Get the free W-4

Get, Create, Make and Sign w-4

Editing w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-4

How to fill out w-4

Who needs w-4?

W-4 Form: A Comprehensive How-to Guide

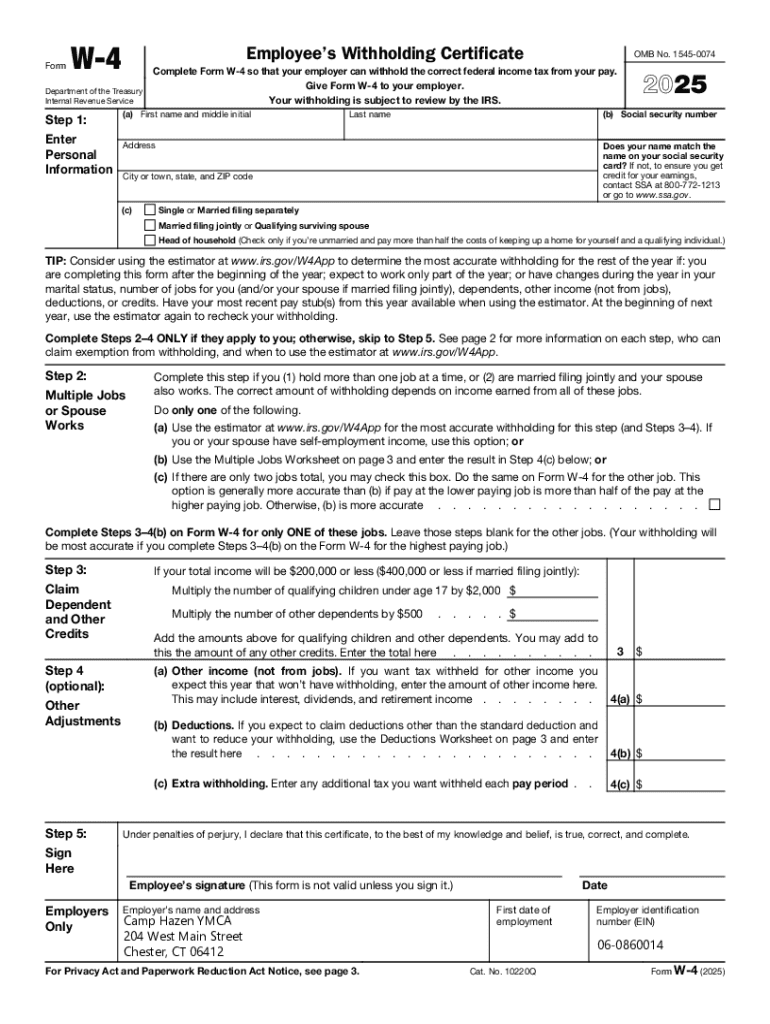

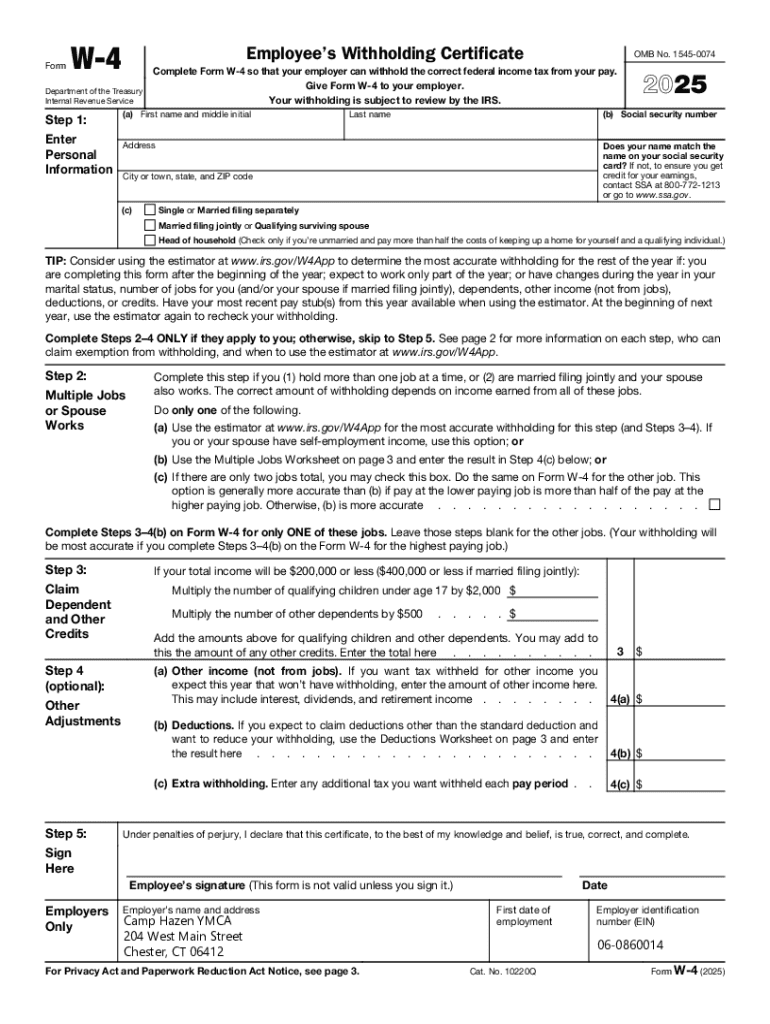

Understanding the W-4 form

The W-4 form is a critical document for employees in the United States, serving the primary purpose of determining how much federal income tax should be withheld from an individual's paycheck. Withholding too much results in a larger tax refund at the end of the year, while too little may result in underpayment penalties. Therefore, understanding the W-4 form is essential for both employees and employers to ensure proper tax compliance.

Key terminology defined

To effectively fill out the W-4, one must understand key terminology. Withholding refers to the amount of an employee's earnings that is withheld by the employer for tax purposes. Exemptions and allowances are terms that contribute to determining this withholding amount, where each allowance reduces the amount of income that is subject to withholding.

When to use the W-4 form

Understanding when to use the W-4 form can save you from unexpected tax bills. There are specific situations that warrant filling out a new W-4 form, including starting a new job or experiencing significant life changes such as a change in marital status or the birth of a child. Each of these events can impact your tax situation, making it important to provide your employer with an updated W-4.

Additionally, you should consider updating your W-4 annually or after major life events. Regular reviews help ensure that your withholdings match your current financial situation.

Employment settings and W-4 requirements

The employment setting plays a significant role in how the W-4 form is used. Full-time employees generally need to submit a W-4 during onboarding, while part-time employees may also need to do so, particularly if their earnings change. Those with multiple jobs face unique challenges regarding accurate withholdings, as income from different employers can complicate tax obligations.

Filling out the W-4 form

Completing the W-4 form accurately is crucial for adjusting tax withholdings. The form comprises several sections that must be filled out thoughtfully. Start with personal information, including your name, address, and Social Security number. Ensure that this information is up to date to prevent any delays in processing your withholdings.

