Get the free Health Care Flexible Spending Account Request for Change in Status - hr umich

Get, Create, Make and Sign health care flexible spending

How to edit health care flexible spending online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health care flexible spending

How to fill out health care flexible spending

Who needs health care flexible spending?

Health Care Flexible Spending Form: A Comprehensive How-to Guide

Understanding health care flexible spending accounts (FSAs)

A flexible spending account (FSA) is a tax-advantaged financial account that allows employees to set aside pre-tax money for specific health-related expenses. Established by an employer, FSAs provide a convenient way to budget for out-of-pocket medical costs. For individuals who anticipate regular medical expenses, FSAs can reduce taxable income and maximize net earnings over time.

This means that employees can effectively create a personal health care budget by allocating funds to an FSA, which can then be used for copayments, deductibles, and other qualified medical expenses. This system offers an attractive financial incentive, especially for families with frequent health care needs.

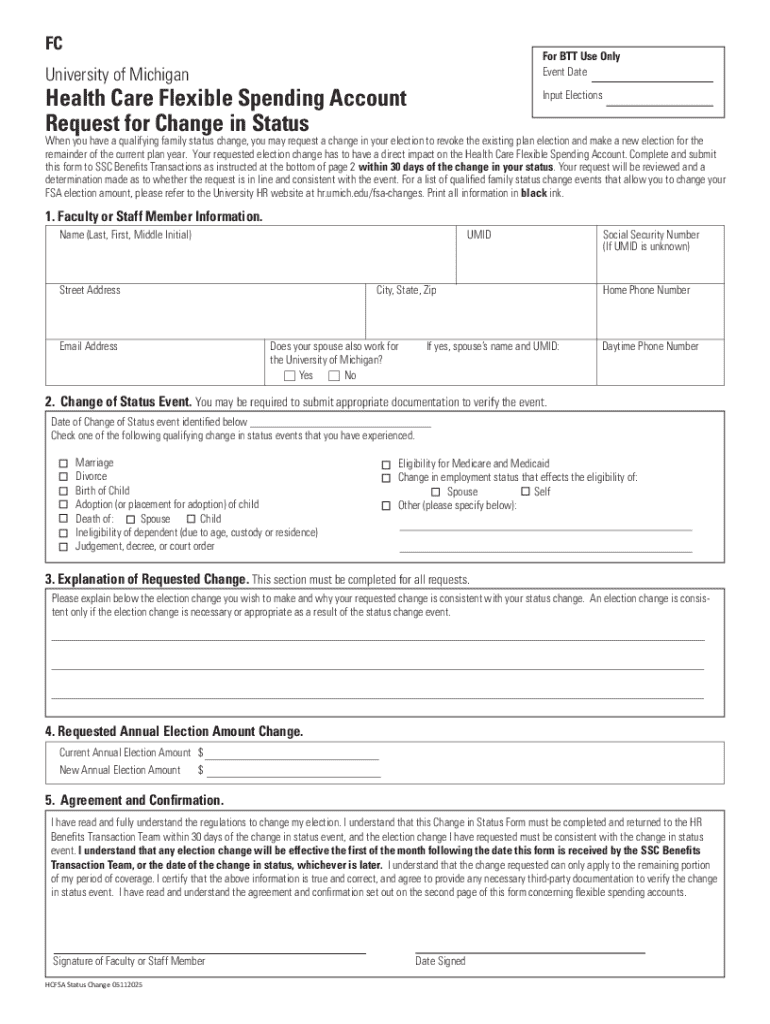

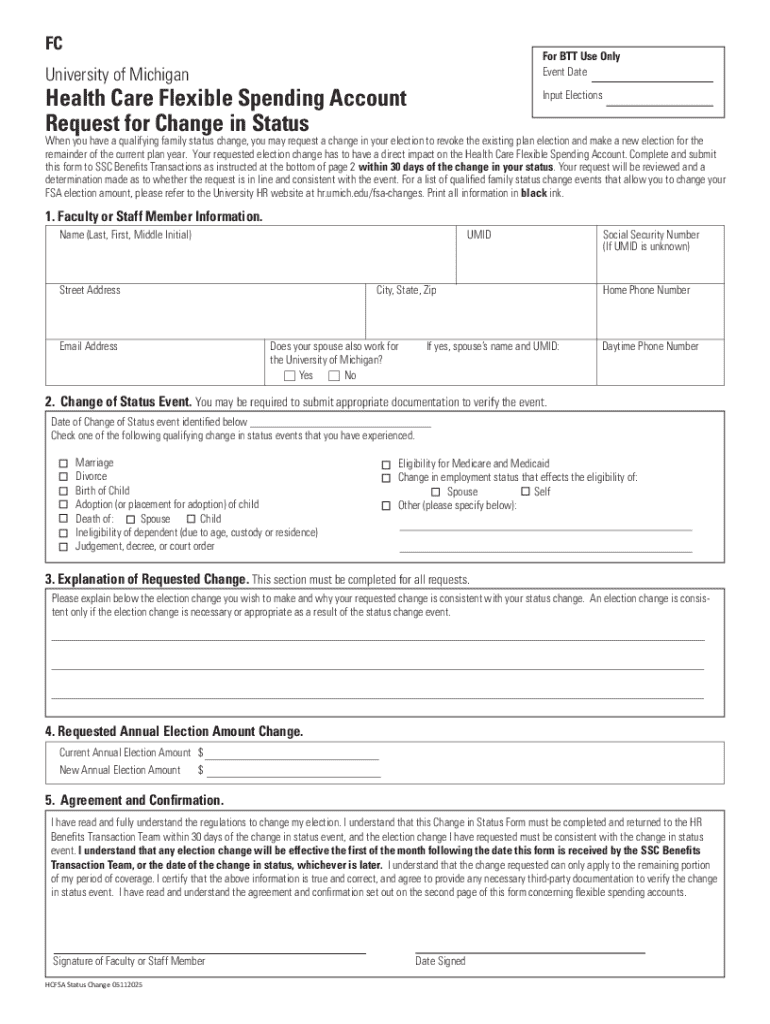

Key features of health care flexible spending forms

Health care flexible spending forms are crucial for managing and utilizing your FSA effectively. There are different types of forms depending on the purpose; for example, reimbursement forms allow you to claim funds for eligible medical expenses, while enrollment forms are used to sign up for the FSA in the first place.

Generally, FSA forms collect important information that influences how reimbursements are processed. Ensuring that forms are correctly completed can prevent delays in accessing your funds.

Step-by-step guide on filling out the health care flexible spending form

Filling out your health care flexible spending form accurately is vital. Preparation is key, which involves gathering all necessary documents and information regarding the medical expenses incurred. This includes invoices, receipts, and personal information as outlined by the form.

Start filling out the form by entering your personal information, including your name, address, and FSA account number. Following that, you should detail your eligible medical expenses, indicating the date incurred, the provider's name, and the amount. Lastly, specify how you prefer to receive your reimbursement, such as via direct deposit or check.

Editing and modifying your health care flexible spending form

Editing your health care flexible spending form ensures that all information is correct before submission. With the digital tools available today, like pdfFiller, editing forms has become streamlined and efficient. Simply upload your completed FSA form to pdfFiller, where you can make necessary changes, whether it involves correcting information or adding annotations.

This platform allows for the easy addition or modification of text, along with options to insert signatures digitally. Once you have made all your changes, be sure to save the document in the cloud for easy access and future reference.

E-signing your health care flexible spending form

E-signatures have become an integral part of submitting any document, including FSA forms. The convenience of e-signing simplifies the submission process by allowing you to sign documents electronically, maintaining the integrity of the form while ensuring compliance with legal requirements.

To create an e-signature in pdfFiller, simply leverage their tools to draw, type, or upload an image of your signature. Make sure to review the document before finalizing your signature to ensure that everything is accurate. Always remember that using e-signatures holds the same legal weight as traditional signatures, as long as the process complies with the eSign Act.

Submitting your health care flexible spending form

