Get the free Checklist of Good Faith Efforts

Get, Create, Make and Sign checklist of good faith

Editing checklist of good faith online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checklist of good faith

How to fill out checklist of good faith

Who needs checklist of good faith?

Checklist of Good Faith Form: A Comprehensive Guide

Understanding the good faith form

The Good Faith Form is an essential document used primarily in real estate transactions and mortgage lending. Its primary purpose is to provide a clear outline of the costs associated with obtaining a loan, ensuring that all parties involved have a transparent understanding of what to expect both financially and procedurally.

Transparency builds trust—a vital element in financial transactions. By using the Good Faith Form, borrowers can make informed decisions based on accurate estimates of their total closing costs, fees, and other financial obligations.

Who should use the good faith form?

The Good Faith Form is primarily utilized by several groups: individuals involved in real estate transactions, including buyers and refinancers, along with real estate professionals and lenders. Each party has a vested interest in ensuring that the information is accurate and clearly presented.

Importance of a checklist for completing the good faith form

Using a checklist when completing the Good Faith Form is invaluable for several reasons. First, it streamlines the filling process by ensuring no vital information is overlooked. This is particularly critical given the numerous details that require attention—everything from borrower information to loan specifics.

Moreover, a checklist enhances accuracy. With numerous figures and data entries, it’s easy to make mistakes; a thorough checklist minimizes errors and clarifies details, ensuring that every section is completed correctly.

Lastly, checklists simplify collaboration, especially for teams working together on document preparation. Clear outlines aid in dividing responsibilities and ensuring that everyone understands their role in completing the form.

Comprehensive checklist for the good faith form

A comprehensive checklist can make completing the Good Faith Form more manageable. Start with preparations, which include gathering all necessary personal and financial documents. Knowing your rights as a borrower is also crucial to ensure that the information you provide is accurate and complete.

Sections of the good faith form

The Good Faith Form consists of several major sections, each pivotal for creating a clear picture of your financial obligations.

Step-by-step instructions for completing each section

To fill out the Good Faith Form accurately, start by completing the general information section. Ensure that all names are spelled correctly and that contact details are up to date. When itemizing charges and fees, break down costs for clarity, ensuring each cost is listed line by line for complete transparency.

Before finalizing the form, go through each section, comparing it against the checklist to ensure completeness. Look for any missing signature requirements, which are crucial for the form’s validity.

Tips for editing and reviewing your good faith form

In today's digital age, utilizing PDF editing tools can greatly facilitate your editing process. Platforms like pdfFiller offer numerous creative tools to make easy adjustments to your Good Faith Form, allowing for quick changes and seamless updates.

Collaboration features also enhance team efforts. By leveraging interactive tools for team reviews, you can ensure everyone has a chance to provide input before the form is finalized.

Furthermore, ensure compliance and accuracy by cross-referencing your filled form with lender guidelines. This step can prevent potential issues down the line.

Common mistakes to avoid

Accuracy in personal information is paramount. Errors in borrower details can lead to significant complications. Double-check names, addresses, and contact numbers to ensure correctness before submission.

Neglecting fee breakdown is another common error. Not itemizing charges can obscure the total cost structure of the loan, making comparisons difficult. This lack of transparency can lead to mistrust from borrowers and may cause issues during the approval stages.

Additionally, always remember to review necessary signatures. Missing e-signatures can render your Good Faith Form invalid, so be vigilant in ensuring every required signature is present.

FAQs about the good faith form

Questions often arise post-submission of the Good Faith Form. If you identify discrepancies after submission, contact your lender immediately to rectify any issues that may arise from inaccurate information.

Updating information on the Good Faith Form can be done through your lender, who will provide guidance on how best to communicate necessary changes.

For any inquiries regarding the form itself, reaching out to your lender or real estate professional is crucial, as they are best positioned to assist you.

Utilizing technology to manage your good faith form

Incorporating cloud technology into your document management process for the Good Faith Form enhances efficiency. It allows for easy access from anywhere, crucial for urgent updates or reviews.

Additionally, the use of e-signatures streamlines the process. Instead of printing and signing physical documents, e-signatures enable faster transaction completion, reducing the time spent waiting for approvals.

Finally, the advantage of cross-device accessibility means that you can fill and review the form from any device, whether it be a smartphone, tablet, or computer, adding to the convenience of document management.

Conclusion of the checklist process

In conclusion, a final review of your Good Faith Form is crucial before submission. Last-minute checks should include validating all information, ensuring necessary signatures are in place, and cross-referencing with your checklist for completeness.

Post-completion, keeping track of your form's progress is essential. Regularly follow up with your lender to stay updated on the status of your application, ensuring that you are always informed and can manage any outstanding issues quickly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute checklist of good faith online?

How do I fill out checklist of good faith using my mobile device?

How do I complete checklist of good faith on an Android device?

