Get the free Business Check and Deposit Slip Specifications

Get, Create, Make and Sign business check and deposit

Editing business check and deposit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business check and deposit

How to fill out business check and deposit

Who needs business check and deposit?

Business Check and Deposit Form: A Comprehensive How-to Guide

Understanding business checks and deposit forms

Business checks are crucial financial tools that enable organizations to manage payments efficiently. Unlike personal checks, business checks are designed specifically for company transactions, ensuring clarity and professionalism in financial dealings. They are utilized in various scenarios, including paying vendors, settling bills, or issuing employee salaries.

Deposit forms, on the other hand, are essential for recording cash and check transactions for businesses. These forms facilitate easier deposits at banks while keeping track of incoming funds. Understanding how to properly use business checks and deposit forms is vital for any organization striving for effective financial management.

Types of business checks

Understanding the different types of business checks available can help companies select the right option for their financial needs. Each type caters to various operational requirements, ensuring that businesses can manage payments seamlessly.

When choosing a type of business check, consider factors such as the nature of your transactions, printing capabilities, and the frequency of use. Each option has its unique advantages that can streamline your payment processes.

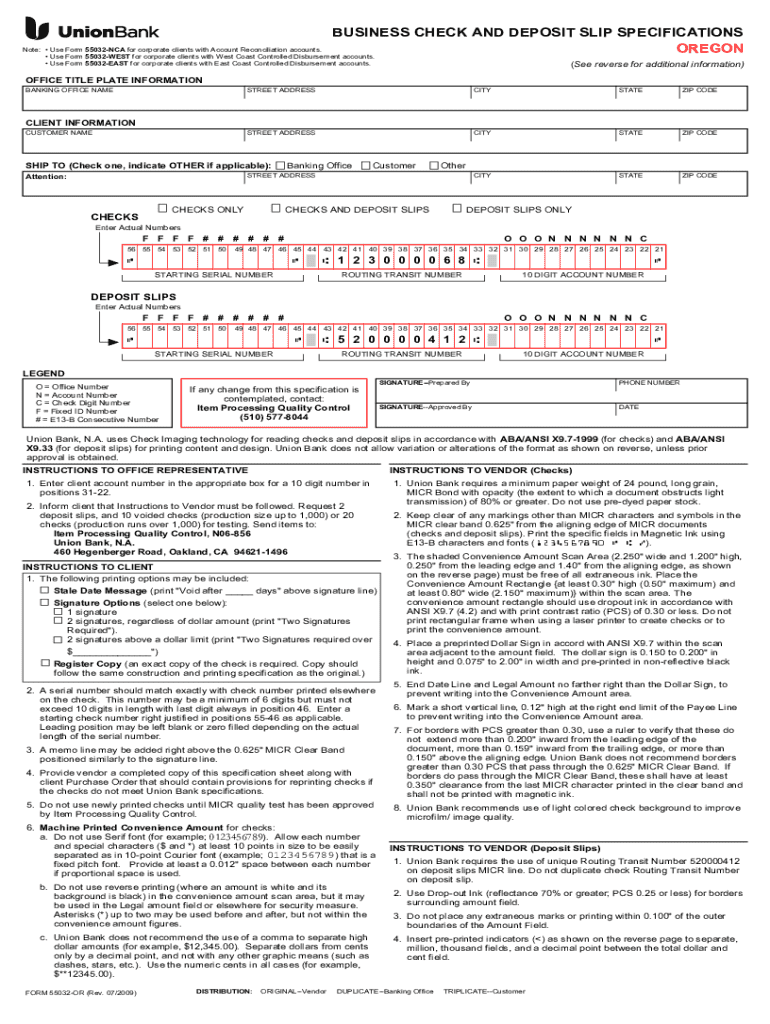

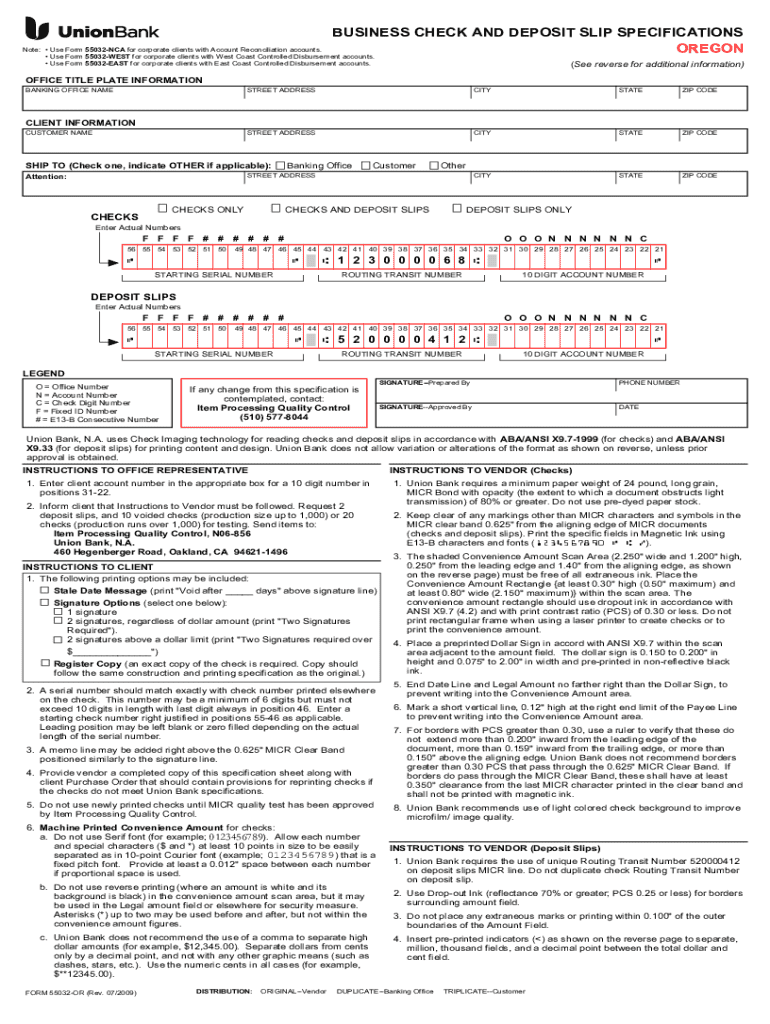

The anatomy of a business check

A business check contains several key components that ensure smooth processing and recognition by banking institutions. Understanding these components is essential for properly filling out checks and maintaining accurate records.

Additionally, business checks often include security features like watermarks or microprinting, which help protect against fraud. Knowing how to identify and utilize these components can safeguard your financial transactions.

How to fill out a business check

Filling out a business check correctly is vital for ensuring that transactions proceed without issues. Here’s a step-by-step guide to ensure accuracy in your check writing.

Common mistakes include writing the wrong amount or misspelling the payee’s name, which can lead to delays or disputes. Double-checking each entry is a smart practice to maintain accuracy.

Managing business checks

Once checks have been issued, it is essential to manage them effectively. Proper record-keeping practices are vital for financial accuracy and compliance.

