Get the free Country-by-country Reporting Xml Schema

Get, Create, Make and Sign country-by-country reporting xml schema

Editing country-by-country reporting xml schema online

Uncompromising security for your PDF editing and eSignature needs

How to fill out country-by-country reporting xml schema

How to fill out country-by-country reporting xml schema

Who needs country-by-country reporting xml schema?

Country-by-Country Reporting Schema Form: A Comprehensive Guide

Overview of country-by-country reporting

Country-by-Country (CbC) reporting is a crucial tool mandated by the OECD for multinational enterprises (MNEs) to provide an annual report containing specific financial and operational data. Its primary purpose is to promote tax transparency and ensure tax compliance across jurisdictions. By detailing where profits are earned and taxes are paid, CbC reporting enables tax authorities to assess potential risks of tax avoidance more effectively.

As global tax regulations tighten and countries push for more transparency, the importance of CbC reporting grows. Compliance with these regulations is not only a legal obligation for companies but also helps in maintaining corporate reputation and ethical standards. Furthermore, the XML format plays a vital role in streamlining the data submission process, ensuring that information is both structured and accessible for review.

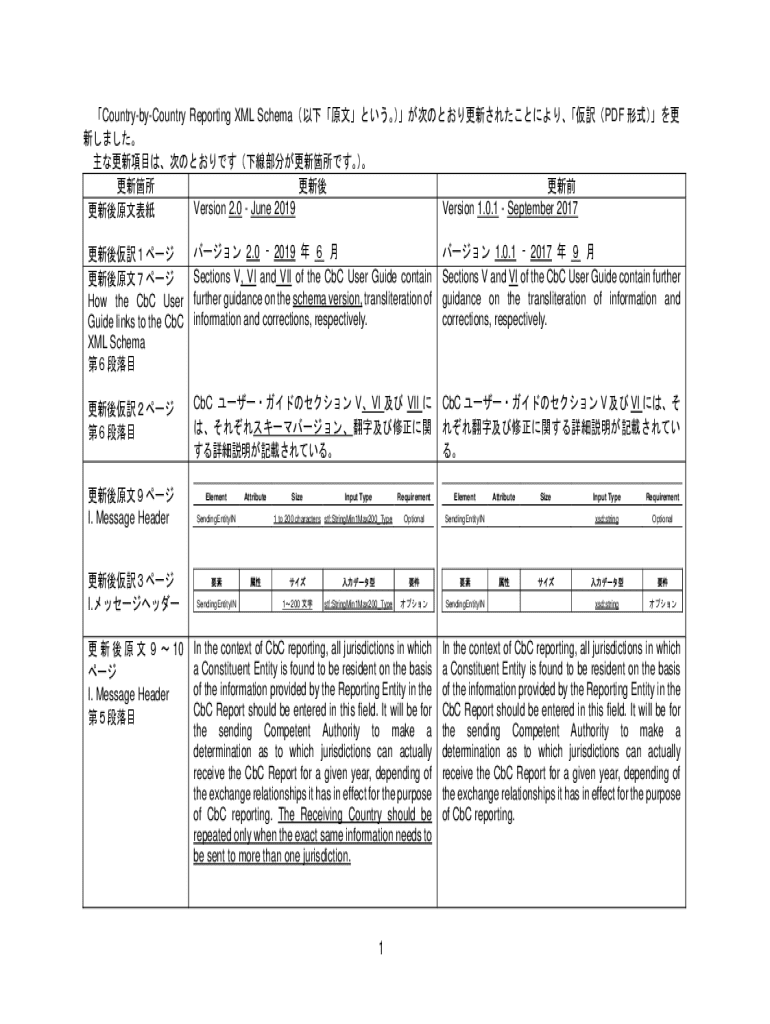

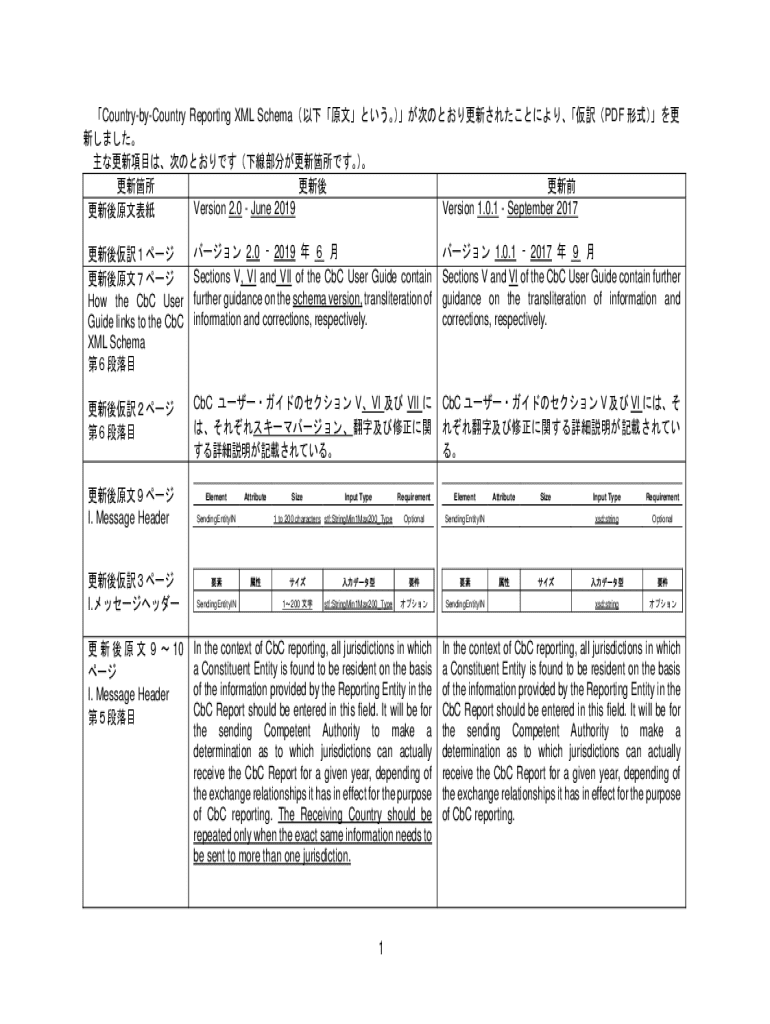

Understanding the schema for country-by-country reporting

An XML schema is a formal specification that defines the structure and the rules for XML documents, ensuring that the data is presented in a consistent manner. In the context of country-by-country reporting, an XML schema outlines the required elements and attributes that must be included in the report, guiding users through the data entry process.

Key components of the CbC reporting XML schema include tags representing specific data points such as revenue, profit before tax, and taxes paid. Each element serves a particular purpose, and understanding this structure is critical for ensuring comprehensive and accurate submissions. Guidelines provided in the schema delineate how to input data correctly, facilitating easier inspections and audits by tax authorities.

Step-by-step guide to filling out the country-by-country reporting schema form

Filling out the country-by-country reporting XML schema form can seem daunting, but a structured approach simplifies the process. Here’s a step-by-step guide:

Editing and managing your schema document

Once you've filled out the XML schema document, you may need to make edits or adjustments. Editing the XML document using pdfFiller is straightforward and user-friendly. Here’s how to do it:

eSigning and securing your country-by-country reporting form

eSigning your country-by-country reporting XML schema document is essential for ensuring compliance. The act of eSigning provides a legal verification that confirms your data’s authenticity and integrity. Using pdfFiller, eSigning is streamlined and efficient, allowing users to sign documents securely from any location.

Document security is paramount, especially when handling sensitive financial information. pdfFiller includes robust security measures that protect your data throughout the editing and signing processes. This ensures your documents remain secure against unauthorized access, while authenticity and accuracy are preserved.

Advanced functionalities for teams

