Get the free Motor Contract of Insurance Application Form

Get, Create, Make and Sign motor contract of insurance

Editing motor contract of insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor contract of insurance

How to fill out motor contract of insurance

Who needs motor contract of insurance?

Motor contract of insurance form: A comprehensive how-to guide

Understanding the motor contract of insurance

A motor contract of insurance is a binding agreement between a vehicle owner and an insurance provider that outlines the coverage of risks associated with owning and operating a motor vehicle. This document serves as a safeguard against financial losses resulting from accidents, theft, or damages. Understanding its intricacies is crucial for any vehicle owner aiming for comprehensive protection.

Key components of a motor contract

The motor contract of insurance typically includes several key components that define the specifics of the coverage. These are:

Importance of motor contracts in insurance

The significance of a motor contract cannot be overstated. For vehicle owners, having a comprehensive motor contract of insurance is essential for securing peace of mind. It not only protects against unforeseen events but also ensures compliance with legal requirements specific to vehicle ownership.

Why motor contracts matter for vehicle owners

Motor contracts serve as critical financial safety nets. Without them, vehicle owners could face enormous financial burdens from accidents, liabilities to other parties, or damage to their vehicles. Additionally, having a valid motor contract is often a legal requirement, as many jurisdictions mandate insurance as part of the vehicle registration process.

Legal implications of having a motor contract

A properly executed motor contract signifies that the owner acknowledges their responsibilities and the insurance company's obligations. This relationship can come into play during legal disputes, accidents, or at renewal times. It's vital to keep this contract updated to ensure that all parties comply with current laws and insurance standards.

Navigating state-specific regulations

Motor insurance regulations vary significantly from state to state. For instance, minimum coverage requirements differ across the U.S., so understanding local laws is critical. Knowing the specific regulations in your area helps in choosing the right level of coverage, ensuring legal compliance while minimizing financial risk.

Types of motor insurance contracts

When considering a motor contract of insurance, vehicle owners can select from various types of policies tailored to their needs.

Comprehensive vs. third-party insurance

Comprehensive insurance covers a wide range of incidents, including theft, vandalism, and natural disasters, while third-party insurance only covers damages to other parties in an accident caused by the policyholder. Understanding the difference is crucial for selecting the best policy according to personal risk tolerance and financial capability.

Understanding motor service contracts

Motor service contracts, often referred to as extended warranties, protect against mechanical failures and related repair costs. They are especially useful for owners of used vehicles who wish to mitigate repair expenses over time.

Comparing policies and benefits helps prospective policyholders assess what best fits their needs, including factors such as cost, coverage limits, and specific services offered.

