Get the free Colorado Debt Management Services Provider Registration Surety Bond

Get, Create, Make and Sign colorado debt management services

Editing colorado debt management services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out colorado debt management services

How to fill out colorado debt management services

Who needs colorado debt management services?

Colorado Debt Management Services Form: A Comprehensive Guide

Understanding Colorado Debt Management Services

Debt management services in Colorado aim to assist individuals in handling their financial obligations effectively. These services typically encompass debt counseling, budgeting advice, and negotiation with creditors. Understanding the framework of Colorado debt management is crucial for both providers and consumers. Failure to comply with regulations can lead to penalties and loss of licensure, making proper registration and adherence to laws critical.

In Colorado, debt management is governed by stringent laws designed to protect consumers while ensuring that providers act responsibly. It's essential for providers to stay informed about these regulations to maintain their operational licenses. Key regulations include the Colorado Consumer Protection Act, which mandates fair treatment of consumers and ethical practices in debt management.

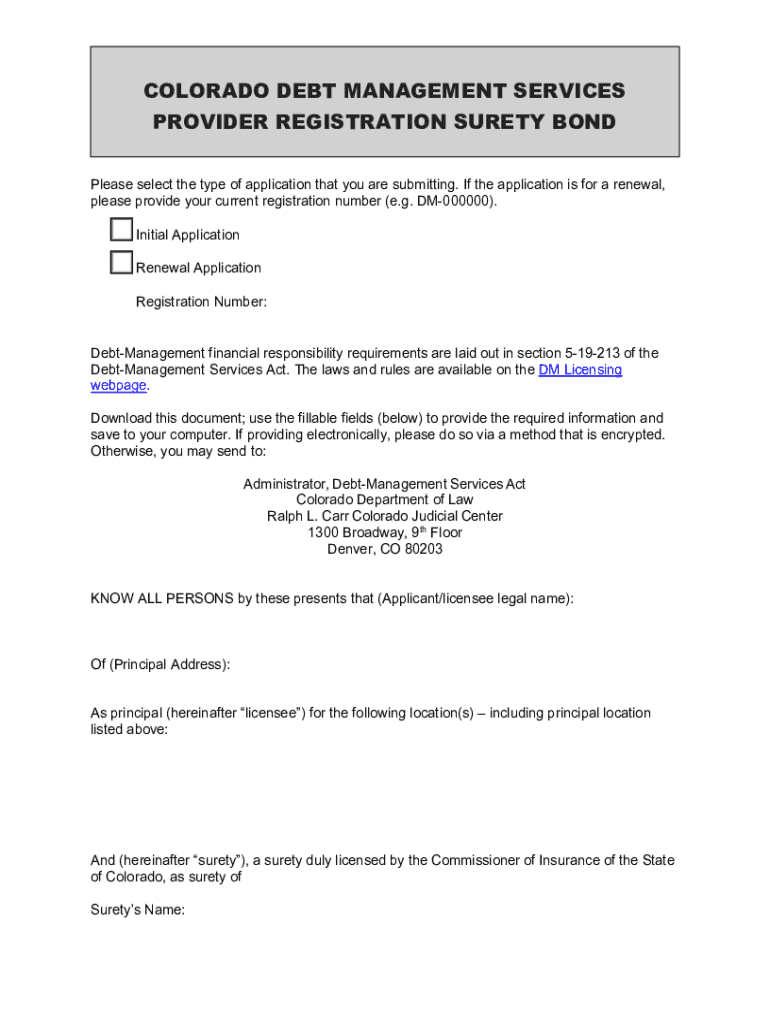

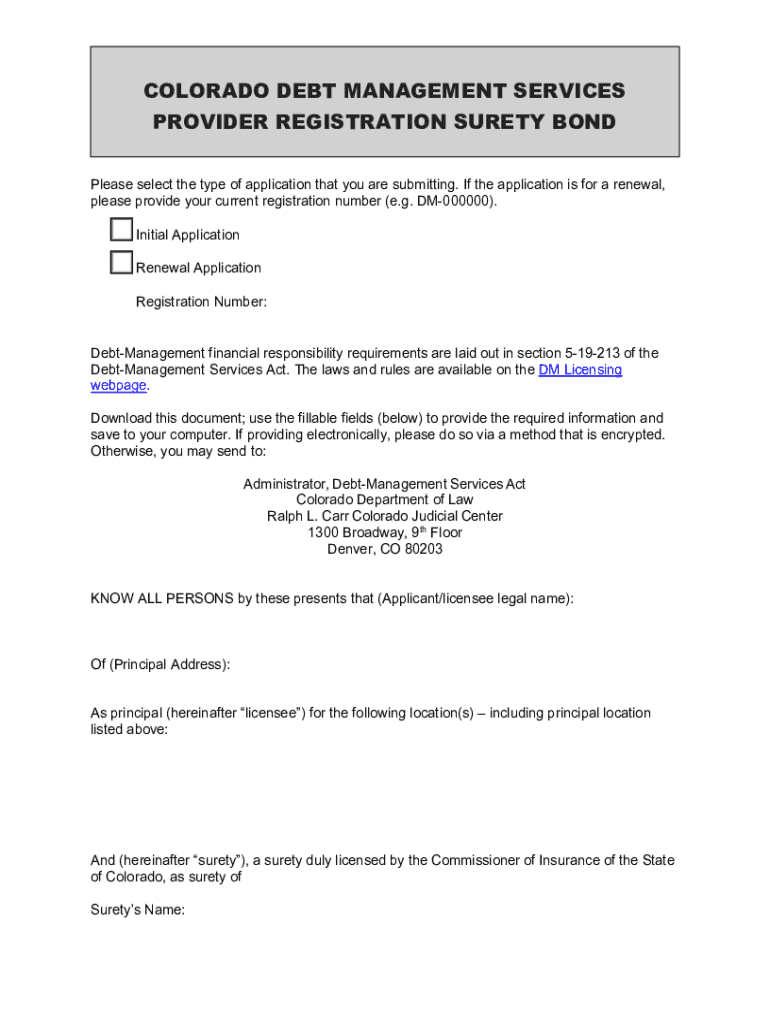

Colorado Debt Management Services Registration Process

To operate as a debt management service provider in Colorado, one must undergo a systematic registration process that varies across different types of services offered. This process generally includes multiple steps to ensure that the applicant meets all criteria for legal compliance.

The first step in this process is determining eligibility, which requires applicants to demonstrate financial responsibility. This may include providing a credit report and passing a background check. Both of these components help to quantify the applicant’s reliability and trustworthiness as a provider.

After confirming eligibility, applicants must gather required documentation, including a Surety Bond, financial statements, and other relevant legal forms. Completing the Colorado debt management services form accurately is crucial to avoid delays. Pay close attention to each section of the form—details such as business name, address, and services rendered need thorough scrutiny.

Understanding the Colorado Debt Management Services Provider Bond

A Colorado debt management services provider bond is a form of security that protects clients against malpractices or failures by the service provider. This bond is critical in ensuring that consumers have recourse in case of a failure to perform by the debt service provider.

The bond serves to create trust and assurance, as it mandates that a financial guarantee be in place. Providers must follow a specific procedure to obtain this bond, which involves completing an application and undergoing various assessments to prove their financial stability.

Maintaining Compliance After Registration

Once registered, compliance with state laws is vital. Compliance requirements include regular renewal of the registration, which typically occurs annually. It's essential to be aware of renewal deadlines to avoid any lapse in service qualification.

Moreover, any changes in business structure, ownership, or services offered must be reported promptly to the relevant authorities. Such timely communication helps maintain transparency and builds credibility with clients and regulators alike.

