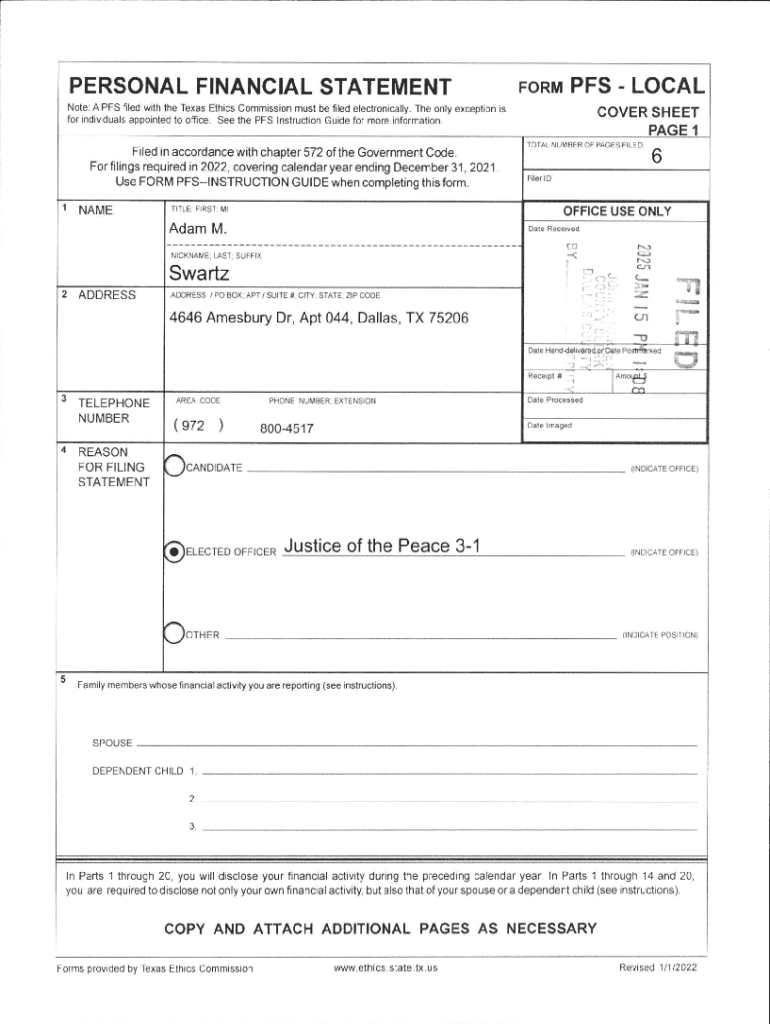

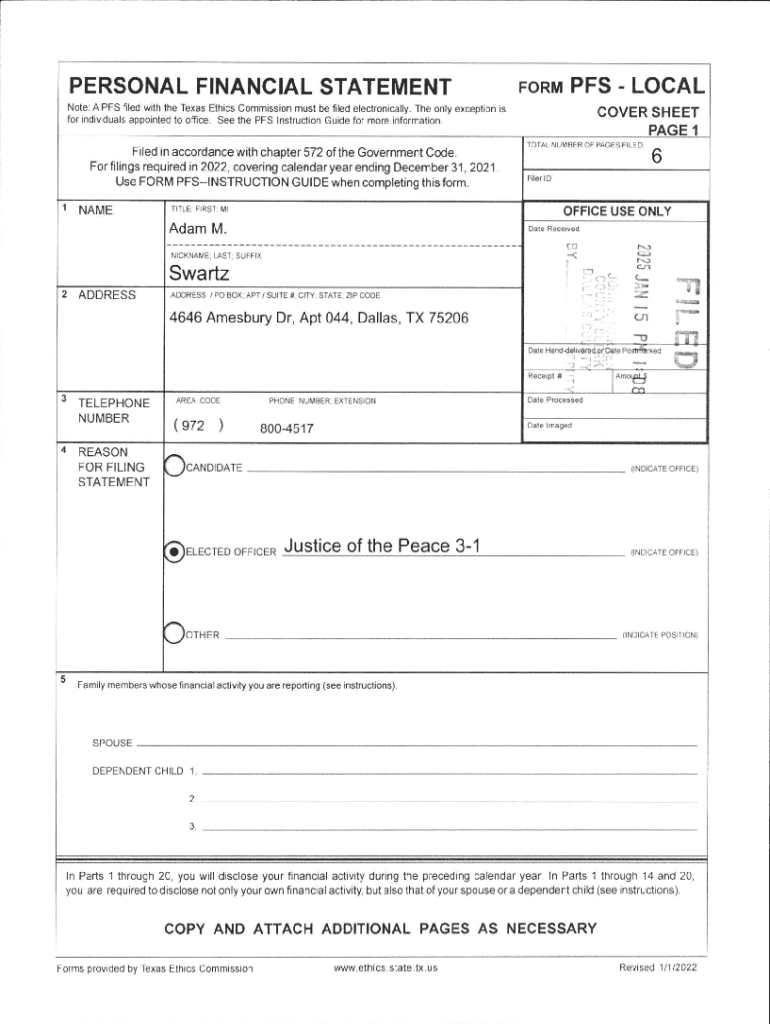

Get the free Personal Financial Statement

Get, Create, Make and Sign personal financial statement

Editing personal financial statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal financial statement

How to fill out personal financial statement

Who needs personal financial statement?

