Get the free Health Savings Account Worksheet

Get, Create, Make and Sign health savings account worksheet

Editing health savings account worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health savings account worksheet

How to fill out health savings account worksheet

Who needs health savings account worksheet?

Your Comprehensive Guide to the Health Savings Account Worksheet Form

Understanding health savings accounts (HSAs)

Health Savings Accounts (HSAs) offer a unique opportunity for individuals to save money tax-free for qualified medical expenses. These accounts are designed for those with high-deductible health plans (HDHPs), allowing users to benefit from significant tax advantages and contribute to their healthcare costs effectively.

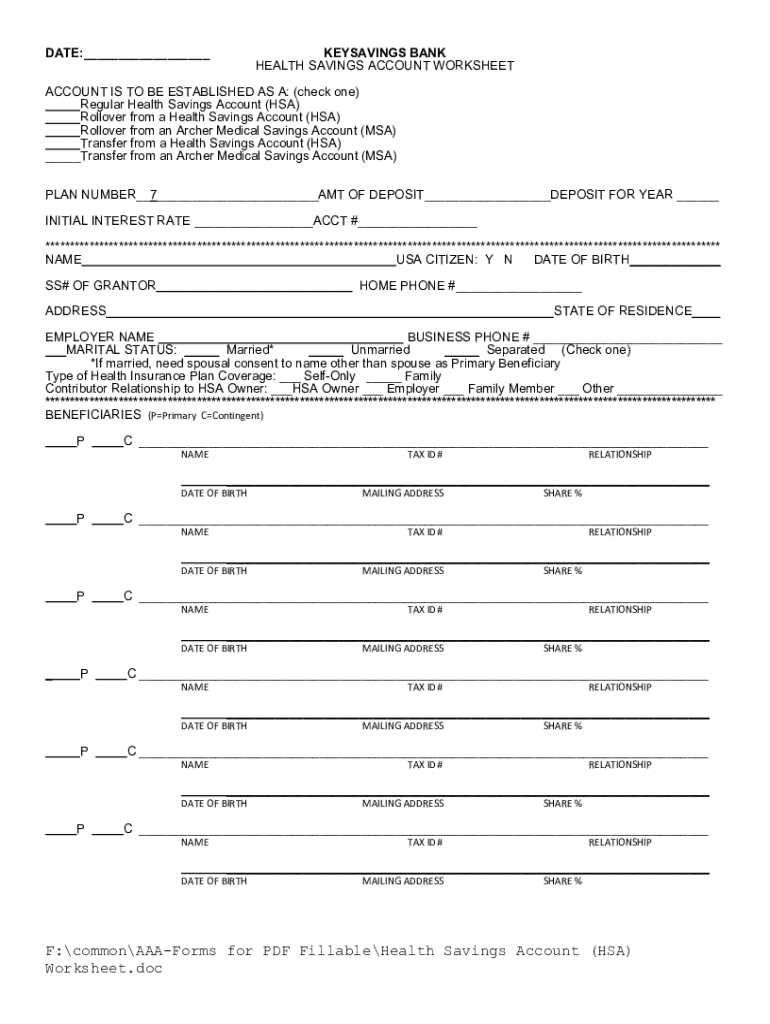

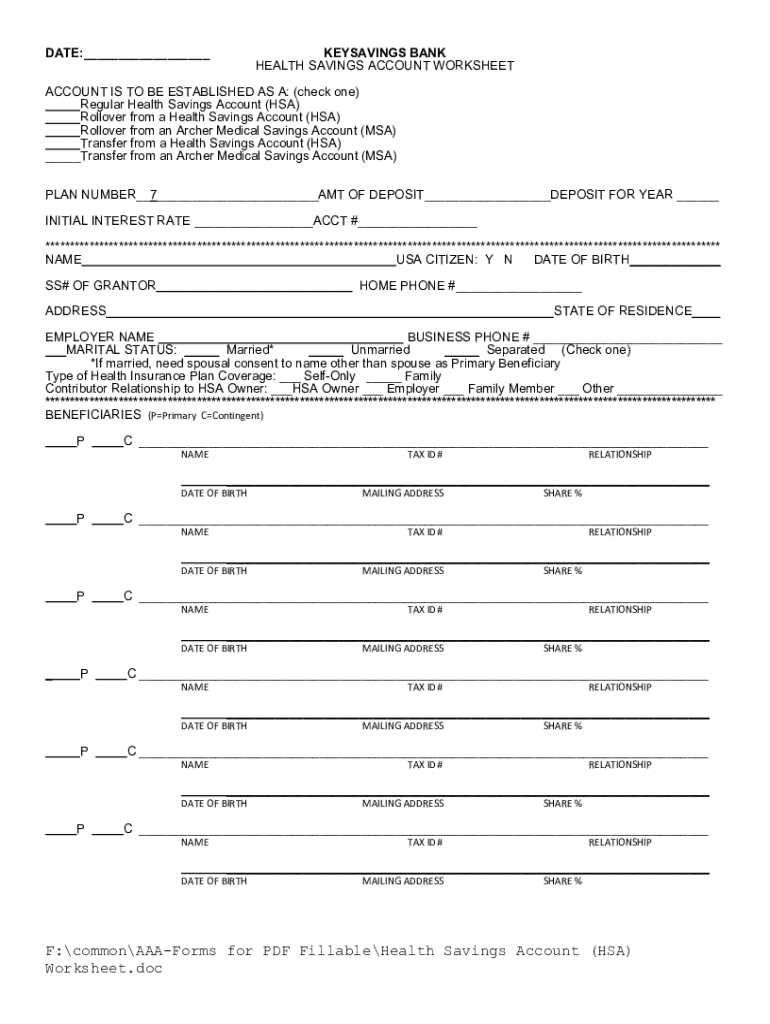

Introduction to the health savings account worksheet form

The Health Savings Account Worksheet Form is an essential tool for managing your HSA effectively. It helps you track contributions, document distributions, and manage expenses related to your healthcare, ensuring you maximize the benefits of your HSA.

How to access and download the worksheet form

Accessing the Health Savings Account Worksheet Form is simple. You can download it directly from the pdfFiller platform, which offers easy navigation and a user-friendly interface for document management.

Filling out the health savings account worksheet form

Completing the Health Savings Account Worksheet Form requires careful input of various pieces of information. Each detail helps in accurately managing your HSA and ensuring compliance with IRS regulations.

Each section of the worksheet comes with specific instructions to guide you. For instance, contributing accurately to your previous years’ data prevents common mistakes such as leaving out required fields or entering incorrect amounts.

Common mistakes to avoid

When filling out the health savings account worksheet form, users sometimes overlook critical details. It’s vital to double-check every part of the worksheet.

Editing and customizing the worksheet form

