Get the free Fdic Quarterly Banking Profile

Get, Create, Make and Sign fdic quarterly banking profile

Editing fdic quarterly banking profile online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fdic quarterly banking profile

How to fill out fdic quarterly banking profile

Who needs fdic quarterly banking profile?

Understanding the FDIC Quarterly Banking Profile Form

Overview of FDIC Quarterly Banking Profile

The FDIC Quarterly Banking Profile is a comprehensive report published by the Federal Deposit Insurance Corporation (FDIC) that summarizes the financial condition and performance of insured commercial banks and savings institutions in the United States. This report serves a dual purpose: providing critical data to policymakers and regulators while also equipping stakeholders with insights into the health of the banking system. The profile is essential for assessing trends in the banking industry and understanding potential risks that may arise in financial markets.

Understanding the components of the FDIC Quarterly Banking Profile

The FDIC Quarterly Banking Profile comprises various key sections that outline essential financial metrics. Among the most critical are the financial condition of banks, asset quality, earnings performance, and measures surrounding capitalization and liquidity. Each component provides a snapshot of the banking sector's health and is crucial for stakeholders who depend on accurate information for decision-making.

In terms of financial metrics, terms like 'non-performing assets' are compared against total assets to gauge asset quality, while return on assets (ROA) highlights the efficiency of a bank's operations. Capitalization ratios, such as the Tier 1 common equity ratio, indicate a bank's resilience against financial shocks.

Importance of the FDIC Quarterly Banking Profile

The FDIC Quarterly Banking Profile plays a crucial role in regulatory compliance. It provides a basis for oversight agencies to ensure that banks operate within safe and sound parameters. By analyzing the reported data, regulators can identify emerging trends that may pose threats to the banking system.

For stakeholders, such as investors and bank management, the profile holds immense significance. Investors use the data to make informed decisions regarding investments in financial institutions. For management teams, understanding the metrics can shape strategic planning and risk management practices.

Detailed instructions for accessing the FDIC Quarterly Banking Profile Form

Accessing the FDIC Quarterly Banking Profile is straightforward. The FDIC maintains an accessible repository on its official website, where users can find the latest report as well as historical data. This resource is invaluable for anyone looking to understand the current state and historical trends of the banking industry.

To navigate to the profile, follow these steps: Visit the FDIC website, locate the 'Data' section on the homepage, and select 'Quarterly Banking Profile.' You can view, download, and even save reports in various formats. For those who prefer third-party access, platforms providing financial data also include the FDIC profile in their offerings.

Completing the FDIC Quarterly Banking Profile Form

Filling out the FDIC Quarterly Banking Profile Form involves multiple steps to ensure accuracy and compliance with regulations. Essential information includes financial metrics, such as total assets and liabilities alongside specific reporting periods. It's crucial to understand what each section requires, as inaccuracies can lead to significant regulatory issues or misinterpretation of a bank's health.

When entering financial details, ensure consistency with previously reported data to maintain integrity. Banks must also adhere to compliance requirements outlined in the reporting standards. A best practice is to establish a review process within your team to verify that all information entered is correct before submission.

Utilizing pdfFiller for effective management of the FDIC Quarterly Banking Profile Form

Using pdfFiller greatly enhances the experience of completing and managing the FDIC Quarterly Banking Profile Form. The platform enables easy editing of PDF files, ensuring that banks can input their data quickly and accurately. Additionally, with its eSigning capabilities, approvals can be achieved swiftly, eliminating delays in the reporting process.

Collaboration tools allow team members to provide input directly on shared documents, improving the overall efficiency of the data collection phase. Since pdfFiller operates on a cloud-based system, users can access their forms from anywhere, ensuring flexibility and ease of use.

Common mistakes to avoid when filling out the FDIC Quarterly Banking Profile Form

While filling out the FDIC Quarterly Banking Profile Form, there are several common mistakes that can jeopardize the accuracy of the report. Overlooking data entry errors can lead to misrepresentations of a bank's financial health, which may provoke scrutiny from regulators. It’s essential to diligently check all numbers, especially in financial ratios, to prevent discrepancies.

Additionally, erroneous dates can lead to reporting outside the acceptable time frame, impacting compliance. Implementing a system for cross-checking each section with prior reports can help mitigate these issues, thereby enhancing the credibility of the documentation.

