Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

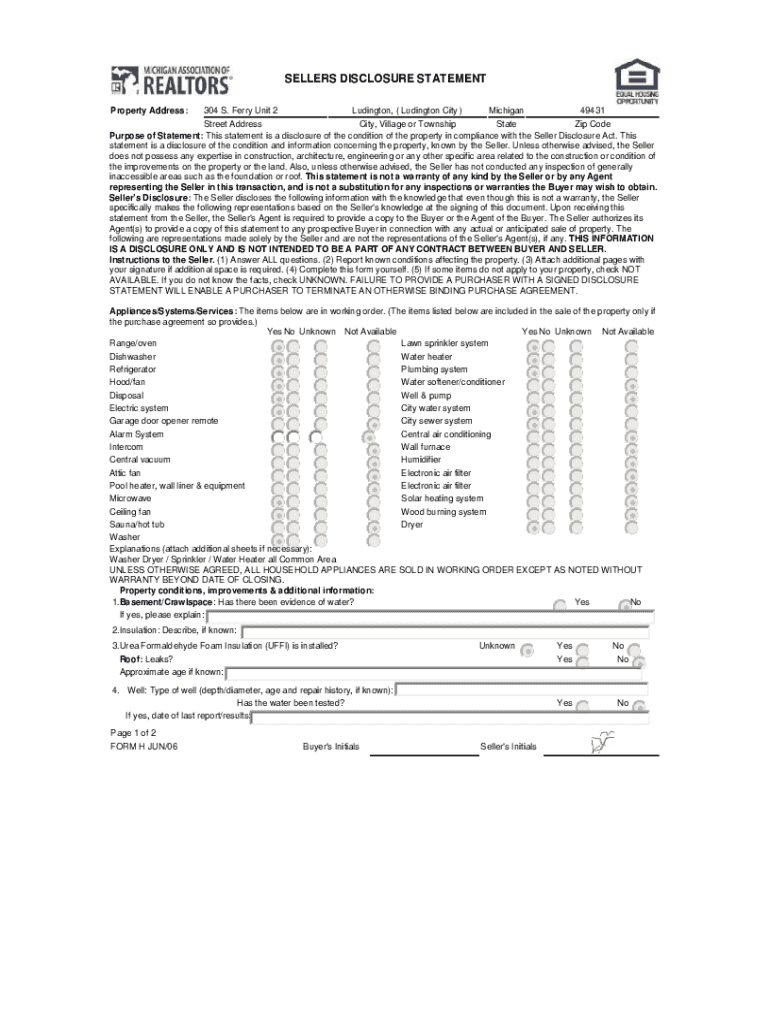

How to fill out sellers disclosure statement

Who needs sellers disclosure statement?

