Get the free Credit Card/check Acceptance Application

Get, Create, Make and Sign credit cardcheck acceptance application

Editing credit cardcheck acceptance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit cardcheck acceptance application

How to fill out credit cardcheck acceptance application

Who needs credit cardcheck acceptance application?

A Comprehensive Guide to the Credit Card Check Acceptance Application Form

Understanding the credit card check acceptance application form

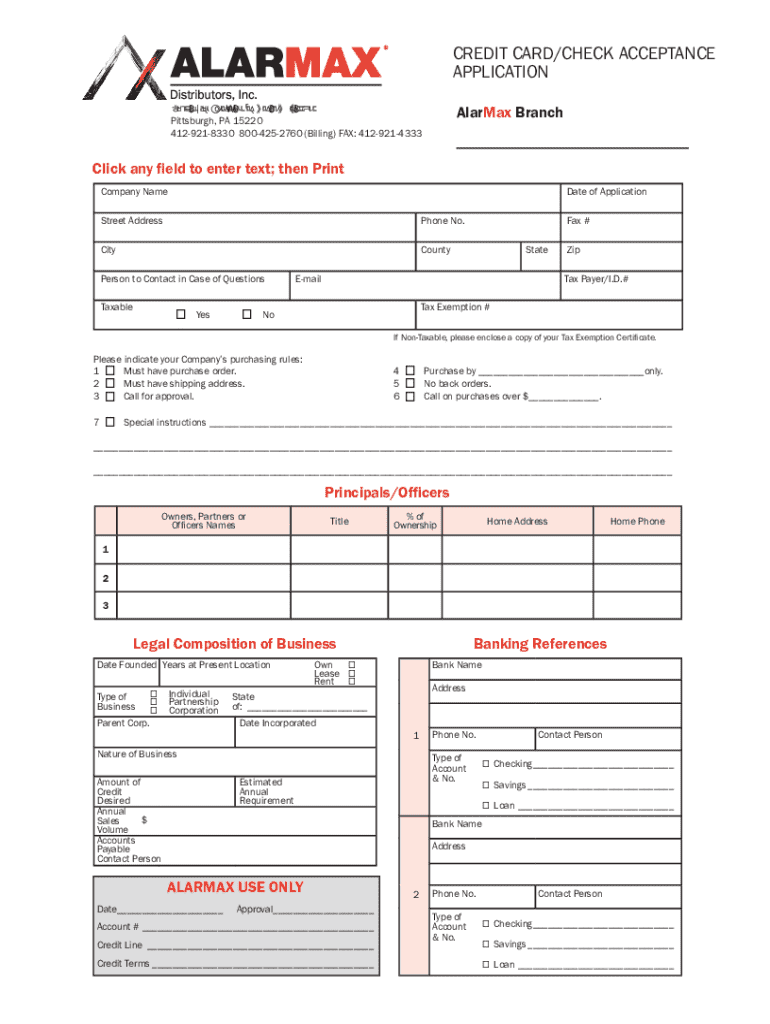

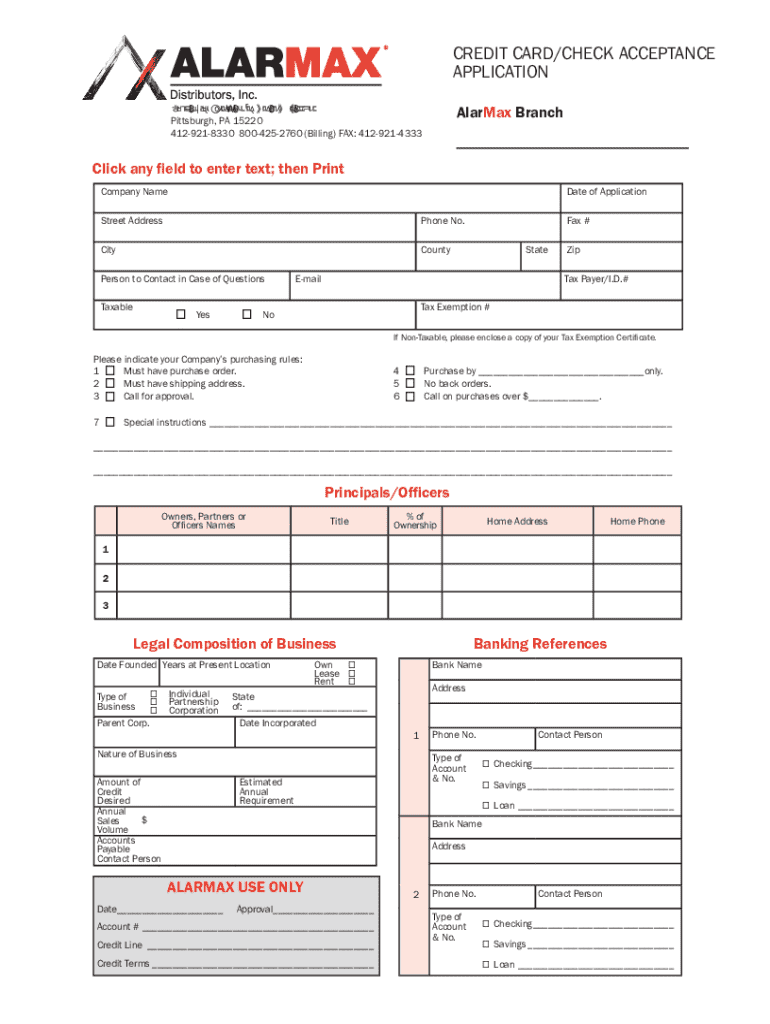

The credit card check acceptance application form serves as crucial documentation for businesses wanting to accept credit card checks. This form essentially authorizes a business to process credit card transactions, providing an essential foundation for security and compliance in payment processing.

Businesses utilize this form to mitigate risks associated with credit card fraud and to confirm the validity of customers’ payment methods. By having customers fill out this form, businesses can streamline their transactions while ensuring they're meeting statutory compliance and safeguarding sensitive financial data.

Key features of the credit card check acceptance application form

This form requires specific information to ensure that it accurately assesses the risk associated with accepting credit card checks. Necessary details include personal identification and financial information from the applicant, which the business uses to evaluate the applicant’s creditworthiness.

The form is equipped with numerous security features such as data encryption to protect sensitive applicant information. Furthermore, compliance with standards like PCI-DSS ensures that all transactions involving credit card processing adhere to high-security protocols. Utilizing this form offers various benefits to businesses, including reducing fraud risks and streamlining their payment processes.

Step-by-step guide to filling out the credit card check acceptance application form

Filling out the credit card check acceptance application form accurately is paramount for successful processing. Below is a detailed step-by-step guide.

Editing and managing your credit card check acceptance application form

pdfFiller offers robust editing tools that make it easy to manage your credit card check acceptance application form. This includes highlighting and annotating to emphasize key details, as well as the ability to add text and signatures wherever necessary.

Collaborative features on pdfFiller allow multiple team members to share and edit the document in real-time, making it convenient for teams to work together seamlessly. Additionally, you can keep track of your application status through features that monitor the progress of your submissions and alert you to any updates.

Frequently asked questions (FAQs)

It's common for applicants to have questions regarding the credit card check acceptance application form. Here are answers to some frequently asked questions.

Understanding related forms and templates

In addition to the credit card check acceptance application form, there are several other related documentation types. Familiarity with these forms can help streamline your business’s payment processes.

