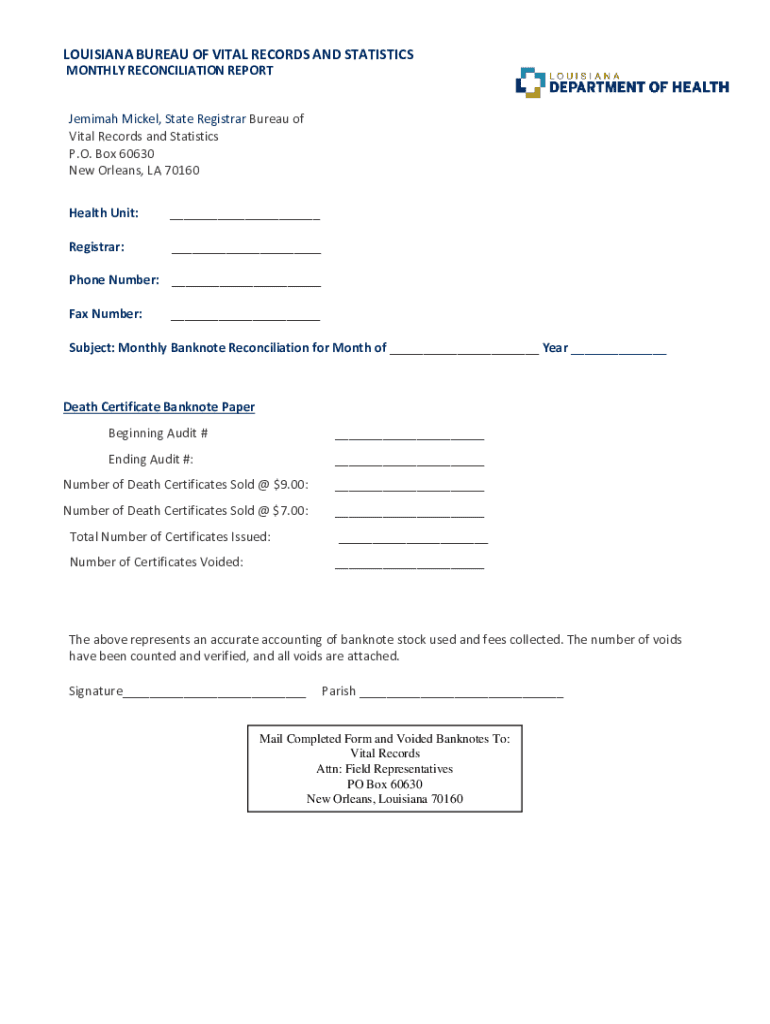

Get the free Monthly Reconciliation Report

Get, Create, Make and Sign monthly reconciliation report

How to edit monthly reconciliation report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly reconciliation report

How to fill out monthly reconciliation report

Who needs monthly reconciliation report?

Monthly Reconciliation Report Form: A Comprehensive How-To Guide

Understanding the monthly reconciliation report

A monthly reconciliation report is a critical document that ensures the accuracy of an organization’s financial data. This report compares the actual financial transactions conducted by a business against its bank statements to identify any discrepancies between what the business has recorded and what appears in the bank records.

The primary purpose of a monthly reconciliation report form is to verify that all income and expenses are accounted for correctly. This process is vital for maintaining financial integrity and allows organizations to make informed budgetary decisions based on accurate data. It serves both as a historical record and a tool for ongoing financial oversight.

Preparing for the monthly reconciliation

Before diving into the monthly reconciliation process, it is crucial to gather all necessary documents. Key documents include bank statements, transaction records, and previous reconciliation reports. Having these on hand will streamline the reconciliation process and help avoid unnecessary delays.

Additionally, setting up a robust tracking system is paramount. Utilizing accounting software not only aids in organizing transaction records but also enhances accuracy. Furthermore, identifying key players in your team who will participate in the reconciliation ensures that everyone understands their roles, which is critical for a successful outcome.

