Get the free G-7 Quarterly Return for Quarterly Payer

Get, Create, Make and Sign g-7 quarterly return for

Editing g-7 quarterly return for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out g-7 quarterly return for

How to fill out g-7 quarterly return for

Who needs g-7 quarterly return for?

G-7 Quarterly Return for Form: A Comprehensive Guide

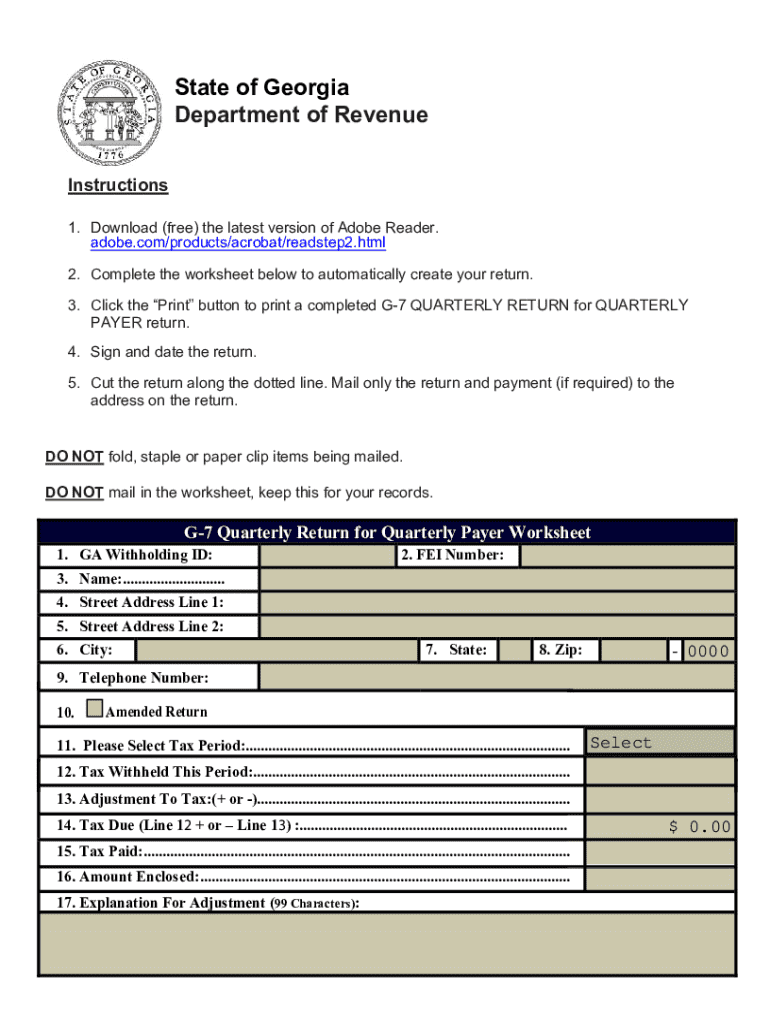

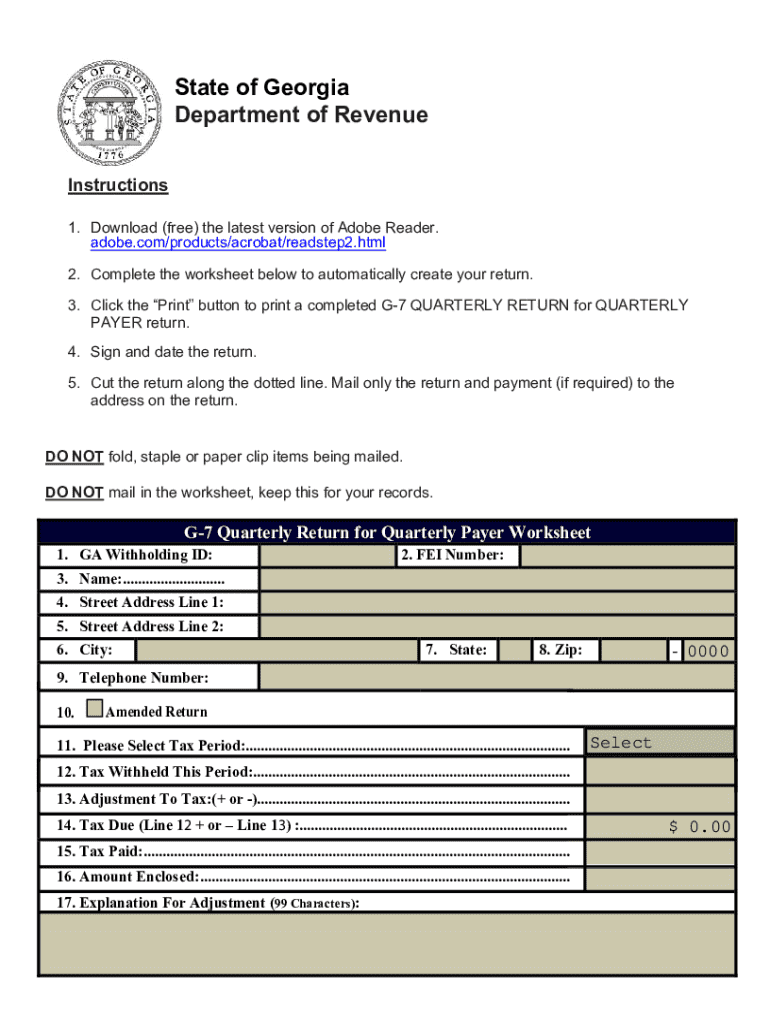

Understanding the G-7 Quarterly Return form

The G-7 Quarterly Return is an essential document that organizations and individuals must file to maintain compliance with financial regulations. This form serves the purpose of reporting income, expenses, and other pertinent financial information periodically, usually on a quarterly basis. Its primary function is to ensure transparency in financial dealings, enabling regulatory bodies to assess the financial health and compliance of entities. Failure to report accurately or timely can lead to serious repercussions, including fines and sanctions.

