Get the free Income Adjustment Form

Get, Create, Make and Sign income adjustment form

Editing income adjustment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income adjustment form

How to fill out income adjustment form

Who needs income adjustment form?

Income Adjustment Form: A Comprehensive How-To Guide

Understanding the income adjustment form

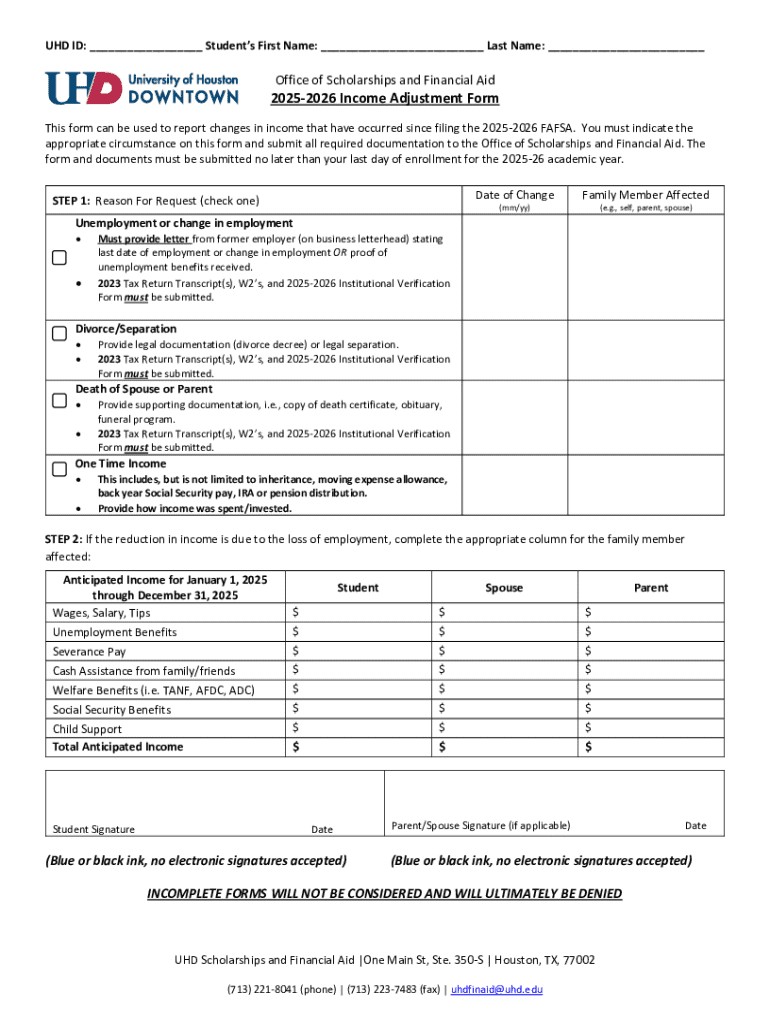

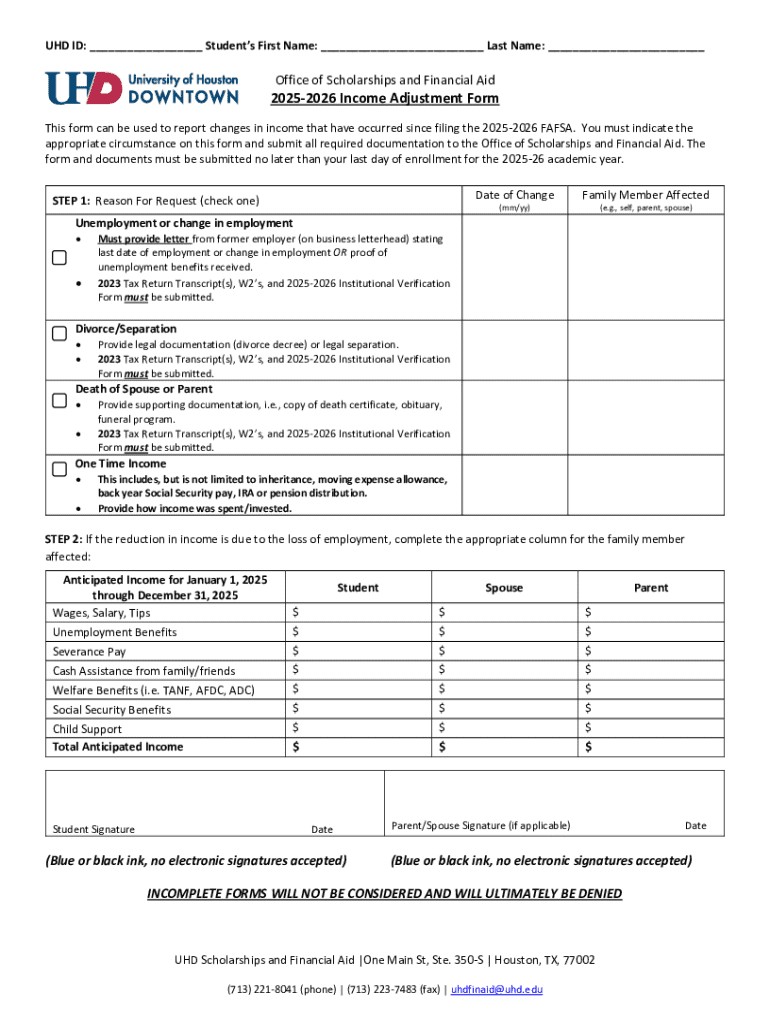

An income adjustment form is a critical document utilized by various organizations to report changes in an individual’s financial status. These changes may include increased or decreased income due to varied circumstances, such as job changes, family size adjustments, or changes in assets.

