Get the free Llp Resolution for Banking Facilities

Get, Create, Make and Sign llp resolution for banking

How to edit llp resolution for banking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out llp resolution for banking

How to fill out llp resolution for banking

Who needs llp resolution for banking?

LLP resolution for banking form: A comprehensive guide

Understanding LLP resolutions

A Limited Liability Partnership (LLP) resolution is a formal document that outlines decisions made by an LLP regarding specific actions or transactions. It serves as an official record and is essential for establishing the authority of individuals to act on behalf of the LLP. The purpose of an LLP resolution for banking transactions typically involves the opening of a bank account but can extend to other financial dealings as well.

The importance of an LLP resolution for banking transactions cannot be underestimated. It provides financial institutions with assurance that the individuals who claim authority to manage the LLP's finances have been granted such power through a structured decision-making process. This is particularly vital in maintaining transparency and trust in business dealings.

It's also critical to understand the key differences between LLC and LLP resolutions. While both serve to document decisions made by the members of the company, an LLC resolution pertains to Limited Liability Companies and typically has different governing rules compared to LLPs. Recognizing these distinctions is crucial for compliance.

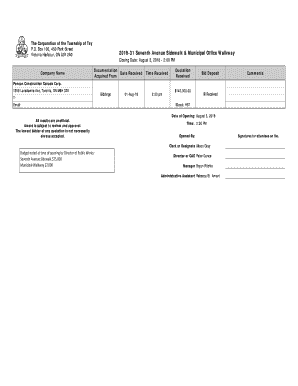

Basic components of an LLP resolution for opening a bank account

Drafting an LLP resolution for a banking form requires several essential components to ensure it meets the bank's requirements. Initially, it must include basic information, such as the name of the LLP, the date of the resolution, and the names of authorized signatories who are permitted to conduct transactions.

Specifying the purpose of the resolution is equally important. The resolution should explicitly state its intention, such as 'to authorize the opening of a bank account with [Bank Name].' Lastly, it's crucial to clarify the decision-making authority within the LLP, indicating how and when decisions are made within the partnership structure.

Step-by-step process to create an LLP banking resolution

Creating an LLP banking resolution is a structured process that requires careful attention to detail. The first step is to gather all necessary information needed to draft the resolution. This includes details about the LLP, authorized members, and the purpose of the resolution.

Next, move on to the drafting stage. A well-structured template can simplify this process. It should encompass all the required elements: the LLP's name, date, signatories, and the purpose of the account opening. Following this, review and approve the resolution internally within the LLP to ensure consensus on the decision-making process.

Finally, finalize the document by ensuring all members sign it. This signature process can often be done electronically for convenience. After the resolution is signed, it's ready to be presented to the bank for action.

Important considerations when filing an LLP resolution

When filing an LLP resolution for a banking form, it's vital to consider jurisdictional variations. Each state has specific requirements for LLP resolutions, which can influence how you draft and present your document. Before submission, verify these requirements to ensure compliance.

Additionally, banks may request further documents alongside the resolution. These can include operating agreements or identification proofs of the authorized signatories. Therefore, be prepared with a comprehensive package to expedite the process. Another aspect to consider is whether or not to notarize your resolution. While not always mandatory, notarization can lend an extra layer of legitimacy to your documentation.

Interactive tools available on pdfFiller for LLP resolutions

pdfFiller offers a range of interactive tools to facilitate the creation and management of your LLP resolution. Using pdfFiller’s Document Creator, users can start with a blank template or fill an existing form. The step-by-step guide helps you navigate the elements needed for an LLP resolution form, simplifying the process.

Editing and customizing templates is another feature that allows users to add specific details relevant to their LLP. You can include signatures and any additional information necessary for completeness. Furthermore, pdfFiller makes collaboration easy; it enables team members to share drafts and collect feedback in real-time, ensuring everyone is on the same page before finalizing the resolution.

Frequently asked questions about LLP resolutions and banking

Many individuals may have questions surrounding the process of creating an LLP resolution. One common inquiry is regarding the turnaround time for creating such a resolution. Typically, once the information is gathered, drafting can be completed within a day, depending on internal approval processes.

Additionally, users often ask if multiple resolutions can be combined into one document. While combining may save time, it's best to keep resolutions separate for clarity, especially when dealing with different purposes. Lastly, it's essential to consider what happens if the resolution is not followed. Non-compliance could lead to complications in transactions and may even expose the LLP to legal challenges.

Best practices for managing LLP resolutions

Managing LLP resolutions effectively requires organization and consistency. Keeping track of resolutions can be enhanced by utilizing a dedicated system for organizing documents. A well-structured filing system, both physical and digital, ensures that necessary documents are easily accessible when needed.

Digital storage options, particularly cloud-based solutions, offer several benefits, such as easy access from anywhere and enhanced security features. Regular reviews of your LLP resolutions are vital to maintain compliance, adapting to changes in laws or internal policies promptly. This practice not only safeguards your LLP but also promotes ongoing diligence.

Exploring other uses of LLP resolutions beyond banking

LLP resolutions have applications beyond just banking transactions. They can also be vital in facilitating other business activities, such as entering into partnerships, authorizing new members, or ratifying significant decisions affecting the LLP. Each resolution helps document internal agreements and ensures that all members are on the same page with respect to big decisions.

Additionally, utilizing LLP resolutions can enhance credibility when negotiating with potential partners or investors, as it clearly delineates authority within the partnership. Overall, LLP resolutions serve as foundational tools for governance and legal compliance in various business contexts.

A closer look at pdfFiller’s advantages for LLP resolutions

pdfFiller stands out as a premier choice for managing LLP resolutions due to its user-friendly interface and comprehensive features. The platform allows for seamless editing and revision capabilities, ensuring that your documents remain current and accurate whenever needed. Users can take advantage of the eSigning features for quick and convenient approvals.

Security is also a priority at pdfFiller, with safe and secure document management in the cloud that ensures your sensitive information remains protected. As such, you can focus on your business while pdfFiller takes care of your document needs efficiently and securely, helping you maintain peace of mind as you navigate through your LLP requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my llp resolution for banking in Gmail?

How do I edit llp resolution for banking on an iOS device?

How do I edit llp resolution for banking on an Android device?

What is llp resolution for banking?

Who is required to file llp resolution for banking?

How to fill out llp resolution for banking?

What is the purpose of llp resolution for banking?

What information must be reported on llp resolution for banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.