Get the free Asset Disposal Form

Get, Create, Make and Sign asset disposal form

Editing asset disposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out asset disposal form

How to fill out asset disposal form

Who needs asset disposal form?

Asset Disposal Form: Comprehensive How-To Guide

Understanding the asset disposal form

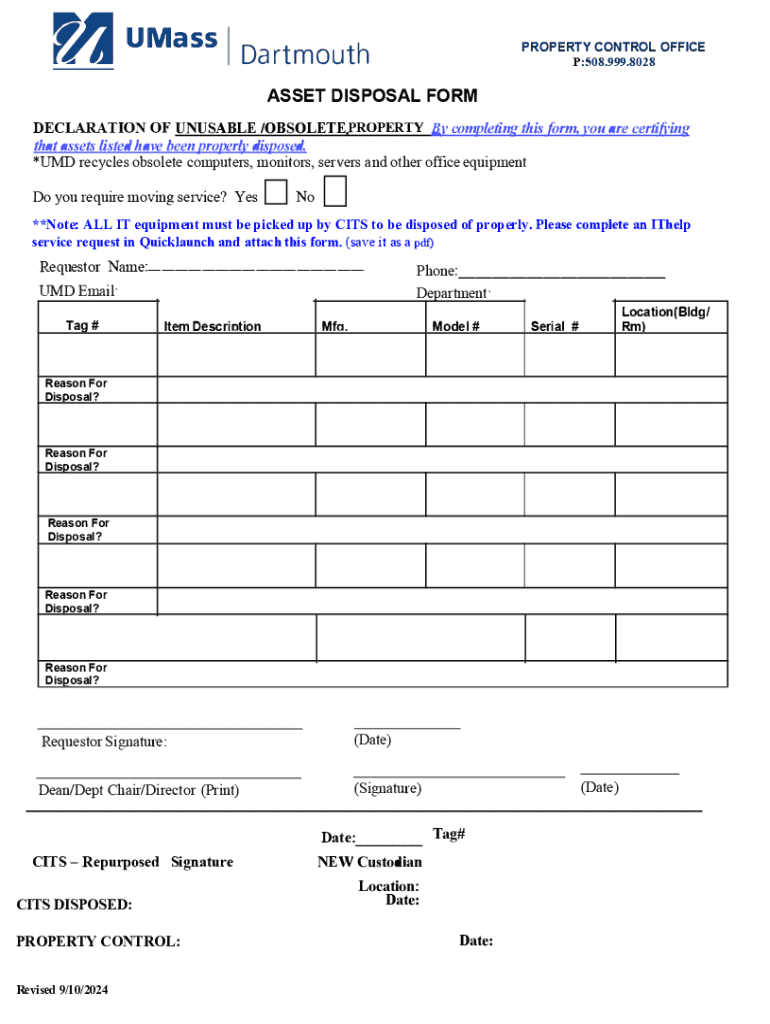

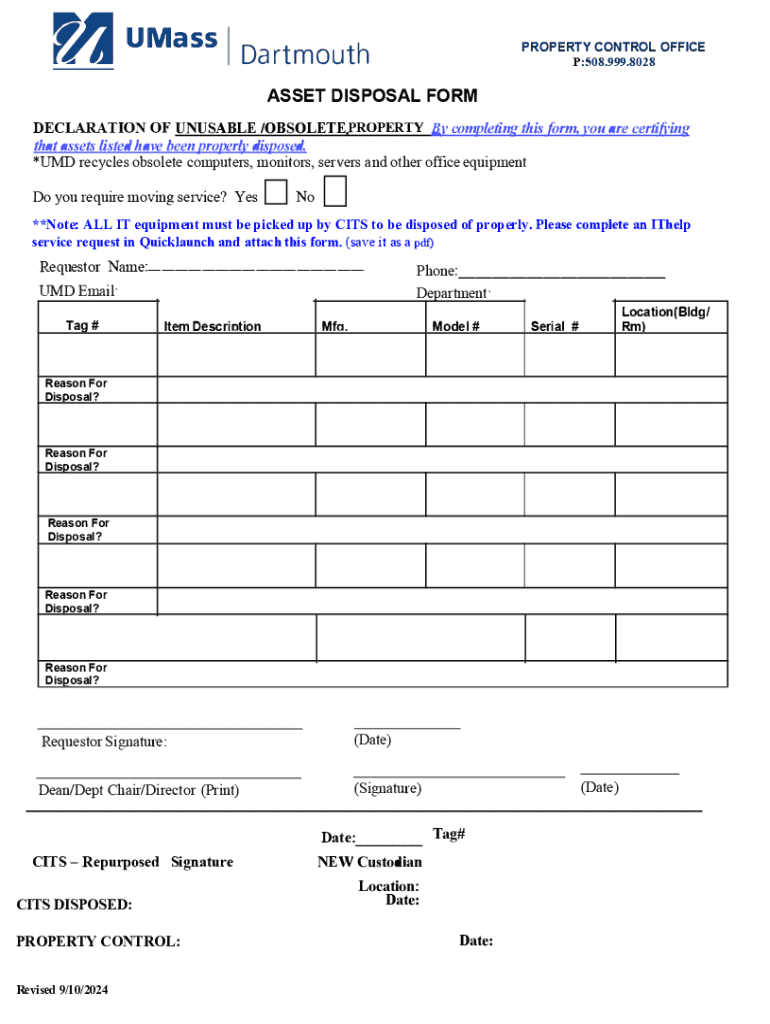

An asset disposal form is a critical document used to record the decision to dispose of an organization’s assets. This form serves multiple purposes, including formalizing the disposal process, ensuring that all assets are accounted for, and maintaining comprehensive records for auditing purposes.

