Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

Editing form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

Form 5500-SF Form How-to Guide

Understanding the Form 5500-SF

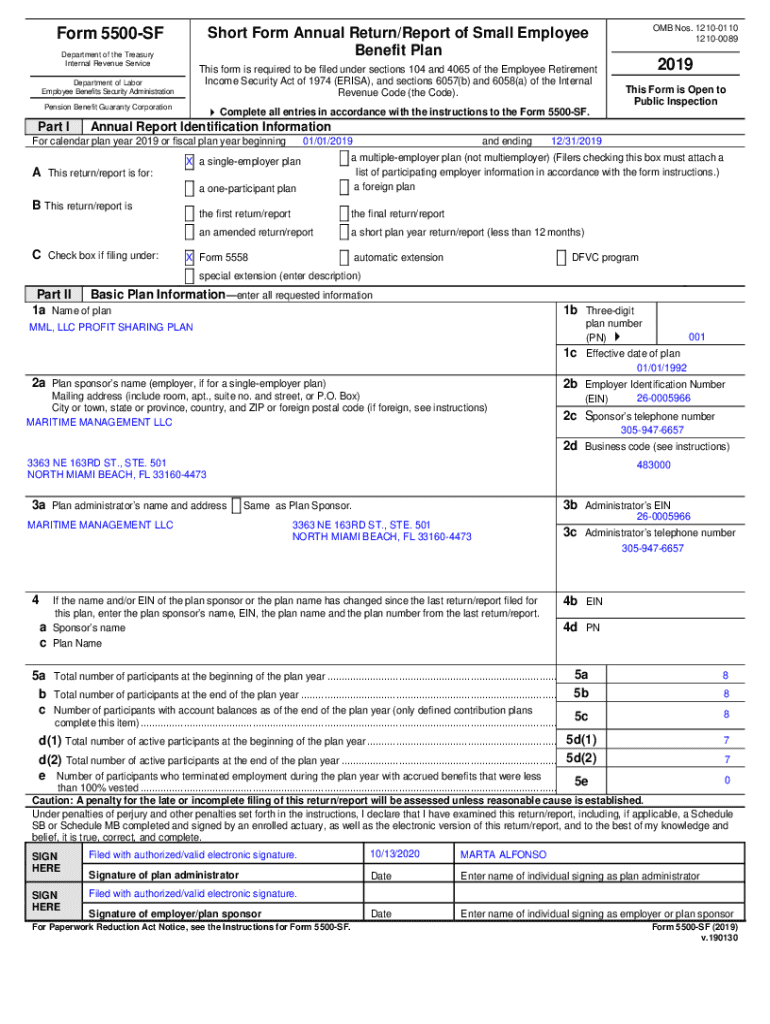

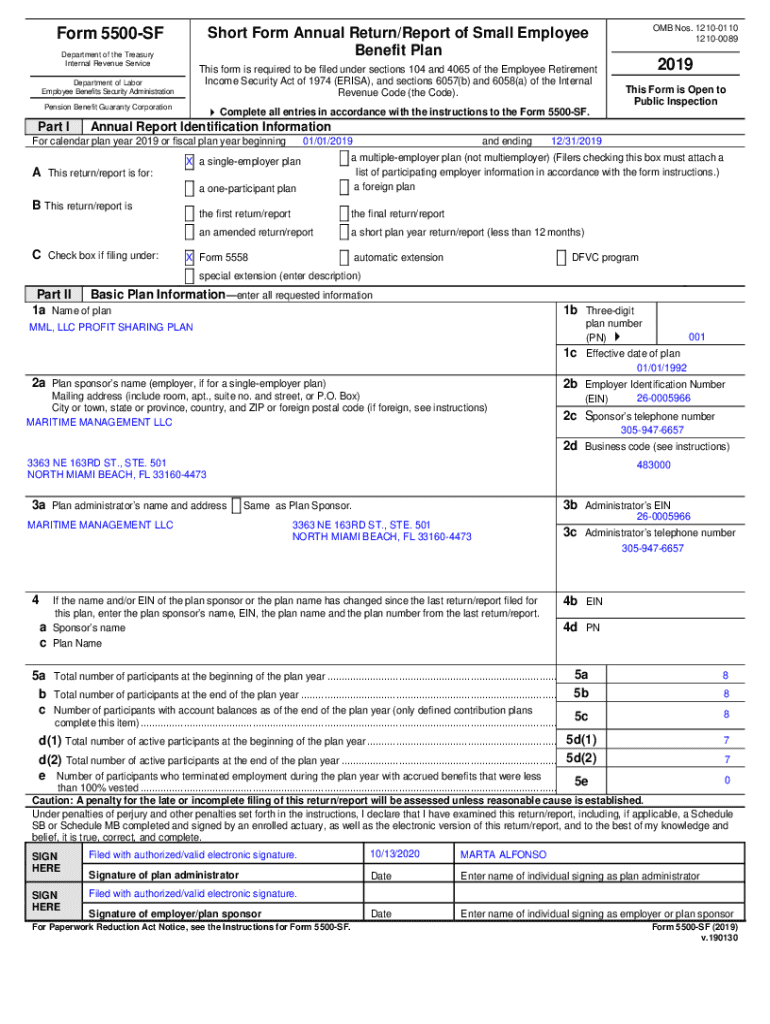

Form 5500-SF is a simplified version of the annual report that employee benefit plans must file with the Department of Labor (DOL). Primarily designed for small pension and welfare benefit plans, it serves as a tool to fulfill the compliance and reporting requirements of the Employee Retirement Income Security Act (ERISA). Its streamlined format helps ease the burden on small plan administrators who might find the standard Form 5500 overwhelming.

The key attributes of Form 5500-SF include fewer data points, making it easier to complete while still providing necessary information regarding the plan's financial status and compliance with federal regulations. Beyond merely collecting data, Form 5500-SF aims to increase transparency in the retirement plan industry across the United States.

Filing requirements for Form 5500-SF

To file Form 5500-SF, plans must meet specific eligibility criteria established by the DOL. These criteria typically stipulate that only small plans with fewer than 100 participants at the beginning of the plan year can file Form 5500-SF. If you find yourself overseeing eligibility requirements, pay attention to thresholds like the 80-120 rule, which designates plans with between 80 to 120 participants to file either Form 5500 or Form 5500-SF, at the plan sponsor's discretion.

Moreover, different types of plans that may use Form 5500-SF include defined contribution plans, health and welfare plans, and retirement plans that don't require an audit by an independent qualified public accountant. However, certain plans might be exempt from the filing requirements altogether, such as those meeting specific criteria outlined in ERISA.

Preparing for filing

Prior to filing Form 5500-SF, it is crucial to check your plan year and filing deadlines. The typical deadline for filing Form 5500-SF is the last day of the seventh month after the end of the plan year. For plans with a fiscal year ending December 31, this translates to July 31 for the filing year. Keeping an updated calendar can prevent accidental missed deadlines, which can lead to penalties.

Gathering necessary documentation is the next fundamental step. In particular, you should prepare financial statements, which provide a comprehensive insight into the plan's financial health. Furthermore, plan descriptions are vital as they detail the purpose and provisions of the plan, ensuring that forms completed accurately represent the operational standards of the plan.

The filing process for Form 5500-SF

To efficiently complete Form 5500-SF, follow a sequence of structured steps. Start by filling out the basic information, which includes the name of the plan and the plan sponsor. Then, move on to the financial information, which requires specifics on the plan's assets, income, and expenses for the reporting year. Make sure to include detailed schedules, such as Schedule A or Schedule C, as necessary.

While filling out the form, avoid common mistakes that often complicate the filing process. Errors like incorrect participant counts, missing signature requirements, or failure to provide complete information can lead to compliance issues down the line. Finally, before submission, carefully proofread the entire form to ensure accuracy, as errors can lead to delayed processing or audits.