Sellers Disclosure Statement Form - How-to Guide

Understanding the seller's disclosure statement

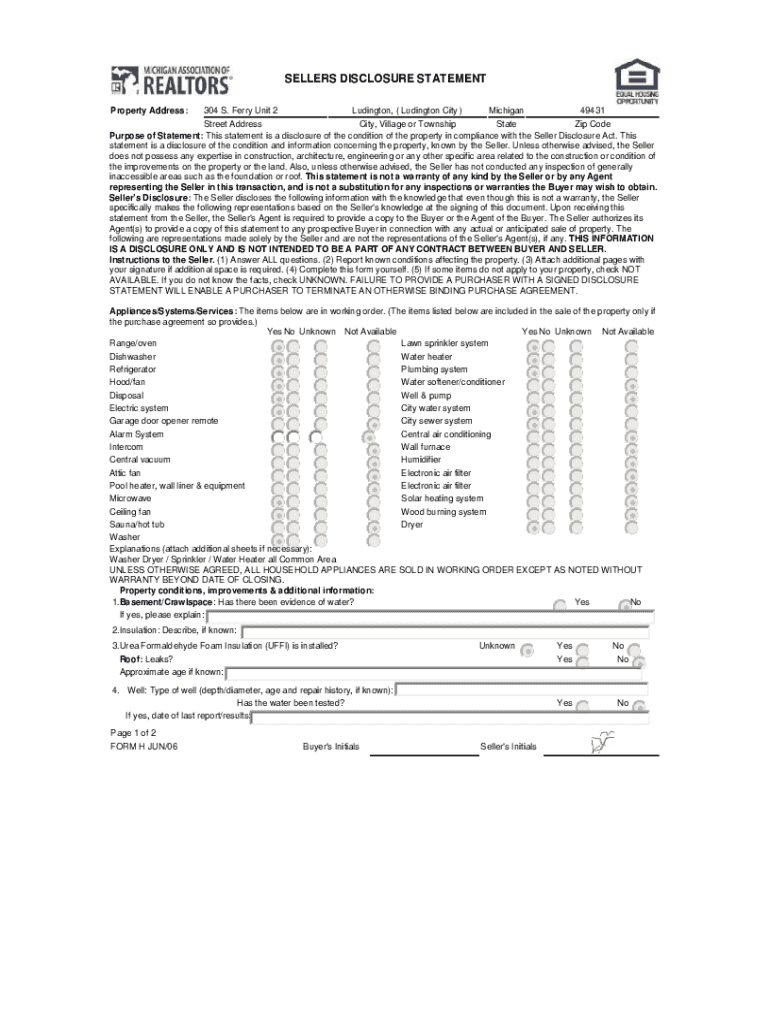

A Seller’s Disclosure Statement is a critical document in the real estate transaction process. It serves as a formal declaration by the seller detailing known issues and conditions of the property that could affect its value or safety. This document is integral in building trust between buyers and sellers. For buyers, it provides transparency into potential issues they might face, while for sellers, it offers a legal safeguard against future claims.

The purpose of a Seller's Disclosure Statement extends beyond mere obligation; it aims to ensure that buyers are fully informed about the property. This knowledge assists them in making educated decisions, thereby enhancing the likelihood of a smooth transaction process. Sellers, on the other hand, can protect themselves from liability by disclosing all known facts about their property.

Legal importance of disclosure statements

Real estate laws around the United States require sellers to furnish a disclosure statement during the sale process. These laws are designed to prevent fraudulent practices and ensure ethical conduct within real estate transactions. Depending on the state, requirements for disclosure can vary significantly. Some states may outline mandatory disclosures with specific guidelines, while others may operate under broader rules.

Understanding state-specific regulations is crucial, as each jurisdiction may impose unique obligations. Familiarizing oneself with these laws can safeguard sellers from potential legal challenges post-sale. Additionally, states like California have stringent disclosure requirements related to natural hazards and environmental factors, while states such as Texas allow for less stringent guidelines, emphasizing the need for accurate and responsible disclosures.

Components of seller's disclosure statement

When filling out the Seller's Disclosure Statement, various components must be taken into account to ensure its completeness and accuracy. Mandatory disclosures often include critical information about the property's condition, such as structural damages, history of mold, pest infestations, and more. Omitting these facts can have significant consequences for the seller, as undisclosed issues might lead to legal liabilities later.

Beyond mandatory disclosures, sellers can also provide optional disclosures that may help enhance trust with potential buyers. These might include routine maintenance activities and improvements made to the property. Such transparency can positively influence a buyer's decision, suggesting that the seller has acted responsibly in maintaining the home.

Special scenarios also necessitate particular disclosures. For example, if a death occurred in the home or if the immediate area is prone to natural hazards, sellers may be required to disclose these facts as well. Moreover, if the property is governed by a Homeowner’s Association (HOA), it’s essential to also include rules and regulations that impact ownership.

Seller’s disclosure requirements by state

Seller’s disclosure requirements can differ widely from one state to another, making it imperative for sellers to understand the specific regulations that apply in their area. For instance, California law mandates a comprehensive disclosure format known as the Transfer Disclosure Statement (TDS), which requires sellers to divulge extensive information about the property’s condition, including any known defects or significant repairs.

Conversely, in Texas, the law allows for a more streamlined seller disclosure process, emphasizing major defects without requiring the depth of information found in states like California. Such variances illustrate the importance of localized knowledge, especially for property owners; understanding the states’ unique regulations can guide sellers in crafting a compliant and effective disclosure.

Understanding the caveat emptor rule

The Caveat Emptor rule, translating to 'let the buyer beware,' remains a pertinent concept in real estate transactions, emphasizing the buyer’s responsibility to perform due diligence. In states where this principle is heavily observed, sellers may not be legally bound to disclose every detail, provided they are not actively concealing defects.

However, this does not absolve sellers of their responsibility to act in good faith. The Caveat Emptor rule highlights the balance of power and responsibility in transactions; while sellers can reap the benefit of less stringent disclosure laws, they must still provide accurate information and avoid willful misrepresentation.

The process of completing a seller’s disclosure statement

Step 1: Download the seller's disclosure statement template

One of the initial steps in creating a Seller’s Disclosure Statement is downloading a reliable template. Platforms like pdfFiller provide diverse templates tailored to various state requirements. Choosing the correct template ensures that you meet local legal standards while streamlining the process.

Step 2: Conduct a comprehensive property inspection

Conducting a thorough property inspection is vital before you begin filling out the disclosure. Key areas to focus on during the inspection process include the roof, foundation, plumbing, electrical systems, and common areas for signs of damage or wear. Utilizing checklists can assist in assessing the property’s overall condition systematically.

Step 3: Fill out the disclosure statement

Completing the disclosure statement requires accuracy and honesty. As you fill out the form, clear documentation of each aspect is vital. Common sections often include those addressing structural integrity, environmental hazards, and previous repairs made. Seek clarity in every section to ensure potential buyers have a transparent view of the property's status.