Step-by-step guide to completing the monthly reconciliation report form

Completing the monthly reconciliation report form can feel daunting, but breaking it down into manageable steps simplifies the process. Start by recording all transactions accurately. This means documenting income and expenses clearly, ensuring that data entry is free from mistakes.

Next, compare your recorded transactions with your bank statements. A thorough check will help identify any common discrepancies, such as duplicate entries or missing transactions. If errors are found, it’s important to make adjustments promptly, documenting them thoroughly for future reference.

Leveraging pdfFiller to create, edit, and manage the report

pdfFiller simplifies the monthly reconciliation report creation process. Users can easily create a reconciliation report from various templates available on the platform. This eliminates the hassle of designing a report from scratch, allowing for quick adjustments and customization to meet specific reporting needs.

The editing options provided by pdfFiller let users modify existing documents seamlessly. Additionally, collaboration features allow teams to share their reports for input from other members. The electronic signature functionality means reports can be signed off without the need for physical copies, streamlining workflows significantly.

Troubleshooting common reconciliation issues

Despite thorough preparation, discrepancies can still arise during the reconciliation process. Common sources of errors include incorrect data entry, missed transactions, or timing differences in report periods. Being proactive about identifying these discrepancies early on can save time and effort down the line.

When encountering disputes with the bank, it's advisable to maintain a clear line of communication. Document each step of your reconciliation process, as having this data on hand can support your case. If persistent issues arise, engaging a financial advisor or accountant can provide the necessary expertise to resolve the problem effectively.

Best practices for monthly reconciliation reports

Establishing a regular schedule for reconciliation tasks is a best practice that many organizations find beneficial. By setting monthly routines, businesses can maintain a high level of accuracy in their financial records, which in turn supports smarter financial decision-making.

Utilizing automation tools can also streamline the reconciliation process. Technology can aid in capturing transactions automatically and reducing the chances of human error. Continuous education on financial management practices is another strategy that can help teams stay updated on best practices and guidelines.

Insights and trends in financial reconciliation

Emerging technologies are reshaping the landscape of financial reconciliation. The integration of artificial intelligence and machine learning into accounting software provides enhanced capabilities for automating data entry and facilitating complex calculations, thus improving overall accuracy and efficiency.

Case studies from organizations that have adopted pdfFiller for their reconciliation processes reveal successful strategies that enhance accuracy and collaboration. These case studies demonstrate how incorporating the right tools can lead to decreased reconciliation times and improved accuracy in financial reporting.

Interactive tools and resources

pdfFiller offers a range of templates and examples for users looking to streamline their monthly reconciliation reporting. These downloadable resources provide a ready-made structure for teams to adapt to their specific needs, saving time and enhancing the reporting process.

In addition, an FAQ section provides answers to common questions encountered during the reconciliation process. Should users face challenges while using the platform, pdfFiller’s customer support options are readily available, ensuring that all users can resolve issues swiftly.

Expanding your knowledge: related topics

Exploring financial compliance is essential for businesses to navigate the complex landscape of legal requirements surrounding financial reporting. Understanding the implications of these laws can support organizations in maintaining accuracy in their financial documentation.

Furthermore, cash flow management plays an integral role in the reconciliation process. Insights into cash inflows and outflows offered through accurate reports can guide future financial strategies and investments, enhancing the stability and growth potential of the organization.

User testimonials and success stories

Real-life experiences from users of pdfFiller illustrate the significant impact effective monthly reconciliation has on their operations. Businesses report increased efficiency, significant time savings, and greater accuracy in financial records since adopting structured reporting through pdfFiller.

These testimonials build trust in the platform, showing prospective users how pdfFiller can empower them to streamline their documentation process effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit monthly reconciliation report from Google Drive?

Can I sign the monthly reconciliation report electronically in Chrome?

Can I edit monthly reconciliation report on an Android device?

What is monthly reconciliation report?

Who is required to file monthly reconciliation report?

How to fill out monthly reconciliation report?

What is the purpose of monthly reconciliation report?

What information must be reported on monthly reconciliation report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.