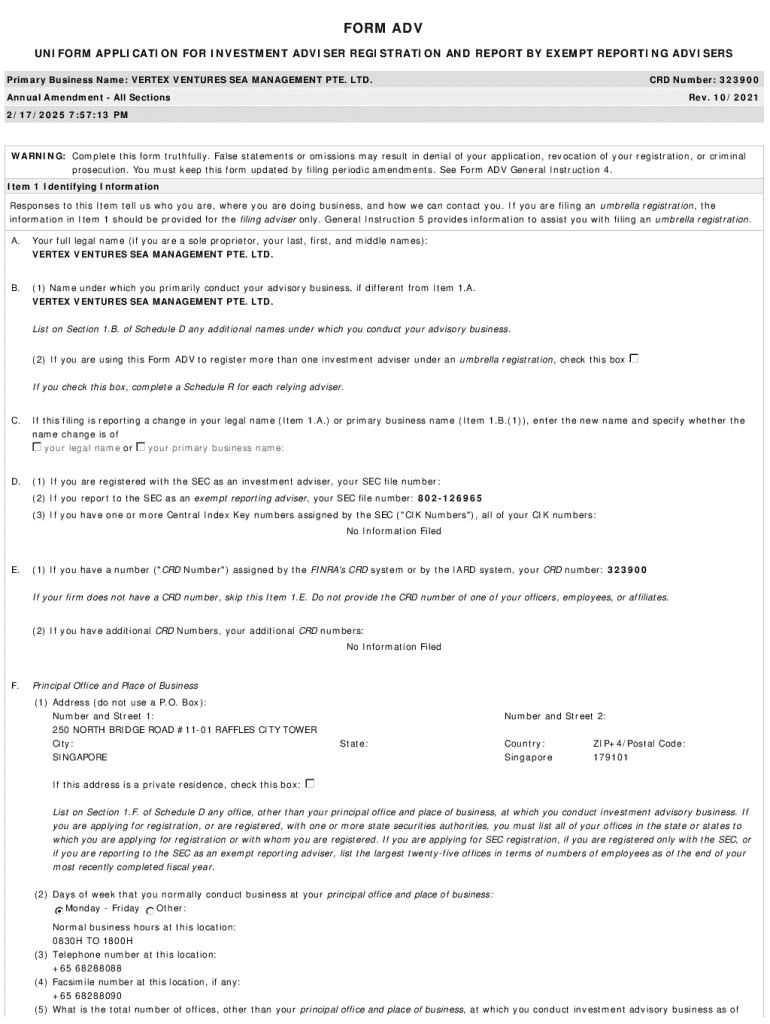

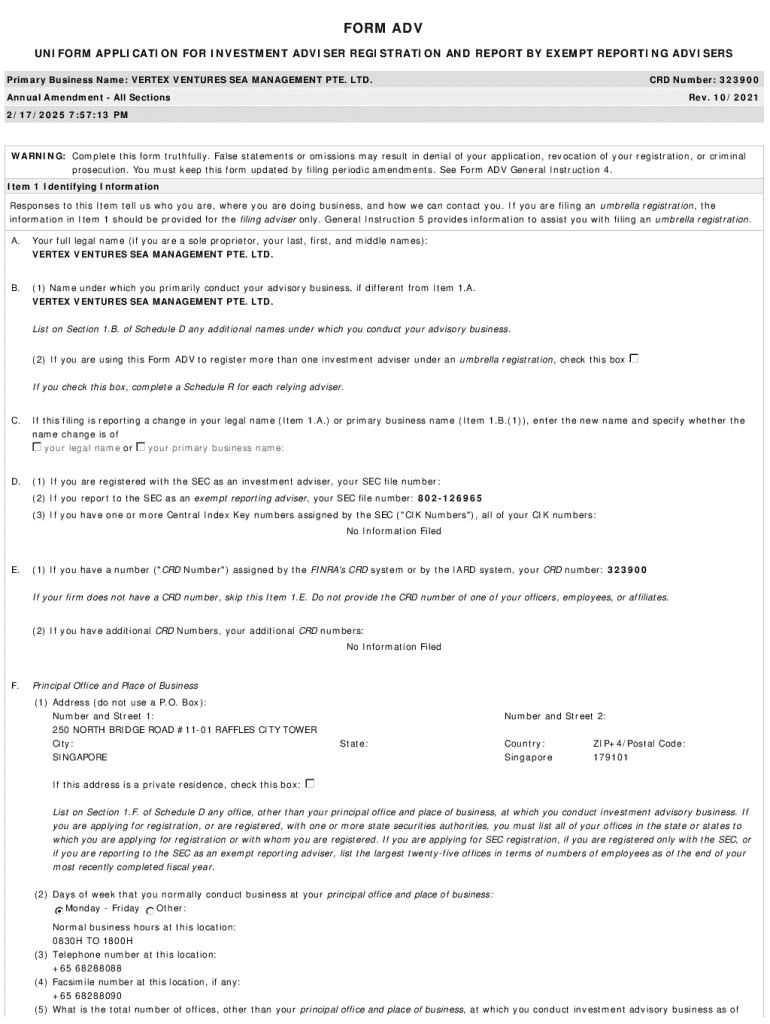

Form ADV serves as a crucial document within the financial services industry. It is a registration form that investment advisors must file with the Securities and Exchange Commission (SEC) and state regulators. The form’s primary purpose is to provide essential information about the advisor's business practices, management, and investment strategies to potential clients.

Understanding the significance of Form ADV is vital for anyone engaging with financial advisors. It not only underpins the integrity and transparency of the advisory profession but also empowers clients by offering critical insights into their chosen advisory firms. By reviewing this form, clients can make well-informed decisions about their financial advisors.

Components of Form ADV

Form ADV consists of several parts, each playing a unique role in delivering comprehensive information about an investment advisor. The primary segments include Part I and Part II, which serve distinct purposes. Part I focuses on business operations, while Part II provides detailed descriptions of services, fees, and practices.

This structured approach ensures advisors disclose all necessary information while also maintaining client interest and understanding.

Breaking down Form ADV Part

Part I is an overview of the advisory firm, geared towards regulatory requirements. It includes information about the firm’s structure, ownership, advisory business, and regulatory history.

Breaking down Form ADV Part

Part II offers a deeper dive into an advisory firm’s services and standards. This section stands out because it directly impacts client choices. A well-outlined Part II can enhance transparency and build client trust.

Accessing and interpreting Form ADV

To access a firm’s Form ADV, clients can utilize the SEC's Investment Adviser Public Disclosure website, which hosts these forms publicly. This level of accessibility is a crucial aspect of the form, ensuring that potential clients can make informed choices.

Interpreting Form ADV requires careful attention to detail. Clients should familiarize themselves with the technical language and legal jargon, emphasizing key areas such as fees, strategies, and the firm’s history. However, one must also consider that Form ADV does not capture the entirety of a firm’s client experience, nor does it reflect personal interactions.

Managing your firm’s Form ADV