Who needs to file the G-7 Quarterly Return?

Filing the G-7 Quarterly Return is not just for large organizations or corporations; it extends to various individuals and teams involved in business activities. Those who earn income from self-employment, partnerships, or certain types of organized business—notably those generating over a set income threshold—are required to submit this form. Additionally, non-profit organizations that conduct business activities may also be subject to these filing requirements. It’s crucial to understand the potential penalties for non-compliance, which can range from monetary fines to restrictions on business operations.

Key features of the G-7 Quarterly Return

The G-7 Quarterly Return is structured to streamline the reporting process, featuring distinct sections that guide the filer in presenting required information accurately. The form typically includes sections for identifying information, financial details, and necessary certifications. Important data points include total income, deductible expenses, and the final net revenue for the quarter, alongside supplementary notes or documentation as required. One should distinguish the G-7 from similar forms such as the G-6 or other financial returns that might have different reporting criteria or timelines.

Preparing to fill out the G-7 Quarterly Return

Preparation is key to completing the G-7 Quarterly Return efficiently and accurately. Gather all necessary documentation, including up-to-date financial statements, receipts, and supporting records that validate the figures being reported. This step is critical, as discrepancies or missing documentation can lead to filing delays or compliance issues. Common pitfalls include overlooking expenses that could reduce taxable income and failing to double-check figures against supporting data to ensure consistency. Being organized and thorough during the preparation phase can greatly ease the submission process.

Step-by-step guide to completing the G-7 Quarterly Return

Filling out the G-7 Quarterly Return can be straightforward if approached systematically. Start with Section A by entering identifying information such as the name, address, and tax identification number of the applicant. Proceed to Section B, where you will report your financial details including gross income earned during the quarter, any deductible expenses, and calculate the net income. Ensure all numbers are accurate, as inaccuracies could trigger audits or require amendments. Lastly, in Section C, provide any certifications necessary and ensure the form is signed where indicated.

Accuracy is vital; consider utilizing interactive tools provided by platforms like pdfFiller that allow for pre-fill assistance, ensuring your information is entered correctly before final submission.

Editing and managing your G-7 Quarterly Return

Once the G-7 Quarterly Return is filled out, reviewing and editing become essential. Utilizing pdfFiller's document editing tools allows you to add annotations, modify fields, and ensure that all entered data accurately reflects your financial situation. It also enables collaboration with team members who might need to review or contribute to different sections of the form. Version control is an added advantage, as it allows you to track changes made and revert to previous iterations if necessary, ensuring that your final submission is both accurate and compliant.

eSigning the G-7 Quarterly Return

eSigning the G-7 Quarterly Return is often a necessary step, particularly for businesses submitting on behalf of a team. Understanding when an eSignature is necessary can help with compliance, as certain regulatory bodies require signatures to ensure accountability. pdfFiller makes the eSigning process secure and efficient, allowing you to sign your document online without the need for physical paperwork. Validity and legal compliance of eSignatures is maintained through compliance with regulations, providing assurance that signed documents hold up in any legal review.

Submitting your G-7 Quarterly Return

Submission methods for the G-7 Quarterly Return vary and include both electronic and physical options. Electronic submission is often preferred due to its speed and efficiency, while physical submissions may be required in certain contexts. After submitting, obtaining confirmation of receipt is crucial; this proof can protect against claims of non-filing. It's important to have a plan in place for handling any necessary resubmissions or corrections, as inaccuracies need to be rectified promptly to avoid penalties.

Managing your G-7 Quarterly Return records

Record-keeping is vital after submitting your G-7 Quarterly Return. Storing and retrieving these records should be done meticulously to ensure that they can be accessed at any future date. Best practices include maintaining electronic copies in a secure cloud service like pdfFiller, which allows for easy organization and retrieval. Keeping your compliance documents in order is not just about IRS rules; it also serves your interests for future filings or audits. This proactive approach can save you time and stress down the road.

Need help with your G-7 Quarterly Return?

If you encounter difficulties while filling out the G-7 Quarterly Return, you’re not alone. Many users have questions or need clarification on specific sections of the form. Refer to common FAQs related to the G-7 Quarterly Return to find quick answers. Additionally, pdfFiller's support is available for personalized assistance should you require it. Users can also access community forums, where peers share experiences and solutions that may further aid in the filing process.

Popular searches related to G-7 Quarterly Return

As you navigate filing the G-7 Quarterly Return, you may find it helpful to explore popular searches associated with this form. Many users seek information on alternative forms that have similar purposes or inquire about the latest changes in G-7 filing requirements. Such inquiries can enhance your understanding and ensure you are up-to-date with compliance standards. Maximizing pdfFiller’s capabilities can also dramatically improve efficiency in managing your documentation.

Accessing additional tools on pdfFiller

Beyond the G-7 Quarterly Return, pdfFiller offers a plethora of forms and templates that can assist with various document management needs. Resources available on the platform can also enhance your efficiency in form handling, providing interactive tools for various administrative tasks. Leveraging pdfFiller’s full suite of features aids users not only in completing the G-7 Quarterly Return but also in streamlining their overall document workflow and enhancing collaborative efforts among team members.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my g-7 quarterly return for directly from Gmail?

Can I create an eSignature for the g-7 quarterly return for in Gmail?

How do I fill out g-7 quarterly return for on an Android device?

What is g-7 quarterly return for?

Who is required to file g-7 quarterly return for?

How to fill out g-7 quarterly return for?

What is the purpose of g-7 quarterly return for?

What information must be reported on g-7 quarterly return for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.