Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A Comprehensive Guide to Form 990: Requirements, Components, and Filing Process

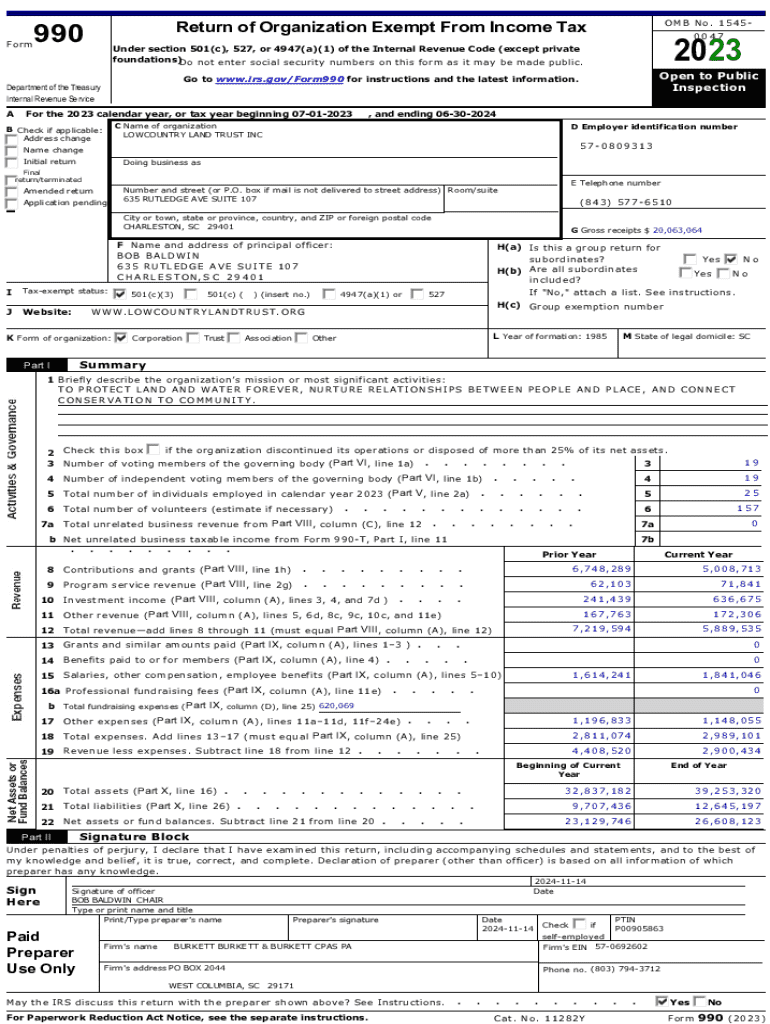

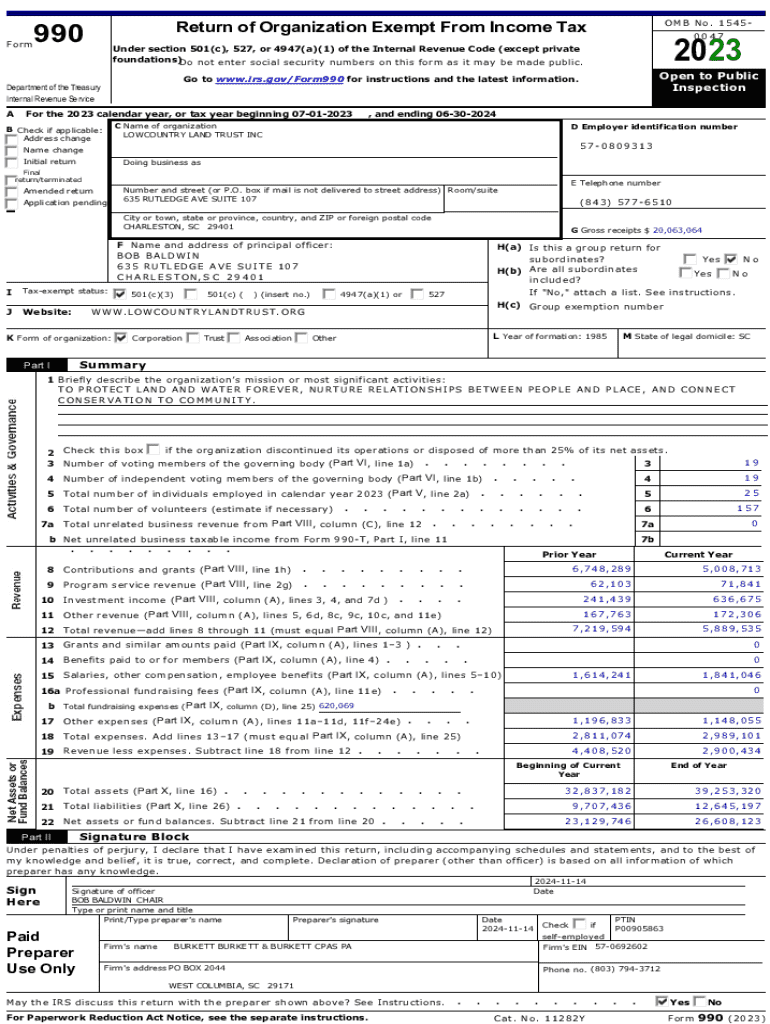

Understanding Form 990

Form 990 is a vital document for nonprofit organizations operating in the United States. This form, often referred to as the 'Return of Organization Exempt From Income Tax,' serves multiple purposes, including providing transparency to donors, ensuring compliance with federal regulations, and offering a snapshot of an organization's financial health and activities. By scrutinizing the data contained within Form 990, stakeholders gain crucial insights into how a nonprofit allocates its resources and manages its operations.

Organizations that fall under the umbrella of Form 990 include public charities, private foundations, and other tax-exempt entities. Generally, all tax-exempt organizations with gross receipts over $200,000 or total assets exceeding $500,000 are required to file this form annually. There are exceptions, including some religious organizations and small nonprofits that may qualify for simplified versions or exemptions from filing entirely.

Key components of Form 990

Form 990 comprises several sections and schedules, each designed to capture specific information critical to assessing a nonprofit's operations. Key components include the organization's mission statement, details of governance, financial data, and compensation of top executives. Understanding the nuances of each section is essential for compliance with IRS regulations and fostering transparency with stakeholders.