Once you have completed the necessary forms, the next step is submitting them. Depending on your employer's guidelines, submission methods may vary. Some organizations allow for online submissions through their FSA platforms while others may require mailing printed forms.

If submitting online, ensure that you adhere to the required upload specifications and that you receive confirmation of submission. If mailing is required, double-check to use the correct address, and it can be beneficial to use certified mail for tracking purposes.

Managing and accessing your FSA information

Managing your FSA effectively involves keeping track of all documentation and understanding your balance and spending limits. Documentation should be organized to avoid missed deadlines for reimbursement or spending. Develop a system, whether digital or physical, to keep receipts and documents easily accessible.

Monitoring your spending can help prevent overspending or meeting the set annual limits. Always stay informed about deadlines related to your plan year, as unused funds may not carry over to the next year. In addition, be prepared for adjustments and appeals if your claims encounter issues.

Frequently asked questions (FAQs) about health care FSAs

Navigating the world of health care flexible spending accounts can lead to many questions. Common queries often pertain to the intricacies of filling out forms, understanding eligibility requirements, and troubleshooting submission issues. It is paramount to refer to your employer's FSA plan documentation for guidance, as policies may vary significantly.

Some questions may involve timelines for reimbursements, what constitutes a qualified expense, and the impact of withdrawing from your FSA. Understanding your specific plan can make the experience of managing your FSA much smoother.

Interactive tools and resources available

When it comes to managing your health care flexible spending account, having access to interactive tools can enhance your experience. pdfFiller offers several resources from a template library to budgeting calculators designed specifically for FSA users.

Templates for health care flexible spending forms ensure that you have the most current versions, while calculators can assist you in estimating your annual health care expenses. These tools empower you to make informed decisions about how much to allocate to your FSA.

Updates and changes related to FSA legislation

Each year, flexible spending accounts are subject to updates that may affect contribution limits and eligible expenses. Staying informed about these changes is vital since they directly impact how you manage your account. For example, the IRS adjusts the annual contribution limits based on inflation, which typically occurs at the start of the new tax year.

Additionally, maintaining awareness of any changes in regulations can help ensure compliance and optimal usage of your benefits, particularly as it pertains to new plan years like 2024 and 2025.

Integration with other health benefits

Flexible spending accounts frequently work in conjunction with other health benefits such as health savings accounts (HSAs) and employer-sponsored health plans. Understanding how these benefits interact is crucial for taking full advantage of available resources.

For instance, while FSAs allow for the use of pre-tax dollars for medical expenses, HSAs function similarly but typically require a high-deductible health plan. Combining these resources can create a comprehensive approach to managing health care costs and maximizing savings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit health care flexible spending online?

How do I fill out health care flexible spending using my mobile device?

Can I edit health care flexible spending on an iOS device?

What is health care flexible spending?

Who is required to file health care flexible spending?

How to fill out health care flexible spending?

What is the purpose of health care flexible spending?

What information must be reported on health care flexible spending?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.