Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit Application Form: How-to Guide Long-Read

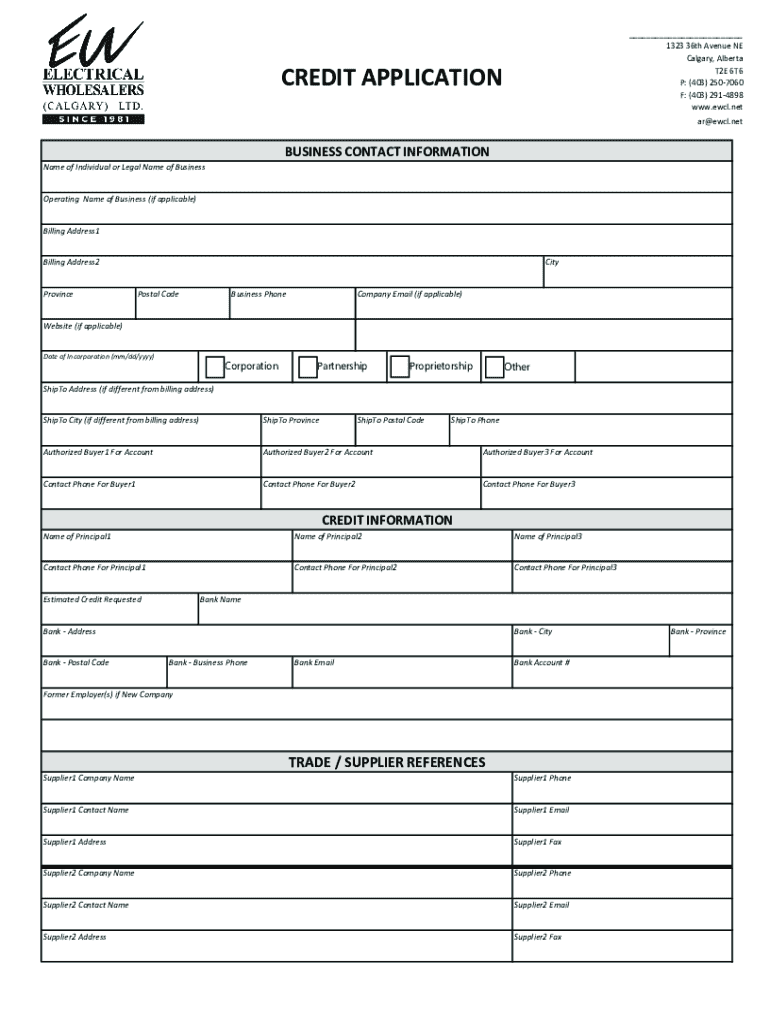

Understanding the credit application form

A credit application form is a document that allows potential borrowers to apply for credit with lenders. It collects critical information about the applicant's personal and financial circumstances, which lenders use to assess creditworthiness. Completing a credit application is a vital step for individuals and businesses seeking loans, credit cards, or financing, as it directly impacts the decision-making process of lenders.

The importance of a well-filled credit application form cannot be overstated. It ensures that the lender has all the necessary details to evaluate the applicant’s request efficiently. The form can also help portrait a trustworthy image, which is crucial in the financial industry. Additionally, it's essential to distinguish between business and personal credit application forms, as each type has unique requirements and implications.

Key components of an effective credit application form

An effective credit application form must capture specific essential information to facilitate the evaluation of the applicant's creditworthiness. This includes personal identification data such as name, address, Social Security number, and date of birth, which are critical for identity verification. Financial information detailing income, expenses, and liabilities offers insight into the applicant's financial health. Additionally, employment history helps lenders assess job stability, while references and prior credit experiences give context to the applicant's borrowing behavior.

Supplemental documents are also necessary for a comprehensive assessment. These often include proof of income, such as pay stubs or tax returns, and credit reports that provide lenders with an overview of the applicant’s credit history and score. Submitting these documents along with the credit application can help strengthen one’s case for approval.

Crafting the perfect credit application form: step-by-step guide

Creating a credit application form that meets the needs of your target audience requires a clear, methodical approach. Step One involves identifying the target audience. Understanding who will fill out this form—whether individual borrowers or business owners—will help shape the questions and information required.

Step Two is to choose the correct format. With options like PDF and online forms, consider user preferences and accessibility. Step Three involves outlining the required information; create sections for personal details, financial data, and supporting documents. In Step Four, design the form to be user-friendly—this includes well-organized sections, clear instructions, and logical flow.