The financial statements within Form 990 are particularly significant. They report income, expenses, and net assets, providing a clear overview of the organization’s financial landscape. For instance, a comprehensive examination of income sources—such as donations or grants—against expenditures can unveil operational efficiency or highlight areas requiring attention. Stakeholders, including potential donors, often analyze these metrics to evaluate the financial health and long-term viability of the organization.

Filing requirements for Form 990

Certain criteria determine who must file Form 990. Generally, all tax-exempt organizations with annual gross receipts exceeding $200,000 or total assets over $500,000 must submit this form each year. Smaller nonprofits, those with gross receipts under $200,000, may opt for Form 990-N, also known as the e-Postcard, which requires less detailed reporting. It's crucial for organizations to understand their specific filing requirements based on their size and revenue structure.

The filing deadlines for Form 990 typically fall on the fifteenth day of the fifth month following the end of the organization’s fiscal year. For example, if a nonprofit's fiscal year ends on December 31, the form would be due by May 15. Organizations can apply for extensions, which provide a six-month grace period for completing their filings. However, being punctual in filing is essential to maintain compliance and avoid penalties.

Penalties for non-compliance

Failing to file Form 990 or submitting it late can result in significant penalties for nonprofits. The IRS imposes fines that can accrue daily, reflecting the urgency of timely compliance. For instance, the penalty for not filing or filing late can reach $20 per day, which can quickly add up. Moreover, nonprofits risk losing their tax-exempt status if they fail to file for three consecutive years, leading to dire financial consequences.

