Get the free Standard Form 1152

Get, Create, Make and Sign standard form 1152

Editing standard form 1152 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard form 1152

How to fill out standard form 1152

Who needs standard form 1152?

A comprehensive guide to the Standard Form 1152 form

Understanding the Standard Form 1152

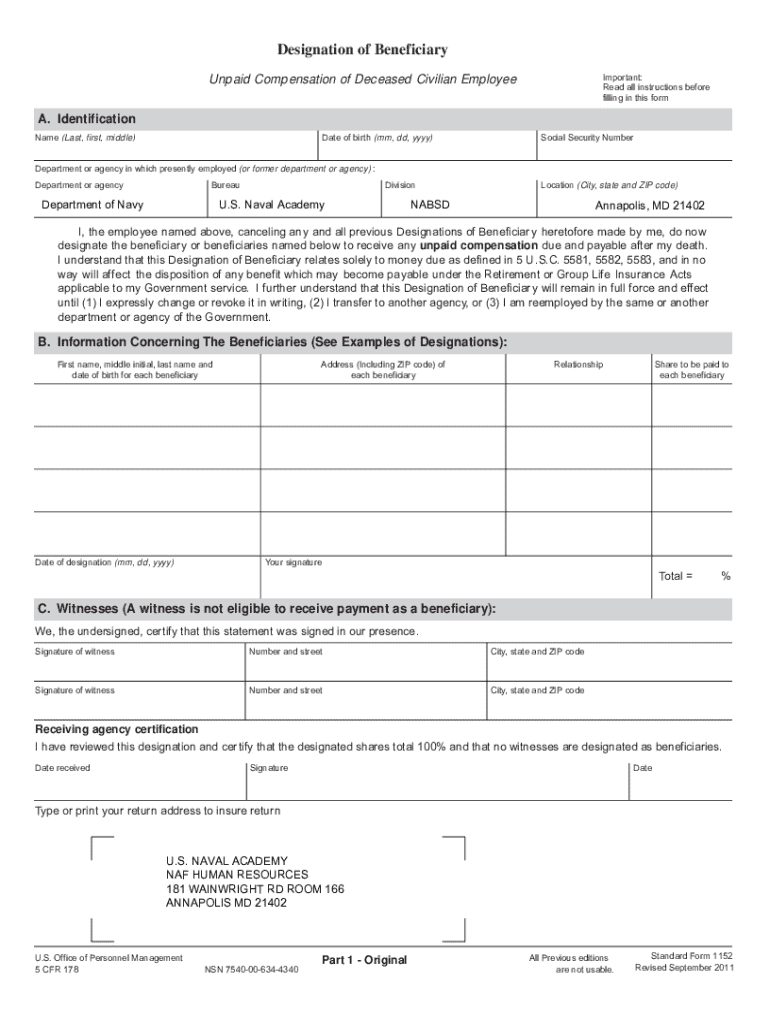

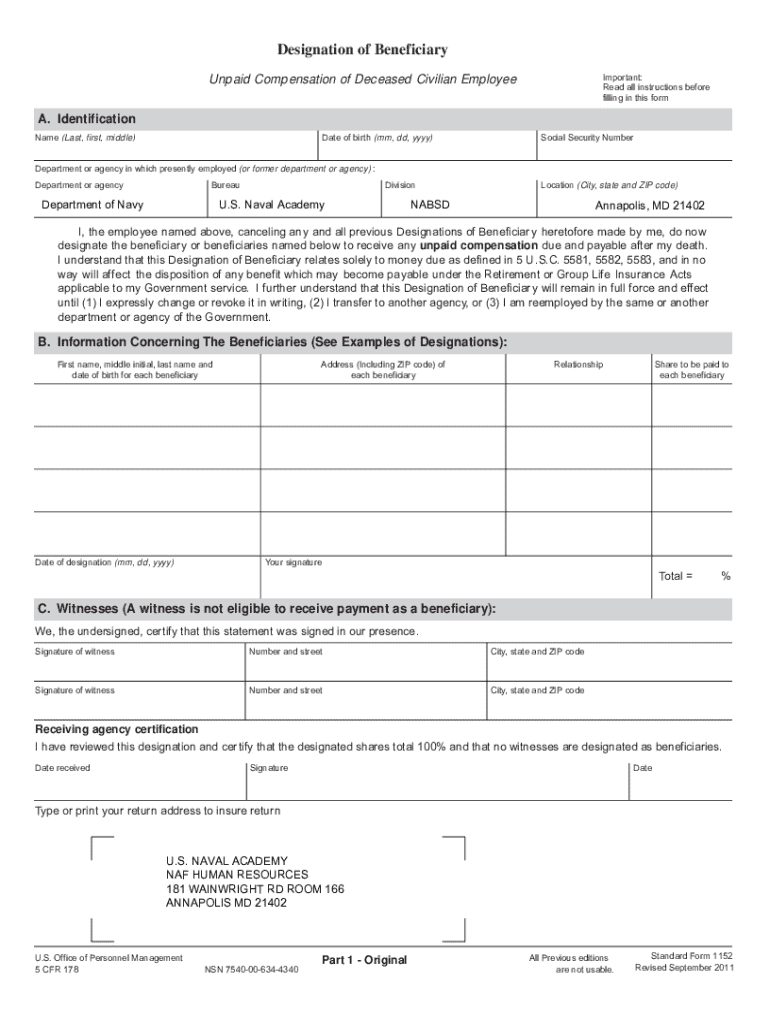

The Standard Form 1152, often referred to simply as SF 1152, is a government document used primarily to designate beneficiaries for certain employee benefits. This form is essential for federal employees who want to ensure that their benefits are correctly distributed according to their wishes after their passing.

