Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: The Comprehensive Guide to Filling Out, Editing, and Managing Your IRS Tax Form

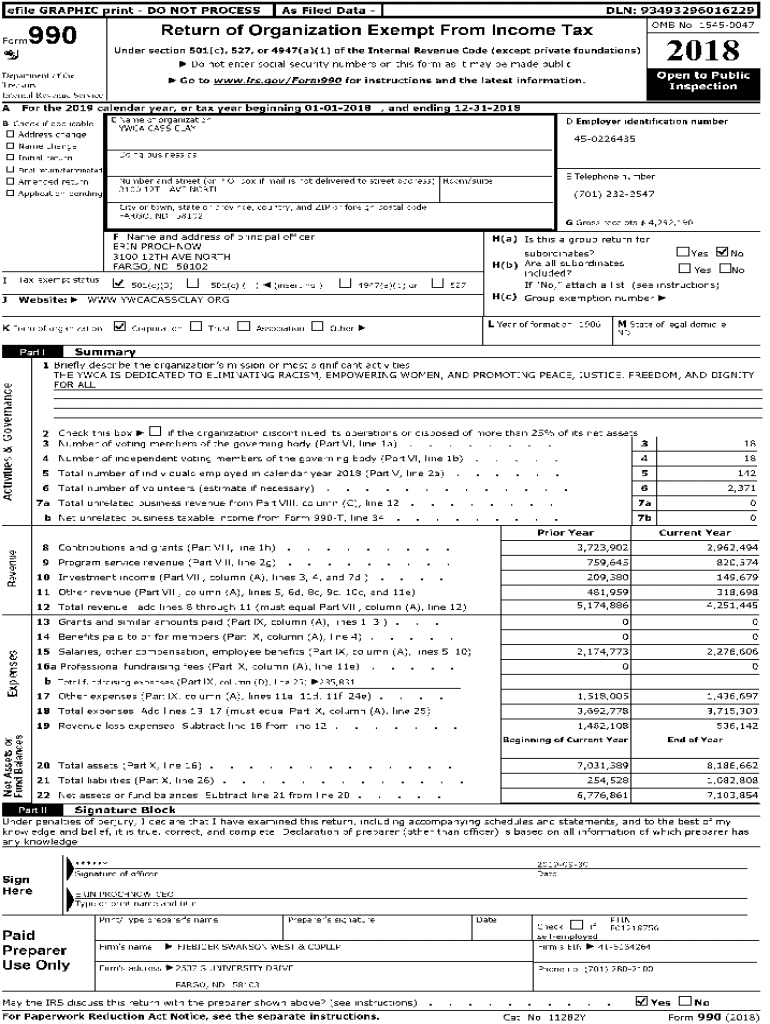

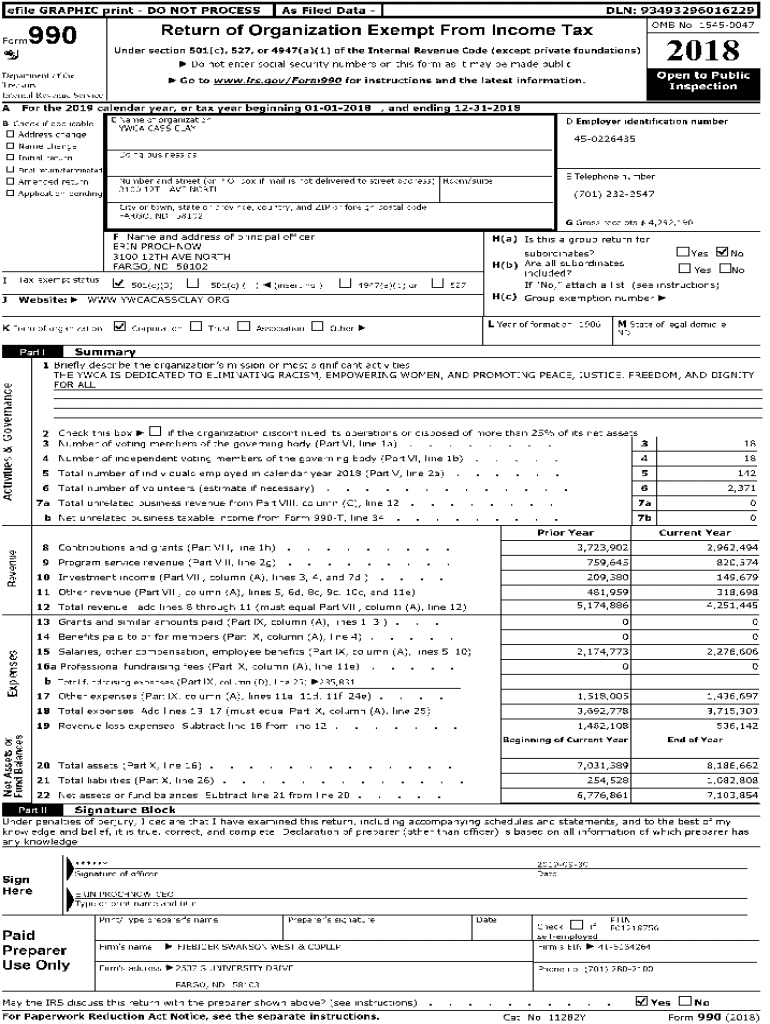

Understanding Form 990

Form 990 serves as the principal instrument of accountability for tax-exempt organizations in the United States. It's crucial for these entities to report their financial information to the IRS accurately. By filling out Form 990, organizations provide transparency about their financial workings and operations, allowing donors and the public to assess their fiscal responsibility and legitimacy.