Additional forms and resources for debt management services providers

Navigating the world of debt management services requires thorough knowledge of various forms and resources. Aside from the primary registration document, other forms may be required based on the services provided.

It is also advisable to familiarize oneself with contact information for the Colorado Consumer Credit Unit, as they can provide valuable resources and assistance on compliance and regulatory matters. Additionally, self-help forms can streamline service providers' operations.

Managing legal documents and claims

Being proactive in managing legal documents is essential for any debt management service provider. This involves not only maintaining contracts with consumers but also being aware of claims that might arise against the debt management provider bond.

To prevent claims, providers should establish clear communication channels with clients and ensure all services rendered are well documented. In the unfortunate event that a claim is filed, having a strategy for resolution becomes paramount, including consultation with a legal expert.

Best practices for successful debt management

For debt management service providers to be truly effective, adopting best practices can optimize both operational efficiency and customer satisfaction. Engaging with consumers ethically is paramount, focusing on transparency and open dialogue to foster trust.

Additionally, collaborating with legal experts and financial advisors can enhance service offerings. By creating a network of knowledgeable professionals, providers can offer comprehensive solutions that cater to their clients' diverse needs.

Conclusion

Navigating the requirements of Colorado's debt management services is no small feat, but it is essential for sustainable operation and consumer protection. By adhering to state regulations, engaging with clients, and leveraging resources such as pdfFiller for efficient document management, providers can ensure long-term success.

Utilize pdfFiller to streamline the creation, editing, and management of necessary forms, ensuring that all documentation meets the regulatory standards. Its cloud-based platform empowers providers to tackle challenges adeptly while focusing on delivering excellent service.

Interactive tools and resources

Efficient document management tools can significantly enhance the operational capacity of debt management service providers. By leveraging template tools available on pdfFiller, users can easily create, edit, and manage forms online. This flexibility not only saves time but also ensures accuracy, as the tools guide users through the necessary steps.

Additionally, eSigning and sharing documents have never been easier with pdfFiller, allowing providers to maintain seamless communication with clients. The cloud-based solutions offered by pdfFiller facilitate access to essential documents from anywhere, ensuring that both consumers and providers have the information needed at their fingertips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute colorado debt management services online?

How do I edit colorado debt management services online?

How do I fill out colorado debt management services using my mobile device?

What is colorado debt management services?

Who is required to file colorado debt management services?

How to fill out colorado debt management services?

What is the purpose of colorado debt management services?

What information must be reported on colorado debt management services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.