Managing your firm's Form ADV is crucial to maintaining compliance and ensuring accurate representations. Investment advisors must file an initial Form ADV when launching their business, followed by regular updates whenever there’s a significant change that impacts the firm.

Filing Form ADV online involves straightforward steps through the IARD system. The online portal simplifies the submission process, making it efficient while maintaining accuracy.

Key considerations for evaluating financial advisors

When evaluating potential financial advisors, Form ADV serves as a cornerstone document. Reading it effectively involves knowing what to look for, such as the advisor's fee structure and their disciplinary history.

Consider disseminating summaries or key takeaways from this document to facilitate easy understanding. Clients should feel empowered to ask their advisors about anything unclear in the Form ADV.

Compliance and regulatory considerations

Understanding the compliance requirements surrounding Form ADV is vital for maintaining the integrity of the financial advisory profession. Advisors are obligated to comply with federal and state regulations, ensuring that their Form ADV is always up to date.

Third-party compliance services can provide invaluable support, assisting firms in navigating the complexities of the regulatory landscape. This ensures that advisors focus on servicing their clients while remaining compliant.

Enhancing your document management with pdfFiller

pdfFiller enhances your ability to manage Form ADV through its robust cloud-based platform. You can easily edit, sign, and collaborate on these forms without hassle. Through pdfFiller, you access streamlined tools that ensure maximum efficiency when handling these critical documents.

Features like document sharing and eSigning make it easier for teams to collaborate on required updates to Form ADV. This not only saves time but ensures all amendments are tracked, maintaining a comprehensive audit trail.

Real-world applications of Form ADV

Understanding how to leverage Form ADV effectively can reveal insights about the best financial advisors in different regions. For example, cities like New York and San Francisco are known for their dense networks of investment firms, highlighting various specialties, which are documented in Form ADVs.

Case studies showing successful advisory firms utilizing Form ADV effectively demonstrate the practical significance of transparency when building client relationships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form adv for eSignature?

How do I complete form adv on an iOS device?

How do I edit form adv on an Android device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.