The primary purpose of this form is to ensure that the financial assistance, benefits, or tax obligations reflect accurate and up-to-date information. Over-reporting income can lead to undue tax burdens, while under-reporting can cause penalties or loss of benefits.

Typically, anyone receiving government assistance, child support, or adjusting their tax status will need to fill out this form. By providing accurate information, users can avoid potential issues and maintain compliance with regulations.

Key components of the income adjustment form

The income adjustment form consists of several essential components that users must complete. Firstly, personal details such as name, address, and Social Security number are crucial for identification purposes. Secondly, providing comprehensive financial details is essential to reflect your current income situation.

Understanding terminology is important when filling out this form. Terms like 'gross income' and 'net income' should be clearly defined. Users often make common mistakes such as incorrect calculations or failing to attach required documents, which can delay the processing of their forms.

Step-by-step guide to filling out the income adjustment form

Before diving into filling out the income adjustment form, preparing your documentation is essential. Gather all financial statements, pay stubs, and any documents that can support your reported income. Accurate data is pivotal as it ensures the correctness of your submissions.

When you begin filling out the form, follow a structured approach. Start with personal information, including your name and contact details, which are crucial for processing. Next, move on to income details where you outline your earnings from various sources, such as wages, bonuses, and any side jobs.

After detailing your current income, focus on the adjustments and deductions section. Here, you should provide any deductions or losses that could impact your net income. Once completed, it’s crucial to review your form meticulously. Common tips for error-checking include looking for numeric discrepancies and ensuring all required signatures are present.

Editing the income adjustment form

Editing the income adjustment form is straightforward, especially with tools like pdfFiller. This platform allows users to modify, add or remove information seamlessly within the document. pdfFiller's editing features include text changes, form-filling options, and easy-to-use navigation for users of all skill levels.

If changes are needed post-submission, users can make necessary adjustments using pdfFiller. Steps include locating the submitted document, making the desired changes, and resubmitting the updated form. It’s advisable to know the deadlines for making changes as they differ by organization and can affect your application's status.

eSigning the income adjustment form

The legal importance of signing an income adjustment form cannot be understated. An electronic signature carries the same weight as a handwritten one in the digital space, ensuring your submission is recognized legally. Signing signifies that all provided information is accurate and truthful.

Using pdfFiller, adding an electronic signature is a simple process. Users can insert their eSignature by following a few intuitive steps. This includes clicking on the signature section, choosing from predefined signatures or creating a new one, and placing it in the appropriate area of the document. Ensuring authenticity and security through a legally binding eSignature gives peace of mind regarding your submission.

Submitting your income adjustment form

When it comes time to submit your income adjustment form, various submission methods are available. Online submissions are often faster and provide immediate confirmation of receipt. Alternatively, users may choose to mail the form, which can take longer but is often preferred by those who like physical documentation.

To confirm that your submission was accepted, users can follow up through their submission platform or contact the relevant organization. Keeping a receipt of submission or a confirmation email can also serve as proof if any discrepancies arise later.

Common questions about the income adjustment form

Frequently asked questions often include how to resolve issues encountered while filling out the income adjustment form. Users may experience questions about specific terminologies or complex scenarios when reporting income changes.

Troubleshooting submission problems can be daunting. Common issues may arise if documentation is incomplete or if submission deadlines are not met. Engaging with resources like user guides or consulting customer support from pdfFiller can facilitate smooth navigation throughout this process. These platforms often provide helpful insights to assist in completing and submitting forms correctly.

Interactive tools and additional features

Utilizing interactive tools on pdfFiller enhances the overall experience when working with the income adjustment form. These tools offer real-time editing capabilities, which mean that users can make changes on the fly without losing their progress.

Additionally, users can track the document status meaning they can see when their form is viewed or received by the relevant organization. Integration with other tools also allows for improved workflow – for example, connecting with cloud storage services or other document management tools to streamline processes further.

Real-life scenarios and case studies

Numerous success stories highlight the importance of correctly using the income adjustment form. For instance, a single parent applying for subsidized housing successfully navigated the process by promptly submitting their adjustment form after a job loss, which ensured they received necessary assistance without delays.

User testimonials further demonstrate the effectiveness of this tool. Many have expressed satisfaction with the ease of use when filling out and submitting forms via pdfFiller, highlighting that timely updates to their income situations were managed seamlessly, leading to improved satisfaction with available services.

Staying informed on changes and updates

Staying updated with policy changes regarding income adjustments is paramount. Organizations may periodically revise the guidelines for filling out the income adjustment form, which means individuals must remain informed about the latest versions and submission requirements.

Regular reviews of one’s financial situation can also prove beneficial, especially during major life changes such as starting a new job, receiving a raise, or experiencing life events like marriage or divorce. Being proactive ensures that any necessary adjustments to income reporting are made in a timely manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out income adjustment form using my mobile device?

How do I complete income adjustment form on an iOS device?

How do I fill out income adjustment form on an Android device?

What is income adjustment form?

Who is required to file income adjustment form?

How to fill out income adjustment form?

What is the purpose of income adjustment form?

What information must be reported on income adjustment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.