Key components of Form 990

Form 990 consists of multiple sections, each serving a specific purpose. Key components include the summary section, which outlines the organization’s mission and financials; the revenue section that captures earnings from various sources; and the functional expenses section detailing how funds are spent. Additional schedules may include information on governance practices and compensation for key personnel.

Types and variants of Form 990

There are several variants of Form 990 tailored to different types of organizations and their needs. The standard Form 990 is designed for larger organizations with gross receipts over $200,000 or total assets exceeding $500,000. Form 990-EZ offers a simplified reporting option for those with less complicated finances, while smaller entities with gross receipts under $50,000 can use Form 990-N, also known as the e-Postcard. Other related forms, such as 990-PF for private foundations and Form 990-T for unrelated business income, cater to specific scenarios.

Who must file Form 990?

Organizations that are recognized as tax-exempt under section 501(c) of the Internal Revenue Code are generally required to file Form 990. This includes charities, educational institutions, and other nonprofit organizations. However, some organizations like churches, certain governmental entities, and most affiliates of national organizations may be exempt from this filing requirement.

Understanding filing requirements

Filing deadlines for Form 990 can vary based on your tax year-end. Generally, organizations must file Form 990 on the 15th day of the fifth month after the end of their fiscal year. It's paramount for organizations to adhere to these deadlines to avoid unpleasant penalties. Additionally, state-specific requirements may also exist, further complicating the compliance landscape.

Penalties for non-compliance

Failing to file Form 990 can lead to hefty penalties, starting from $20 per day with a maximum of $10,500—or 5% of the gross receipts for smaller organizations. Furthermore, inaccuracies and misstatements can result in additional penalties, emphasizing the importance of precise and thorough reporting. Maintaining diligent records and referencing IRS guidelines can help organizations avoid these pitfalls.

How to access and download Form 990

The IRS provides Form 990 and all its variants for free on its official website. Users can navigate to the IRS forms section where they will find downloadable versions of the forms in PDF format. It's essential to access the most current version to ensure compliance with the latest regulations and filing requirements.

Step-by-step guide to filling out Form 990

To effectively fill out Form 990, organizations should first assemble essential documents like prior tax returns, financial statements, and organizational bylaws. Each section of the form should be completed meticulously, addressing items such as revenues, expenses, and program services separately to reflect accurate information. Common pitfalls include incorrect reporting or omission of required details, which can trigger penalties.

How to edit and manage Form 990

As organizations find themselves needing to edit their Form 990, using tools like pdfFiller streamlines the process. Users can upload their downloaded PDF, edit text, and collaborate with team members effortlessly. The platform's features allow for electronic signatures, eliminating the need for paper, which can expedite the submission process without compromising security.

Public inspection regulations

Form 990 is subject to public inspection, which means anyone may request to view it. The information disclosed is vital for maintaining the public trust. Organizations should prepare for public inspection by keeping electronic and hard copies readily accessible and ensuring that all submitted forms are complete and accurate. This enhances transparency and satisfies regulatory demands.

Using Form 990 for evaluation and research

Researchers, grantmakers, and potential donors often utilize Form 990 as a key research tool. These stakeholders analyze the financial data provided to evaluate the health of nonprofit organizations and their accountability. Trends related to funding sources, spending habits, and program impacts are often assessed using this data, which informs decision-making processes for donors and evaluators alike.

FAQs about Form 990

Many common questions arise about Form 990, particularly around the nuances of filling it out and the implications of not filing. Specifically, filers often ask about how to amend a submitted Form 990, as well as the guidelines surrounding reporting unrelated business income. Clear understanding of the requirements and the filing timeline helps mitigate potential issues.

Additional considerations and best practices

Maintaining thorough documentation and meticulous records is fundamental for any organization engaging in non-profit activities. Best practices include keeping earlier forms on file for reference and consulting with financial professionals when uncertainties arise. Adhering to accounting principles and ensuring compliance with IRS guidelines will not only help avoid penalties but also strengthen organizational integrity.

Staying informed: Changes to Form 990

Over time, there are periodic adjustments to Form 990, often driven by changes in the law or IRS regulatory adaptations. Organizations must remain vigilant and proactive in reviewing updates to ensure compliance. This includes attending workshops, following IRS announcements, or seeking guidance from tax professionals familiar with nonprofit regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I complete form 990 on an iOS device?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.