The importance of the asset disposal form cannot be overstated. It ensures that individuals and teams are aligned in their understanding of asset valuation and compliance standards. Without it, organizations could face discrepancies in inventory and potential legal penalties due to improper asset disposal.

Key roles involved

Several key individuals typically collaborate during the asset disposal process. This includes finance team members, who account for the asset's previous value; IT personnel, who handle technology assets; and compliance officers, who ensure the disposal aligns with applicable regulatory standards.

Collaboration is vital in ensuring each team contributes its expertise. Effective communication between these roles enhances transparency and promotes accountability throughout the disposal process.

When to use an asset disposal form

The asset disposal form should be utilized in various circumstances. One common situation is during the retirement of company assets, whereby items no longer in use need formal documentation for their removal from company records. Additionally, the disposal of obsolete assets, such as outdated technology, also necessitates this form to maintain accurate inventory.

Another significant scenario is when assets are being reallocated or donated. In these cases, documenting the transfer of ownership is crucial for maintaining accurate financial and operational records.

Compliance and legal considerations

Organizations are bound by various regulatory requirements when disposing of assets, especially in sectors such as healthcare, finance, and technology. Compliance with local, state, and federal laws is essential to avoid costs related to fines and penalties.

Furthermore, responsible disposal methods that take environmental impacts into account are increasingly necessary. Many organizations now adopt practices that include recycling or properly disposing of hazardous materials, which can be outlined and tracked through the asset disposal form.

Components of the asset disposal form

An effective asset disposal form should capture essential information to facilitate the disposal process accurately. The fundamental components typically include a description of the asset—including the type and its condition—and a clear reason for the disposal.

Additionally, it is crucial to include approval signatures and dates, certifying that the disposal process has been reviewed and authorized by the necessary parties within the organization.

Optional fields for enhanced tracking

To enhance the management of disposed assets, organizations may incorporate optional fields such as the asset’s value at the time of disposal and documentation of the disposal method as well as details about service providers involved in the process. This information not only supports accountability but also assists in financial reporting.

How to fill out the asset disposal form

Filling out the asset disposal form requires careful attention to detail. Start by accurately entering a description of the asset, followed by the reason for disposal. Ensure that all relevant stakeholders review this information to minimize misunderstandings.

Next, provide the necessary approval signatures. This step ensures that all layers of management are aware of the asset disposal, fostering a sense of accountability across the organization.

Common pitfalls to avoid

Common pitfalls during this process often include incomplete information or miscommunication between departments. It's essential to double-check all entries and designate a point person to oversee the process to eliminate these risks.

Utilizing interactive tools can also streamline the process. pdfFiller, for example, provides valuable options for editing and signing forms in a user-friendly interface.

Best practices for managing asset disposal

Establishing guidelines for asset management is crucial in optimizing the disposal process. Organizations should develop a formal asset disposal policy that outlines the procedures and responsibilities involved in managing asset lifecycle. This policy should be regularly reviewed to adjust for changing regulations and organizational growth.

Conducting regular inventory assessments ensures that all assets are accounted for and accurate records are maintained, preventing discrepancies during audits and enhancing overall asset management efficiency.

Maintaining records and accountability

As part of best practices, tracking disposed assets through comprehensive record-keeping is essential. This approach enhances accountability; organizations can demonstrate that they adhere to standards and safeguard sensitive information.

Adhering to accounting standards is also critical. Proper disposal documentation not only affects financial statements but also aligns with ethical business practices.

Alternative templates for asset management

In addition to the asset disposal form, organizations may benefit from related templates that enhance operational efficiency. Asset inventory forms and fixed asset register templates serve as complementary tools for tracking assets responsibly.

These templates can be leveraged to classify assets broadly, enabling teams to segment their assets and make informed disposal decisions when necessary. Customization of these templates ensures they meet specific organizational needs.

Common challenges and solutions

While the asset disposal process is integral to effective management, challenges may arise. Miscommunication among teams can lead to errors in documentation, which may hinder compliance efforts and delay the disposal timeline.

To mitigate these issues, organizations can implement training sessions for stakeholders involved in the process. By fostering an environment of collaboration and understanding, organizations can address concerns proactively.

Efficient solutions and resources

Support resources provided by platforms such as pdfFiller can offer valuable insights and guidance. Providing easy access to training materials and FAQs helps stakeholders to navigate common challenges efficiently.

The importance of going digital

Adopting a cloud-based platform for managing asset disposal processes presents numerous benefits. One key advantage is the ability to access documents from anywhere, ensuring that team members can contribute regardless of their physical location.

Real-time collaboration features empower teams to work effectively, providing updates and adjustments as necessary without delay. This adaptability promotes efficiency in the disposal process.

How pdfFiller enhances the asset disposal process

pdfFiller streamlines form completion, signature collection, and document management through its user-friendly interface. With tools designed for efficient collaboration, organizations benefit from quicker response times and reduced administrative overhead.

Interactive features of the asset disposal form on pdfFiller

One of the most significant advantages of using pdfFiller is its ability to facilitate electronic signatures. E-signing not only provides legal validity but also offers convenience and security compared to traditional signing methods.

Moreover, pdfFiller allows users to edit and customize forms easily. Organizations can modify forms to better suit their specific documentation needs, ensuring efficiency while maintaining compliance with required standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit asset disposal form from Google Drive?

How do I make edits in asset disposal form without leaving Chrome?

How do I fill out asset disposal form using my mobile device?

What is asset disposal form?

Who is required to file asset disposal form?

How to fill out asset disposal form?

What is the purpose of asset disposal form?

What information must be reported on asset disposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.