When filling out the W-4, be aware of common mistakes. Many individuals miscalculate allowances or forget to update their W-4 regularly, leading to potential tax issues later on.

Modifying your withholding

After submitting your W-4 form, it's vital to monitor your tax liability and adjust your withholding if necessary. Many individuals may not know how to estimate their tax liability accurately, but there are various online calculators available to assist with this task. Understanding your potential tax responsibilities allows you to make informed decisions about your withholdings.

Digital solutions for managing your W-4 form

Leveraging digital solutions can streamline the process of managing your W-4 form. Platforms like pdfFiller offer interactive tools that allow for easy completion and editing of the W-4 digitally. Utilizing these tools not only simplifies the filling process but also ensures that documents are securely stored and easily accessible.

Frequently asked questions (FAQs)

Understanding common queries around the W-4 form can prevent confusion and help users stay compliant with tax regulations. Many individuals wonder how to check if their withholding is accurate. Tools are available for estimating tax obligations, making it easy to fluctuate withholdings as necessary. If an error is made on the W-4, it's important to correct it quickly by filing a new form.

Tax season: How the W-4 impacts your return

The relationship between the W-4 form and tax returns is significant. Your withholdings directly influence the size of your tax refund or the amount you may owe when filing your taxes. Accurate withholdings lead to a smoother tax season experience, while miscalculations can create unnecessary stress and expensive penalties.

By being proactive in managing your W-4 form, you can mitigate tax-related stress and foster a more financially stable future.

Resources for further assistance

For individuals seeking more guidance on the W-4 form, numerous resources are available. The IRS website provides clear instructions and updates regarding tax regulations that can be invaluable for comprehension. Additionally, consulting with tax professionals can lend personalized advice tailored to specific financial situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my w-4 in Gmail?

How can I edit w-4 from Google Drive?

Can I create an electronic signature for signing my w-4 in Gmail?

What is w-4?

Who is required to file w-4?

How to fill out w-4?

What is the purpose of w-4?

What information must be reported on w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.