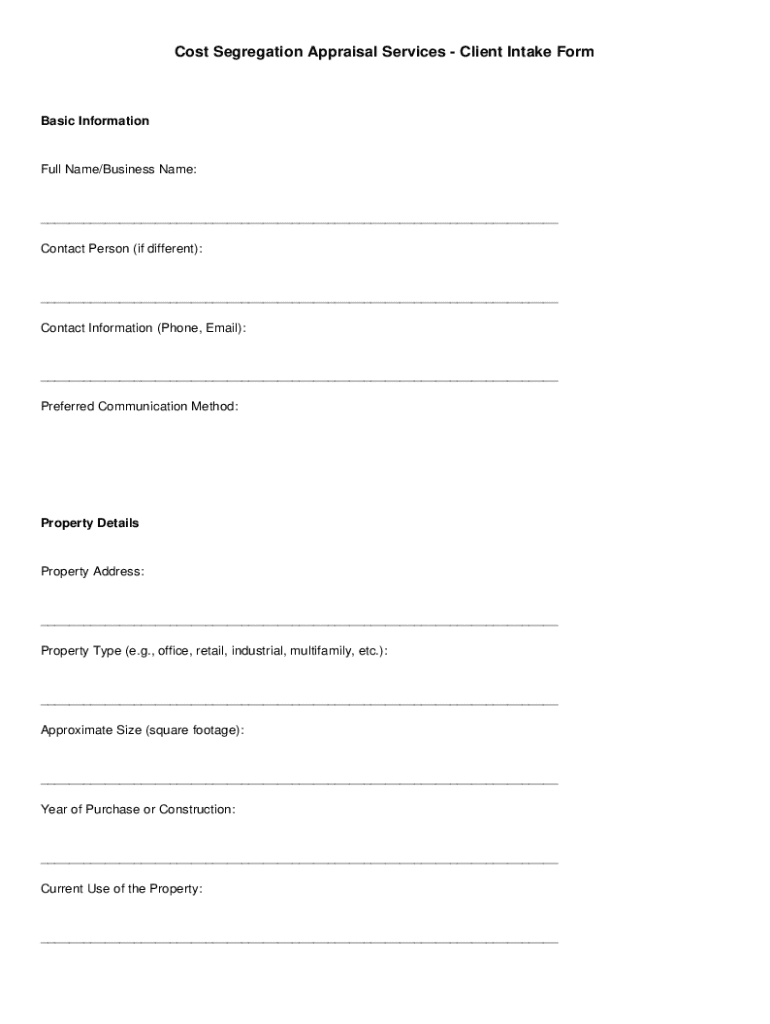

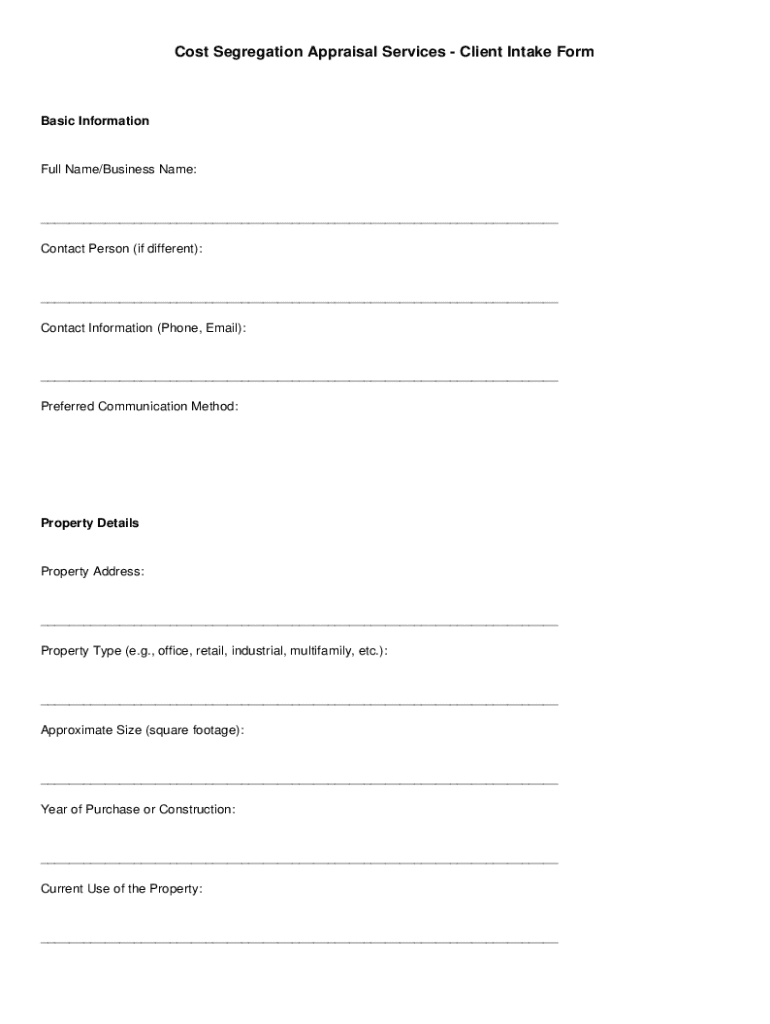

Get the free Cost Segregation Appraisal Services - Client Intake Form

Get, Create, Make and Sign cost segregation appraisal services

How to edit cost segregation appraisal services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cost segregation appraisal services

How to fill out cost segregation appraisal services

Who needs cost segregation appraisal services?

