Get the free Nh-1065-es

Get, Create, Make and Sign nh-1065-es

Editing nh-1065-es online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nh-1065-es

How to fill out nh-1065-es

Who needs nh-1065-es?

A Comprehensive Guide to the nh-1065-es Form

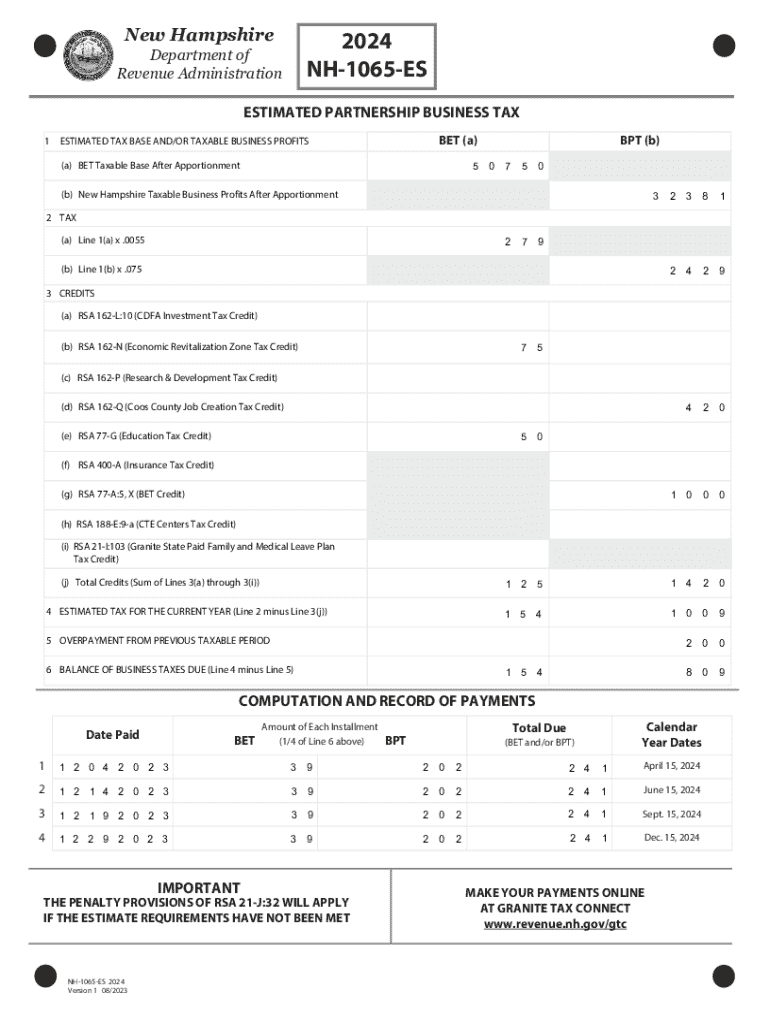

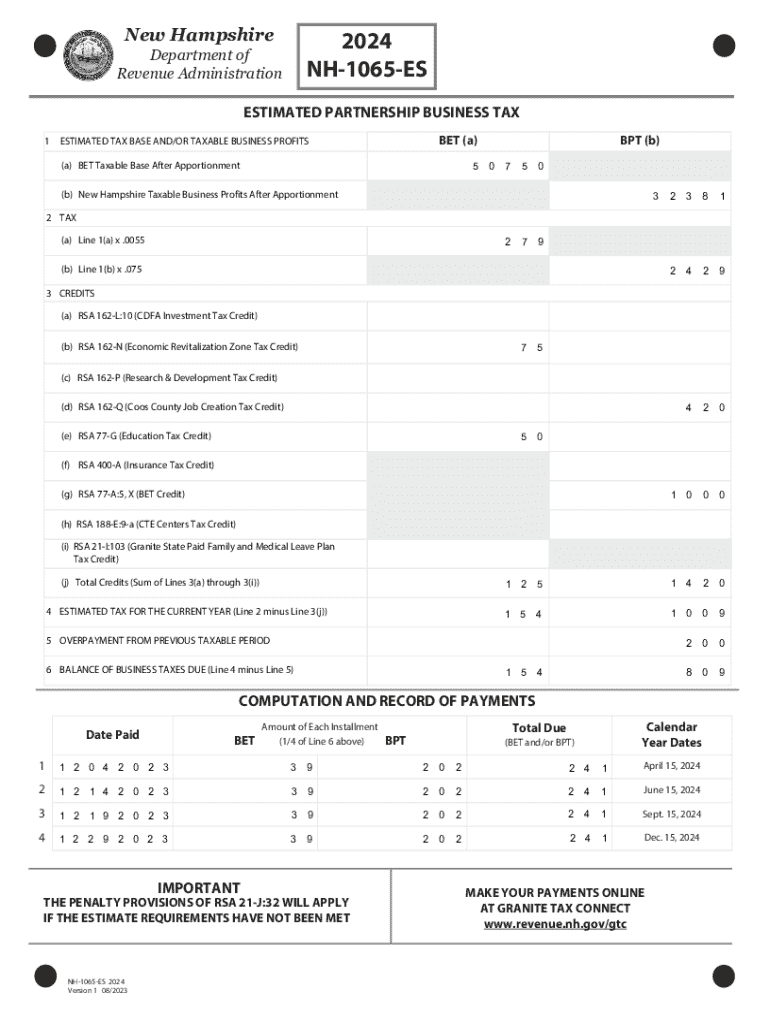

Understanding the nh-1065-es form

The nh-1065-es form is a crucial document for individuals and teams who need to report income or file for adjustments to their income tax obligations. Designed to provide the necessary information for the IRS, this form serves a specific purpose in the tax system, primarily focusing on pass-through entities. Its importance cannot be understated, as accurate completion is essential for compliance with federal tax laws. Given the complexities involved in tax regulations, understanding the nh-1065-es form is vital for ensuring that your submissions meet legal requirements and avoid audits.

Key features of the nh-1065-es form include its straightforward structure and online accessibility, allowing users to fill it out efficiently with guided prompts. Moreover, it enables representatives of partnerships and other pass-through businesses to report their income clearly. Understanding its functionalities can enhance overall document management experience within tax preparation, ultimately leading toward more productive tax filing.

Essential details of the nh-1065-es form

Filling out the nh-1065-es form requires careful attention to detail. Some essential requirements for completing this form include accurate personal information of the filer, details about the partnership or LLC, and pertinent financial data. As a taxpayer, you must ensure that all required fields are filled correctly to avoid rejection of the form. Common fields included in the nh-1065-es form typically encompass the name of the partnership, federal identification numbers, and an analysis of income versus losses.

Beyond straightforward data entry, the nh-1065-es form also carries significant legal implications. Non-compliance can lead to penalties or audits, emphasizing the importance of understanding the regulatory compliance factors associated with its submission. Potential implications such as understated income reporting or discrepancies in partnership distributions should be considered while filling out this essential form.

Form preview example

Having a visual representation of the nh-1065-es form can significantly aid in understanding and completing it. Utilizing a preview allows users to familiarize themselves with the layout and sections of the document before diving into details. Each segment is designed with a user-friendly approach, where clearly labeled fields provide guidance on what information is required. An annotated breakdown can highlight crucial areas such as taxpayer identification numbers and financial summary tables.

When navigating the nh-1065-es form, keep in mind the importance of reading instructions carefully to ensure data entry aligns with required formats. This familiarity with each section will streamline the completion process and improve accuracy.

Step-by-step guide to filling out the nh-1065-es form

To effectively fill out the nh-1065-es form, start by preparing the necessary information. Collect all relevant documents, such as previous tax returns, income statements, and partner details. This data will streamline your entry process, ensuring each section of the form is completed with accurate information.

