Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: Your Comprehensive Guide

Understanding SEC Form 4: A comprehensive overview

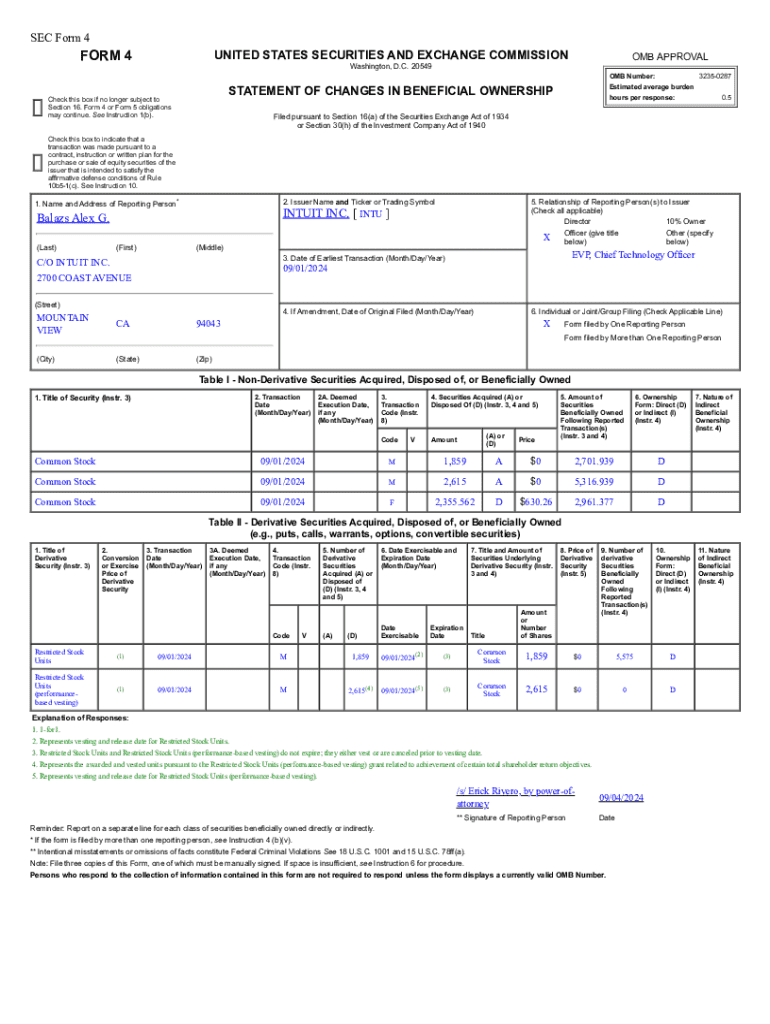

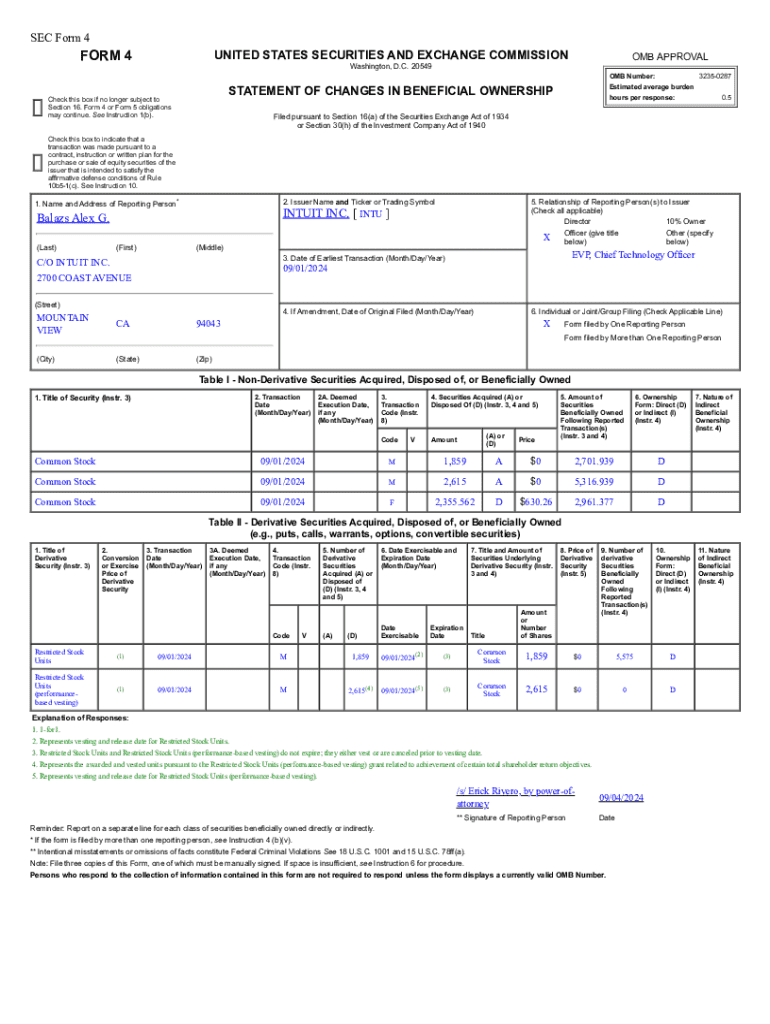

SEC Form 4 is a crucial document that insiders must file with the Securities and Exchange Commission (SEC) to report their trading activities in their company's securities. This form is designed to provide transparency regarding the stock transactions of corporate officers, directors, and significant shareholders, especially when they buy or sell shares. The primary purpose of SEC Form 4 is to inform the public about potential insider trading activities and maintain market integrity.