Understanding Cost Segregation Appraisal Services Form

What is cost segregation?

Cost segregation is a tax strategy that allows property owners to decrease their tax burden by accelerating depreciation on certain components of their real estate. By breaking a property down into different asset categories—such as personal property, land improvements, and building structure—that can be depreciated over shorter periods of time, businesses can significantly increase their cash flow.

This strategy is particularly important for real estate investors and business owners, as it provides an opportunity to reclaim cash quickly, which can then be reinvested into the business or used for other purposes. However, many misconceptions exist, such as the belief that only new construction qualifies or that the process is overly complicated.

Understanding the cost segregation appraisal services form

The cost segregation appraisal services form is a crucial document for property owners wishing to undertake a cost segregation study. It details the various components of a property and assigns suitable depreciation timelines for each, thereby allowing filers to optimize their tax strategy. This form is vital in documenting the justification for the accelerated depreciation claims.

Key components of the form include property description, acquisition date, estimates of costs associated with improvements, and the allocation of costs among different asset classes. Various stakeholders, including real estate investors, CPA firms, and tax professionals, need to use this form to ensure compliance with IRS regulations.

The benefits of cost segregation

Utilizing cost segregation appraisal services can lead to accelerated depreciation benefits, translating to significant tax savings. By identifying and separating personal property and land improvements from the overall building structure, property owners can depreciate those elements over a shorter lifespan, often 5, 7, or 15 years instead of the standard 27.5 or 39 years.

This strategy not only improves cash flow management but also incentivizes property reinvestment, providing businesses with the liquidity to expand or enhance their operations. The potential for tax deferral through these savings allows for more straightforward business planning. Furthermore, understanding these benefits can empower property owners to make informed financial decisions vital for long-term success.

Step-by-step guide to using the cost segregation appraisal services form

To effectively utilize the cost segregation appraisal services form, it is essential to follow a systematic approach. Here’s a step-by-step guide to ensure the process runs smoothly.

Navigating common challenges and mistakes

Understanding potential challenges is critical to successfully submitting the cost segregation appraisal services form. One frequent error is the misallocation of costs, where certain elements of the property are not categorized properly. This can significantly impact the depreciation claimed and may even trigger IRS inquiries.

If inquiries arise, it is crucial to address them promptly with accurate documentation. Ensuring compliance with IRS regulations and providing all required supporting documents can mitigate issues. By collaborating actively with tax professionals, property owners can significantly enhance their submission's accuracy and legality.

Advanced considerations for cost segregation

For seasoned investors, understanding advanced topics related to cost segregation can further enhance tax strategy. One such consideration is the Section 481(a) adjustment, which enables taxpayers to make adjustments to prior depreciation calculations when changes are made to depreciation methods. This is pertinent when retroactively applying cost segregation studies.

Moreover, linking cost segregation with bonus depreciation strategies can significantly leverage tax advantages. Bonus depreciation allows businesses to deduct a significant percentage of an asset's cost in the first year after purchase, enhancing the benefits of a well-executed cost segregation study. Awareness of how these interconnected strategies influence other tax returns will ensure comprehensive financial planning.

Case studies and success stories

Numerous success stories abound in regard to cost segregation appraisal services. Take, for instance, a large multi-family property that utilized a detailed cost segregation study. The owners were able to reclassify over $1 million in property components, resulting in a tax savings that exceeded $300,000 in the first year alone.

These measurable benefits illustrate the power of cost segregation and serve as real-world examples of how effective this strategy can be. Users often report increased cash flow, enabling reinvestment in further property acquisitions or renovations, ultimately enhancing portfolio growth.

FAQs about cost segregation and its application

FAQs surrounding cost segregation offer clarity on common concerns. For instance, many individuals wonder what qualifies as new deductions through this method. Particularly, structural components that can be reclassified into shorter depreciation schedules are considered.

Others may question the feasibility of completing cost segregation studies independently. While possible, partnering with experienced professionals is often advisable due to the technical complexities involved. Addresses surrounding audit risks and whether to amend previous tax returns post-study further illustrate the importance of informing oneself thoroughly.

Utilizing the pdfFiller platform for cost segregation appraisal services form

pdfFiller enhances the experience of filling out the cost segregation appraisal services form by providing a user-friendly, cloud-based alternative. Users can conveniently edit and fill out the form regardless of their location, ensuring that every component is accurately addressed.

Features like eSigning and document management streamline the process, while collaborative tools allow teams to work efficiently on the same document. pdfFiller empowers property owners and professionals alike to elevate their document management strategy.

Moving forward with cost segregation: next steps

Evaluating specific needs for cost segregation is crucial for property owners seeking financial efficiency. Engaging with professional cost segregation studies is a recommended approach, ensuring that all qualifying deductions are aptly addressed. Utilizing the capabilities of pdfFiller will simplify ongoing document management, making the process more accessible and efficient.

In conclusion, mastering the cost segregation appraisal services form not only aids in tax savings but also fosters better business planning and cash flow management, empowering property owners to leverage their investments more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my cost segregation appraisal services in Gmail?

How do I fill out cost segregation appraisal services using my mobile device?

Can I edit cost segregation appraisal services on an iOS device?

What is cost segregation appraisal services?

Who is required to file cost segregation appraisal services?

How to fill out cost segregation appraisal services?

What is the purpose of cost segregation appraisal services?

What information must be reported on cost segregation appraisal services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.