pdfFiller not only offers the basic document management features but also advanced functionalities tailored for teams. For organizations with multiple stakeholders involved in the CbC reporting process, collaboration is essential.

Common challenges and solutions in country-by-country reporting

Despite the clear regulations surrounding country-by-country reporting, many organizations face challenges in meeting compliance standards. One of the most common issues is misalignment with local or national regulations, which can lead to discrepancies in data reporting and submission.

To overcome these challenges, businesses should establish clear lines of communication with tax advisors and compliance officers and invest in training for their teams on the specifics of country-by-country regulations. Adopting best practices, such as periodic internal audits of the reporting process, can help identify and rectify potential issues before submission.

Your expert team at pdfFiller

At pdfFiller, our team is dedicated to supporting individuals and organizations in navigating the complexities of document management and compliance. Our experts understand the intricate details of country-by-country reporting and offer tailored assistance to address your specific needs.

From answering queries related to XML submissions to providing insights on best practices, we are committed to supporting our users. With testimonials from satisfied clients who have successfully used pdfFiller for their reporting needs, we continue to strive for excellence in service delivery.

Engaging with pdfFiller

Engagement with pdfFiller is easy and straightforward. Users can access expert advice through our support channels, ensuring help is always available when needed. We also offer webinars and detailed workshops to enhance your understanding of document management.

These educational resources provide valuable insights into best practices and the latest updates in compliance, ensuring that users remain informed and proficient in handling their CbC reporting requirements.

Key insights: The future of country-by-country reporting

The landscape of global tax regulations is continually evolving, and the future of country-by-country reporting is set to be shaped by greater technological advancements and data analytics. As governments implement stricter compliance measures, businesses will need to stay ahead by adopting innovative practices in their reporting processes.

Looking forward, the role of technology like pdfFiller will be increasingly vital in helping organizations comply with regulations efficiently. By leveraging cloud-based platforms, businesses can ensure they meet submission deadlines and maintain high standards of data integrity. As tax authorities seek to enhance their enforcement capabilities, staying compliant becomes not just a benefit, but a necessity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify country-by-country reporting xml schema without leaving Google Drive?

How can I send country-by-country reporting xml schema to be eSigned by others?

How do I edit country-by-country reporting xml schema straight from my smartphone?

What is country-by-country reporting xml schema?

Who is required to file country-by-country reporting xml schema?

How to fill out country-by-country reporting xml schema?

What is the purpose of country-by-country reporting xml schema?

What information must be reported on country-by-country reporting xml schema?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.