Get the free Uk Share Transfer Form

Get, Create, Make and Sign uk share transfer form

Editing uk share transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uk share transfer form

How to fill out uk share transfer form

Who needs uk share transfer form?

UK Share Transfer Form - A How-to Guide

Understanding share transfers in the UK

A share transfer refers to the process by which ownership of shares from one individual or entity to another is officially transferred. This procedure is essential in both private and public companies as it ensures that ownership records are accurate and up-to-date. In the UK, shares can vary significantly in terms of rights and obligations, making proper documentation crucial for compliance and legal clarity.

Various types of shares can be transferred, including ordinary shares, preference shares, and redeemable shares. Each category carries different rights, including voting privileges and dividend entitlements, which may influence a buyer's decision. As a result, understanding the specific type of shares involved in a transfer is vital.

Legal framework governing share transfers

In the UK, the transfer of shares is governed by several laws, with the Companies Act 2006 being particularly significant. This legislation outlines the procedures for transferring shares and ensures that all transactions are conducted lawfully. Compliance with these regulations is not only mandatory but also protects the rights of all parties involved in the transaction.

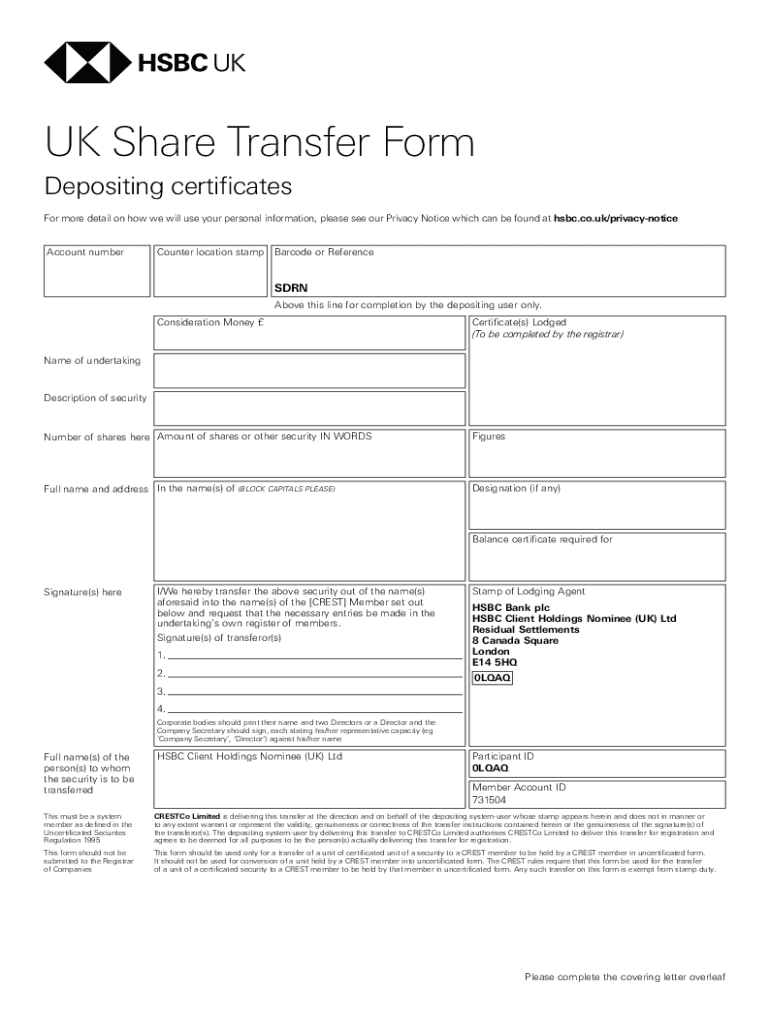

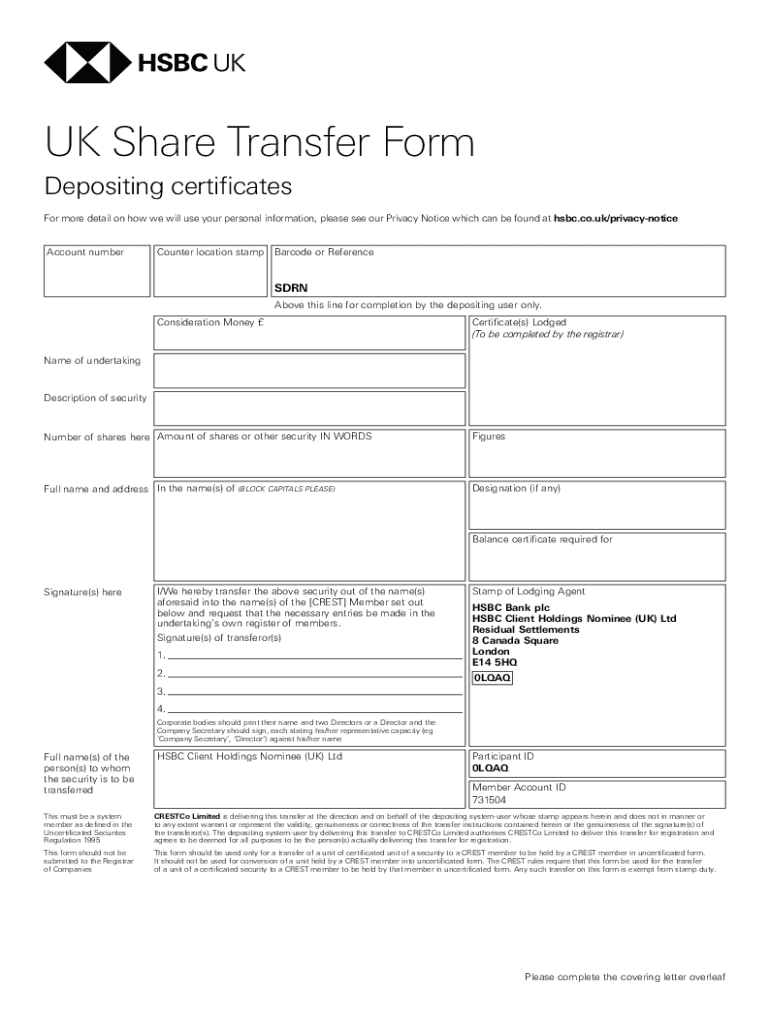

Key components of a UK share transfer form

A UK share transfer form typically includes essential components that must be accurately filled out to avoid any legal complications. The form requires detailed information about both the seller and buyer, such as their names, addresses, and contact information. It also necessitates specific details about the shares being transferred, including the number of shares and their class.

Signatures play a critical role in validating the share transfer. Both the seller and buyer must sign the document, and, depending on the circumstances, it may also be necessary to have the signatures witnessed. Additionally, consideration money, which refers to the payment made in exchange for the shares, should be clearly stated to demonstrate that a transaction has taken place.

Step-by-step guide to completing the UK share transfer form

Completing a UK share transfer form involves several steps to ensure accuracy and compliance. Firstly, gather all necessary information, including personal details of the involved parties and share specifics. Sometimes overlooked are details like the unique share certificate numbers, which should be double-checked to prevent errors.

Next, go online to download the UK share transfer form. Websites such as pdfFiller provide user-friendly templates available in various formats like PDF and DOCX, making it easy to access and fill out the form.

Carefully fill out each section of the form by providing accurate information and checking for typos. Avoid common pitfalls by reviewing the completed form for any missing data or inconsistencies. Finally, have both parties sign the document, ensuring that all signatures are obtained before completing the transfer.

Editing and modifying the share transfer form

