Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: The Comprehensive How-to Guide

Understanding Form 990

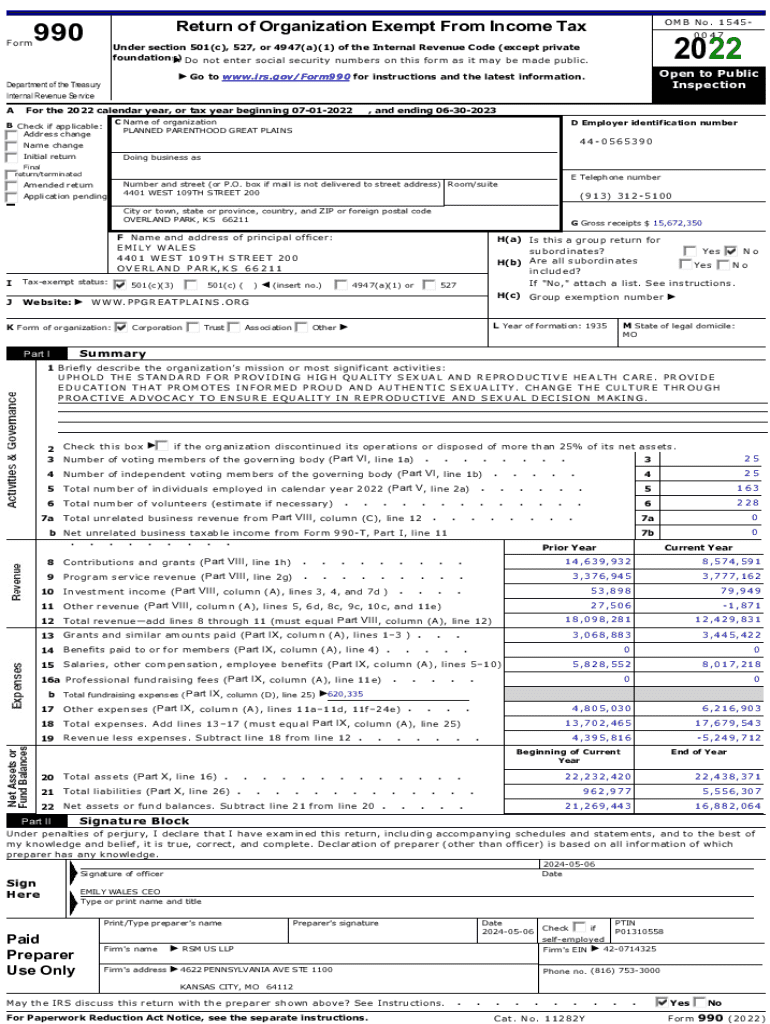

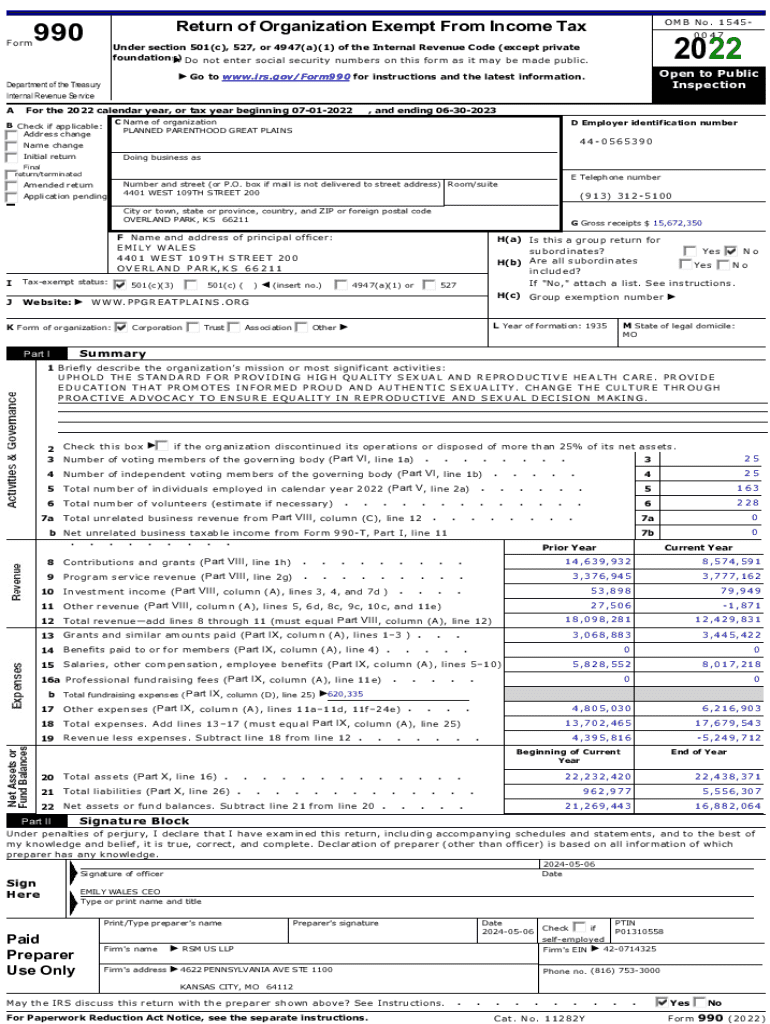

Form 990 is an essential document that nonprofits must file annually with the Internal Revenue Service (IRS). It serves as a detailed report of an organization's financial activities, governance, and compliance with federal tax regulations. Nonprofits, regardless of size, are expected to submit this form to maintain their tax-exempt status.

