Get the free Uniform Residential Loan Application

Get, Create, Make and Sign uniform residential loan application

How to edit uniform residential loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uniform residential loan application

How to fill out uniform residential loan application

Who needs uniform residential loan application?

Understanding the Uniform Residential Loan Application Form: A Comprehensive Guide

Understanding the Uniform Residential Loan Application

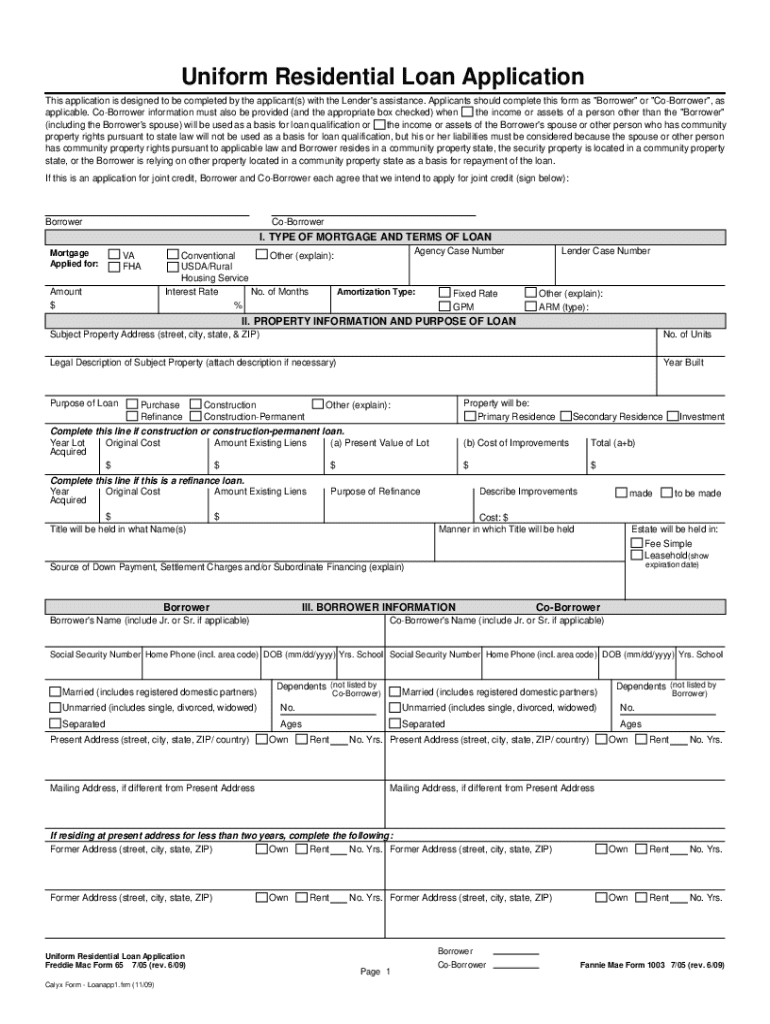

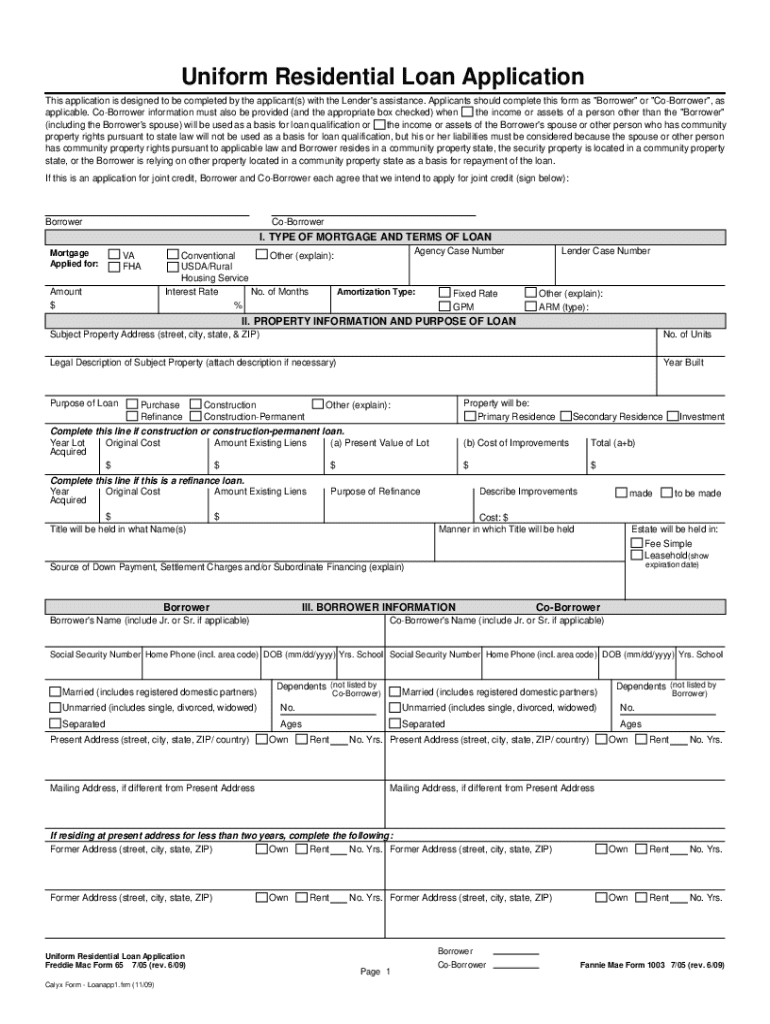

The Uniform Residential Loan Application (URLA) is a standardized form used by lenders to evaluate a borrower's eligibility for a mortgage. This form serves as a crucial step in the home financing process and is typically required by most mortgage lenders to ensure a uniform assessment of borrowers across the board.