Taking time for each of these steps can prevent errors and ensure compliance with tax regulations, making tax season less stressful for individuals and teams alike.

How to edit the nh-1065-es form online for free

Editing the nh-1065-es form online has never been easier, thanks to tools like pdfFiller. With its intuitive interface, users can easily upload existing forms or work from scratch. Editing features include the addition of text boxes, erasing unwanted data, and highlighting vital information for emphasis. This flexibility ensures that any necessary changes can be made without hassle.

These features are designed to facilitate seamless document management and minimize the stress of managing tax forms like the nh-1065-es.

eSigning the nh-1065-es form

The legality of electronic signatures is recognized for nh-1065-es form submissions, making eSigning a convenient option. With pdfFiller, adding your eSignature to the form is straightforward. Users can upload their handwritten signature and place it directly in the designated fields.

This convenient method simplifies the signing process without sacrificing compliance with legal requirements.

Collaborating on the nh-1065-es form

Effective collaboration on the nh-1065-es form ensures all team members contribute their expertise and information. Using pdfFiller’s collaborative tools allows team members to provide feedback in real time, helping to streamline the review process.

Collaborative features not only enhance the accuracy of data entered but also ensure that all voices are heard in the preparation process.

Troubleshooting common issues

Despite its user-friendly design, users may encounter common issues while filling out the nh-1065-es form. A well-structured FAQ section can address several common problems related to data entry, form submission errors, or formatting dilemmas.

By proactively identifying these common issues and applying effective solutions, users can improve their experience with the nh-1065-es form overall.

Related documents and forms to consider

While working with the nh-1065-es form, it may be beneficial to consider related documentation that could also impact tax liability. Examples include individual income tax forms, partnership tax returns, and state-specific adjustments that may apply to your financial situation.

A comparative analysis of these forms can help clarify when each should be utilized, thus promoting broader understanding and compliance.

Navigating beyond the nh-1065-es form

Ultimately, utilizing the nh-1065-es form effectively integrates into a broader document management strategy. pdfFiller offers a host of additional tools and features that facilitate seamless document creation and collaboration beyond just tax forms.

These tools enhance your ability to manage documents efficiently, ultimately contributing to a smooth workflow from form filling to submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the nh-1065-es in Gmail?

How can I edit nh-1065-es on a smartphone?

Can I edit nh-1065-es on an Android device?

What is nh-1065-es?

Who is required to file nh-1065-es?

How to fill out nh-1065-es?

What is the purpose of nh-1065-es?

What information must be reported on nh-1065-es?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.