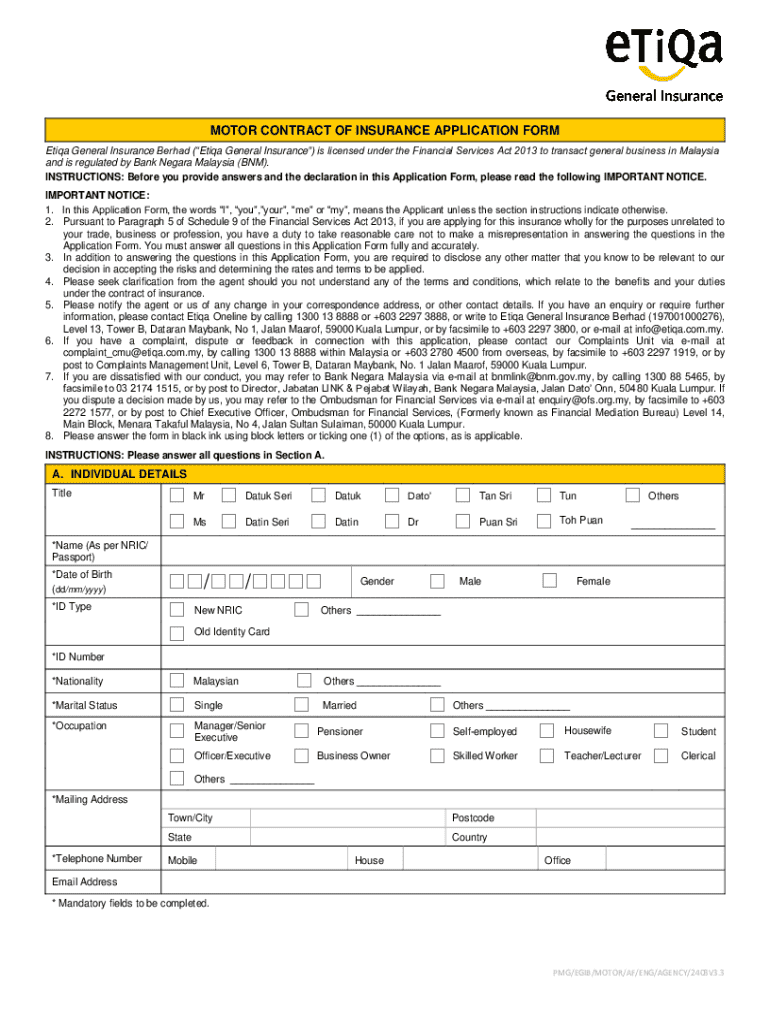

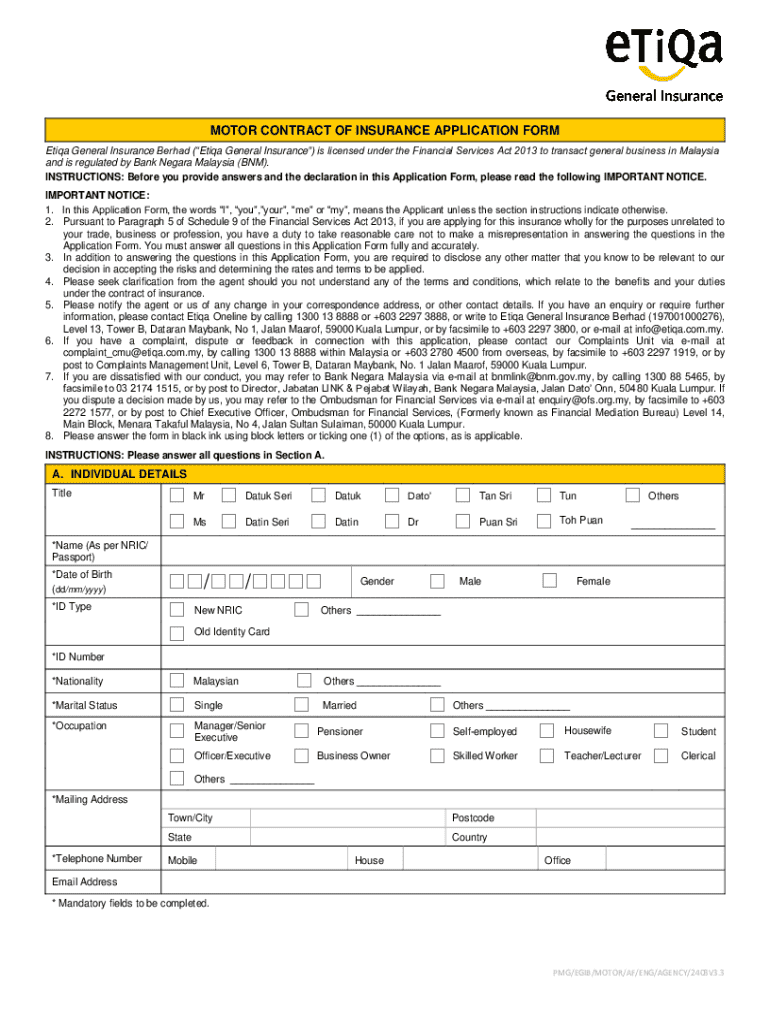

Detailed process of filling out a motor contract of insurance form

Filling out the motor contract of insurance form requires careful attention to ensure accuracy and completeness.

Step 1: Gathering necessary information

Before beginning your application, it's essential to gather all necessary information. This includes personal details like your full name, address, and contact information. You'll also need specific details about your vehicle, such as make, model, year, and Vehicle Identification Number (VIN).

Step 2: Understanding the sections of the form

The form typically includes several sections that require careful attention. You'll need to select your coverage options, which might vary based on your personal needs and state regulations. Additionally, you must review premium calculations based on selected coverage, ensuring that the final rate fits your budget.

Finally, don't forget to sign and date the form. This is a critical step as it validates your application and confirms that you understand the terms outlined in the policy.

Editing the motor contract of insurance form

Editing and customizing your motor contract of insurance form can be simple with the right tools. pdfFiller provides a user-friendly platform for making necessary adjustments before finalizing the document.