For instance, credit card authorization forms serve as another essential tool, confirming that businesses have explicit permission to charge a customer's card. By comparing these forms, businesses can determine the best approach for payment acceptance tailored to their needs.

Case studies and real-world applications

Several businesses have effectively utilized the credit card check acceptance application form to enhance their transactional efficiency. For instance, a local retail store integrated this form into their checkout process, significantly reducing chargeback disputes. They reported improved customer satisfaction as transactions became quicker and more secure.

Conversely, some businesses faced challenges during initial submissions due to incomplete applications, which led to delays in approval. By refining their internal processes and educating staff on the correct way to fill out the form, they were able to streamline their application process and better serve customers.

Tips for optimizing your credit card acceptance processes

To make the most of your credit card acceptance processes, consider implementing best practices regarding payment authorization forms. First, always ensure that forms are filled out accurately and comprehensively. This prevents unnecessary delays and rejection.

Moreover, keep security at the forefront by training employees on data protection best practices, including using secure networks for submissions, keeping customer data confidential, and regularly updating security measures. By doing so, you will greatly enhance customer confidence in your payment processes.

Additional tools and resources

Utilizing additional tools will further enhance your ability to manage the credit card check acceptance application form efficiently. pdfFiller provides interactive tools such as automated reminders and templates that simplify the document management process.

In addition, users can access downloadable resources like pre-filled form examples and templates for related documents to facilitate easier document preparation.

Future of credit card acceptance technologies

Looking ahead, credit card acceptance technologies are evolving rapidly. Innovations such as integrated payment processing solutions are gaining traction, allowing businesses to process payments through multiple channels seamlessly. These advancements promise to enhance security and user experiences.

Furthermore, trends like mobile payment capabilities are expected to dominate, especially with increased smartphone adoption. Businesses can leverage these new technologies to optimize payment processing and keep pace with customer demands.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit cardcheck acceptance application in Gmail?

How can I get credit cardcheck acceptance application?

How do I fill out the credit cardcheck acceptance application form on my smartphone?

What is credit cardcheck acceptance application?

Who is required to file credit cardcheck acceptance application?

How to fill out credit cardcheck acceptance application?

What is the purpose of credit cardcheck acceptance application?

What information must be reported on credit cardcheck acceptance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.