Frequently asked questions about the FDIC Quarterly Banking Profile

One common question regarding the FDIC Quarterly Banking Profile is how frequently the profile is updated. The profile is published quarterly, providing real-time insights into the banking sector. This allows stakeholders to remain informed about the financial industry's status in a timely manner.

Another inquiry pertains to which agencies utilize this data. Beyond banks and financial institutions, various regulatory agencies, researchers, and investors leverage this data for decision-making. Understanding the distinctions between quarterly and annual reports, where quarterly reports enable responsiveness to immediate trends while annual reports provide a more extensive review, is also critical for stakeholders.

Case studies utilizing the FDIC Quarterly Banking Profile

Case studies reveal how the FDIC Quarterly Banking Profile has influenced strategic planning for various banks. For instance, a regional bank utilized quarterly trends to shift its loan portfolio directions in response to market demand. By analyzing data from the profile, the bank successfully mitigated risks associated with non-performing loans and improved overall profitability.

Another instance involves an investment firm that based its acquisition strategy on significant trends highlighted in the quarterly report, leading to an informed decision that resulted in a beneficial merger with a growing bank. These examples underline the practical applications of the quarterly profile in shaping critical financial strategies.

Future trends in the FDIC Quarterly Banking Profile and its relevance

Looking ahead, the FDIC Quarterly Banking Profile is poised to evolve with advancements in technology and data analysis. The integration of machine learning and artificial intelligence could lead to more predictive analytics, allowing banks and stakeholders to preemptively address financial challenges and innovate their services.

Furthermore, the need for transparency and timely reporting has never been greater, paving the way for real-time data access that could redefine how the industry engages with financial information. These trends will ensure that the FDIC Quarterly Banking Profile remains a relevant and invaluable tool for decision-makers in the financial sector.

Conclusion and additional insights

In conclusion, the FDIC Quarterly Banking Profile Form is a fundamental document in the landscape of banking. Understanding its components, relevance, and methods for effective completion is crucial for financial professionals. The use of platforms like pdfFiller can significantly streamline the process of document management, allowing for more efficient completion of regulatory requirements.

The insights gained from effective utilization of this form can enhance the strategic direction of banks and financial institutions. As the industry evolves, remaining informed and capable in handling these documents will position stakeholders for success in this dynamic environment.

Breadcrumb navigation for easy access

For efficient navigation through this comprehensive guide, users can refer to the following sections for quick reference: Overview, Components, Importance, Access Instructions, Completing the Form, Utilizing pdfFiller, Common Mistakes, FAQs, Case Studies, Future Trends, Conclusion. Each section provides a distinct pathway to understanding the FDIC Quarterly Banking Profile Form.

Footer secondary menu

For further exploration of related resources, please refer to the following links: Contact Information, Support Resources, and Additional Tools relevant to document management. Keeping informed will assist you in navigating the complexities inherent in banking documentation and reporting.