Electronic filing requirements

Filing Form 5500-SF electronically via the DOL's EFAST2 system is mandatory. The system is designed to streamline the filing process while ensuring that submissions are tracked efficiently. To get started, you will need suitable filing software compliant with EFAST2's requirements. Many service providers offer DOL-approved software that provides different features like electronic signatures and data integrations.

Filing in the correct format is crucial, as using non-compliant formats may lead to rejection of the submission. Each year, software developers may update their platforms to align with new regulatory requirements, so staying current with your chosen software is essential to successful filing.

Common questions related to Form 5500-SF

The intricacies of Form 5500-SF raise numerous common questions, one being whether it exclusively pertains to employee benefit plans. While primarily focused on these plans, its requirements and compliance measures can also intersect with other types of relevant plans. Additionally, those who miss the filing deadline may wonder about the next steps. It’s crucial to seek guidance immediately as late filings might incur significant penalties unless remedial actions are taken.

Addressing errors post-submission also prompts many inquiries. Users may need to file a Form 5500-SF amendment to correct discrepancies found after the fact, while others jump to questions about the consequences of late submissions. Tracking the filing status, either through the DOL’s portal or third-party software, also forms a common concern among filers, highlighting ongoing needs for communication and transparency.

Special considerations

One crucial aspect to consider around Form 5500-SF is the 80-120 rule. This guideline allows plans with between 80 to 120 participants to choose whether to file Form 5500 or Form 5500-SF. While the ease of Form 5500-SF is tempting for small plan sponsors, those approaching the 120 participants threshold must evaluate their filing strategy carefully. It’s also central to recognize when an audit report might be necessary, as plans with primarily employer contributions or those that do not qualify for the filing exemption will typically require this additional documentation.

Additionally, fidelity bonds are vital for many retirement plans; these bonds protect against fraud or dishonesty. Understanding the role of these bonds in safeguarding employee benefits is key, especially in light of increased scrutiny on retirement plan fiduciaries and their duties. For small businesses or plan administrators unfamiliar with these intricacies, collaborating with finance or legal experts can enhance risk management strategies.

Enhancing employee benefits communication

Communicating plan benefits effectively to employees is just as crucial as compliance. Transparent communication strategies build trust and enhance understanding among plan participants. Displaying clear summaries or FAQs about the plan comprehensively across various channels can significantly aid in clarifying benefits. Regular communication, especially during open enrollment phases, helps ensure employees can make informed decisions regarding their benefits.

Incorporating methods like informational workshops or webinars can also foster engagement and empower employees. Additionally, providing online resources, such as an easy-to-navigate website with up-to-date information on benefits, can enhance employees' abilities to manage their retirement outcomes effectively.

Navigating amendments and late filings

Submitting a delinquent Form 5500-SF is a common concern among plan sponsors. Utilizing the Delinquent Filer Voluntary Compliance Program (DFVCP) provides a structured pathway for rectifying missed filings without the hefty penalty repercussions. The DFVCP allows plan sponsors to submit late filings while benefiting from reduced penalties under specific criteria.

Being proactive is essential; filing the necessary Forms and required schedules promptly will help instigate better compliance. Understanding and effectively managing the DFVCP can serve as a critical resource for individuals or teams overseeing these filings.

Recap of filing process for Form 5500-SF

In summary, the key filing steps for Form 5500-SF revolve around understanding eligibility, through ensuring accurate document preparation to efficient electronic submissions. Reviewing the essential data points ahead of time helps streamline filing and minimizes errors. Each step, from gathering financial information to revising for compliance, forms a vital piece of the overall filing strategy.

Best practices for maintaining compliance also include being proactive about deadlines and staying updated with changes in regulations. Ongoing collaboration with finance or legal professionals regarding plan compliance and employee communication can enhance management quality and the plan's overall effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 5500-sf from Google Drive?

How do I edit form 5500-sf online?

How do I fill out the form 5500-sf form on my smartphone?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.