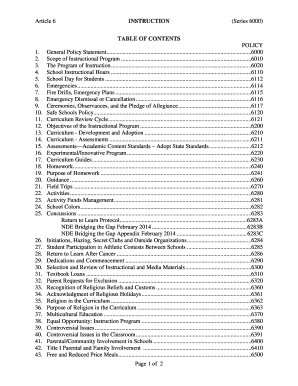

Get the free Commercial Crime Policy Application for Small Businesses

Get, Create, Make and Sign commercial crime policy application

How to edit commercial crime policy application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial crime policy application

How to fill out commercial crime policy application

Who needs commercial crime policy application?

Comprehensive Guide to the Commercial Crime Policy Application Form

Overview of commercial crime insurance

Commercial crime insurance is a critical safeguard for businesses against losses stemming from various types of fraudulent activities. This insurance protects against risks such as employee theft, outside theft, forgery, and fraud, making it essential for any organization that handles money or sensitive information.

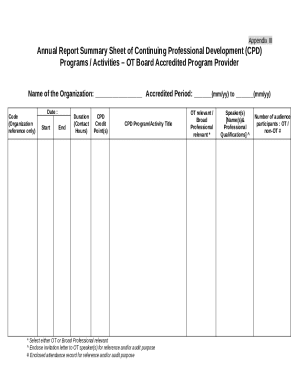

Understanding the commercial crime policy application form

The commercial crime policy application form serves as the gateway to obtaining your insurance coverage. It is a vital document where you detail your business's specifics, risk profile, and coverage needs.

Businesses of all shapes and sizes need to fill out this form, particularly corporations, limited liability companies (LLCs), and nonprofit organizations. Completing this form accurately is essential; it lays the groundwork for your policy and impacts the extent of coverage you can receive.

Preparing to fill out the application form

Preparation is key to completing your commercial crime policy application form accurately and effectively. Start by gathering essential information about your business, which includes identification details, financial statements, and any loss history related to crime.

Documentation like current insurance policies and details of any security systems in place will also be necessary to provide a complete picture of your risk management and coverage needs.

Step-by-step guide to completing the commercial crime policy application form

Filling out the application form can be straightforward if you follow a structured approach. Here’s a breakdown of how to complete each section.

Editing and finalizing your application

Once you have filled out the application, it’s important to edit and finalize it thoroughly. Utilizing pdfFiller tools can streamline this process, allowing for efficient real-time collaboration and digital signing.

Before submitting, ensure all sections are completed and thoroughly review the application for any common errors such as inconsistencies in provided information.

Submitting your application form

When ready, submit your commercial crime policy application form following best practices. Choosing between digital submission or paper submission can depend on your industry and preferences.

Once submitted, stay informed about the approval timeframes and the next steps in your application process.

What to expect after submission

Following submission, your application will enter the underwriting process. During this time, insurers will evaluate your application against their risk assessment criteria.

Navigating common challenges

Understanding potential challenges can prepare you for unexpected setbacks, such as application denials. Common reasons for denial often stem from incomplete or misleading information provided in the application.

Honest and accurate reporting reinforces your credibility and may significantly enhance your chances of approval.

Maintaining your commercial crime coverage

It’s essential to regularly review your commercial crime coverage to ensure it meets your evolving business needs. Periodic policy reviews are vital, especially post any expansion or structural changes.

Leveraging pdfFiller for application management

Using a cloud-based solution like pdfFiller for managing your commercial crime policy application offers numerous benefits. This platform allows you to access your documents from anywhere, streamlining not just the application process but your entire document management.

Frequently asked questions about the commercial crime policy application

As businesses navigate the commercial crime policy application process, several common queries arise. Having clear, accurate answers can ease concerns and streamline the process.

Tips for future applications

Learning from your current experience can greatly enhance future applications. Focus on improving your business's overall risk profile by strengthening security measures and employee training programs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my commercial crime policy application in Gmail?

How can I edit commercial crime policy application from Google Drive?

How can I get commercial crime policy application?

What is commercial crime policy application?

Who is required to file commercial crime policy application?

How to fill out commercial crime policy application?

What is the purpose of commercial crime policy application?

What information must be reported on commercial crime policy application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.