Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out hsa contribution form

Who needs hsa contribution form?

A comprehensive guide to the HSA contribution form

Understanding the HSA contribution form

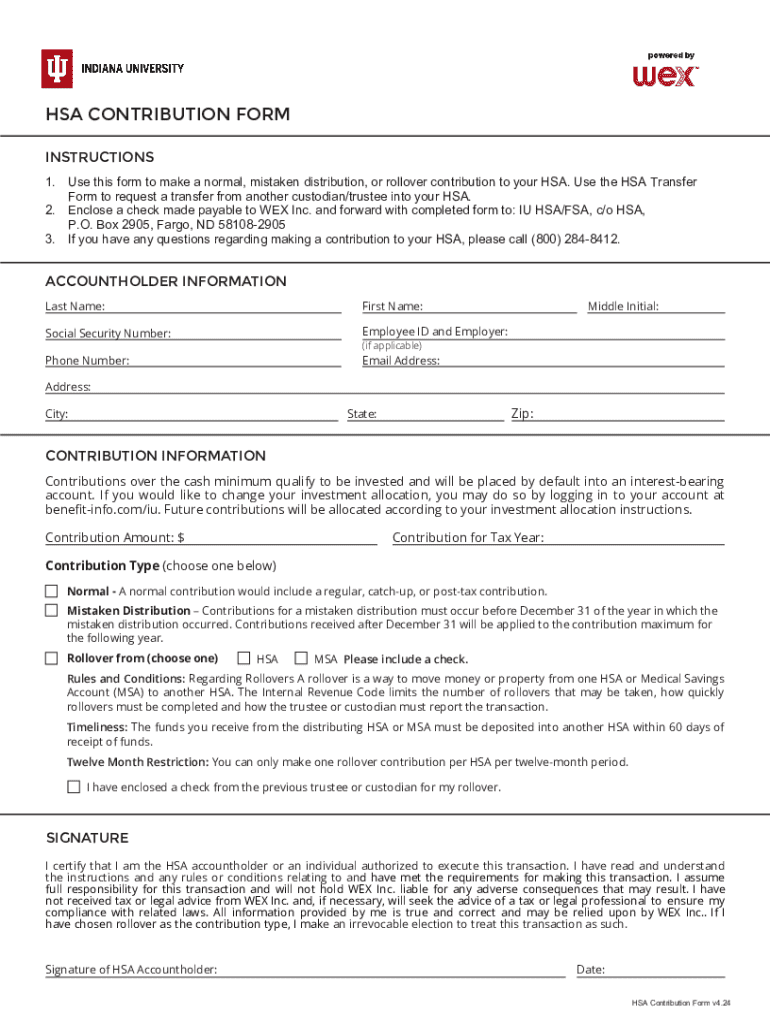

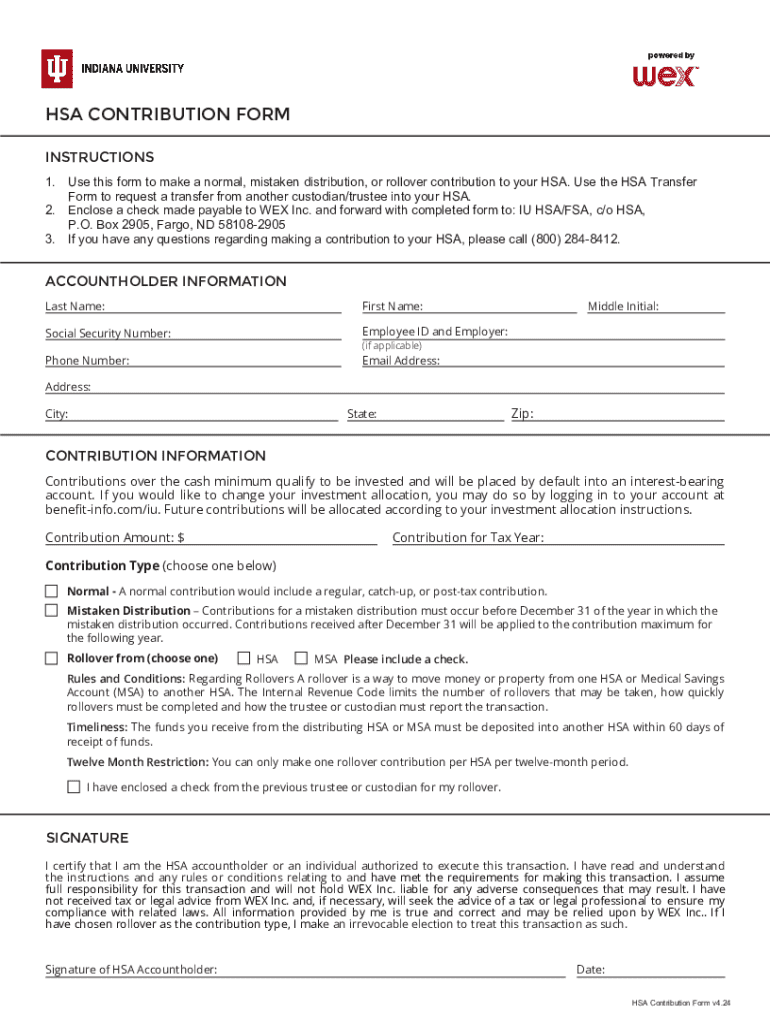

The HSA contribution form is a crucial document used by individuals to contribute to their Health Savings Accounts (HSAs). This form serves the fundamental purpose of detailing the amount an account holder wishes to contribute for a specific tax year. It allows individuals to effectively manage their contributions and ensure they stay within IRS limits while maximizing their tax benefits.

Understanding the HSA contribution form is essential for anyone looking to take full advantage of the benefits offered by HSAs. The importance of this form cannot be understated, as accurate completion facilitates seamless tracking of contributions and ensures compliance with legal requirements.

Why use the HSA contribution form?

Utilizing the HSA contribution form comes with a myriad of benefits. One of the most appealing advantages of contributing to an HSA is the significant tax advantages. Contributions are tax-deductible, reducing taxable income, and any growth in the account is tax-free. These features make HSAs an excellent option for individuals looking to save for future healthcare costs while enjoying immediate tax relief.

Moreover, contributing to an HSA can serve as a long-term savings vehicle for healthcare expenses, allowing individuals to build a nest egg for future medical needs. HSA funds can be used for a range of qualified medical expenses, such as dental care, prescription drugs, and preventive services, ensuring that individuals can manage their healthcare costs effectively as they age.

Step-by-step guide to filling out the HSA contribution form

Filling out the HSA contribution form may seem straightforward; however, careful attention to detail is essential for accuracy. Here’s a step-by-step guide to ensure you complete your form correctly.

Editing and managing your HSA contribution form

Once your HSA contribution form is filled out, maintaining it efficiently is crucial. Tools like pdfFiller enhance your experience by providing easy editing capabilities for your documents.

With pdfFiller, you can edit the PDF form effortlessly, adding or removing fields as necessary. This is particularly advantageous when your circumstances change or if you need to update your contribution amounts due to changed financial situations or health plans.

