Comprehensive Guide to Garnishee Response Template Form

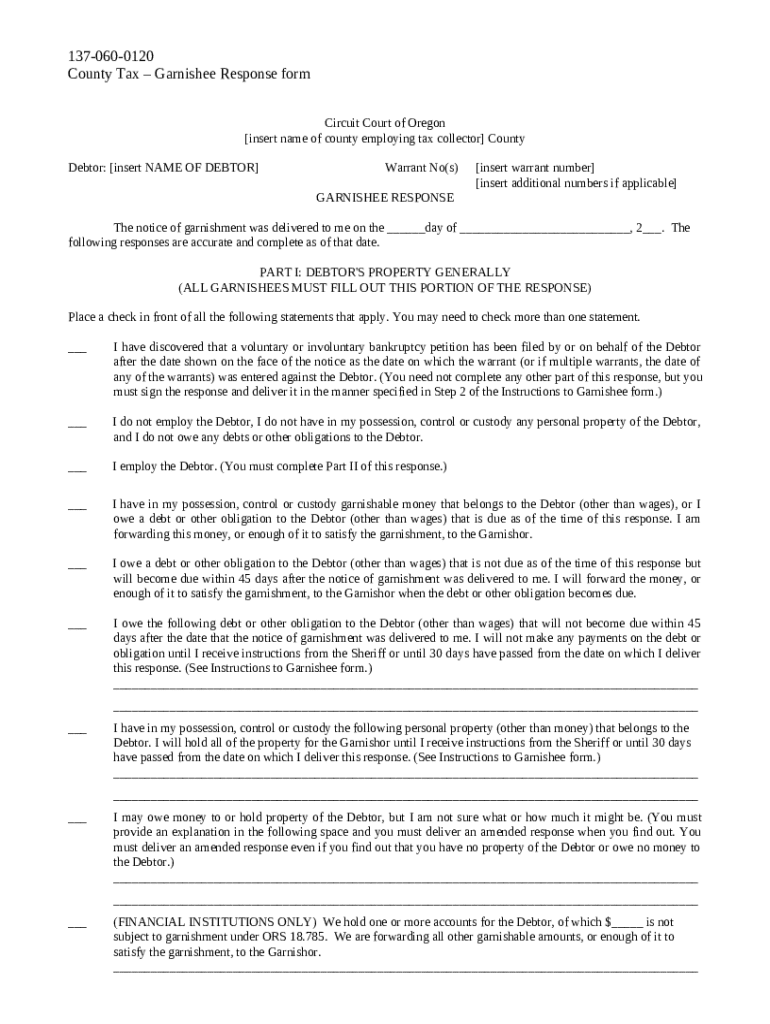

Understanding the garnishee response template form

A garnishee response template form is a legal document that a third party, known as a garnishee, must complete and submit in response to a garnishment notice. This notice typically involves a request to withhold a portion of the debtor's wages or bank account to satisfy a creditor's claim. Understanding this form is crucial, as it plays a significant role in the garnishment process. A thorough and accurate response ensures compliance with legal requirements and might help evade further legal repercussions.

The importance of a garnishee response cannot be overstated. If a garnishee fails to respond promptly or accurately, they may face legal actions or liabilities. The garnishee response template form also provides necessary information to the court about the debtor's assets, ensuring that the garnishment process proceeds without undue delay. Legal implications surrounding this form are extensive, and it's vital for individuals and businesses to understand their obligations.

Types of garnishment notices

Garnishments come in various forms, depending on the nature of the debt. It's essential to recognize the specific type of garnishment notice to respond correctly. Below are the primary categories:

These involve unpaid county taxes, requiring the garnishee to provide information specific to local tax requirements.

In this case, state tax agencies can issue garnishments based on income or property tax debts, necessitating strict adherence to state deadlines.

These can include credit card debts or personal loans, where standard debt collection laws apply.

Particular considerations must be addressed, especially in family law situations, to ensure compliance with support obligations.

These garnishments may involve specific cases that require additional information or stipulations.

Components of the garnishee response template form

The garnishee response template form consists of several essential fields necessary for lawful compliance. Each section requests vital information enabling the creditor and court to understand the garnishee's obligations adequately.

Key components of the form include:

Including name, address, and contact information to establish the garnishee's identity.

This should cover the creditor's name, address, and any relevant identification numbers.

Details pertaining to the case number, date of the notice, and amounts owed must be referenced.

Optional fields may be present, allowing additional commentary or notations that could impact the garnishment. However, common mistakes such as incomplete information or failure to sign should be avoided to ensure the response is deemed valid.

Step-by-step instructions for filling out the garnishee response

Filling out the garnishee response template form accurately is crucial for compliance. Here are step-by-step instructions to follow:

Before starting, review any court documents, notices, and your records regarding the debtor to ensure you have complete information.

Carefully fill in each section, ensuring accuracy in personal information, creditor details, and specifics of the garnishment.

Utilize a checklist to ensure you have not missed any information. Double-check for spelling errors or omissions.

Lastly, submit the completed form via mail, fax, or electronic filing, ensuring you comply with deadlines and maintain proof of submission.

Editing and signing your garnishee response form

Using tools like pdfFiller makes editing your PDF format simple, allowing you to make necessary changes efficiently. You can add your digital signature to the response, ensuring it meets legal standards.

If working with a team, pdfFiller allows you to share access to the document, facilitating collaboration while also maintaining document integrity. This access helps ensure that all necessary stakeholders can review and contribute to the garnishee response before submission.

Managing your garnishee response documents

Once you have submitted your garnishee response form, effective management of your documents remains essential. Using cloud storage benefits you by allowing easy access anytime, anywhere, which is crucial for quick references if further clarifications arise.

Track all responses and legal correspondence concerning the garnishment. Tools like pdfFiller empower users to efficiently oversee this process with features specifically designed for managing legal documents. If circumstances change, remember that the form can be easily revised to ensure that your response remains accurate and compliant.

Common questions about the garnishee response template form

As with any legal form, users often have common queries regarding the garnishee response template form. Below are some frequently asked questions:

Follow the step-by-step instructions provided or consult with legal counsel for complex cases.

Failure to respond timely can lead to court penalties. It's crucial to act at your earliest opportunity if deadlines are missed.

Non-compliance could result in legal repercussions, including the garnishment continuing without accurate representation of the debtor's assets.

Legal considerations and compliance

Understanding legal requirements concerning garnishee responses is vital for compliance. Each state may have specific regulations governing the garnishment process, affecting how and when a garnishee must respond.

Being aware of state-specific variations can help prevent mishaps during the response process. In some cases, seeking legal advice may be beneficial, especially when complicated family law matters or substantial debts are involved. An attorney can provide insight into how best to frame your response and what legal protections might be available.

Enhancing your document workflow

In today's fast-paced environment, efficient document management is essential. pdfFiller offers features that help streamline your document workflow, allowing for quicker edits, eSignatures, and collaboration options.

Additionally, consider integrating pdfFiller with other productivity tools you use regularly to enhance workflow efficiency. By staying organized with garnishment-related documents, you can ensure that all necessary paperwork is in order and easily accessible, reducing stress around compliance.