Get the free fillable k 1

Get, Create, Make and Sign k 1 form

How to edit k 1 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out k 1 form

How to fill out business loan application

Who needs business loan application?

Business Loan Application Form: A Comprehensive How-to Guide

Understanding the business loan application form

A business loan application form is a formal document that a business submits to financial institutions to request funding. This form typically requires detailed information about the business, the purpose of the loan, and financial projections. By accurately completing this form, business owners can significantly increase their chances of securing necessary funding.

The application form serves as a critical first step in the funding process. It not only provides lenders with the information they need to assess creditworthiness but also reflects the seriousness and preparedness of the applicant. Failing to present a well-prepared application can result in delays or outright rejections.

Preparing to apply for a business loan

Before diving into the application, it's essential to gather all necessary documents. This preparation phase ensures a smoother application process. Key documents typically include:

Furthermore, assessing your business's financial health is critical. This includes checking your credit score and preparing financial projections. Knowing your credit score helps you understand your borrowing power and negotiate better terms.

Step-by-step guide to filling out the business loan application form

Completing the business loan application form requires attention to detail. Here's a breakdown of the essential sections:

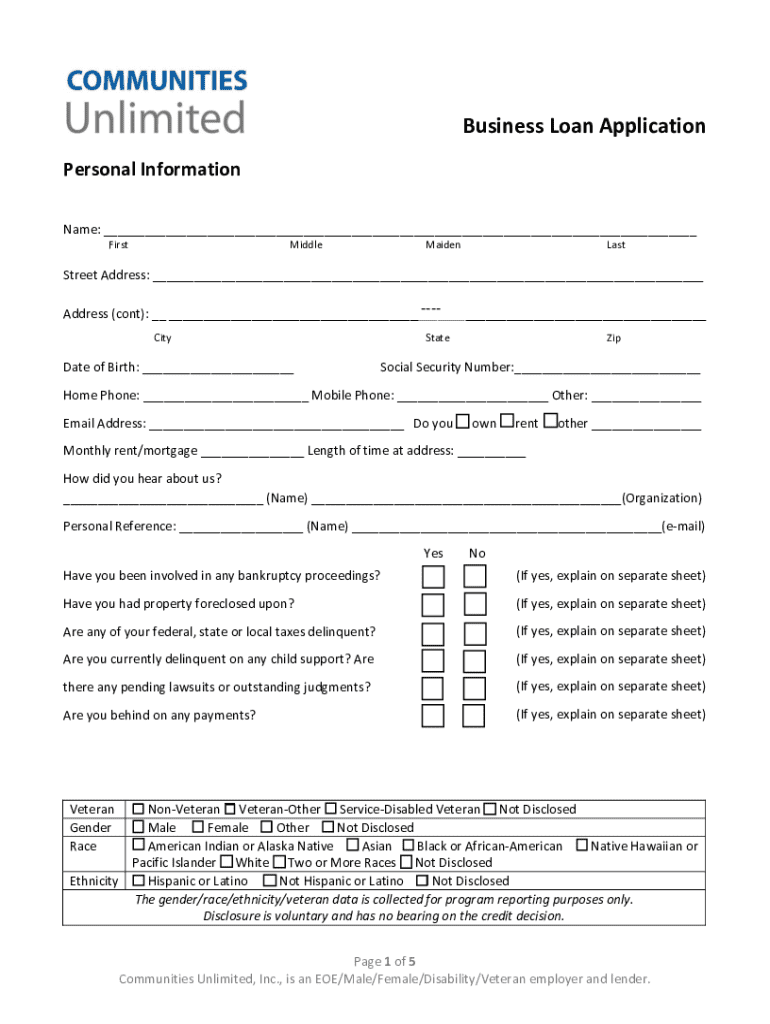

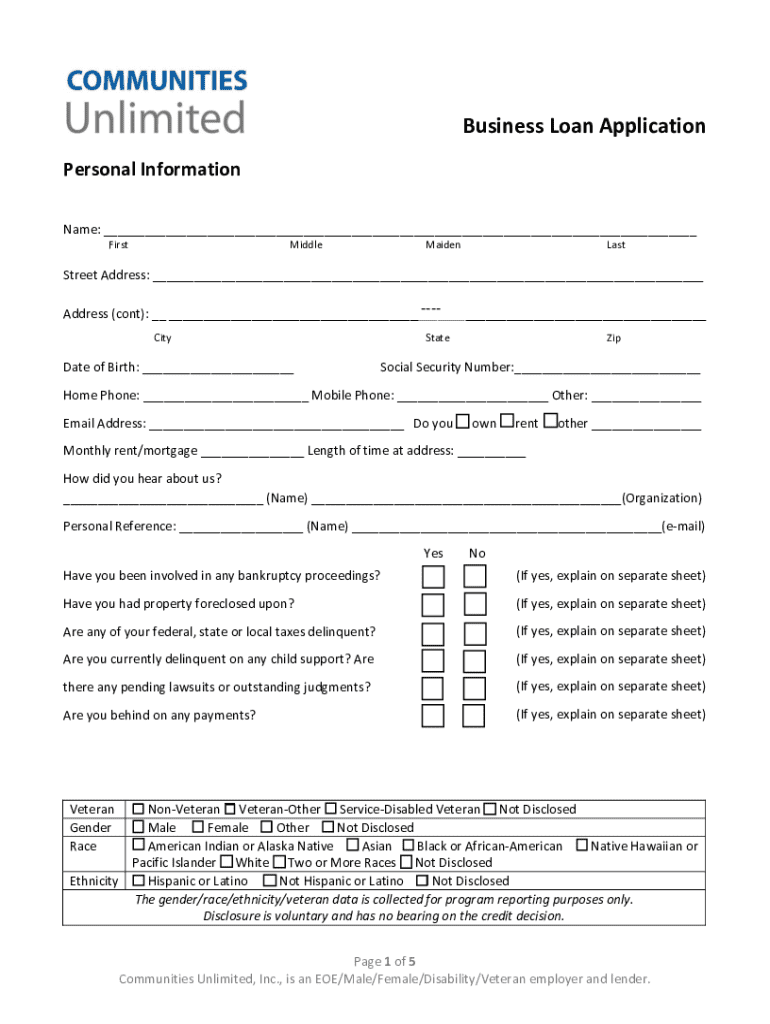

Personal information section

Start by providing your name, address, and contact information. Ensure that the details are current and accurately reflect your identity.

Business information section

This section looks at your business structure, whether it's an LLC, corporation, or sole proprietorship. You'll also need to provide the establishment date and the industry in which you operate.

Loan request section

Clearly state the amount of money you need and the purpose of the loan—whether it's for equipment, inventory, or working capital. Also, consider your repayment terms; providing clear options can help lenders assess your proposal.

Financial information section

In this vital segment, you must furnish accurate financial data, detailing revenue streams and expenses. This data helps lenders gauge the viability of your business and repayment capability.

Uploading and submitting your application

Once your application form is complete, the next step is to submit it efficiently. Modern tools like pdfFiller can streamline this process.

Interactive tools for submission

Using pdfFiller, you can easily create and edit forms before uploading required documents. This platform allows you to upload all necessary documents securely and quickly.