Signing the HSA contribution form

Signing the HSA contribution form is more than just a formality; it carries legal implications. By signing the form, you are confirming that the information provided is true and that you agree to the terms associated with the contribution.

With pdfFiller, you can eSign your form easily. The platform provides a step-by-step process for placing your electronic signature, making it convenient and compliant with legal standards. Embracing electronic signatures can save time and streamline the process of document management.

Common questions about the HSA contribution form

As individuals navigate the intricacies of the HSA contribution form, questions often arise. Addressing these common queries can clarify numerous uncertainties.

Additional tips for managing your HSA contributions

Staying on top of your HSA contributions requires diligence and organization. Implementing these tips can enhance your management strategy, allowing for smarter savings.

Resources and tools for HSA management

To facilitate effective management of your HSA contributions, there are several tools and resources available. Platforms like pdfFiller offer interactive tools tailored for your needs.

From contribution calculators to expense trackers, these interactive resources empower you to make informed decisions regarding your health savings. Additionally, connecting with financial advisors can provide personalized guidance to enhance your HSA outcomes.

Ensuring compliance with IRS regulations

Compliance with IRS regulations is crucial for maintaining the benefits of your Health Savings Account. Understanding what the IRS allows and prohibits is necessary for all HSA holders.

Preparing for potential audits requires keeping well-organized records that detail all contributions and withdrawals. Utilizing pdfFiller can streamline the documentation process, allowing for easy retrieval and submission of necessary paperwork should the need arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

Where do I find pdffiller form?

How do I edit pdffiller form on an Android device?

What is hsa contribution form?

Who is required to file hsa contribution form?

How to fill out hsa contribution form?

What is the purpose of hsa contribution form?

What information must be reported on hsa contribution form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.