The main purpose of the Standard Form 1152 is to provide a clear and concise means for employees to indicate their beneficiary preferences for unpaid compensation, such as salaries, bonuses, or other employee-related payments and benefits. By completing and submitting this document, an employee can streamline the claims process for their beneficiaries, ensuring that they receive what they are entitled to without unnecessary delays.

Key features of the form include the specific identification of the employee, detail about the relationship between the employee and the designated beneficiaries, and any stipulations or conditions tied to the awards. The form needs to be accurately filled to avoid potential disputes or complications that could arise during the disbursement of benefits.

Practical applications of the Standard Form 1152

The Standard Form 1152 has various practical applications across different scenarios, especially in government-related contexts. For instance, it plays a crucial role for federal employees when planning their estates and ensuring their titles are passed on according to their preferences, thus mitigating potential family disputes.

Additionally, this form can be relevant in situations where employees are applying for benefits such as worker's compensation or retirement benefits. It serves as a safeguard for employees, ensuring their loved ones are provided for in their absence. In personal situations, individuals may also use this form to designate beneficiaries for other types of financial entitlements, helping to streamline financial planning.

The benefits of utilizing the Standard Form 1152 include increased accuracy in submissions, which reduces the likelihood of errors that could delay benefit distributions. Furthermore, the standardized nature of this form means that it can expedite the entire process of benefit claims, allowing beneficiaries to receive funds more swiftly.

Step-by-step guide to filling out the Standard Form 1152

Filling out the Standard Form 1152 can seem daunting, but following a systematic approach can simplify the process. Start by gathering all necessary information, including your identification credentials, employment details, and any supporting documentation that confirms your beneficiary designations.

A detailed breakdown of each section will further assist through this process:

Common mistakes to avoid include neglecting to provide required signatures — both yours and those of your witnesses if necessary. Be wary of incomplete sections since any gaps could lead to processing delays, and double-check date entries to ensure they reflect the current time frame.

Interactive tools for efficiency

Utilizing digital solutions to manage the Standard Form 1152 can greatly enhance your efficiency. With services like pdfFiller's Fillable Forms, users can easily fill out, edit, and manage their forms online without the hassle of paper files. The advantages of digital forms include the simplicity of saving, sharing, and integrating additional data directly.

One significant feature is the ability to eSign your Standard Form 1152, allowing users to complete their documentation remotely. E-signatures hold the same legal standing as handwritten ones, provided they meet specific criteria under federal and state law, ensuring that your submissions are both valid and enforceable. Additionally, collaborating with teams has never been easier, as users can share the form for review and approval, track changes, and maintain clear communication throughout the documentation process.

Managing your Standard Form 1152

After filling out your Standard Form 1152, managing it correctly is essential. First, save your completed form in a secure manner, choosing from various file formats that suit your needs — typically, PDF is preferred for its compatibility and security features. Explore storage options that allow for access from anywhere while ensuring your sensitive information remains protected.

When it comes to updating or reusing the form for future submissions, many find it helpful to utilize pre-existing templates. This approach saves time and ensures consistency across multiple filings. For editing, simply re-open the digital file, make adjustments to your beneficiaries or other details, and save the updated version.

Frequently asked questions

Mistakes during the completion of a form are common. If you realize you've made a mistake while filling out the Standard Form 1152, the best course of action is to cross out the incorrect information, write the correct information, and initial the change. However, if the error seems substantial, consider filling out a new form entirely to avoid confusion.

For those interested in the digital submission of the form, various agencies may allow for electronic submissions, but this depends on specific organizational policies. Always check the submission guidelines provided by your agency to be certain.

If you're unsure or require assistance while completing the form, it's advisable to reach out directly to your HR department or the relevant authorities processing the form for help. They can provide necessary clarifications and support.

Best practices for submitting the Standard Form 1152

Before submitting the Standard Form 1152, it's crucial to review the requirements meticulously. This means double-checking that all sections are filled accurately and completely, mitigating the risk of any delays in processing your requests.

Awareness of deadlines also plays a vital role. Understand the submission timelines relevant to your agency to avoid missing any critical dates. Additionally, know where to send the completed form — many agencies have dedicated submission channels that must be followed precisely.

Once you've submitted your form, consider following up. You can track the status of your submission by contacting the relevant agency, confirming they received the documentation and checking on the timeline for processing.

Additional tips for utilization

In certain scenarios, seeking professional help might be beneficial, especially when dealing with complex beneficiary designations. Consulting with an estate attorney or a financial advisor can provide insights that ensure your decisions align with your long-term financial goals.

Staying organized after completing the Standard Form 1152 is essential. Continually keep copies of all submissions for your records, aiding in future reference and documentation verification. Maintaining a systematic approach to your forms can save time and frustration down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get standard form 1152?

How do I fill out the standard form 1152 form on my smartphone?

How do I edit standard form 1152 on an iOS device?

What is standard form 1152?

Who is required to file standard form 1152?

How to fill out standard form 1152?

What is the purpose of standard form 1152?

What information must be reported on standard form 1152?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.