eSigning your application

The final step in the submission process is eSigning your application. pdfFiller provides a straightforward pathway for electronically signing your document, ensuring that it complies with legal standards.

Common mistakes to avoid in your application

Navigating the business loan application can be tricky. Avoid these common pitfalls to enhance your chances of approval:

Post-submission: what happens next?

Once you submit your application, it's critical to understand what follows. Lenders will begin a review process to assess your application. This stage can take anywhere from a few days to a few weeks, depending on the lender.

During this time, be available to respond to any requests for additional information. Timely responses can significantly streamline your application review.

Frequently asked questions (FAQs)

Utilizing a business loan application form comes with questions. Some frequently asked ones include:

Variations of business loan application forms

Different financial products require tailored application forms. Key variations include the following types of loans:

Related documents and useful tools

Having the right tools can enhance your application experience. Here are resources that may be beneficial:

Integrating pdfFiller into your loan application process

To optimize your application experience, consider using pdfFiller to collaborate with your team. This tool allows multiple users to work on an application simultaneously, ensuring efficiency and accuracy.

Manage your documents

Organizing your loan application files on pdfFiller not only keeps everything accessible but also allows for effortless edits and updates.

User success stories

Real-life examples underscore the potential of utilizing pdfFiller. Many businesses have successfully secured funding by using this platform to streamline their application processes.

Testimonials from users further illustrate the benefits of a seamless document management solution, highlighting features such as eSigning, easy collaboration, and organized record-keeping.

Footer navigation

To maximize your journey through the financial landscape, consider linking to related financial services and additional resources designed for small business owners. This can guide you in making informed decisions while navigating through your financial needs.

Also, don't forget to sign up for pdfFiller for ongoing document management solutions that adapt to your business requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my k 1 form in Gmail?

How can I edit k 1 form on a smartphone?

How do I edit k 1 form on an iOS device?

What is business loan application?

Who is required to file business loan application?

How to fill out business loan application?

What is the purpose of business loan application?

What information must be reported on business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.