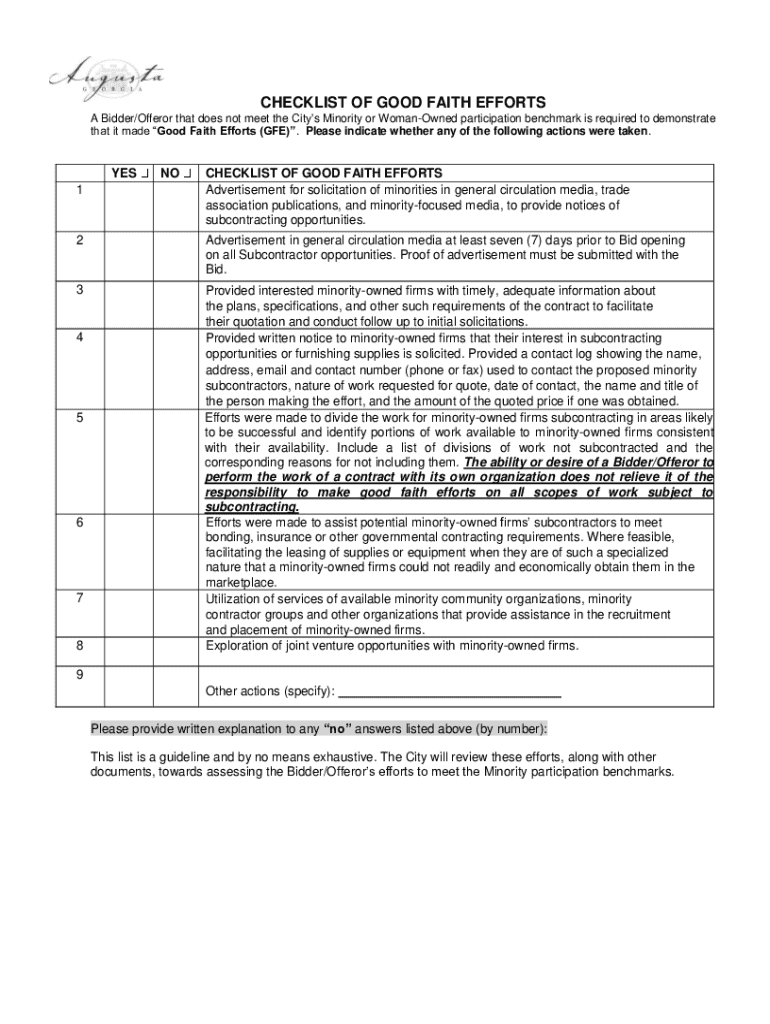

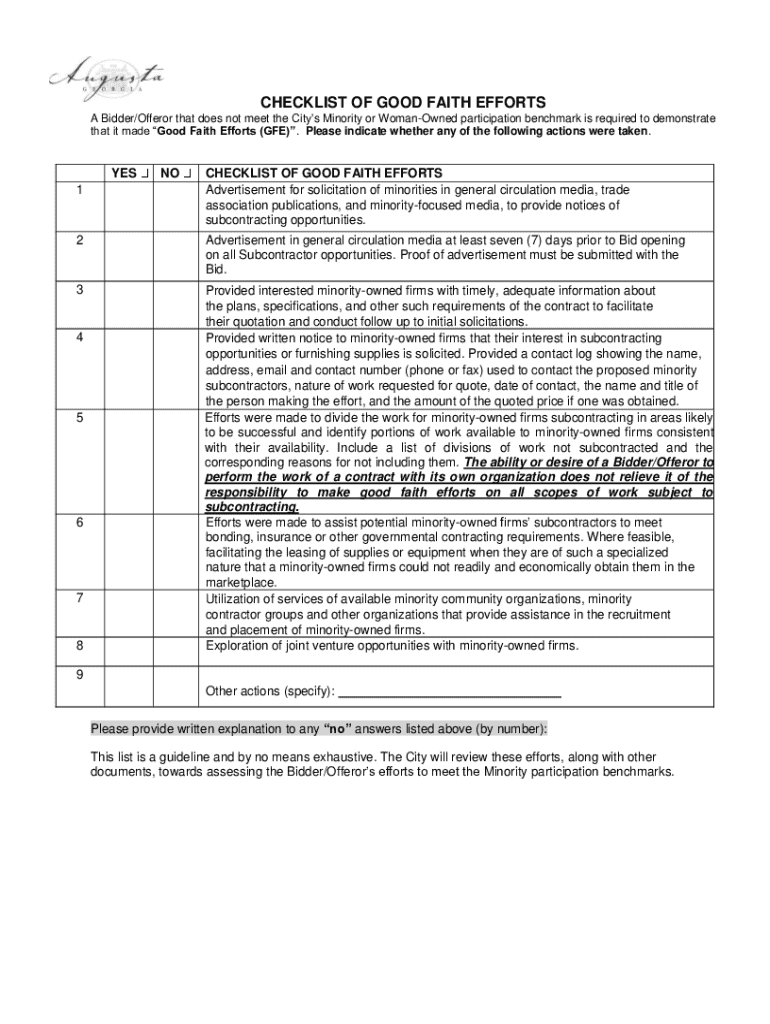

What is checklist of good faith?

Who is required to file checklist of good faith?

How to fill out checklist of good faith?

What is the purpose of checklist of good faith?

What information must be reported on checklist of good faith?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.