Get the free 2 Certifcate of Insurance Instructions Revised.doc

Show details

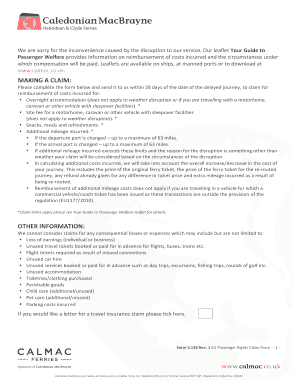

General Liability/Professional (also known as Malpractice) Liability Insurance Certificate Instructions We require the following information listed in bold print below for insurance coverage. If your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2 certifcate of insurance

Edit your 2 certifcate of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2 certifcate of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2 certifcate of insurance online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2 certifcate of insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2 certifcate of insurance

01

To fill out two certificates of insurance, start by obtaining the necessary information from your insurance provider. This typically includes the policyholder's name, address, and contact information.

02

Next, gather the details of the person or entity requesting the certificates. This may include their name, business name, address, and any specific requirements they have for the insurance coverage.

03

Make sure you have the correct policy numbers for the certificates you are filling out. Each certificate may pertain to a different policy, so double-check that you have the right information.

04

Complete the sections on the certificates that require your policyholder information. This usually includes your name, address, and contact details. Write this information clearly and legibly to ensure accuracy.

05

Fill in the sections related to the person or entity receiving the certificate. Include their name, business name, and contact information accurately to avoid any issues or delays.

06

Provide the necessary policy information, such as the type of coverage, limits, and effective dates. These details are crucial for the recipient to understand the scope of the insurance coverage.

07

If there are any additional requirements or special endorsements needed on the certificates, ensure they are properly documented. This could include specific wording, additional insured parties, or any other applicable provisions.

08

Review the completed certificates thoroughly to ensure accuracy and completeness. Check for any errors, missing information, or inconsistencies that could potentially cause problems or misunderstandings.

09

Once you are confident that the certificates are completed correctly, sign and date them as the policyholder. This signifies your acknowledgment and authorization of the information provided in the certificates.

10

Finally, distribute the certificates as required. Send them electronically or by mail to the intended recipient(s) promptly to fulfill the necessary insurance obligations.

Who needs two certificates of insurance?

01

Contractors or subcontractors: Many construction projects require contractors to provide certificates of insurance to prove they have the necessary coverage before commencing work. A contractor may need one certificate for their own purposes and another to satisfy the requirements of the project owner or general contractor.

02

Vendors or suppliers: Businesses that supply goods or services to other companies may be asked to provide certificates of insurance. This is to ensure they have adequate liability coverage in case their involvement causes any damage or harm.

03

Event organizers: Those planning events, such as weddings, conferences, or festivals, often require vendors, performers, or exhibitors to provide proof of insurance. Having two certificates allows the event organizer to verify that all parties involved have appropriate coverage.

04

Property managers: Property managers who oversee multiple properties or rental units may need two certificates of insurance - one for their own insurance policy and another for the building's insurance policy. This ensures that both parties are protected in case of any liability or property damage incidents.

05

Municipalities or government agencies: When working with municipalities or government agencies, they may request two certificates of insurance - one to fulfill their own requirements and another for their records. This allows them to verify that the contractor or service provider has the necessary coverage to perform the requested tasks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2 certifcate of insurance from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 2 certifcate of insurance into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send 2 certifcate of insurance to be eSigned by others?

When you're ready to share your 2 certifcate of insurance, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find 2 certifcate of insurance?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 2 certifcate of insurance and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

What is 2 certificate of insurance?

2 certificate of insurance is a legal document that serves as proof of insurance coverage.

Who is required to file 2 certificate of insurance?

Any party involved in a business transaction or agreement may be required to file a 2 certificate of insurance.

How to fill out 2 certificate of insurance?

Fill out the required fields with accurate insurance information, including policy number, coverage amount, and effective dates.

What is the purpose of 2 certificate of insurance?

The purpose of 2 certificate of insurance is to provide proof of insurance coverage to interested parties, such as clients, vendors, or landlords.

What information must be reported on 2 certificate of insurance?

The 2 certificate of insurance must include policy number, coverage limits, effective dates, insurance company information, and additional insured if applicable.

Fill out your 2 certifcate of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2 Certifcate Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.