Tips for editing and customizing the template

Key tips when editing include reviewing each section for accuracy, ensuring that all personal and vehicle information is up-to-date, and double-checking your coverage selections.

Using pdfFiller’s tools for document management

pdfFiller offers various document management tools that enhance the editing process, such as:

Signing the motor contract of insurance form

Signing the motor contract is a vital step in the process of obtaining insurance. There are multiple methods to finalize your form.

Different methods for signing

You can choose between electronic signatures for quick processing or opt for printing the document and signing it manually. Both methods are effective, depending on your preference and the requirements of your insurer.

Legal validity of electronic signatures in insurance

In many jurisdictions, electronic signatures are legally binding, provided they meet specific criteria as outlined in laws like the ESIGN Act. This means that your e-signature on a motor contract of insurance form holds the same weight as a traditional handwritten signature, making it a convenient option.

Submitting your motor contract

Once completed and signed, submitting your motor contract of insurance form is the next step in ensuring you have coverage.

Where to submit the completed form

Typically, you can submit your form directly to your insurance provider, either through their online platform, by email, or via postal mail. Each insurance company may have preferred methods, so it’s wise to check their guidelines.

Common submission methods (online, postal)

Online submissions are usually the fastest, while postal methods allow for physical copies. Whichever method you choose, ensure your submission is tracked and that you receive confirmation of receipt.

Confirmation of submission and tracking status

Upon submission, you should receive a confirmation from your insurer. Tracking your submission status helps ensure that your application is being processed without any delays, providing peace of mind.

Managing your motor contract after submission

After submitting your motor contract, management of your document and ongoing coverage becomes crucial.

Accessing and editing your form on pdfFiller

Using pdfFiller, you can access your submitted form at any time, making it easy to review or edit as necessary. This flexibility is invaluable for updating information or making changes to your policy.

How to retrieve documents

Retrieving documents through pdfFiller is straightforward. Simply log in to your account, locate the document in your dashboard, and download or print as needed.

Keeping track of policy changes and renewals

It's essential to stay proactive in managing your insurance policy. Set reminders for renewal dates and policy updates to ensure that you maintain the correct coverage over time.

Frequently asked questions (FAQs)

Individuals often have questions after submitting their motor contract of insurance form. Here are some common queries.

What to do if you encounter issues with the form?

If you experience issues while filling out the form, reach out to your insurer's customer service for clarification. They can guide you through any confusing sections.

How long does processing take?

Processing times can vary based on the insurer, but typically it can take anywhere from a few hours to a couple of days. Checking in with the insurer can provide specific timelines.

Can make changes after submission?

Yes, changes can often be made to your agreement after submission, but it requires formal communication with your insurer. Be aware that adjustments might affect your premium.

Resources for further assistance

Several resources can help you navigate the complexities of your motor contract of insurance form.

Accessing customer support

Most insurance providers have dedicated customer support teams. Don't hesitate to contact them for help with your policy or specific issues.

Online community forums and user guides

Many online forums and user guides exist that explore common themes regarding motor contracts of insurance. Engaging with other policyholders can help share experiences and advice.

Legal advice contacts for specific issues

For legal inquiries surrounding your motor insurance contract, consulting a qualified attorney who specializes in insurance law can provide you with accurate guidance.

Best practices for motor insurance management

Effective management of your motor insurance involves ongoing evaluation and adjustments.

Regularly review your insurance coverage

It's crucial to periodically assess your coverage to ensure it aligns with your current needs, especially after significant life changes such as moving, marriage, or purchasing a new vehicle.

Stay informed on changes in insurance law

Insurance laws change frequently, and staying informed will help you adapt your policies accordingly and avoid potential legal issues.

Utilize technology for document management

Technology, like pdfFiller, allows for easy document management, ensuring that your important files are organized and accessible whenever needed.

Conclusion

Effective document management through platforms like pdfFiller empowers users to navigate the complexities of the motor contract of insurance form seamlessly. Understanding insurance contracts is pivotal for maximizing coverage and safeguarding against unforeseen events. By following this guide, vehicle owners will be better equipped to fill out, edit, sign, and manage their motor insurance contracts efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send motor contract of insurance to be eSigned by others?

Can I sign the motor contract of insurance electronically in Chrome?

How do I edit motor contract of insurance straight from my smartphone?

What is motor contract of insurance?

Who is required to file motor contract of insurance?

How to fill out motor contract of insurance?

What is the purpose of motor contract of insurance?

What information must be reported on motor contract of insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.