Step 4: Review and sign the disclosure statement

Before finalizing the document, review the form to double-check that all provided information is correct and comprehensive. Proper documentation is essential, as any inaccuracies can lead to legal disputes. Utilizing services like pdfFiller allows for easy electronic signatures, simplifying the finalization process without compromising security.

Common mistakes to avoid when filling out disclosures

Preventing mistakes during the completion of the Seller’s Disclosure Statement is crucial for avoiding potential complications down the road. One common error is submitting incomplete or vague statements, which can leave room for misinterpretation. Always ensure that all required fields are thoroughly addressed to convey clear information.

Another prevalent mistake is failing to include required information, such as essential details on known issues. Sellers should be diligent and forthcoming in documenting any concerns related to the property. Additionally, misrepresenting property condition can lead to legal ramifications if issues are discovered post-sale. Transparency is key; buyers appreciate candor in disclosures.

Best practices for buyers reviewing disclosure statements

Buyers should approach Seller’s Disclosure Statements with an analytical lens. Watch for specific red flags, such as inconsistencies in the seller’s narrative or omissions of significant repairs. Identifying these irregularities can illuminate aspects of the property that require further scrutiny.

It’s also beneficial for buyers to engage in discussions with sellers, asking pointed questions about the property issues outlined in the disclosure. Understanding the context and potential implications of reported issues can guide prospective buyers in making informed decisions. Utilizing professional inspectors and real estate agents is also advisable; their expertise can provide additional insights that enhance the home-buying experience.

Consequences of not disclosing properly

Failing to disclose property conditions adequately can lead to severe legal repercussions for sellers. In many jurisdictions, undisclosed issues can prompt lawsuits from buyers claiming misrepresentation. Such actions could result in financial penalties or, worse, the cancellation of the sale, which can severely impact a seller’s financial standing.

Moreover, unresolved issues stemming from inadequate disclosures can complicate the overall property sale process. Buyers discovering significant problems post-sale may demand remediation or, in extreme cases, pursue legal action, delaying or derailing transactions altogether. Thoroughly completing the Seller's Disclosure Statement is not just good practice—it is crucial for a successful and seamless transaction.

Using technology for seller disclosures

In an increasingly digital era, technology plays a vital role in managing Seller’s Disclosure Statements. Services like pdfFiller enhance document management through their collaborative tools, allowing sellers and real estate professionals to work together seamlessly. The cloud-based nature of such platforms ensures accessibility from anywhere, lending flexibility to the document creation process.

Editing and eSigning documents on pdfFiller is straightforward. Sellers can easily navigate editable templates, making necessary modifications with user-friendly features. In just a few clicks, they can finalize disclosures—making the entire process more efficient and reducing the likelihood of errors. Embracing these modern tools ensures that sellers can manage their documents effectively and professionally.

Additional considerations for various types of properties

Different types of properties may have unique disclosure requirements that sellers must consider. For instance, disclosures for investment properties require a different level of detail, particularly regarding the potential income derived from the property, its management history, and zoning restrictions. Understanding these nuances can help sellers avoid pitfalls.

Similarly, multi-family units pose unique challenges when it comes to disclosures. Information must encompass not just the individual units but also common areas and overall building conditions. New constructions may have separate guidelines, particularly regarding warranties and unfinished work. Each property type necessitates careful consideration to ensure full compliance and transparency with potential buyers.

Frequently asked questions about seller's disclosure statements

Several common queries arise regarding Seller's Disclosure Statements, particularly concerning state-specific laws and requirements. Many buyers ask about the specific conditions a seller must disclose, leading to confusion regarding the legal obligations in their state. Additionally, sellers commonly inquire about the potential consequences of failing to disclose certain issues, particularly penitent liabilities.

Buyers frequently seek clarification on how undisclosed issues impact their rights after the purchase, emphasizing the importance of understanding the nuances of the law governing disclosures. Consulting real estate professionals is often recommended to navigate these complex legal waters effectively.

Summary of key points

Completing a comprehensive Seller’s Disclosure Statement is paramount for both sellers and buyers in the real estate transaction process. Accurate and thorough disclosures not only foster trust but also protect sellers from legal repercussions. Utilizing tools like pdfFiller can streamline this process, allowing easy documentation and facilitating collaboration throughout the transaction.

Ultimately, being diligent and upfront about property conditions fosters a positive buying experience. For sellers, this transparency translates to smoother transactions and better relationships with buyers, ensuring the successful sale of their properties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form for eSignature?

Can I create an electronic signature for the pdffiller form in Chrome?

How do I edit pdffiller form straight from my smartphone?

What is sellers disclosure statement?

Who is required to file sellers disclosure statement?

How to fill out sellers disclosure statement?

What is the purpose of sellers disclosure statement?

What information must be reported on sellers disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.