Get the free Matching Gifts and Grants Application

Get, Create, Make and Sign matching gifts and grants

How to edit matching gifts and grants online

Uncompromising security for your PDF editing and eSignature needs

How to fill out matching gifts and grants

How to fill out matching gifts and grants

Who needs matching gifts and grants?

Understanding Matching Gifts and Grants Forms for Nonprofits and Donors

Understanding matching gifts

Matching gifts are a unique fundraising tool that amplifies the impact of charitable contributions. They refer to a program through which employers match donations made by employees to eligible nonprofit organizations. By participating in these programs, donors can double—or even triple—their contributions, significantly benefiting the charities they support.

The importance of matching gifts lies in their potential to increase fundraising amounts and boost donor engagement. Nonprofits can leverage these contributions to enhance their financial sustainability and expand their missions. For donors, it provides an opportunity to maximize their philanthropic impact without incurring extra costs.

The mechanics of how matching gifts work are relatively straightforward. After making a donation, employees typically fill out a matching gift form through their employer's program, which then validates and processes the match. Numerous corporations offer matching gift programs, mainly in sectors such as technology, finance, healthcare, and manufacturing.

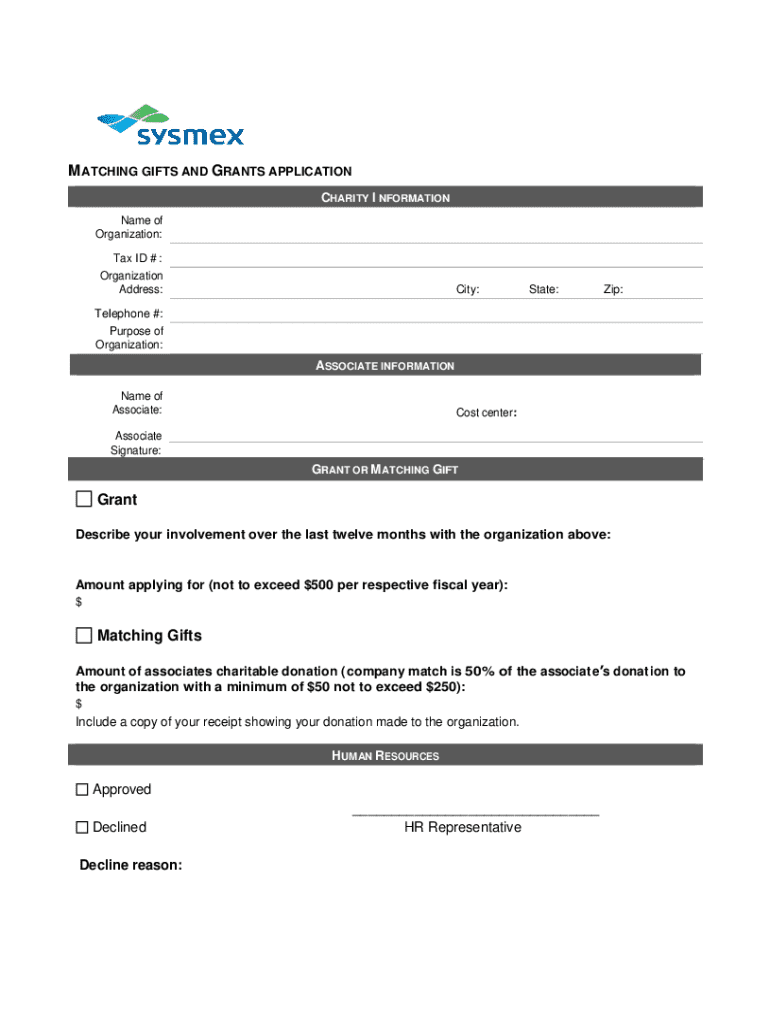

The matching gifts and grants form

The matching gifts and grants form is a critical document that facilitates the process of matching contributions from employers. It serves as the official request for an employer to match a donation made by an employee. Properly completing this form is essential, as inaccurate details can lead to delays or denials in the matching gift process.

Key components of the matching gifts form typically include donor information, nonprofit details, specifics about the donation, and the necessary employer verification. Let's delve deeper into each of these components:

To enhance successful submission of matching gifts and grants forms, pay careful attention to accurately inputting data, including all requested supporting documents, and being conscious of deadlines.

Types of matching gifts forms

Matching gifts forms can come in various formats, each with its own use cases and advantages. Understanding these types can help streamline your approach to securing matching donations.

The primary types include paper forms and electronic forms. Paper matching gift forms are traditional documents that require manual completion and mailing. Although still in use, they can sometimes slow down the processing of matching gifts. The submission process usually involves mailing the completed form to the employer or a designated department.

The benefits of using electronic matching gift forms include easier access to information, fewer errors, and the advantage of automating submissions, making the overall process significantly more efficient.

Completing the matching gifts and grants form

Successfully completing the matching gifts and grants form requires attention to detail and thoroughness. Here is a practical step-by-step guide on how to approach filling out the form.

Common mistakes to avoid include submitting incomplete information, missing deadlines, and providing incorrect employer details. These pitfalls can lead to delays or even denials of your matching gift request.

Maximizing matching gift contributions

To maximize the contributions received from matching gift programs, nonprofits should actively promote these opportunities among their donor base. This promotion could involve creating awareness through various channels.

Incorporating matching gifts into a nonprofit's overall fundraising strategy can lead to considerable financial improvements. Successful initiatives often include targeted email campaigns that educate donors on how to leverage matching gift programs and encourage participation.

Example initiatives can include highlighting specific matching gift challenges where every donation is matched within a defined timeframe, creating a sense of urgency among donors.

Leveraging technology for matching gift management

The advancement of matching gift software solutions has transformed how nonprofits manage matching gift programs. These software systems are designed to streamline the entire matching gift process, from submission to tracking contributions.

Using a matching gift database can significantly enhance a nonprofit's ability to process requests efficiently. Such databases provide immediate access to information about companies that offer matching gifts, enabling organizations to reach out proactively and maximize contributions.

pdfFiller enhances this process by offering tools for editing, customizing, and securely managing matching gifts and grants forms. Its collaborative platform also supports eSigning, ensuring documents are completed and processed promptly.

Special considerations in the matching gift process

While most corporations support matching gift programs, eligibility criteria can vary based on both nonprofit organizations and donors. Understanding these criteria is crucial for successful participation.

Recent trends indicate that many companies are adjusting their policies regarding matching gifts—some have made them more favorable to donors. Additionally, the impact of COVID-19 has spurred companies to adapt their matching gift programs in response to economic pressures and evolving employee needs.

FAQs about matching gifts

Matching gifts can bring about numerous questions from both donors and nonprofits. Clearly outlining responses to these inquiries can facilitate smoother transactions and enhance understanding.

Resources for further learning

Educating yourself about matching gift programs and processes is essential for both donors and nonprofits. To better navigate the complexities of matching gifts and grants forms, various resources are available.

By consolidating information and employing the right tools, both donors and nonprofits can simplify their processes and unlock the full potential of matching gifts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute matching gifts and grants online?

How do I fill out the matching gifts and grants form on my smartphone?

Can I edit matching gifts and grants on an Android device?

What is matching gifts and grants?

Who is required to file matching gifts and grants?

How to fill out matching gifts and grants?

What is the purpose of matching gifts and grants?

What information must be reported on matching gifts and grants?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.