Beyond financial implications, non-compliance can damage an organization’s public perception. Prospective donors often evaluate an organization’s commitment to transparency and accountability, and any indication of filing issues can foster distrust. Maintaining compliance with Form 990 not only safeguards financial standing but also strengthens relationships with the community and potential supporters.

How to fill out Form 990

Filling out Form 990 can seem daunting, but with a systematic approach, organizations can navigate the process efficiently. Start by gathering essential documents such as financial statements, donation records, and board meeting minutes. Having these materials readily available reduces the time spent searching for necessary information during completion.

When you begin completing Form 990, take your time with each section. Review the instructions carefully to understand what information is required. After filling in each section, it's crucial to review the entire form for accuracy and completeness. Common mistakes include typos, incorrect financial figures, and missing signatures. Avoiding these pitfalls ensures a smoother review process by the IRS.

Filing modalities

When it comes to submission, nonprofits can choose between electronic and paper filings for Form 990. Electronic filing is highly recommended, as it allows for instant submission and minimizes the likelihood of errors. Platforms like pdfFiller provide user-friendly interfaces for completing and e-filing Form 990 seamlessly. Additionally, e-filing enables organizations to receive immediate confirmation of submission.

If an organization opts for paper submission, it should be aware of potential delays in processing times due to postal service variables. For assistance, nonprofits can reach out to the IRS, or utilize resources from accounting professionals experienced in nonprofit filings to clarify any doubts they may have during the process.

Public inspection regulations

Form 990 is not only a reporting requirement; it also acts as a tool for public accountability. Most information included in Form 990 must be accessible to the public, enabling transparency. This openness helps reinforce trust between nonprofits and their stakeholders. Key information available to the public includes financial statements, operational information, and executive compensation details.

To access Form 990 filings from other organizations, interested individuals can utilize the IRS website or third-party transparency platforms. These resources allow anyone to review a nonprofit's financial health and governance practices, akin to how investors analyze public companies. Such access encourages healthy competition among nonprofits to maintain high standards of accountability and transparency.

The role of Form 990 in charity evaluation research

Research and analysis conducted on Form 990 data play a pivotal role in evaluating nonprofit organizations. This form is often used by researchers, regulatory bodies, and philanthropists to assess effectiveness, efficiency, and overall impact. By analyzing key metrics derived from Form 990, stakeholders can draw insights about revenue sources, expenditure patterns, and overall fiscal responsibility, influencing funding decisions and strategic planning.

Critical metrics derived from Form 990 data include administrative costs versus programmatic spending, fundraising efficiency, and the proportion of contributions directed toward mission-related activities. These indicators provide a comprehensive view of a nonprofit's operational priorities and fiscal health, helping decision-makers allocate resources effectively and maximize impact.

How to use Form 990

For nonprofits, Form 990 is more than just a regulatory requirement; it’s a strategic asset. By utilizing the insights provided in the form, organizations can engage in informed strategic planning. For instance, analyzing past Form 990s can help identify trends in funding sources and spending patterns, informing future fundraising and operational strategies.

Transparency through Form 990 builds trust with donors and stakeholders. Organizations can highlight their accountability practices in outreach materials and on their websites, illustrating how resource allocations align with mission-driven activities. Engaging with stakeholders by openly sharing Form 990 details can enhance confidence in the organization’s integrity and commitment to its cause.

FAQs about Form 990 and filing requirements

Many nonprofits have questions surrounding Form 990 filings, and addressing these inquiries is essential for promoting understanding and compliance. Some of the most frequently asked questions include: what happens if we miss the filing deadline, or how can we amend a previously submitted Form 990? Providing clear and concise answers to these questions helps demystify the process, making it more approachable for organizations of all sizes.

Furthermore, nonprofits can find additional resources on the IRS website, which offers detailed guidelines and instructions specific to Form 990. Partnering with accounting professionals can also provide extra layers of support, ensuring compliance and enhancing the quality of submitted information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I edit form 990 online?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.