Incorporating eSignature capabilities in Step Five allows for seamless signing and submission. Finally, in Step Six, test the form to ensure that all links are functional, and the process is smooth for potential applicants.

Best practices for filling out a credit application form

Filling out a credit application form accurately and thoroughly sets the tone for interactions with lenders. Key best practices include ensuring accuracy and completeness in all provided information. Applicants should double-check facts such as employment history and income details to minimize errors that could delay processing.

Honesty and transparency are paramount. Misrepresentation can lead to denial or future issues with credit. Organize supporting documents methodically—label each document clearly so that they can be easily referenced by lenders. Utilize tools like pdfFiller to manage submissions efficiently; users can keep track of document versions and edits, making the process streamlining and stress-free.

Common mistakes to avoid on a credit application form

Avoiding mistakes on a credit application form is crucial for achieving rapid approval. Common pitfalls include submitting incomplete information, which can result in delays or even rejection. Another frequent error is inaccuracies in financial data; even minor discrepancies can raise red flags during the review process.

Lastly, neglecting to attach the necessary supporting documentation can jeopardize the application's success. Always ensure that all required documents are included with the application to provide lenders with a complete picture of your financial standing.

Managing your credit application post-submission

Once you have submitted your credit application form, it is important to understand what to expect. Typically, the application will undergo a thorough review process. This can vary in length based on the lender's workload and your credit status—generally, expect a timeline of a few days to a couple of weeks.

Following up on your application is advisable. If you have not received feedback within the expected timeframe, reaching out to the lender can provide valuable insights into your application’s status and any additional requirements. Additionally, troubleshoot any common issues by revisiting the lender’s communication for possible follow-up actions you may need to take.

Enhancing the credit application process with automation

Implementing automation tools can greatly improve the efficiency of the credit application process. A platform like pdfFiller enables users to manage and create forms seamlessly, offering cloud-based solutions to streamline the approvals workflow. By automating routine tasks, such as document review and data entry, lenders can focus more on the critical aspects of evaluating applications.

Moreover, automation enhances data security and compliance, as all documents are stored in encrypted formats and can be easily accessed and managed. This level of efficiency can significantly reduce turnaround times, benefitting both applicants and lenders alike.

Addressing frequently asked questions (FAQs)

One of the most common questions about credit application forms is what happens after submission. The majority of lenders will process applications promptly, but approval times can vary based on documentation and applicant complexity. Another frequently asked question centers on application timelines; typically, expect a response within 3 to 15 business days, depending on the lender's speed and workload.

If an application is denied, applicants often wonder if they can revise and resubmit. The answer is yes, but it is imperative to understand the reasons for denial and rectify those issues before resubmitting. Lastly, to improve approval chances, maintaining a good credit score and providing complete, verifiable information during the application stage are essential steps.

Valuable resources for credit application success

A wealth of resources at pdfFiller can enhance the credit application process. The website provides free templates and sample forms tailored for various credit applications. A checklist for completing the application ensures no steps are overlooked, improving the accuracy of submissions and increasing approval chances.

Additionally, pdfFiller offers educational tools and guides to help users understand the ins and outs of credit application processes. These resources empower both individuals and teams in navigating their credit journeys confidently.

Exploring related topics

Understanding creditworthiness is vital in financial transactions. Your credit score plays a major role in determining the interest rates and terms you receive. It’s essential to learn how to safeguard against credit risks; this includes monitoring your credit report regularly and being cautious about taking on additional debt.

Leveraging analytics in credit applications can also provide meaningful insights into applicant patterns and forecasts. Utilizing advanced data analytics tools can help lenders make informed decisions and improve application processing times, enhancing the overall experience for both consumers and financial institutions.

Discovering additional tools for document management

pdfFiller stands out as a robust document management solution. The platform offers features that enhance user experience, such as interactive tools for form creation and editing. Users can collaborate in real-time, enabling teams to work together on documents regardless of location.

Managing multiple document types from a single platform streamlines workflows and enhances productivity. Users no longer need to switch between different tools, as pdfFiller consolidates everything in one accessible space.

Further learning and development opportunities

For those eager to deepen their understanding of credit management, pdfFiller offers various webinars focused on essential topics and skills. Users can register for on-demand demos, gaining hands-on experience with the platform's features and functionalities.

Additionally, engaging with articles and blog posts on credit management best practices will provide users with valuable insights and updates to stay ahead in their financial planning. This ongoing education enhances users' ability to navigate credit landscapes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit application directly from Gmail?

Can I create an eSignature for the credit application in Gmail?

How do I edit credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.