Effective management of business checks not only safeguards your finances but also enhances trust with vendors and stakeholders.

Understanding deposit forms and their usage

Deposit forms play a crucial role in recording financial transactions within a business. They serve as a receipt for deposits made to a bank and ensure that funds are accurately accounted for.

Understanding how to use these forms properly can streamline the deposit process and minimize errors during bank transactions.

How to complete a deposit form

Completing a deposit form correctly ensures that all transactions are effectively recorded. Follow this step-by-step guide for proper completion.

Common errors to avoid when filling deposit forms include forgetting to sign the form or inaccurate totals, which can complicate processing. Ensure each entry is checked before submission.

Security and fraud protection for business checks

With fraudulent activities increasingly targeting businesses, understanding security risks associated with business checks is critical. Every organization should adopt practices that safeguard their financial instruments.

By employing integral security measures, businesses can mitigate risks and protect their financial interests effectively.

Best practices for ordering business checks

Ordering business checks requires careful consideration to ensure that your company receives high-quality and secure checks.

When placing an order, consider both the aesthetics and security aspects of the checks to ensure they align with your company's image while safeguarding against fraud.

Frequently asked questions about business checks and deposit forms

Addressing common queries can enhance your understanding of business checks and deposit forms, clarifying any uncertainties that may arise.

Understanding these FAQs can greatly assist businesses in navigating the complexities of check writing and overall financial management.

Additional tips and resources

Efficient document management is key in both creating and utilizing business checks and deposit forms. Tools like pdfFiller can streamline this process considerably.

Implementing these tips can lead to enhanced productivity and reduce errors when handling business checks and deposit forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business check and deposit in Chrome?

How do I edit business check and deposit straight from my smartphone?

How do I fill out business check and deposit using my mobile device?

What is business check and deposit?

Who is required to file business check and deposit?

How to fill out business check and deposit?

What is the purpose of business check and deposit?

What information must be reported on business check and deposit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.