Personal financial statement form - How-to guide long-read

Understanding the personal financial statement form

A personal financial statement form is a crucial document that provides a snapshot of your financial health at a particular point in time. It typically includes two primary sections: assets and liabilities, which help in calculating your net worth. This document is not only a tool for personal reflection but also a vital component for various financial applications.

The importance of this document cannot be overstated. It reveals your financial status, allowing you to track your progress, set financial goals, and make informed decisions. By summarizing your financial situation, you gain insights into your overall wealth and the areas needing improvement, providing a roadmap for future financial planning.

Key components of a personal financial statement

Understanding the key components of your personal financial statement is critical for accurate completion. The statement primarily consists of assets, liabilities, and a net worth calculation. Each section plays a vital role in painting a comprehensive picture of your financial circumstances.

Assets comprise all things of value, from liquid cash and investments to real estate. Liabilities, on the other hand, are obligations such as mortgages and loans. Lastly, the net worth calculation is essential as it shows your financial standing, indicating whether you have more assets than liabilities.

When do you need a personal financial statement?

Several situations necessitate the need for a personal financial statement. Whether applying for loans, seeking investments, or planning your estate, having a clear financial snapshot is vital. Lenders, for instance, often request this document as part of their approval process to assess your creditworthiness.

Additionally, as your financial situation evolves, it's essential to regularly update your financial statement. Frequent revisions ensure you're aware of your current standing, helping you to stay on track with your financial goals.

Step-by-step guide: How to fill out a personal financial statement

Filling out a personal financial statement can seem daunting, but breaking it down into manageable steps can simplify the process. First, gather all necessary information including bank statements, investment details, debts, and property valuations. Ensuring accuracy and honesty in your reporting is crucial, as discrepancies can lead to negative consequences down the line.

Once you have collected your data, begin filling out the form by listing your assets followed by liabilities. Use precise figures for each entry to calculate your total net worth accurately. This step-by-step methodology allows you to maintain a clear overview of your finances, ultimately aiding in better financial decision-making.

Editing and managing your personal financial statement

Once your personal financial statement is complete, managing it efficiently is key. Utilizing platforms like pdfFiller not only simplifies the editing process but also ensures your document remains accessible. You can easily make adjustments while securely storing your forms in the cloud, making it convenient to retrieve and review whenever necessary.

pdfFiller also offers features such as e-signing and collaboration options, allowing you to share your statement with a financial advisor or partner for their input. Being able to edit your financial statement easily within this platform enhances your capability to keep your financial records current and accurate over time.

Interactive tools and resources

To enhance your understanding and utilization of your personal financial statement, various online tools are available. For example, financial calculators can help you quickly assess your net worth or determine ratios critical for financial health. pdfFiller provides interactive features that make this process seamless, turning data entry into a fluid experience.

Additionally, reviewing examples of completed personal financial statements can offer insights and guidance on how to organize your data effectively. Such resources ensure you are well-equipped to craft a comprehensive personal financial statement that serves your financial goals.

Common mistakes to avoid

While creating a personal financial statement, several pitfalls can undermine its accuracy and usefulness. One significant error is overestimating assets or underreporting liabilities, which can create a misleading picture of your financial health. This inaccuracy not only affects personal assessments but may also hinder opportunities when applying for credit.

Moreover, neglecting to update your financial statement regularly can result in outdated information that misrepresents your current situation. It's essential to use reliable sources for asset valuation, ensuring your statements maintain integrity. Steering clear of these common mistakes will make your personal financial statement an effective financial tool.

The importance of professional insight

Consulting with financial advisors or accountants can provide invaluable support in preparing your personal financial statement. These professionals bring expertise that can highlight crucial aspects of your financial health that you may overlook. Their guidance can also help you create a more sophisticated financial strategy aligned with your long-term objectives.

Additionally, a second opinion from someone with a deep understanding of financial management can help reveal potential issues or improvement areas. Leveraging professional insight strengthens your financial literacy and positions you to make smarter financial choices.

Additional considerations

When maintaining your personal financial statement, consider privacy and security concerns. Given that your financial details can be sensitive, storing your documents securely is paramount. Platforms like pdfFiller prioritize user security, ensuring your documents remain private and protected.

Furthermore, understanding how personal financial statements influence credit reports can aid you in better managing your finances. By keeping a well-organized financial statement, you not only prepare for immediate needs but also build a foundation for long-term financial stability.

Frequently asked questions

1. What if I’m a business owner? While business owners may have different financial considerations, a personal financial statement remains beneficial. It can reflect personal investments in the business, helping lenders and investors to evaluate your overall financial standing.

2. Can I use my personal financial statement for business purposes? Absolutely! Your personal financial statement can be essential in demonstrating financial reliability when seeking business loans or funding.

3. Do banks verify personal financial statements? Yes, banks often review and verify the details provided in personal financial statements to assess loan applications accurately, making honesty and accuracy crucial for successful approval.

Engaging with your community

Sharing your financial journey can foster important community support and encouragement. Whether discussing successes or challenges, being transparent can help others learn and grow alongside you. Consider joining online forums dedicated to financial health, where members exchange insights and offer feedback.

Engaging with others on platforms focused on financial literacy not only boosts your own understanding but allows you to contribute positively to others' journeys. In this way, the process of managing your personal financial statement becomes not just an individual task but a community effort.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in personal financial statement without leaving Chrome?

Can I create an electronic signature for the personal financial statement in Chrome?

How do I fill out the personal financial statement form on my smartphone?

What is personal financial statement?

Who is required to file personal financial statement?

How to fill out personal financial statement?

What is the purpose of personal financial statement?

What information must be reported on personal financial statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.