Using pdfFiller for document editing offers a straightforward solution for making changes to your share transfer form. The platform provides a variety of interactive tools which allow users to edit text, add signatures, and even annotate the document, ensuring that all changes are easily incorporated without fuss.

Collaboration features on pdfFiller strengthen the editing process. Users can invite others to review or sign their documents, streamlining the transfer process. This collective ability ensures that feedback is gathered promptly, minimizing delays and misunderstandings.

Managing and storing your share transfer documents

Keeping your share transfer documents secure is paramount. Utilizing secure cloud storage solutions not only enhances document safeguarding but also facilitates easy access for future references. pdfFiller supports document management, allowing users to store documents safely and retrieve them as needed.

When handling copies of your share transfer agreements, it's important to exercise best practices. Always ensure that proper distribution occurs to all parties involved in the transfer, and keep a copy for personal records. Archiving past transfers can help you keep track of ownership changes over time, which can be essential for future dealings.

Addressing common questions and concerns

Some frequently asked questions about share transfers often revolve around what happens if the share transfer form is filled out incorrectly. Mistakes can happen, and it is typically advised to rectify the errors through either a revised form or an annex explaining the changes. However, ensuring accuracy from the start minimizes these occurrences.

Understanding liability post-transfer is also crucial. After a share transfer, the rights and obligations of both the buyer and seller change. The seller is generally relieved of any responsibilities towards the shares, while the buyer assumes all rights, including dividends and voting rights associated with the shares.

User feedback and experiences

Gathering user feedback about the share transfer process can illuminate pain points and highlight successful strategies. Encouraging users to share their experiences can build a community of support and learning, enhancing others' understanding of the share transfer process.

The insights shared by users can also inform continuous improvements to platforms like pdfFiller. With testimonials and user stories showcases, it is clear how these tools can streamline the share transfer process, ultimately leading to a more user-friendly experience.

Conclusion: Starting your share transfer with confidence

Completing a share transfer involves several vital steps, from gathering necessary information to ensuring all signatures are obtained. Following a structured approach can help guarantee a seamless transfer process. The platform at pdfFiller enhances this experience, offering cloud-based convenience for filling, signing, and managing share transfer documents effectively.

By utilizing pdfFiller's tools and resources, users can navigate the complexities of the share transfer process with confidence, ensuring compliance and clarity every step of the way.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit uk share transfer form online?

How do I edit uk share transfer form on an iOS device?

How can I fill out uk share transfer form on an iOS device?

What is UK share transfer form?

Who is required to file UK share transfer form?

How to fill out UK share transfer form?

What is the purpose of UK share transfer form?

What information must be reported on UK share transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.