Statistics at a glance

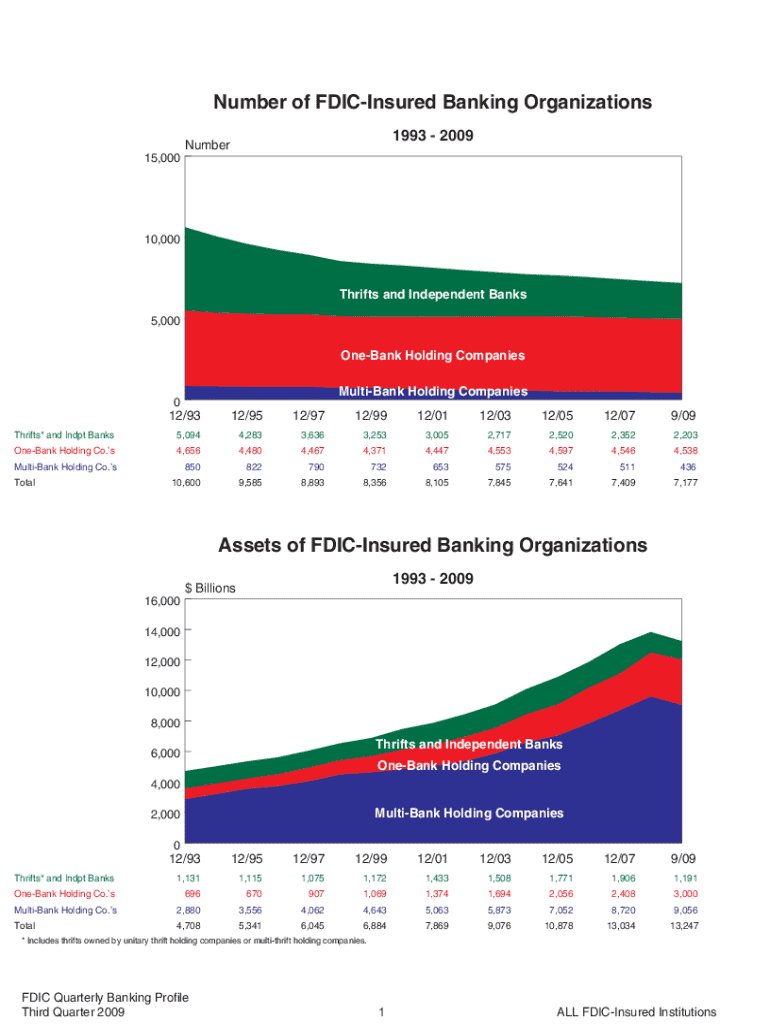

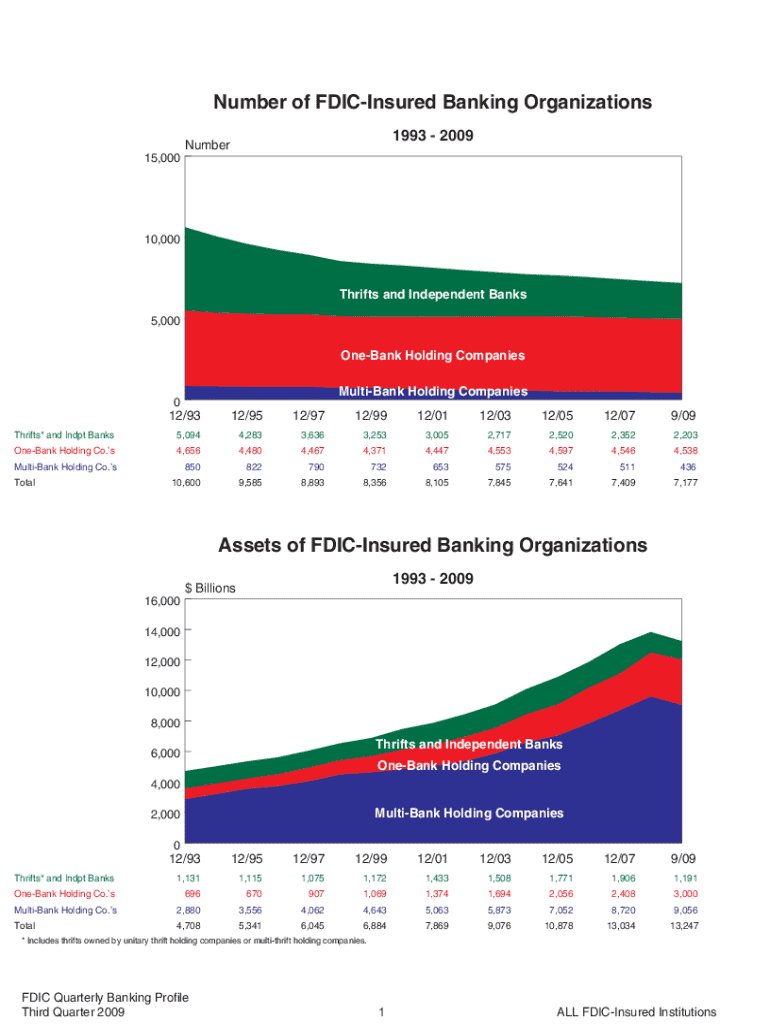

The latest FDIC Quarterly Banking Profile presents valuable statistics that depict the current state of the banking sector. Trends noted in recent profiles include insights on capital adequacy ratios, non-performing loan volumes, and profitability measures across the sector.

Visual aids such as graphs and charts are employed to enhance the reader's understanding, allowing for quick comprehension of complex data. For instance, trends over recent quarters in non-performing loans might show a gradual decline, indicating improved asset quality within the banking system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fdic quarterly banking profile directly from Gmail?

How can I get fdic quarterly banking profile?

How do I edit fdic quarterly banking profile on an iOS device?

What is fdic quarterly banking profile?

Who is required to file fdic quarterly banking profile?

How to fill out fdic quarterly banking profile?

What is the purpose of fdic quarterly banking profile?

What information must be reported on fdic quarterly banking profile?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.