One of the standout features of using pdfFiller is its robust editing capabilities, allowing you to personalize your Health Savings Account Worksheet Form extensively.

Once you customize the form, consider saving a template for future use, which can significantly enhance your document management strategy.

Signing and securing your health savings account worksheet form

Securing your Health Savings Account Worksheet Form is crucial when it comes to maintaining your personal information. pdfFiller’s advanced security measures ensure that your documents are protected from unauthorized access.

Submitting and managing your health savings account worksheet form

After completing the Health Savings Account Worksheet Form, the next step is submission. This process can vary based on your needs.

Moreover, utilizing pdfFiller boosts your ability to track and manage HSA records efficiently. Keeping these records organized aids in effective financial planning.

Resources for more information on health savings accounts

For those seeking additional insights into health savings accounts, the pdfFiller platform offers a range of resources that can enhance your understanding and management of HSAs.

Frequently asked questions

Navigating the Health Savings Account Worksheet Form may raise questions, especially for newcomers to HSAs. Below are common inquiries that can provide clarity.

User cases and testimonials

Real-world experiences can shed light on the effectiveness of using the Health Savings Account Worksheet Form through pdfFiller. Here are some insights and testimonials from users who have successfully managed their HSAs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit health savings account worksheet from Google Drive?

Can I edit health savings account worksheet on an iOS device?

How do I complete health savings account worksheet on an Android device?

What is health savings account worksheet?

Who is required to file health savings account worksheet?

How to fill out health savings account worksheet?

What is the purpose of health savings account worksheet?

What information must be reported on health savings account worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.