The purpose of the application extends beyond just gathering data; it helps lenders analyze the creditworthiness of a borrower, ensuring that they can repay the loan. Additionally, the URLA is vital for meeting federal regulations and guidelines, promoting consistency in the lending process.

Key sections of the form include borrower information, employment details, income sources, asset reporting, and liability disclosures. Each element is designed to provide lenders with a holistic view of the borrower's financial status and home-buying intentions.

Preparing to fill out the application

Before you begin filling out the Uniform Residential Loan Application, it’s essential to gather all required documentation. This may include personal identification such as your Social Security Number and driver’s license, financial records like income statements and tax returns, and specific details about the property you wish to purchase.

Common terminology associated with the application is crucial for understanding what each section requires. Familiarize yourself with loan types (conventional, FHA, VA, etc.), interest rate concepts (fixed vs. adjustable), and the significance of credit scores in determining your loan terms.

Step-by-step instructions for filling out the form

Correctly completing the Uniform Residential Loan Application involves a series of necessary steps. Start with Section 1, which requires detailed borrower information. Be thorough with personal details such as your full name, social security number, and date of birth as inaccuracies can delay your application process.

In Section 2, document your employment information, including current employment status and history. It's vital to provide accurate dates of employment as lenders may verify this information. Section 3 breaks down monthly income and combined housing expenses, where you will need to list your income sources, including salary, bonuses, and any other relevant earnings.

Continuing with Section 4, asset information requires specifying your assets such as savings accounts, investments, and any real estate. Be prepared to document the value of these assets accurately. Section 5 focuses on liabilities where you'll report any outstanding debts, including credit cards and loans. Comprehensiveness is essential here as lenders assess your overall debt-to-income ratio.

Section 6 addresses details of the transaction, so be clear about the nature of the mortgage and the amount you wish to finance. In Section 7, declarations regarding your financial history and any declinable conditions must be made, while Section 8 is where you'll acknowledge and agree to the terms, culminating with your signature.

Editing and customizing your application with pdfFiller

pdfFiller provides a user-friendly platform for accessing the Uniform Residential Loan Application. You can conveniently edit the PDF form, allowing for corrections or updates that might be necessary after initial completion. Features include adding text, annotations, and highlighting critical sections of the form, which can help keep your information organized.

If you're working with a team, pdfFiller enables you to share the application easily. Collaborative tools such as comments and feedback features allow for streamlined teamwork, which can greatly enhance the application review process before submission.

eSigning the application

With pdfFiller, eSigning your Uniform Residential Loan Application is a straightforward process. It's essential to understand that eSignatures are legally binding and recognized by law, thus offering a convenient alternative to traditional ink signatures.

Once you've reviewed the application, you can easily apply your eSignature. Ensure that all fields are properly filled out, and that your signature is clearly indicated where required. The signature process will guide you through confirming your identity for verification.

Submitting your completed application

Once your Uniform Residential Loan Application is filled and signed, it's time to submit it. You have a couple of methods at your disposal: online submission through your lender’s portal or sending it via traditional mail. Each method has its advantages; digital submission tends to be faster, while mail can serve as a backup.

After submission, tracking the status of your application is crucial. Most lenders will provide you with a tracking mechanism, but proactively reaching out for updates can ensure you are kept informed throughout the processing stage.

Common questions and troubleshooting

As you navigate through the Uniform Residential Loan Application process, it’s normal to have various questions. Some common concerns might include the specific documents required or how long the processing time will take. Familiarizing yourself with the application can alleviate many worries.

It's important to avoid common mistakes, such as omitting required information or inconsistencies in your financial disclosures. Taking time to review everything can help sidestep unexpected delays or complications down the line.

Accessing support and resources

pdfFiller provides robust support options for those encountering challenges with their Uniform Residential Loan Application. Users can access live chat and email support, ensuring that help is only a message away for any questions or technical issues.

Additionally, video guides and tutorials offer step-by-step assistance tailored specifically to common concerns during the application process. Community forums present an opportunity for users to share experiences and get answers from peers who may have faced similar challenges.

Sample form and template resources

For individuals looking for a reference, pdfFiller provides downloadable sample forms and templates. These resources can serve as a helpful guide when preparing your own application and ensure you adhere to any specific lender requirements.

Accessing sample forms not only gives insight into standard practices but also allows you to familiarize yourself with the structure and flow of the URLA, helping to streamline your own completion process.

Non-English translations available

Recognizing the diversity of borrowers, finding translated forms of the Uniform Residential Loan Application can be critical for non-English speakers. pdfFiller is committed to inclusivity, providing translations and resources to assist those who may require guidance in languages other than English.

Resources for obtaining these translations can often be found directly on lender websites or through community organizations that specialize in aiding minority borrowers in the home financing process.

Recent updates and changes in loan application processes

The landscape of mortgage lending is continually evolving, with recent regulatory changes impacting the Uniform Residential Loan Application process. Staying up to date with these changes is vital for borrowers as they can alter eligibility criteria, documentation requirements, and overall processing time.

Being informed about the latest modifications enables borrowers to prepare adequately and understand their rights. Key takeaways often emphasize the importance of transparency in reporting financial status and the necessity of complete and accurate submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find uniform residential loan application?

How do I edit uniform residential loan application in Chrome?

How do I fill out uniform residential loan application using my mobile device?

What is uniform residential loan application?

Who is required to file uniform residential loan application?

How to fill out uniform residential loan application?

What is the purpose of uniform residential loan application?

What information must be reported on uniform residential loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.