The importance of reporting transactions by insiders cannot be overstated. It ensures that all investors have equal access to information that may influence their investment decisions. By obligating insiders to disclose their transactions publicly, the SEC aims to curb insider trading and promote fairness in the financial markets.

Who is required to file SEC Form 4?

SEC Form 4 must be filed by insiders, specifically corporate officers, directors, and individuals or entities owning more than 10% of a company's shares. These insiders are privy to sensitive information about their organization, making their trading activities particularly sensitive. The SEC stipulates that these reports must be filed within two business days following a transaction to ensure information remains current.

Filing obligations extend to all securities transactions conducted by these insiders, including sales, purchases, and grants. The deadlines are strict, and failing to comply can result in penalties, including fines and reputational damage to the individuals involved and the company.

The structure of SEC Form 4

The structure of SEC Form 4 is designed to capture essential information about the transaction being reported. Key components include identification information, the relationship of the filer to the issuer, transaction details, and the ownership form and amounts. Each section plays a pivotal role in painting a complete picture of the transaction.

The identification section includes the insider's name, address, and relationship to the company. The relationship section clarifies the nature of their position, while transaction details provide specifics on the securities traded. The ownership form outlines the type of securities and quantities involved in the transaction.

Common transaction codes used within SEC Form 4 help categorize the nature of transaction activities. For example, 'P' represents a purchase, while 'S' signifies a sale. Understanding these codes is essential for accurate reporting and compliance.

How to fill out SEC Form 4

Filling out SEC Form 4 accurately is crucial to ensure compliance with regulatory requirements. Here is a step-by-step guide to help you complete the form effectively:

By following these steps, insiders can ensure their Form 4 filings are accurate, comprehensive, and compliant with SEC regulations.

Insights on managing SEC Form 4 filings

To effectively manage SEC Form 4 filings, it’s essential to stay organized and keep track of deadlines. Here are a few best practices for ensuring timely and accurate submissions:

Using a platform like pdfFiller streamlines the workflow for filling out, editing, and signing documents. Features such as automated reminders for filings and easy document access make it an invaluable resource for managing SEC Form 4.

Common mistakes to avoid when filing SEC Form 4

Insiders often face pitfalls when filing SEC Form 4. It’s vital to avoid these common mistakes to ensure compliance and accurate reporting. Some frequent errors include misreporting ownership changes, which can confuse stakeholders and regulators.

Missing deadlines for filings can lead to serious consequences, including fines or legal actions. Additionally, using incorrect transaction codes can mislead investors and potentially breach regulatory mandates.

Real-life examples of SEC Form 4 filings

Real-life case studies can provide insightful lessons regarding SEC Form 4 filings. For instance, high-profile transactions involving corporate executives often make headlines, demonstrating market reactions to insider trading. Monitoring these transactions can reveal patterns and behaviors in insider trading, which is invaluable for investors.

Through analysis of Form 4 data, trends can be observed, such as when executives buy stock ahead of good news or sell before a downturn. This data is critical, enabling both regulatory bodies and investors to gauge the compliance and practices within a company.

FAQs about SEC Form 4

Many individuals have questions regarding SEC Form 4 filings. Common queries include the implications of filing an incomplete form, how to amend a filed Form 4, and the consequences of failing to comply with filing requirements.

If a filing is incomplete, it may be subject to additional scrutiny, and prompt corrections are essential. Amending a previously filed SEC Form 4 is a straightforward process—insiders simply need to submit a new form indicating the corrections. Non-compliance can result in fines or even legal actions, emphasizing the importance of diligent reporting.

Additional resources and tools for SEC Form 4 filings

Accessing the right resources is essential for filing SEC Form 4 effectively. The SEC’s official guidance and filing portal provide valuable information on filing requirements and deadlines. Additionally, investing in software like pdfFiller enhances the filing process, offering features that streamline document creation, editing, and signing.

Monitoring insider activity is made easier using pdfFiller’s tools, equipping users with capabilities to track filings and stay informed about market changes that affect their investments.

Key takeaways on SEC Form 4 management

Effective management of SEC Form 4 filings requires attention to detail, adherence to timelines, and accurate reporting. Insiders must prioritize transparency to foster trust with investors and avoid compliance issues. Several key takeaways include understanding the components of the form, recognizing the importance of timely filings, and leveraging technology for efficient management.

Ultimately, the benefits of thorough SEC Form 4 management extend beyond regulatory compliance, promoting a fair market environment where investors feel confident in their decisions.

About pdfFiller

pdfFiller is dedicated to empowering users for efficient document management. Offering a cloud-based platform for editing, signing, and collaborating on documents, it streamlines the entire process of handling SEC Form 4 filings and beyond. Users can enjoy features that facilitate quick access to documents, making compliance easier than ever.

The benefits of using pdfFiller extend into various areas, including improved workflow, seamless collaboration, and a user-friendly interface, all designed to simplify document handling for individuals and teams.

Engage with our community

Joining a network focused on SEC filings can provide valuable insights and opportunities for collaboration. Interacting with other professionals, sharing knowledge, and discussing industry best practices can significantly benefit your understanding of SEC Form 4 and other filing requirements.

Stay connected for ongoing updates on SEC filings and enhance your document management skills by subscribing to relevant newsletters and participating in community discussions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 4 in Gmail?

How can I get sec form 4?

How do I complete sec form 4 online?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.