The importance of Form 990 extends beyond mere compliance; it enhances transparency and accountability. This document allows donors, grant-makers, and the public to examine how organizations use their funds and measure their impact.

Who must file Form 990?

Nonprofit organizations are required to file Form 990 unless they fall below specific income thresholds or meet other exemption criteria. A broad overview indicates that all tax-exempt organizations must file, but certain exceptions exist based on their annual gross receipts and assets.

Understanding the thresholds for filing Form 990 is crucial for compliance. Generally, nonprofits with gross receipts exceeding $200,000 or total assets above $500,000 must file the standard Form 990. In contrast, organizations with gross receipts below $200,000 and assets under $500,000 may opt for Form 990-EZ.

Filing requirements for Form 990

Completing Form 990 requires specific information including the organization's name, address, Employer Identification Number (EIN), and financial statements detailing revenue, expenses, and net assets. The due date for filing generally falls on the 15th day of the 5th month after the end of the organization's fiscal year.

Extensions can be requested, but failing to meet deadlines may attract late filing penalties, which can accumulate quickly. Knowing the necessary information and maintaining accurate financial records is integral to avoiding these penalties and ensuring compliance.

Navigating the Form 990: A section-by-section breakdown

The Form 990 consists of multiple sections that provide a comprehensive view of an organization's financial health. Each segment serves a unique purpose and requires careful attention to detail.

For instance, the basic information section requests the organization's name, address, and EIN, establishing the foundation for accurate filing. The summary of revenue and expenses summarizes the organization's financial activity, while the program service accomplishments section demonstrates the impact of the organization’s work.

How to fill out Form 990 with pdfFiller

Using pdfFiller to complete Form 990 simplifies the process significantly. The platform provides fillable fields and dropdown options, making it easier to enter necessary information accurately. Start by selecting the appropriate Form 990 version based on your organization's size and requirements.

The tool allows users to sign the document electronically, a crucial step before submission. Moreover, managing changes is straightforward; you can edit your filed forms directly within the platform, saving time and ensuring compliance.

eSigning Form 990

The importance of eSignatures in submitting Form 990 cannot be understated. Electronic signatures are not only fast and convenient, but they also ensure compliance with contemporary regulations. pdfFiller’s secure eSignature capability allows users to authenticate their documents without the hassle of printing and scanning.

To add an eSignature with pdfFiller, simply navigate to the signature field in the form. The platform prompts effective steps to create a secure signature, ensuring that all submissions are compliant with IRS regulations.

Collaborating on Form 990

For organizations with multiple stakeholders involved in the filing process, pdfFiller’s collaborative features are invaluable. Teams can work together seamlessly, sharing and reviewing drafts in real-time. This feature is particularly beneficial for ensuring accuracy and comprehensive reflection of organizational achievements.

Team members can keep track of changes, leave feedback, and engage in discussions directly within the document. This level of collaboration supports a collective approach to filing, enhancing accountability and thoroughness.

After filing: Managing your organization’s Form 990

After successfully filing Form 990, it’s essential to manage your documentation and ensure compliance with public inspection regulations. Organizations must make their filed forms available for public inspection, particularly to donors and potential funders, thus reinforcing transparency.

Keeping organized records of past submissions is equally important. It allows nonprofits to revisit previous financial data when preparing future reports or addressing inquiries from stakeholders.

Common challenges and solutions

Navigating the complexities of Form 990 can present challenges for many organizations. A common issue is misunderstanding the reporting requirements, which could lead to incomplete filings. Organizations often confuse the appropriate type of Form 990 to file based on their size and revenue.

Errors can also occur during the completion process. It is crucial to double-check all information before submission. If mistakes are made post-filing, organizations must understand the procedures to correct these errors efficiently to avoid penalties.

Form 990 variants and their specific uses

Understanding the nuances between different Form 990 variants is essential for appropriate filing. Form 990-EZ is a simplified version for smaller organizations, whereas Form 990-PF caters specifically to private foundations, focusing on their unique financial structures.

Organizations may need to transition between these forms as they grow or alter their structures. Knowing when and why to use each version is critical for maintaining compliance and transparency.

Utilizing Form 990 for charity evaluation research

Form 990 serves as a crucial resource for funders and researchers evaluating nonprofit organizations. The detailed financial and operational data contained within provides transparency and insight, allowing stakeholders to make informed decisions regarding grantmaking or investment.

This form is vital in monitoring nonprofit performance over time, as repeated filings allow for comparative analysis. Funders often rely on this data to measure impact and guide their funding strategies.

Additional tools and resources

Finding your organization's Form 990 can be an easy process through resources like IRS databases and pdfFiller’s platform. Organizations can order copies of exempt organization returns directly from the IRS or access them through websites that specialize in nonprofit data.

To conduct effective evaluations or maintain compliance, understanding how to search for tax-exempt organization data is crucial. With the right tools, organizations can enhance transparency and improve their outreach efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 990 in Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

How can I edit form 990 on a smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.